Electric Capital: Analysis of Key Mechanisms for Value Capture in Rollups

Electric Capital: Key value mechanisms in RollupsAuthor: Sanjay Shah, Electric Capital; Translation: Blockingxiaozou

There have been several key narratives in the crypto space over the past two years, one of which is the rise of L2. L2 has attracted billions of TVL in a short amount of time, with transaction volumes on Arbitrum alone rivaling those on the Ethereum mainnet.

However, there is still a key question: are L2 tokens simply valueless governance tokens? Or can these L2 tokens accrue real value?

In this article, we will delve into the key mechanisms for value capture in L2.

- Exhaustion of Gas fee causes Arbitrum to pause transaction processing for one hour

- Analysis of SEC’s “Trigger” for Launching Crypto War and 5 Possible Outcomes

- Viewpoint: Why the US Congress should regulate cryptocurrency

1. Core Mechanisms for Value Capture in L2

L2 primarily captures value through two mechanisms:

· MEV (maximal extractable value)

· Transaction fees

Let’s take a closer look at each.

2. MEV as a Source of Value Capture

Currently, L2s do not generate MEV revenue because they are operated by centralized sequencers that do not want users to extract value. However, the eventual decentralization of sequencers will enable MEV extraction on rollups.

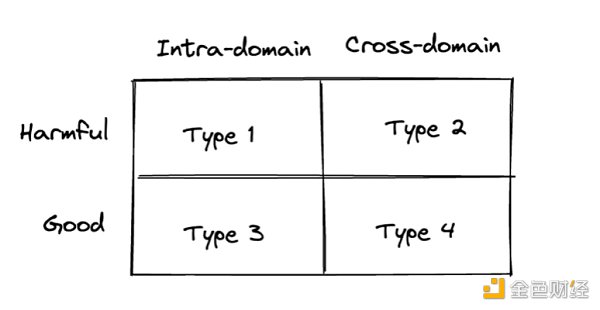

To better understand the MEV mechanism, we can think about it from two different angles:

· Harmful vs. Beneficial MEV

a. Harmful MEV has a negative impact on users. The sandwich attack on DEXs is a good example, as the user ends up executing trades at worse prices.

b. Beneficial MEV is advantageous to users. For example, cross-DEX price arbitrage helps maintain price consistency across different DEXs.

· Domain-Specific MEV vs. Cross-Domain MEV

a. Domain-specific MEV occurs within a single rollup, e.g., price arbitrage between two DEXs on the same rollup.

b. Cross-domain MEV occurs across different rollups, e.g., price arbitrage between two DEXs on different rollups.

Combining the above situations, we arrive at four subtypes of MEV.

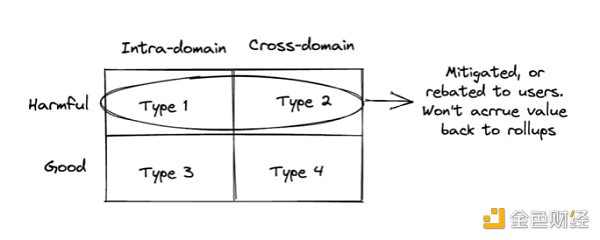

(1) Harmful MEV may be mitigated or refunded to users and does not bring value to the rollup.

As a final state, most harmful MEV may be mitigated or refunded to users. Why? Because this type of MEV directly harms users, there is a strong incentive for all participants in the stack (wallets, apps, rollups) to create more efficient ways of dealing with harmful MEV.

Some excellent teams are already working on solutions to harmful MEV:

· CowSwap is a Dex that utilizes batch auctions to mitigate harmful MEV.

· MEV blocker is an RPC endpoint that can protect your transactions from harmful MEV.

· MEV Share, launched by Flashbots, is a protocol aimed at returning MEV to users.

Methods to mitigate harmful MEV will continue to improve, and users will increasingly be able to avoid harmful MEV.

Rollups themselves are also eager to help users mitigate or return harmful MEV, to provide excellent user experiences and gain more adoption. It is still rare for enterprises to gain value by leveraging their own customers!

So, harmful MEV is unlikely to become a source of accumulated value for rollups in the end.

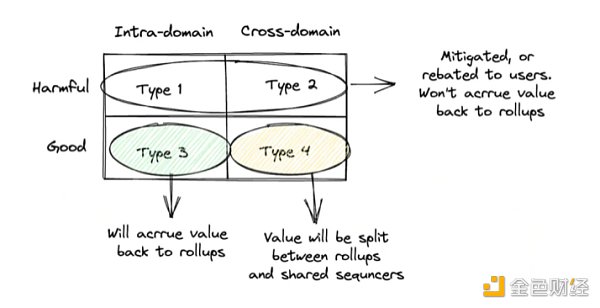

(2) Beneficial MEV may provide value for rollups

On the other hand, beneficial MEV is advantageous for users and can serve as an important source of value accumulation for rollups. I expect that most rollups will use shared sorters (such as Espresso Systems and Astria) in the future, and the question is how to allocate this beneficial MEV between the sorter and the rollup.

Here, domain MEV and cross-domain MEV can be considered separately.

· rollup domain MEV

Some people believe that if a rollup does not receive domain MEV, it will not join the shared sorter network, because the rollup can obtain the same amount of MEV without joining the shared sorter.

I do not agree with this view because whether a rollup can receive its domain MEV ultimately depends on the network effect of the shared sorter, which remains to be seen.

The shared sorter supports cross-rollup interoperability. If the resulting network effect is very strong and eventually becomes a winner-takes-all market, then rollups will choose to join the shared sorter network, even if they have to give up some domain MEV. Why? Because if they do not provide this interoperability while other rollups can, they may have difficulty acquiring users (and the value-generating transaction fees).

My view is that due to the lack of atomic cross-chain composability, the network effects of a shared sequencer will be moderate. With a shared sequencer, you can ensure that two transactions will automatically include across two chains, but you cannot guarantee that they will be executed (because one of the transactions may be invalid and rolled back on one of the chains). James Prestwich briefly explains this in his blog post.

“Specifically, simple transfers and withdrawals can be automatically executed, but any transaction that is likely to fail cannot be automatically executed, such as token swaps or DeFi interactions. Unfortunately, most high-value interactions involve one or more error-prone transactions, making it difficult to achieve atomic inclusion. The shared sequencer is not a panacea.”

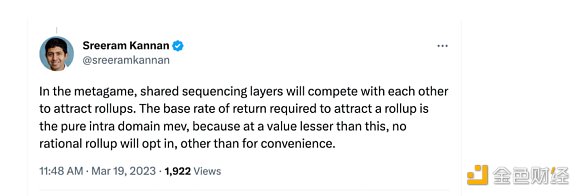

Under moderate network effects, I agree with Sreeram’s view that the shared sequencer may need to return MEV within the rollup domain.

· Cross rollup Domain MEV

Cross-domain MEV may be divided between the rollup and the shared sequencer. Rollups themselves are difficult to capture cross-domain MEV, so shared sequencers will want to get a share of that MEV.

The exact division will depend on the pricing power/network effects of each specific shared sequencer.

MEV Value Acquisition Overview:

In summary, the following is my expectation for rollup MEV value acquisition.

Please note that there is a very important question in the above picture. What is the ratio of harmful MEV to beneficial MEV? If most of the generated MEV is harmful, it limits the value rollups can generate from MEV. The answer to this question is not yet clear.

3. Transaction fees as a source of value

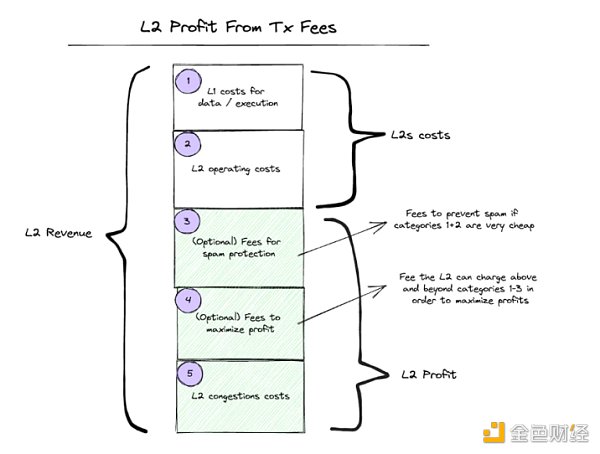

In addition to MEV, transaction fees will also be an important source of accumulated value. The following are the various fees that rollups will charge users.

At a minimum, rollups will make users (directly or indirectly) pay for the following costs they generate.

· L1 cost for data publication and execution

Rollups must pay the cost of publishing data and verifying proofs on L1, which they will recover from users.

· L2 operating costs

Rollup networks will generate various chain operation-related costs, including sorting, proving, and executing costs. They will recover these costs from users.

In addition to recouping costs, they can also choose to earn revenue by:

· Implementing a minimum charge to prevent spam

In cases where direct costs are very low, rollups may need to artificially set a minimum fee to prevent spam and prevent the inflation of L2 states. Therefore, even if EIP-4844 reduces L1 costs to almost zero, all saved costs will not be passed on to users, otherwise it may result in a large amount of spam.

· Implementing a minimum charge to maximize profit

Additionally, rollups may choose to charge more than their direct costs and spam protection. Why? Like any other business, they pursue profit maximization. It’s like Starbucks producing a cup of coffee for 0.10 dollars doesn’t mean they sell coffee at that price. They sell it at a price that maximizes their profit.

For example:

Imagine a rollup with L1 costs and operating costs of 0.01 gwei. They add 10% markup to charge customers 0.011 gwei, with a net profit of 0.001 gwei per transaction. Now imagine that the rollup decides to set the minimum L2 gas price to 0.1 gwei. Even if the number of transactions decreases by 75%, they will still make more profit. Like any product, there is always a price that maximizes profit that a rollup can set.

In fact, L2 may already be doing this. Arbitrum currently imposes a minimum L2 gas fee of 0.1 gwei per transaction. This is 100 times the minimum L2 gas fee of Optimism (0.001 gwei).

It should be noted that only rollups that can generate true network effects and are not easily replicated will be able to generate pricing power and charge fees above cost, thereby generating additional profits. Otherwise, competition will push prices down to maintain operating costs.

However, rollups that can generate true network effects and valuable states may become very valuable.

Finally, L2 will generate congestion fees.

· Congestion fees

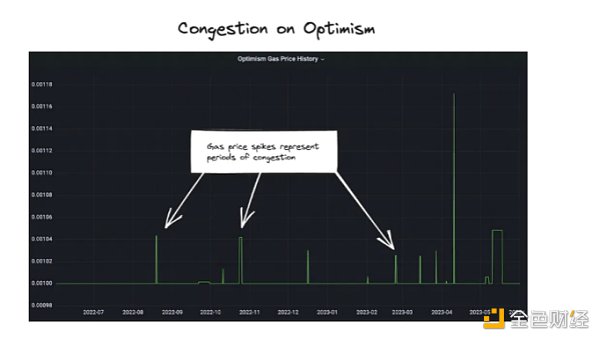

When the block space is saturated, congestion fees are generated. You can see the surge in fees last year when Optimism’s block space was congested in the following figure.

As you can see, Optimism had limited congestion last year (as did Arbitrum). However, as demand for block space grows, congestion fees may increase.

Value Capture from Transaction Fees Overview:

In summary, we can consider the value capture from L2 transaction fees as follows:

4 , Conclusion

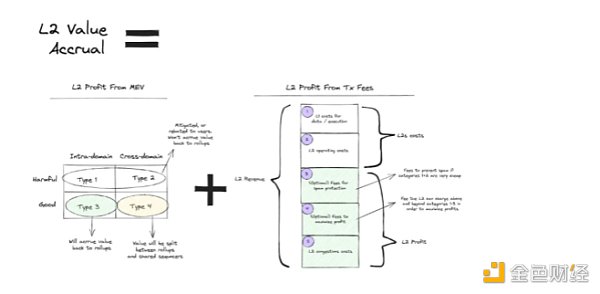

Overall, I believe that L2 value capture will come from:

(1) beneficial MEV within the rollup domain

(2) beneficial MEV shared across rollup domains

(3) L2 gas prices higher than anti-spam protection costs

(4) L2 gas prices higher than costs to maximize profit.

(5) L2 congestion fees

As stated above, some L2s may be extremely valuable. Which L2s are most valuable? The answer is those that can generate network effects and value status, which allows them to control the pricing power of their own block space.

They will not adopt a simple middleman model of charging a fixed percentage above operating costs. Instead, they will be able to set minimum prices for their block space (to reduce spam and/or maximize profit), charge congestion fees for profit, and capture value from beneficial MEV.

Finally, it is worth noting that specific application rollups have a lot of room to achieve completely different business models! For example, dYdX and Immutable X both charge users a certain percentage of transaction fees. These different business models will enable these rollups to capture more value than just gas/congestion fees.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Reflections on the SEC’s lawsuit against Binance: What are the reasons behind the controversy?

- Analysis: What are the common characteristics of cryptocurrencies listed as securities by the US SEC?

- Dune Dashboard Data: As of now, there are a total of 117,849 Lens Profiles

- Source and Security of Arbitrum Assets

- Core developers of the Ethereum execution layer have confirmed the Cancun EIP list, which includes five EIPs such as EIP-1153, EIP-4788, and EIP-4844.

- EN: Binance.US keeps records of all user funds, which have never left the platform unless withdrawn by the user.

- Discussing the SEC’s lawsuit against Binance: Years of regulatory balance disrupted, optimistic about the final outcome