LianGuai Daily | HTX hot wallet was stolen about 8 million US dollars; US SEC opposes Celsius distributing tokens to customers through Coinbase

LianGuai Daily | HTX hot wallet stolen $8 million; US SEC opposes Celsius distributing tokens via CoinbaseToday’s News Briefing:

SEC opposes Celsius’ plan to distribute digital assets to customers through Coinbase

OpenAI introduces voice and image capabilities in ChatGPT

Taiwan Financial Supervisory Commission officially releases “Guidelines for the Management of Virtual Asset Platforms and Trading Business”

- Analyst Bitcoin ETF may be approved in early 2024.

- Bitcoin price faces risks? The golden cross of the US dollar strength index has been confirmed.

- Web3 enters ‘late autumn’ ahead of schedule, how should industry builders respond?

Hacker attacks on a hot wallet of HTX result in a loss of $8 million

Leaked documents reveal Microsoft’s plan to introduce encrypted wallets to Xbox consoles

Remitly to launch non-custodial wallet for transferring funds between fiat and USDC

Coinbase to decide in a few weeks where to apply for EU license as a center in the European market

MakerDAO adds $50 million in RWA assets, total RWA assets of the protocol exceed $3 billion

Regulatory News

SEC opposes Celsius’ plan to distribute digital assets to customers through Coinbase

The U.S. Securities and Exchange Commission (SEC) has filed a document opposing the plan of crypto company Celsius Network to distribute digital assets to customers through Coinbase. Celsius filed for bankruptcy over a year ago and will seek bankruptcy court approval for its restructuring plan in the coming weeks. According to the proposed restructuring plan by Celsius, Coinbase will provide brokerage and primary trading services for Celsius, which has triggered regulatory scrutiny. The lawsuit is still ongoing, as per court documents filed by the SEC last Friday in the Celsius Chapter 11 case.

Federal Reserve: Tokenization reduces barriers to entry into other markets but transfers volatility across different markets

The Federal Reserve has published a report titled “Tokenization: Overview and Financial Stability Implications” on its official website, discussing the potential benefits of tokenization as well as financial stability risks. The report concludes that the scale of tokenization is still small, but many projects involving different categories of reference assets are under development, indicating that tokenization could become a larger component of the digital asset ecosystem. One of the benefits of tokenization is the reduction of barriers to entry into other high-barrier markets and increased liquidity in that market. The financial stability risks of tokenization are mainly associated with the connections established by tokenization between the digital asset ecosystem and the traditional financial system. Tokenized assets may transmit shocks or volatility from one market to another.

“Crypto Queen” Valeria Fedyakina of Russia arrested on suspicion of defrauding $72 million

According to foreign media reports, Valeria Fedyakina, an Instagram model/crypto celebrity from Russia also known as “Bitmama,” has been arrested in Moscow on suspicion of defrauding clients of nearly 7 billion rubles ($72 million). The 28-year-old woman received cash from her clients in Russia and promised to withdraw funds in another country, providing additional bonuses for these withdrawals instead of charging commissions. She mostly worked with wealthy clients, and her reported daily turnover reached tens of millions of dollars. Fedyakina told investors that the funds they deposited with her were expected to generate a 1% return.

Currently, Bitmama faces up to ten years in prison if convicted of fraud. Despite being six months pregnant, she is still being held in jail awaiting trial. It is believed that she was denied bail because she holds a residency permit from the United Arab Emirates.

The Financial Supervisory Commission of Taiwan has officially released the “Guidelines for the Management of Virtual Asset Platforms and Trading Businesses”.

According to official website news, the Financial Supervisory Commission of Taiwan has officially released the “Guidelines for the Management of Virtual Asset Platforms and Trading Businesses (VASP)”. The key points are summarized as follows: 1. Management of virtual asset issuance: If virtual assets are issued through a platform, the issuer should publish a white paper on its website (and disclose certain information), and the platform should announce the link to that website. 2. Review mechanism for listing and delisting of virtual assets: Standards and procedures for reviewing the content of white papers and listing and delisting should be established and incorporated into internal control systems. 3. Segregation and custody of platform assets and customer assets: When a platform accepts legal tender or virtual assets from customers for trading and payment, it should keep these assets separate from its own assets. 4. Fairness and transparency of transactions: The platform should establish and publish rules for virtual asset transactions and establish mechanisms to ensure fair market transactions. 5. Contract formation, advertising solicitation, and complaint handling: The platform should comply with customer protection regulations based on principles of fairness, reciprocity, and good faith. 6. Operational systems, information security, and management mechanisms for cold and hot wallets: The platform should establish management systems for continuous operation, information security, and private keys of cold and hot wallets. 7. Information disclosure: The platform should fully disclose the issuance and listing of virtual assets, asset segregation and custody, transaction information and rules, and customer protection matters. 8. Internal control and institutional audits: The platform should establish internal control and internal audit systems, ensure their independent and objective operation, and agree to on-site inspections by the Financial Supervisory Commission or authorized institutions. 9. Individual currency dealers: Natural persons engaged in virtual asset businesses who declare compliance with anti-money laundering laws and regulations to the Financial Supervisory Commission should have declaration contents and qualities comparable to legal entities. 10. Foreign currency dealers outside Taiwan: Virtual asset platform operators outside Taiwan who have not registered in accordance with the Company Law and who declare compliance with anti-money laundering laws and regulations to the Financial Supervisory Commission and complete the declaration are not allowed to solicit business in Taiwan or with Taiwanese individuals.

Earlier today, it was reported that nine cryptocurrency exchanges in Taiwan have formed a working group to prepare for the establishment of a cryptocurrency industry association.

The magazine “People’s Police” supervised by the Ministry of Public Security of the People’s Republic of China has published an article titled “Constructing a Multilateral Regulatory Model for Legal Digital Currency in the New Situation”. The author of the article is Huaxia from the China Development Bank. The article states that constructing a regulatory model for legal digital currency in China and improving the regulatory framework is an important part of preventing and combating crimes related to legal digital currency, maintaining financial security and stability, and safeguarding the legitimate rights and interests of the people. Compared to traditional currency, legal digital currency has features such as controllable anonymity and fast transactions, which can be exploited by illegal activities such as money laundering, cross-border remittances, drug and gun trafficking, and hacking. The existing regulatory model and legal system in China are facing new challenges.

There are two mismatches. Although the regulatory model of legal digital currency considers the operating model, it does not combine the characteristics of diversified participants in the operation process, and the allocation of regulatory authority and functions is unclear. With the rapid growth of the trading volume of legal digital currencies, the regulatory model dominated by the central bank is difficult to achieve timely and comprehensive supervision of funds, which increases the risk of related information data leakage and theft, and may threaten social and economic security and network security. The regulatory model of legal digital currency needs a more comprehensive system to support the massive data transaction volume. The second mismatch is the technological mismatch. The traditional regulatory model is not designed based on data information, and its technical system cannot meet the regulation of legal digital currencies. Therefore, it is urgent to accelerate the improvement of China’s regulatory model for legal digital currencies.

The article suggests constructing a multi-polar regulatory model for legal digital currencies in China from the following aspects: at the legislative level, improve the laws and regulations on legal digital currencies; at the central bank level, take the central bank as the main body, and increase the regulatory intensity of financial regulatory authorities, securities regulatory authorities, and foreign exchange management authorities according to their respective functions; at the level of industry regulatory authorities such as the China Digital Currency Research Institute, further improve the research on digital currencies, technology, policies, and regulations.

NFT & AI

OpenAI introduces voice and image features in ChatGPT

OpenAI announced that ChatGPT can now see, hear, and speak. Voice and image features will be rolled out to Plus and Enterprise users in the next two weeks. Voice will be available on iOS and Android (select “join” in your settings), and images will be available on all platforms.

Enku Collection, owned by Lakala, has been suspended for several months and has now been deregistered

According to Blue Whale Finance, Tianyancha App shows that Enku Collection (Beijing) Digital Technology Co., Ltd., jointly invested by Lakala and BlueFocus, was deregistered on September 20, 2023, due to a decision to dissolve. The reporter found that Enku Collection was sued for housing lease issues before deregistration. In addition, its official Weibo account, Enku N-SLianGuaiCE, has not been updated since May 10, and users left comments on May 19 saying that they can’t access Enku anymore and wondered if it is going to run away. The official has not responded to this.

It is reported that due to unclear industry policies and certain development bottlenecks in terms of business logic and user numbers, Enku Collection gradually suspended its operations within a year and a half since its establishment. In March of this year, due to server migration and adjustment, Enku Collection accidentally backed up some key information in the code to a public repository on GitHub, indirectly resulting in the theft of management account private keys by hackers, and the company’s digital collections encountered serious security issues. During this period, some users lost their collections. Enku Collection used internal and external resources and technical capabilities to recover the collections by deleting the previous block data of the contract, successfully recovering most of the collections. However, this incident still caused dissatisfaction among many users.

Earlier in March 2022, LAKALA Investment established Enku Collectible Digital Technology Company.

Project Updates

Radiant applies for a grant of up to 3.36 million ARB from Arbitrum Short-Term Incentive Program

Radiant Capital, a multi-chain lending protocol, has submitted a proposal to Arbitrum DAO’s Short-Term Incentive Program (STIP), seeking a grant of 52,126 to 3,359,302 ARB by January 31. The grant will be used for the ARB airdrop plan for dLP locking + incremental lending TVL for 6-12 months (0 to 2,380,952 ARB) and the strategic ecosystem plan (52,126 to 978,349 ARB).

HTX hot wallet hacked, losing $7.9 million, Sun Yuchen claims HTX fully bears the losses caused by the attack, user funds are safe

Cyvers Alerts on X platform stated that yesterday, a certain EOA address received 5,000 ETH from Huobi HTX, and this morning, it was found that HTX had performed a hot wallet migration. It has been confirmed that one HTX hot wallet was attacked, resulting in a loss of $7.9 million, and the hacker’s address has been disclosed.

Sun Yuchen confirmed on X platform that HTX lost 5,000 ETH (approximately $8 million) in the recent hack. Sun Yuchen also stated, “HTX has fully borne the losses caused by this attack and has resolved all related issues. All user assets are safe, and the platform is operating normally.”

Celsius bondholders vote in favor of restructuring plan

A majority of the bondholders affected by Celsius’ bankruptcy have voted in favor of a restructuring plan, with a support rate exceeding 98%. Under the plan, the debtor will distribute approximately $2 billion worth of Bitcoin and Ether to the bondholders, as well as equity in a new company (NewCo). The plan has received support from the Official Unsecured Creditors’ Committee. The case will be heard in the United States Bankruptcy Court for the Southern District of New York on October 2, and a final ruling will be made on approval. NewCo will inherit Celsius’ business and will be managed by the Fahrenheit Group, which won the Celsius asset auction bidding in May of this year.

Circle: Native USDC to be launched on the Polygon chain

Circle announced on X platform that native USDC will be launched on the Polygon chain.

Binance reopens registration and access to products and services in Belgium

Binance tweeted that registration and access to Binance products and services have been reopened in Belgium. According to previous reports, in June of this year, the Belgian financial regulatory authority ordered Binance to stop providing cryptocurrency trading and custodial wallet services to local customers, citing violations of local anti-money laundering and anti-terrorist financing requirements. Binance announced in a statement on August 28 that it will continue to serve Belgian users through its registered entity, Binance Poland sp. z o.o.

Binance plans to launch stablecoins denominated in USD, EUR, and JPY in Japan next year

According to Bloomberg, Binance is seeking to launch stablecoins denominated in USD, EUR, and JPY in Japan next year. Takeshi Chino, the General Manager of the Trust Banking Department at Mitsubishi UFJ Financial Group, stated in an interview that Binance’s Japanese company, Binance JaLianGuain, hopes to collaborate with Mitsubishi UFJ Financial Group’s Trust Banking Department to launch these three tokens in 2024, and possibly even more tokens. A statement mentioned that the two companies have already begun joint research on this issuance.

Japan legalized the issuance of stablecoins by licensed companies in June, prompting Orix Corp. and other firms to consider launching tokens that reportedly provide financial advantages such as faster remittances and settlements.

Previously reported, MUFG’s Progmat platform plans to issue a yen stablecoin on public blockchains such as Ethereum. Mitsubishi UFJ, Japan’s largest bank, is in discussions with multiple institutions about issuing global stablecoins, and Circle is considering issuing stablecoins in Japan based on the new regulations. Mitsubishi UFJ Trust and Banking Corporation plans to collaborate with Binance JaLianGuain to launch new stablecoins.

Audio and video calls on X will become premium features available only to paid subscribers.

According to TechCrunch, X CEO Linda Yaccarino confirmed last week that the app formerly known as Twitter will introduce video calling as part of its transition to an “everything app.” New code in the X app now indicates support for audio and video calls. However, this feature won’t be available to all X users – it seems that only those who have X Premium membership will be able to use it.

Crypto KOL Ben Armstrong arrested while attempting to confront former business partner.

According to The Block, online records from the Gwinnett County Sheriff’s Office show that Ben Armstrong, founder of the BitBoy Crypto YouTube channel on Web3, was arrested while attempting to confront a former business partner, but no charges have been listed at this time.

Gemini plans to invest 2 billion Indian rupees, approximately 24 million USD, in its Gurugram center over the next two years.

Gemini announced today that it plans to invest 2 billion Indian rupees (24 million USD) over the next two years to develop its Gurugram development center. Gemini’s Gurugram office will serve as the location for its engineering, design, and operations teams responsible for developing products and services for customers in over 70 countries/regions worldwide. The Gurugram office will also double its employee count from 70 to over 150. Gemini has also opened an office in Campus Cyber Greens’ Cyber Hub.

Gurugram is one of India’s major economic and industrial cities and is the country’s third-largest recipient of capital inflows. Following Mumbai and Chennai, Gurugram has become a leading financial and banking center in India, often referred to as India’s “Shenzhen.”

SlowMist: Upbit’s experience with Aptos fake recharge attack was due to its failure to pay attention to the update of the token transfer mechanism.

In response to the recent Aptos fake recharge attack on Upbit, security company SlowMist stated on the X platform that Aptos’ token transfer mechanism underwent a significant update on January 15, 2023. Prior to this, the recipient had to pre-register their address in the token’s contract in order to receive the corresponding tokens. Aptos officially changed this based on Aptos Labs’ submission on GitHub. Now, when transferring Aptos tokens, if the recipient’s address is not registered in the token contract, the system will default to registering the transferor as the recipient. In this attack, the attacker executed a false token transfer to the entrance address. Due to Upbit’s failure to check the token type, an incorrect deposit was made. Therefore, it is recommended that entities relying on transfer detection always pay attention to official code updates and perform multi-dimensional checks on account deposits to ensure the security of assets.

The leaked documents show that Microsoft plans to introduce encrypted wallets into Xbox game consoles.

According to CryptoSlate, a leaked document about Xbox recently released on the gaming forum ResetEra shows that the technology giant Microsoft plans to integrate encrypted wallets into its Xbox game consoles. Xbox’s roadmap for May 2022 includes support for encrypted wallets, but specific details about this integration plan are not shown.

Xbox’s head, Phil Spencer, attributed the leaked documents to the Federal Trade Commission’s legal action against Microsoft. It is reported that the Federal Trade Commission opposed Microsoft’s acquisition of Activision Blizzard, which inadvertently led to the inclusion of leaked documents in the submitted files. The report reveals key communications between Xbox executives, plans to launch a new discless Xbox Series X, gyro controllers, and the next generation of hybrid Xbox in 2028.

Despite this, Spencer tried to downplay the leak and pointed out that some plans have already changed. He said, “It’s hard to see the work of our team being shared in this way because so many things have changed and there are so many exciting things happening now and in the future.”

Foreign media: BitsLianGuaiy falsely claimed to hold an Estonian license on CMC and its official website, and deleted relevant information after being discovered.

According to Cointelegraph, the media discovered in its investigation that the cryptocurrency trading platform BitsLianGuaiy, which reported a daily trading volume of $1.4 billion on CoinMarketCap, misled customers. BitsLianGuaiy claimed on CoinMarketCap that it held an Estonian license and was regulated by Estonia until the media inquired, after which BitsLianGuaiy deleted the information.

The media contacted the Estonian Financial Intelligence Unit to confirm that BitsLianGuaiy does not have any valid licenses in Estonia. A spokesperson for the Financial Intelligence Unit stated in a statement on September 21, “We conducted an investigation, and the license number previously disclosed by BitsLianGuaiy seems to refer to the Estonian company Globe Assets OÜ. The validity period of this license is from March 2019 to January 2020.” The Financial Intelligence Unit did not respond to other questions regarding the legal status of BitsLianGuaiy in Estonia. BitsLianGuaiy displayed the above license data to visitors until at least September 18, 2023. The company subsequently renamed its website from BitsLianGuaiy.io to BitsLianGuaiy.global, and the website removed information about its registration or regulation in Estonia.

The report stated that BitsLianGuaiy appears to be far from the only platform reporting huge trading volumes on CoinMarketCap without disclosing their licenses, founders, or backgrounds. Exchanges like Topcredit, which reports a daily trading volume of $1.8 billion on CoinMarketCap, and Bika, which reports a daily trading volume of $1.2 billion, are also unwilling to discuss their backgrounds and founders with the media. A spokesperson for CoinMarketCap stated, “We have long been aware that self-reported data may be problematic, but the API is the only feasible source for collecting data.”

MoneyGram to Launch Non-Custodial Wallet for Fund Transfer Between Fiat and USDC

According to Fortune magazine, global payment platform MoneyGram announced on Tuesday that it will launch a non-custodial wallet to help users transfer funds between fiat currencies and the US dollar stablecoin (USDC). MoneyGram continues to use the Stellar blockchain to power its wallet. MoneyGram CEO Alex Holmes said the company has undergone digital transformation over the past five years to “dispel misconceptions” that it will be replaced by cashless products. He said, “We are redefining the true meaning of transferring funds between fiat currencies.”

Unlike many non-custodial wallets, MoneyGram’s new product will have full Know Your Customer (KYC) requirements and can only be compatible with other MoneyGram wallets. While this restricts its functionality in the broader crypto ecosystem, it also protects MoneyGram from regulatory scrutiny, which is often associated with the uncertain world of decentralized finance. Currently, non-custodial wallets will be limited to countries with KYC capabilities. Holmes said that there are currently about 40 countries that can support digital KYC processes. Holmes also said, “We are leveraging blockchain to turn MoneyGram into a global ATM concept.”

Coinbase to Decide Where to Apply for EU License as European Market Hub within Weeks

According to DL News, Tom Duff Gordon, Vice President of International Policy at Coinbase, said that Coinbase will decide where to apply for the Markets in Crypto-Assets (MiCA) license in the European Union within the next few weeks. Gordon said, “We will decide where to conduct our regulatory activity from one place. It is not yet decided where this hub will be, and we are taking our time to carefully consider what is the right location. We would like to have a tier one regulator that we feel comfortable with and access to talent. We will choose one location as the hub, but that doesn’t mean we will stop all operations in Europe.”

At the time of making the above remarks, Coinbase CEO Brian Armstrong had criticized US regulatory agencies. Meanwhile, the new European cryptocurrency regime is changing the regulatory landscape in Europe. MiCA allows companies to enter the entire European market after obtaining a license, but first they need to choose a member state to obtain the license.

Funding News

On-chain leverage trading platform Avantis Labs completes $4 million funding round led by LianGuaintera Capital

According to Techcrunch, on-chain leverage trading platform Avantis Labs has completed a $4 million seed funding round led by LianGuaintera Capital, with participation from Founders Fund, Coinbase’s Base Ecosystem Fund, and Modular Capital. The new funds will be used to develop its flagship product, Avantis, which is a perpetual contract trading and market-making protocol.

Avantis aims to provide leverage trading of cryptocurrencies and RWA assets for institutional and retail investors. Its underlying trading engine is supported by Pyth and Chainlink’s oracle, and the platform is being developed on the Optimism Superchain. It has already launched a private testnet phase on the Base blockchain and plans to go live on the Base mainnet in the first quarter of 2024. After the launch on the mainnet, Avantis will support Bitcoin and Ethereum as well as three fiat currency pairs: GBP, JPY, and EUR, and will later add more cryptocurrencies, fiat currencies, and commodities such as gold, silver, and oil. Avantis also plans to start developing an options engine in mid-2023.

Important Data

MakerDAO increases its RWA assets by another $50 million, with the total RWA assets of the protocol exceeding $3 billion

MakerDAO once again increases its RWA assets by $50 million through BlockTower Andromeda, mainly investing in short-term US government bonds with an annual interest rate of 4.75%. In addition, the total RWA assets of the protocol currently exceed $3 billion.

A whale converts 3999 ETH into stablecoins via Uniswap

According to on-chain analyst Yu Jin, a whale sold 3999 ETH and exchanged them for 5.04 million DAI, 560,000 USDT, and 720,000 USDC (a total of $6.32 million) via Uniswap 4 hours ago. The average selling price was $1582. Currently, the whale still holds 2970 ETH (approximately $4.72 million).

Data: Two transactions totaling 46,500 ETH transferred from an unknown wallet to OKEx

Whale Alert monitoring shows that two transfers of 33,000 ETH ($52,438,243) and 13,500 ETH ($21,458,510) respectively were transferred from an unknown wallet to OKEx. Also, this morning at 10:20, there was another transfer of 15,000 ETH to OKEx from an unknown wallet. In total, more than $100 million worth of ETH was transferred.

Data: Address labeled as “Bluzelle: ComLianGuainy Wallet” transfers 5.73 million BLZ to DWF Labs

According to on-chain analyst Yu Jin, 5 minutes ago, an address labeled as Bluzelle: ComLianGuainy Wallet (company wallet) transferred 5.73 million BLZ (approximately $1.06 million) to DWF Labs.

Subsequently, as of 16:50, the address has transferred approximately 11.46 million BLZ to DWF Labs.

LianGuaiNews APP Reward Store is officially launched

Hardcore rewards for free redemption: imKeyPro hardware wallet, First Class Research Monthly Card, Ballet REAL series wallets, AICoin membership, various peripherals, and hundreds of selected research reports. First come, first served, experience now!

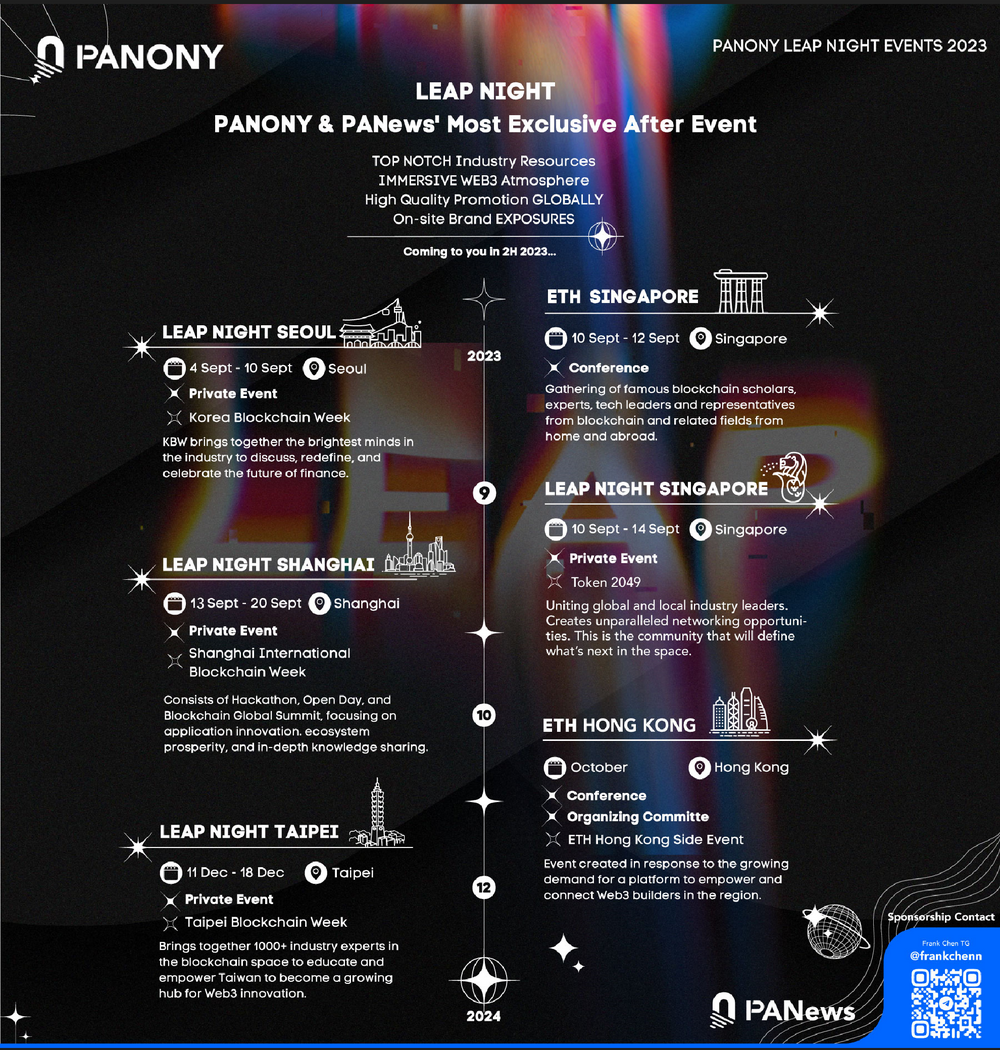

LianGuaiNews launches the global LEAP tour!

South Korea, Singapore, Shanghai, Taipei, gather in multiple locations from September to December to witness a new chapter in globalization!

📥Activities in multiple locations are under construction, welcome to communicate!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Calaxy Co-founder 3 Facts You Need to Know Before the Next Bull Market

- An overview of the top 12 Bitcoin ETFs worldwide ProShares takes the lead, holding over 35,000 Bitcoins.

- Wu said Zhou’s selection The Federal Reserve did not raise interest rates, Mt Gox repayment date postponed, Tether crazy purchases of GPUs, and the top 10 news (0916-0922).

- Bitwise has withdrawn its application for a Bitcoin and Ethereum market-cap-weighted ETF.

- First Market Observation A Brief Discussion on Derivatives, Ton, Games, and ZK New Trends After Token2049

- After Token2049 Discussing Derivatives, Ton Ecology, Games, and ZK in the Primary Market Trend

- The surge of the US dollar and the further decline of BTC, what does the high interest rate mean for cryptocurrency companies?