Sequoia China Leads $22 Million Investment in Ethereum Layer 2 Network Taiko

Sequoia China invests $22M in Ethereum's Taiko Layer 2 network.Author: Blockingcryptonaitive

On June 8, 2023, Taiko, the Ethereum Layer 2 network, announced that it had raised a total of $22 million in two rounds of financing, led by Sequoia China and Generative Ventures, with participation from BAI Capital, GGV Capital, GSR Markets, IOSG Ventures, Kucoin Ventures, Mirana Ventures, OKX Ventures, Skyland Ventures, Token Bay Capital, Yunqi Blockingrtners, and prominent contributors and community members from the Ethereum ecosystem.

One-sentence introduction to Taiko

Taiko is a type-1 ZK-EVM equivalent to Ethereum that uses a decentralized, permissionless, and secure layer-2 architecture to support all EVM opcodes for scaling Ethereum.

Background

ZK-Rollups scale the computational capabilities of Ethereum by executing, aggregating, and proving transactions off-chain, relying on Ethereum to provide data availability and validate the proof’s correctness.

- Quick preview of upcoming frxETH v2: a more efficient and decentralized LSD protocol

- MR Headset: Vision Pro, a “Legal Risk Pro” in the Virtual Reality Industry?

- Long-term Effects of Shapella Upgrade: Yield, Competition, and LSD-Fi

However, the biggest drawback of ZK-Rollups is that they cannot fully support the general computation of the EVM. This breaks compatibility with existing Ethereum L1 smart contracts and dapps and makes it difficult to build new composable dapps of the same kind.

Ethereum-equivalent ZK-Rollups, sometimes referred to as ZK-EVMs. Taiko aims to be a type-1 ZK-EVM, prioritizing EVM/Ethereum equivalence over ZK proof generation speed.

Taiko Explained

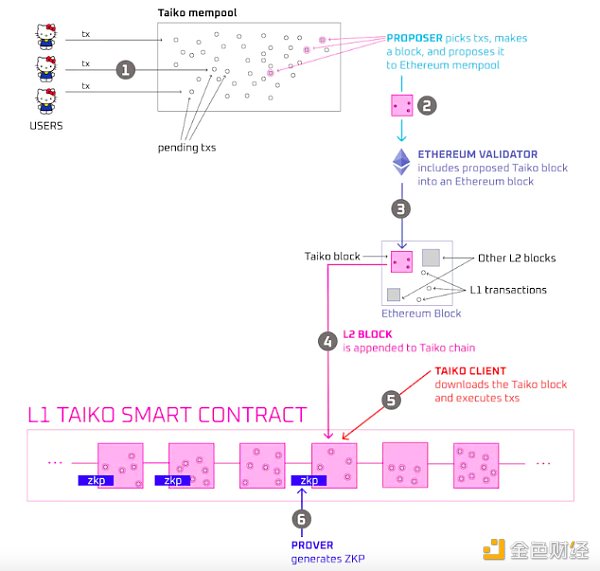

Taiko consists of three main parts: the ZK-EVM circuit (for generating proofs), the L2 Rollup nodes (for managing the Rollup chain), and the Taiko smart contract on L1 (which connects the previous two parts for Rollup protocol verification).

1. ZK-EVM

ZK-EVM proves the correctness of EVM computation on Rollup through validity proofs.

Taiko implements a ZK-EVM that supports every EVM opcode for generating validity proofs for ZK-EVM circuits. This means, in addition to full compatibility with Ethereum L1 smart contracts and dapps, that all Ethereum and Solidity tools can seamlessly work with Taiko, enabling leverage of Ethereum’s existing infrastructure and tools, as well as the large number of smart contracts and developer ecosystems on Ethereum.

Taiko can run Ethereum smart contract code directly without any modifications. Developers can easily migrate existing Ethereum smart contracts and complete dapps to Taiko, or of course implement their new Solidity code on Taiko as their first/only environment.

2. L2 Rollup Nodes

The Taiko nodes obtain transaction data from Ethereum and execute these transactions on L2, ultimately advancing the state based on the execution of the transactions. Therefore, these nodes manage the Rollup chain. Currently, Taiko nodes are a fork version of Ethereum Geth.

3. Taiko L1 Smart Contract

Taiko L1 smart contracts define and execute Rollup rules, and define potential participants. The design follows the core principles of security, decentralization, and permissionlessness. Smart contracts deployed on Ethereum L1 serve as data availability mechanisms and validators of ZK-SNARK proofs.

Understanding Taiko in One Picture

Three Roles of Taiko

In terms of network participants, three roles that adapt to the Taiko architecture can be observed:

Proposer. Constructs Rollup blocks from user L2 transactions and submits them to L1; anyone willing to participate can perform this block creation function.

Prover. Generates ZK-SNARK proofs, declaring the validity of L2 transactions and blocks generated from the aforementioned proposal blocks; anyone willing to participate can perform this proof function.

Node operator. Executes transactions from on-chain data to keep in sync with the chain’s state. Although proposers and provers need to run nodes to fulfill their respective roles, other participants also run nodes, such as participants who provide block explorer services and node infrastructure providers. Anyone willing to participate can run Taiko nodes.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Electric Capital: Analysis of Key Mechanisms for Value Capture in Rollups

- Exhaustion of Gas fee causes Arbitrum to pause transaction processing for one hour

- Analysis of SEC’s “Trigger” for Launching Crypto War and 5 Possible Outcomes

- Viewpoint: Why the US Congress should regulate cryptocurrency

- Reflections on the SEC’s lawsuit against Binance: What are the reasons behind the controversy?

- Analysis: What are the common characteristics of cryptocurrencies listed as securities by the US SEC?

- Dune Dashboard Data: As of now, there are a total of 117,849 Lens Profiles