Quick preview of upcoming frxETH v2: a more efficient and decentralized LSD protocol

Preview of frxETH v2: more efficient and decentralized LSD protocolBy Dong Nuo

Frax Finance has recently released detailed information on their upcoming LSD protocol frxETH v2, and why it is the most unique, versatile, and efficient decentralized protocol, which has quickly attracted widespread attention. We know that in traditional LSD protocols, their basic structures are similar, with lenders lending out ETH and receiving a receipt token, and borrowers renting ETH and paying interest. The way Rocket Pool works is to stake ETH on validators. Lenders can stake ETH on Rocket Pool and get rETH (Rocket Pool’s receipt token). Borrowers can rent ETH and pay interest in order to run validators. The value of Rocket Pool’s receipt token rETH corresponds one-to-one to the value of ETH. Therefore, the value of rETH will fluctuate with the price of ETH.

Similarly, Lido, another LSD protocol, works by staking ETH on Ethereum 2.0 validators. Investors deposit ETH into Lido and then receive stETH (Lido’s receipt token). Like Rocket Pool, borrowers can rent ETH and pay interest in order to run validators. However, Lido’s validator leasing is limited, and only specific nodes can be used for validators, which are managed and controlled by the Lido team. Although the two differ in their specific implementations, the basic logic remains the same.

- MR Headset: Vision Pro, a “Legal Risk Pro” in the Virtual Reality Industry?

- Long-term Effects of Shapella Upgrade: Yield, Competition, and LSD-Fi

- Electric Capital: Analysis of Key Mechanisms for Value Capture in Rollups

The founder of Farx also stated on social media that the motivation and first principles of building the frxETH protocol are precisely because the basic structure of all LSD protocols is a simple lending market, regardless of the incentive mechanism or marketing strategy, where lenders lend out ETH and receive a receipt token (LSD), and borrowers rent the right to run validators and pay interest based on loan-to-value (LTV) loan terms to lenders. The purpose of FrxETH v2 is also clear, with a focus on creating a truly decentralized, unique, and versatile LSD protocol. The key to creating a truly decentralized LSD protocol is to create a peer-to-peer pool lending market where lenders can receive receipt tokens and borrowers can rent validators. This structure allows for maximum decentralization and versatility. The design of the frxETH v2 protocol is as simple as possible, with borrowers only needing to provide a minimum amount of ETH collateral to rent validators. Withdrawal addresses and all regulation are decentralized and on-chain, just like DeFi lending markets. Interest is paid directly from borrowers’ ETH and PoS cash flows, with interest rates determined by market forces and utilization. There are no hardware costs or commissions, making the protocol very profitable for advanced node operators.

If interest rates soar and you can’t earn profits, just withdraw or repay your debt. Because your debt is in the validator, not in ETH. So you can temporarily stop and wait for the interest rate to meet your expectations again. And your loan-to-value ratio (LTV) is calculated by the validator value divided by the collateral value plus the validator value.

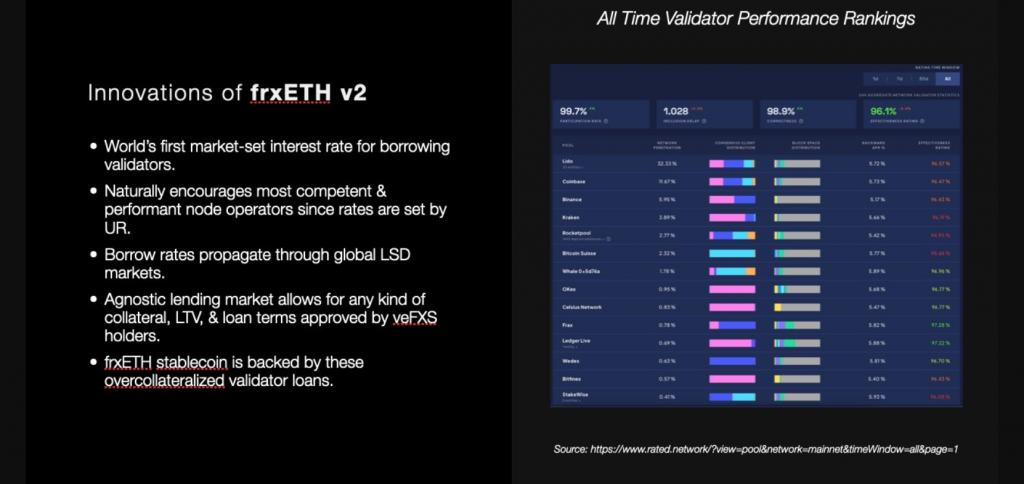

These features ensure that frxETH nodes become the best operator in the entire industry in a decentralized manner, without restrictions such as whitelisting, KYC, or reputation. Like the frxETH v1 validator, the frxETH v2 node will also be ranked at the top of the performance rankings, becoming one of the highest-rated nodes in PoS history.

At the same time, you should also ensure that your LTV is healthy. Otherwise, you will be liquidated (that is, the validator will be kicked out). If you are punished or behave improperly, your LTV will increase and some collateral will be confiscated. If your collateral cannot repay your debt, you must increase your collateral or be liquidated.

As it stands, frxETH v2 is the most efficient and decentralized lending market and is a stablecoin backed by ETH. It is also the most programmable LSD base layer for projects to build on. The protocol has more innovations, such as ETH unused in validators being sent to Curve AMO for liquidity and yield. The utilization rate will take into account AMO ETH, so it is self-balancing. The beacon oracle is also completely decentralized and on-chain controlled, with zk proof, without administrator keys, multi-signatures, or EOA trust.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Exhaustion of Gas fee causes Arbitrum to pause transaction processing for one hour

- Analysis of SEC’s “Trigger” for Launching Crypto War and 5 Possible Outcomes

- Viewpoint: Why the US Congress should regulate cryptocurrency

- Reflections on the SEC’s lawsuit against Binance: What are the reasons behind the controversy?

- Analysis: What are the common characteristics of cryptocurrencies listed as securities by the US SEC?

- Dune Dashboard Data: As of now, there are a total of 117,849 Lens Profiles

- Source and Security of Arbitrum Assets