Disappeared “Chinese richest man”

"Chinese richest man" disappeared.“Damn it! Where is he?” SEC Chairman Gensler slammed his desk in anger, with as many as 136 pages of indictment papers against Binance on the side. This may be the picture that most industry insiders imagine. After all, Zhao Changpeng’s whereabouts have been elusive in recent years, and no one knows where he is.

SEC charges easy to find people difficult

Faced with the SEC’s charges, Zhao Changpeng responded to all this on Twitter as if he were used to it: the team is on standby to ensure the stability of the system, including withdrawal and deposit transactions. His placating users and actively responding attitude seems to have achieved good public relations results.

- Experts Interpret What Will Happen Next with Binance and Coinbase

- Even the legendary GPT cannot create your dream divine vehicle

- How far are we from an Ethereum centered around intent?

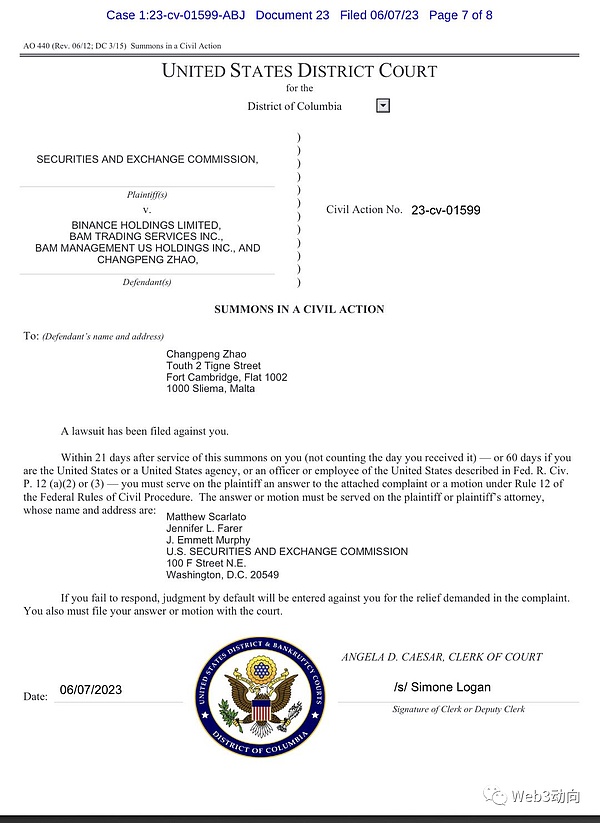

As Zhao Changpeng’s address is unknown, an embarrassing scene occurred. The SEC was forced to request court approval for ” alternative service ” to deliver documents, that is, to let Binance and Zhao Changpeng’s representative lawyers do it.

The SEC’s thunderous charges are powerful, but why can’t they find the defendant Zhao Changpeng? There are two main reasons: 1. Binance does not have a “headquarters” concept, and Zhao Changpeng is particularly careful to protect his whereabouts; 2. The US SEC has proposed civil lawsuits , which naturally cannot find people through criminal means.

The Road to the Attack of the Richest Chinese

On November 30, 2021, according to the “Finance” magazine, Binance founder Zhao Changpeng’s net worth reached $90 billion (equivalent to RMB 573.3 billion) , surpassing the chairman of Nongfu Spring, Zhong Shanshan’s RMB 424.4 billion, and became the richest Chinese.

Zhao Changpeng, who owns the richest Chinese position, used a simple and rude method to achieve it: parachuting . Because, according to informed sources, Binance’s valuation will reach $300 billion, and Zhao Changpeng owns 30% of Binance’s shares. Converted like this, Zhao Changpeng’s net worth is as high as $90 billion (about RMB 573.3 billion). Therefore, Zhao Changpeng does not want to stand on the so-called peak. At that time, he tweeted that the valuation without liquidity is not significant.

Can you list some of the significant historical milestones for Zhao Changpeng before he founded Binance? This is one of the few times that there is a traceable path.

In 1977, Zhao Changpeng was born into a family of teachers in Lianyungang, Jiangsu. His father was a professor at the University of Science and Technology of China. In the year he turned 12, Zhao Changpeng’s fate took a turn when his entire family moved to Vancouver, Canada, where he spent six years in high school. During his university years, Zhao Changpeng studied computer science at McGill University in Montreal.

In 1997, Zhao Changpeng, a college graduate, developed a system for matching trading orders for the Tokyo Stock Exchange. He then went to work for Bloomberg, the world’s largest financial information company, in New York, where he participated in the development of futures trading software. After three promotions in less than two years, he became the team leader in New Jersey, London, and Tokyo at the age of 27. When talking about the impact of this migratory life, Zhao Changpeng believed that he liked having many different cultures mixed together, and that these experiences made him realize that cross-border remittances were cumbersome and expensive until he later came across bitcoin.

In 2005, Zhao Changpeng resigned and returned to China to start a business. He founded Fuxun Information Technology Co., Ltd. in Shanghai, which specializes in developing the fastest high-frequency trading system for securities firms.

In 2013, Zhao Changpeng learned about bitcoin from a poker friend and venture capitalist. Subsequently, he began to get involved in cryptocurrency projects and joined Blockchain.info (an online wallet service provider) as its third founding employee, where he stayed for eight months.

In 2014, Zhao Changpeng sold his house in Shanghai and bought all of it in bitcoin. Even though the price of Shanghai real estate doubled in less than a year, and bitcoin fell to one-third of its original value, he did not back down. Because he had no assets other than his phone, Zhao Changpeng was called the “first person to hold 99% of his assets in crypto-currency.” In March of the same year, at a forum in Hangzhou, Zhao Changpeng met Xu Mingxing, the founder of OKCoin, a domestic bitcoin exchange. Three months later, Zhao Changpeng became the CTO of OKCoin and was also responsible for the company’s international affairs. At that time, he, He Yi, known as the “Sister of the Coin Circle”, and CEO Xu Mingxing formed the “Bitcoin Dream Team.”

In 2015, Zhao Changpeng left OKCoin in less than a year. Recalling this experience, he said, “OKCoin encountered some cultural and value conflicts, and I didn’t want to get involved, so I left in 2015.” After leaving the cryptocurrency industry, Zhao Changpeng founded Bijie Technology, which provides trading systems for collectibles such as stamps, coins, and phone cards. But two years later, he returned to the cryptocurrency industry.

On June 24, 2017, Zhao Changpeng founded Binance and launched the BNB token. The total supply of BNB was 200 million, of which 100 million were used for ICO (initial coin offering), 80 million were held by the team and locked up, and released annually, and the remaining 20 million were held by angel investors. Another important partner of Binance, Zhao Changpeng’s colleague at OKCoin, He Yi, also joined Binance as a co-founder and chief marketing officer.

It can be seen that before founding Binance, Zhao Changpeng mainly operated in countries or regions such as China, Canada, the United States, and Tokyo. Perhaps he did not expect that he would need to manage his whereabouts after founding Binance.

Establishing Binance was like pressing the button to set sail, and Zhao Changpeng began a long drift, with his whereabouts becoming increasingly uncertain.

In 2017, when he encountered the 9.4 storm that clearly prohibited the first token offering in China, Zhao Changpeng transferred all the servers and went abroad again. Zhao Changpeng stayed briefly in Japan and the European island of Malta with Binance, but both stays were short-lived. It turned out that these places “did not welcome” Binance. In 2018, Binance stayed in Japan for only three months before being ordered to leave by the Japanese Financial Services Agency. In 2020, when the outside world thought that Binance had settled in Malta, the country clarified that Binance was not within its jurisdiction.

Moving back and forth, it seems that Zhao Changpeng was already tired of the “roaming” life, and he adopted a more daring approach. Binance announced that it would no longer search for a new headquarters office location. Binance officially became a headquarters-free collaborative organization, and Zhao Changpeng said, “No matter where I sit, it is in Binance’s office.” Perhaps this is also a way for Zhao Changpeng to comfort himself.

The turning point came in 2022. Under pressure from regulators in many countries, Zhao Changpeng will soon announce a suitable headquarters address. But as of now, neither Zhao Changpeng nor Binance has issued an official statement. Perhaps the headquarters address has already been “stillborn” or “temporarily shelved”.

As for Zhao Changpeng’s personal whereabouts, in most cases he only appears on posters of various sizes at blockchain conferences, but after seeing the posters many times, it can also be inferred that this is a marketing gimmick that attracts attention for many conference organizers. In 2021, one of Binance’s competitors in the United States sued Binance for delisting tokens and hired a private detective to find Zhao Changpeng. In the investigation report, the private detective stated that the team had made “great” efforts, but failed to succeed, suspecting that Binance had hired others to cover up Zhao Changpeng’s past and whereabouts, making him “almost impossible to be discovered”.

At the end of 2021, the media reported that Zhao Changpeng had been in Singapore for two years and often rode a skateboard to work.

In September 2021, Zhao Changpeng bought an apartment in Dubai and moved his family from Singapore there.

In June 2022, Zhao Changpeng appeared in Hanoi, Vietnam, attending the Vietnam NFT summit, and at that time he tweeted “I love Pho”.

Overall, in recent years, Zhao Changpeng’s figure has been seen in places such as Singapore, Dubai, and Vietnam, and more appearances have used online methods such as video live broadcast. He has become more and more cautious about his whereabouts, and in the face of the “unknown” SEC’s accusations, Zhao Changpeng has regarded Twitter as his familiar “home” and used it as a battlefield to launch one after another “small battle” against the SEC.

Recently, netizens have also dug out the SEC’s subpoena 23-cv-01599, which clearly writes Zhao Changpeng’s address, and some netizens have also taken pictures of the address on site.

Later, Zhao Changpeng forwarded the tweet and said: “Someone told me that this is just part of SEC’s compliance process and there is nothing new.” It can be seen that Zhao Changpeng does not live here, at least no one is currently living here.

Thinking back to November 6th last year, Zhao Changpeng tweeted: “We will sell all FTT (FTX tokens) on the books.” This move became one of the biggest catalysts for the collapse of FTX, and the Chinese idiom “the tide turns” was also confirmed on Zhao Changpeng and Binance. The time when the US SEC sued Bincance and Zhao Changpeng made Zhao Changpeng stand alone, will his “Robinson Crusoe” eventually come to an end? Or can he lead Binance to find a new continent and find a new home alone? Let’s raise the gesture of “4” to watch. (“4” represents “refuse FUD, fake news, attacks, etc.”)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Comparison analysis of developer experience for the four major ZKRU solutions: StarkNet, Scroll, zkSync, and Polygon

- Life After the Collapse of Sanjian Capital: Surfing, Meditation, and World Travel for the Founders

- Vitalik: Three Transformations Ethereum Needs to Complete – L2, Wallets, Privacy

- Matter Labs receives $1 million in funding from a16z crypto’s “Crypto Startup School” accelerator.

- An in-depth introduction to Tenet: the new public chain designed specifically for LSD

- Sequoia China Leads $22 Million Investment in Ethereum Layer 2 Network Taiko

- Quick preview of upcoming frxETH v2: a more efficient and decentralized LSD protocol