An in-depth introduction to Tenet: the new public chain designed specifically for LSD

Introduction to Tenet: a new public chain for LSD.As LSD narratives continue to gain momentum, LSD race innovation mechanisms are also emerging one after another, such as frxETH V2 and Pendle. Today, however, we introduce a new LSD protocol and Layer 1 blockchain designed for LSD, the Tenet Protocol.

Tenet Protocol is an EVM-compatible Layer 1 blockchain protocol based on Cosmos that uses LayerZero bridging LSD assets to bring LSD to the chain level. Below is a brief introduction to the unique features of this project.

Tenet Features

Tenet has two main features. First, its innovative consensus mechanism, known as Diversified Proof of Stake. In short, Tenet is PoS, and its “Diversified” innovation allows network security to be maintained not only through its native token TENET, but also through the Omni-Chain tLSD token. It allows assets on one chain to be pledged to another chain, establishing a mutually beneficial economic relationship and increasing network security. Omni-Chain is also seen by most people as a mainstream trend in future encryption.

The second feature is the introduction of its own decentralized stablecoin LSDC (Liquid Staking Dollar), supported by LSD-like tokens, including: ETH, BNB, ADA, and ATOM. More tokens will be added in the future. Users can use over-collateralized LSD to mint stablecoins, which are fully transparent with reserve proof that can be viewed on the chain.

- Sequoia China Leads $22 Million Investment in Ethereum Layer 2 Network Taiko

- Quick preview of upcoming frxETH v2: a more efficient and decentralized LSD protocol

- MR Headset: Vision Pro, a “Legal Risk Pro” in the Virtual Reality Industry?

Users can use their LSD assets to borrow LSDC at zero interest and earn additional income from Tenet DeFi Dapp. Adding LSDC to a stable pool and earning rewards from liquidation or Native Gauge voting. Currently, LSDC can be minted for various LSD assets such as stETH, rETH, and ankrBNB.

In addition, Tenet Protocol also launched its own wallet Eva at the end of May. Eva was designed with retail investors in mind. It is a keyless wallet designed for people with zero crypto knowledge and can also be commanded to perform on-chain operations via AI commands. Eva also provides on/off-ramp fiat and in-wallet staking, similar to the previous Sui wallet, official download link (https://tenet.org/eva).

Tenet Token

Tenet’s native token is TENET, which also serves as the gas to pay transaction fees on the Tenet chain’s base layer.

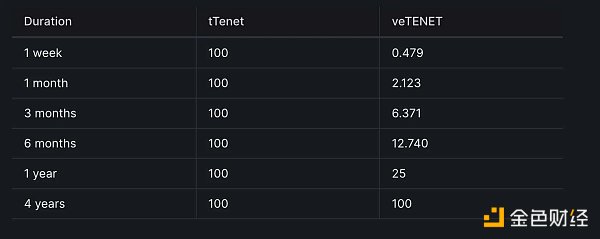

In addition, when users pledge TENET, they will receive a TENET LSD called tTENET. TENET’s token model comes from veTokenomics, and users can lock tTENET to generate veTENET. veTENET represents the TENET held in voting custody, which means that the longer tTENET is locked, the more veTENET received. Like the traditional veToken model, veTENET can vote on protocol governance and reward standards. The shortest time to lock tTENET as veTENET is one week, and the longest is one year. The following are the criteria for obtaining veTENET by locking tokens:

Holding veTENET can earn rewards from various aspects:

TENET validator

TENET stablecoin protocol

TENET money market

TENET DEX

Tenet’s stablecoin lending

The Tenet Stablecoin Protocol provides zero-interest loans and has higher capital efficiency (that is, less collateral is required for the same amount of borrowing) compared to other lending systems. It allows users to pledge assets that have already generated income by participating in the Tenet node verification. Users can use the protocol to lock LSD, borrow LSDC, and then repay the loan on the due date, rather than selling these collateral assets to obtain liquid funds.

A good thing about Tenet is that users can perform nested operations, pledge interest-bearing assets as loans, and swap LSDC for more interest-bearing assets to obtain more funds and deposit them into CLIP for leverage. It can obtain additional liquidity from assets that users want to hold for a long time and have already generated income, allowing them to continue to expose assets to earn income.

CLIP represents a collateralized liquid interest position, the concept of which is similar to Vaults or CDPs. Each CLIP is tied to a Tenet address, and each collateral type for each address can only have one CLIP.

CLIP includes: pledged assets and debt denominated in LSDC. Users can change the CLIP amount at any time by adding collateral or repaying debt, and the collateral ratio of the CLIP changes accordingly.

Tenet team and partners

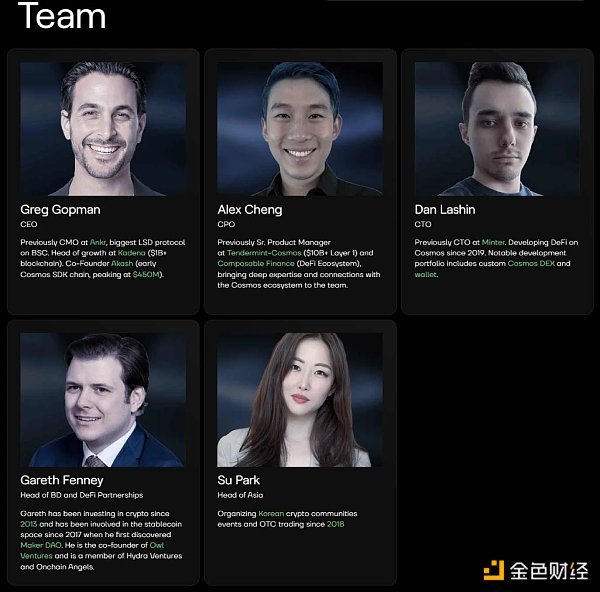

The Tenet team includes senior talents in the DeFi and AI fields, core team members or contributors from companies such as Ankr, Lido, Blockdaemon and even Open AI. They are:

-CEO Greg Gopman – former Ankr CMO

-CPO Alex Cheng – former Tendermint and Composable Finance product manager

-CTO Dan Lashin – former Minter CTO, developed Cosmos DEX and wallet

-BD and DeFi partner – Owl Ventures Co-founder

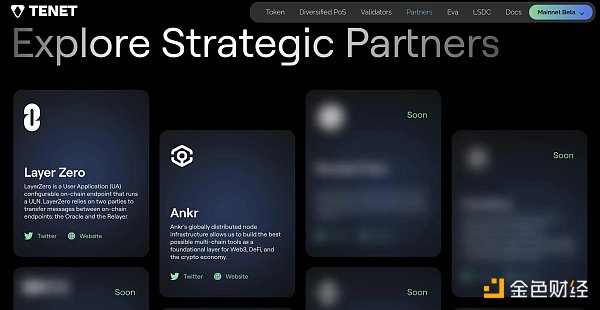

Currently, its partners include Ankr and LayerZero, and other partners will be announced in the future.

Introduction and interaction of LSD Blockingd launched by Tenet

As mentioned earlier, LSD narrative is in a hot stage and may become the mainstream of the next bull market. Recently, Tenet has also launched LSD Blockingd, the industry’s first launchBlockingd designed specifically for LSD key projects. LSD Blockingd is built on Tenet and aims to launch LSD-related key projects on Tenet chain. It is also supported by the Tenet Foundation. This launchBlockingd supports LSD DeFi, LSD Game, and LSD incentive products.

As the first launchBlockingd specifically for LSD key projects, LSD Blockingd is backed by Tenet. The Tenet community naturally has the opportunity to experience Tenet and other LSD ecosystem projects on the chain ahead of time. The native token of LSD Blockingd is LSDP, and the operation of LSD Blockingd is similar to that of other launchBlockingds:

-Stake LSDP

-Participate in IDO

-Purchase and confirm IDO allocation

Basically, the more you invest, the more shares you get. To celebrate the launch of LSD Blockingd, the Tenet team is conducting a Fairdrop, with a total supply of 20% of LSDP to be airdropped to:

-Stakers in Tenet Mainnet

-LSD stakers (including Ankr, Stader and Lido’s LSD)

However, the snapshot time and specific airdrop details have not been announced yet, and users can still go to the LSD Blockingd staking interaction, which is simple and easy:

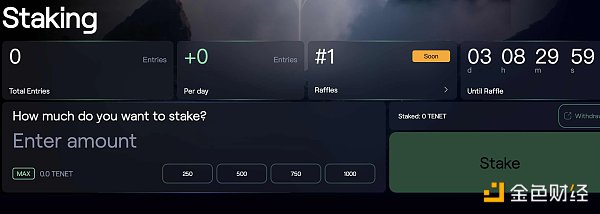

-Go to the staking website

-Get TENET, which can currently be purchased through the following four trading platforms or purchased through Uniswap, and then bridged to TENET mainnet from other networks using Multichain.

-Enter the amount and click Stake (currently conducting staking token lottery to obtain NFT raffles, and can store them in the Eva wallet for “Trade 2 Earn” in the future)

Conclusion

Tenet integrates LSDfi, L1 blockchain, Omni-Chain, native wallet, Fiat on-ramp, native token, native stablecoin, and AI into one. At present, the LSD track is hot, and it is not difficult for Tenet to become the next LSD giant. Of course, Tenet’s disadvantage is its over-reliance on LSD. If the LSD narrative disappears, Tenet will also disappear.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Long-term Effects of Shapella Upgrade: Yield, Competition, and LSD-Fi

- Electric Capital: Analysis of Key Mechanisms for Value Capture in Rollups

- Exhaustion of Gas fee causes Arbitrum to pause transaction processing for one hour

- Analysis of SEC’s “Trigger” for Launching Crypto War and 5 Possible Outcomes

- Viewpoint: Why the US Congress should regulate cryptocurrency

- Reflections on the SEC’s lawsuit against Binance: What are the reasons behind the controversy?

- Analysis: What are the common characteristics of cryptocurrencies listed as securities by the US SEC?