Analysis: What are the common characteristics of cryptocurrencies listed as securities by the US SEC?

Analysis: Common characteristics of SEC-listed cryptocurrency securities.Author: Cryptanalysis Analyst Miles Deutscher; Compilation: BlockingNews

On the evening of June 5th, Beijing time, the US Securities and Exchange Commission (SEC) filed a lawsuit against cryptocurrency exchange Binance and its CEO Zhao Changpeng. One day later, the SEC filed a lawsuit against cryptocurrency exchange Coinbase. In both lawsuits, the SEC classified 19 tokens as “securities,” a decision that could have a huge impact on these tokens and even the entire crypto industry.

This article will briefly summarize these tokens and explore their commonalities.

- Dune Dashboard Data: As of now, there are a total of 117,849 Lens Profiles

- Source and Security of Arbitrum Assets

- Core developers of the Ethereum execution layer have confirmed the Cancun EIP list, which includes five EIPs such as EIP-1153, EIP-4788, and EIP-4844.

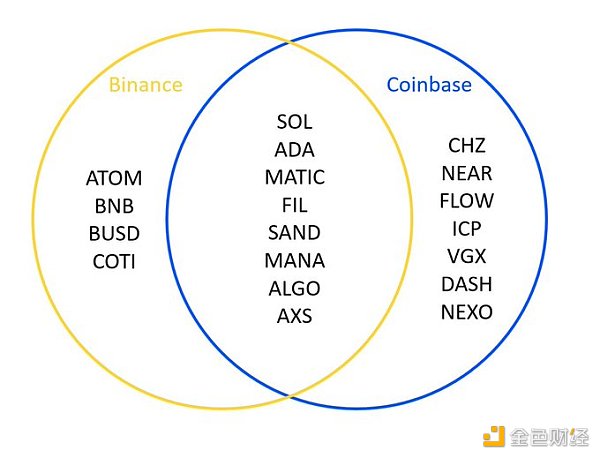

First, the cryptocurrencies identified by the US Securities and Exchange Commission as securities include:

On Binance: ATM, BNB, BUSD, COTI

On Coinbase: CHZ, NEAR, FLOW, ICP, VGX, DASH, NEXO

On both Binance and Coinbase: SOL, ADA, MATIC, FIL, SAND, MANA, ALGO, AXS

What do these cryptocurrencies have in common? There are mainly three:

1. Each token has had an initial sale/fundraising activity;

2. The project team for each token has promised to improve the protocol through ongoing development (including business development or use of marketing expenses);

3. The official social media for each token has demonstrated the characteristics or advantages of the relevant protocol.

So why did the SEC classify these tokens as “securities”? This is where the Howey test comes into play. The Howey test has four standards for determining whether “something” is an investment contract (security), which are:

1. “Something” involves a monetary investment;

2. “Something” is aimed at a specific business;

3. “Something” has profit expectations;

4. “Something” benefits from the efforts of others or the issuer.

The SEC claims that the 19 tokens subject to this lawsuit meet at least three of the above four standards, creating “profit expectations” and therefore meeting the requirements of the Howey test.

The next question is, what would be the impact if these 19 tokens were classified as securities? There are three main points:1. These tokens will not be tradable on US exchanges;2. These tokens may be delisted from US exchanges (such as Coinbase and Robinhood) for a period of time;3. These tokens bring regulatory adjustments and set industry precedents.The main issue here is that the Howey Test is an outdated and relatively limited framework created in 1946. Applying regulations established in 1946 to a brand new digital asset industry is bound to be challenging. The enforcement actions taken by the US Securities and Exchange Commission are indeed somewhat reckless, failing to consider industry differences and lacking foresight. In contrast, the UAE, the UK, and Australia have taken different and more thoughtful enforcement approaches.For the development and future growth of the entire industry, and for legitimate and compliant integration into the financial system, the crypto industry needs clear regulatory and policy guidance from the US Securities and Exchange Commission. That day will come, but until then, you need to buckle up because this journey is full of bumps.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- EN: Binance.US keeps records of all user funds, which have never left the platform unless withdrawn by the user.

- Discussing the SEC’s lawsuit against Binance: Years of regulatory balance disrupted, optimistic about the final outcome

- Latest updates on regulatory events: CZ releases internal memo, Gensler criticizes two exchanges again.

- Why did 1kx, Three Arrows Capital, and Polychain Capital “fall out” and sue the founder of Curve for encryption VC?

- Discussing the application of traditional corporate finance theory in the DAO field

- Lens Protocol raises $15M in funding with IDEO CoLab Ventures as the lead investor.

- Comprehensive Explanation of Radiant: Can it Beat Aave and Compound to Become the New King?