Conversation with Cai Weide: Compared to Libra, Fnality can really set off the blockchain financial revolution.

[ Interlocked Pulse Press] On September 28th, the national special expert, the founder of Tiande Chain, and the professor of Beihang Bo, Mr. Cai Weide visited the British company Farality in London to discuss the release plan of the stable USC. During the National Day, Cai Weide published three articles in succession, interpreting the Fnality white paper and detailing its architecture and technical application. In this article, Cai Weide has repeatedly stressed the importance of Fnality, and believes that Fnality can completely change the financial world, and compare USC and Libra from multiple dimensions, encouraging the Chinese central bank and commercial banks to participate in Fnality.

Based on this, Inter-Chain Pulse interviewed Professor Cai Weide to understand the progress of the Fnality project and discuss whether the Chinese central bank and banks should participate and how to participate.

Cai Weide: National Specialist, Beihang University, MIT Bachelor. Scientific Consultant, Blockchain Research Center, University College London, UK, Chief Scientist of Tiande Technology, Director of Blockchain Internet Lab, National Big Data (Guizhou) Comprehensive Experimental Zone, Honorary Dean of CCID (Qingdao) Blockchain Institute, Central Asia President of the Association Block Chain Committee.

- Digital currency wallet mobile market is a necessary development trend

- Blockchain Weekly | The central bank released the 2020 recruitment announcement; Jia Nan Zhizhi is going to the US

- Blockchain faction: traditional giants, academics, political circles, startup companies

The following is the content of this interview:

Mutual chain pulse : Recently, you have been invited to the Fnality company in the UK. Can you tell us why they invited you?

Cai Weide: I met some of the leaders of Fnality in the past. They hope to contact some of China's blockchain scholars to understand the development of China's blockchain and find me. Because I used to accept interviews from some international media. Four months ago, Fnality had invited Chinese commercial banks and central banks to join the organization. I also reported the needs of Fnality.

I went to the UK this time. After they learned it, they contacted me to meet and exchange.

Inter- Chain Pulse: Can you introduce Fnality, why do you get support from so many banks?

Cai Weide: I think that Fnality's current operation route has gained more consensus.

Fnality began its research project in 2015. It is a project of a technology company and a number of banks. The purpose is to establish a clearing system based on blockchain. In the past few years, sometimes the team will post a message, but there is not much news. These four years have also suffered some technical difficulties. For example, the experiment that Canada did in 2017 ended in failure. This is not good news for Fnality. In addition, between 2017 and 2018, other central banks also experimented, the most famous of which was the joint experiment between the European Central Bank and the Bank of Japan. Later experiments were more successful than earlier experiments. These experiments have an impact on Fnality.

In addition to these issues, there are external factors. According to the company, in 2018, because of the relationship between digital tokens, most of the energy is in the digital token market, affecting formal blockchain financial research. However, after the digital token market fell at the end of 2018, in 2019, everyone re-emphasized the formal blockchain finance, so the company was established.

We can find a very interesting thing, these central bank experiments began with the payment system between banks, which is the project that Fnality later focused on. Does this mean that these teams have been secretly laid out in this direction at the time, but it was not until 2019? Very likely.

I have written that the current central bank currency system has evolved over the past hundred years and cannot be immediately replaced by the blockchain system. It’s like riding a bicycle and watching the moon say that I’m going to ride the bicycle to the moon tomorrow, that’s impossible.

In February 2018, the Bank of England announced that it had abandoned the original digital currency plan.

However, in March 2018, BIS (Bank for International Settlements) proposed the concept of “wholesale digital currency” (wCBDC). In July 2018, IBM announced their stable currency project, and announced in August that it was a digital dollar project. The project is small, regional, and is limited to digital currency projects in the payments sector, unlike the original Bank of England central bank project. In November 2018, the Bank of Canada, the Singapore Monetary Authority (Singapore Central Bank), the Bank of England issued a report on cross-border payment of the digital currency system, and officially proposed to use wholesale digital currency to make a fast channel between banks. . In 2018, the Swiss Federal Council report (Legal Framework for Distributed Ledger Technology and Blockchain in Switzerland) believes that the central bank can cooperate with civil society for digital currency projects. It is believed that the government should formulate regulations and encourage innovation, and letting businesses carry out projects is the way that digital money should go. Because the central bank's role is to formulate monetary policy, regulate currency operations, and coordinate economic activities, not to engage in blockchain research. They believe that technical issues should be left to the technology company. So the central bank, commercial banks, and technology companies have established such a cooperative relationship.

The project of the digital currency at once is feasible, because the original problem is greatly simplified, and multiple units work together to complete it, not the central bank's independent completion. In 2019, the International Monetary Fund also reported on the digital legal currency project supporting the cooperation between the central bank and the private sector, and considered it a project of “Synthetic Digital Law Currency” (sCBDC).

Fnality also accepted this route: not to make a large digital currency system, only a small payment system. And not to do the system that everyone can use, but to do payment transactions between banks. This range is much smaller. When the system is small, it becomes a viable project. Fnality was supported by multinational commercial banks and received financing of $63.2 million from 15 banks.

Fnality's technical route. The most important of the Fnality technology route is based on the November 2018 report of the three central banks (UK, Canada, and Singapore). But also propose new ideas or new technologies, such as:

• One legal currency for a current account;

• a chain of legal currency;

• 100% of the legal currency exists as a reserve for the central bank as a digital legal currency.

These are all innovations, not the same as the previous central bank report. For example, unlike the idea of the International Monetary Organization, they do not adopt a partial reserve system; unlike the reports of the three central banks, they adopt a blockchain system, and the other is a chain of legal currency; unlike traditional bank cross-border payments, they use one legal currency. Current account.

In addition, technically, a chain is used to do a job. This is consistent with the "Panda Model" that I proposed in 2016. The data in this chain is simple, the system is modular, and the expansion is easy. This "panda model" is based on the ABC/TBC (account chain, transaction chain) double-chain architecture, and a group of chains form an application system. Because it is the same structure of the chain composition. Chains and chains interact with each other easily. The Panda model can be load balanced, the chain can be divided and combined, and can be easily extended and extended everywhere, which is very suitable for the use of multi-agents.

Interchain Pulse: How did your project progress when you talked to Fnality?

Cai Weide: After the route is confirmed, the progress of Fnality is still quite fast. According to them, in addition to the determination of the issuance of the US dollar, the euro, the Japanese yen, the British pound, the Canadian dollar and the five-country digital legal currency, they will cooperate with the two legal currencies in the near future.

Mutual chain pulse: What innovative ideas does Fnality propose for their project?

Cai Weide: They believe that the use of blockchain can replace the current CSD (Central Securities Depository System). They proposed using Fnality's payment system, and the blockchain-based CSD is placed on the exchange, which can replace the current "exchange + CSD + payment" system, which is enough to cause a blockchain financial revolution, which will achieve high-speed stocks. After the transaction, clear settlement and payment at high speed.

CSD is considered by many countries to be an important national financial system. The credit system guarantee for securities trading in capital markets around the world is mainly CSD. Earlier this year, a British company completed a blockchain-based CSD system, but did not complete the regulatory review because there was not enough money.

If CSD can be implemented by blockchain, coupled with high-speed payments, the financial infrastructure has changed dramatically, and this change is not from Bitcoin, but from participating in the central bank.

In addition, compared to Libra being opposed by different countries, Fnality is supported by multinational central banks and more than a dozen commercial banks, which is easier to achieve.

Therefore, the blockchain financial revolution officially began.

Interchain Pulse: Fnality Is there a technical problem with their project?

Cai Weide: Fnality's structural design is very good, but it is not enough to choose the blockchain system, which is why it can successfully bury hidden dangers in the future. Fnality does not require banks to choose any blockchain, but if some banks choose a “pseudo-chain”, then systemic risks may result, which is very risky.

Mutual chain pulse: After you came back, you wrote a lot of articles about Fnality in succession. Why do you think so?

Cai Weide: Because Fnality is a blockchain financial revolution, this revolution was led by the central bank, combined with commercial banks and technology companies. The day that was made was the day when the Wuchang Uprising was successful, and it is now in the deployment stage. This can be compared to Libra: Libra has been criticized by many central banks, but today, no central bank has publicly criticized Fnality.

I have studied Fnality before, and I have seen it in the white paper. There are a lot of important information in the book that are understated. But when I talked to them, I learned more details and the real reasons for their team's excitement.

I have written many articles, and I hope to pass this revolutionary idea to China.

Libra awakened everyone, but the financial revolution may have started from the USC of Fnality, because this is the revolution that the foreign central banks themselves opened, coming out of the orthodox financial center. Whether we agree or disagree with their route, their route is worthy of our reference. Central banks do not recognize Bitcoin, but what is the blockchain financial route? Many people may not answer this question. And Fnality USC is a fairly complete route provided by these foreign central banks.

Mutual chain pulse: So, Fnality is the Wuchang Uprising, Libra is more like the Huanghuagang Uprising, then do you judge whether Fnality's stable currency is issued smoothly?

Cai Weide: It is not easy to say now. If they don't find the right person, they may not be able to do it, or they will have a big security problem. This requires people who understand finance, know how to pay, and understand the blockchain. After contacting them, I feel that I should do it.

Mutual chain pulse: You have suggested in the article that the People's Bank of China and commercial banks participate. So how do you participate, especially if the Chinese central bank is going to do its own digital currency, will it still participate?

Cai Weide: We must not admit that foreign countries are indeed more advanced than us in some places. We should learn from them abroad where we are advanced. And they are welcome to China. One of the biggest uses of participation is to work with them and know some new ways to know their development.

They contacted me four months ago. But at that time, only from the outside, it was not clear where their source of thought was. It is impossible to string their thoughts from beginning to end.

After talking with them in London this time, I came back and did hundreds of hours of research and read all of their references so that their entire development story can be strung together. Their stories need to be seen together from other stories. For example, the Bank of Canada's report in 2017, the report of the European Central Bank and the Bank of Japan in 2018, the BIS digital currency report in March 2018, the report of the 3 central banks in November 2018, and the report of the International Monetary Fund in 2019. These reports can be seen together to have a three-dimensional view. I have studied these reports before, but it is the first time I have read them together.

They have a big layout, special ideas, failures and successes. So if we can understand some of their source ideas, we can have an awareness of the entire project. One important thing is that if the blockchain is not used for cross-border payments, the use is greatly reduced. So I think the biggest meaning of participation is to communicate with the world.

In fact, Fnality also believes that by joining this organization, China can also have its own blockchain, its own payment regulations and regulatory system. Therefore, after joining, it is basically completely controlled in its own hands and can be controlled independently. It is only necessary to comply with USC's agreement standards when trading with other legal currencies.

This is related to participating in the legal currency, because each central bank thinks that it is the owner of the legal currency. This sovereignty will not let out, so the USC system is to let each central bank have its own rules and technology, and they provide an interactive platform.

Fnality revealed that within six months, it may announce cooperation with two other countries, and its platform will become a joint platform for seven countries.

Mutual chain pulse: Are the other two countries now easy to disclose? What kind of impact can delay participation have on China?

Cai Weide: The other two countries are in Europe and the other in Africa.

Fnality has invited China many times, and China has not joined, so if you want to join, it may be "franchise" rather than a core partner. The current core partners are the United Kingdom, the United States, Canada, Japan, and the European Union (Euro). It may also add a major currency country in Europe and a big country in Africa. But specifically, they have to wait for them to post a message.

[Introduction to Panda Model]

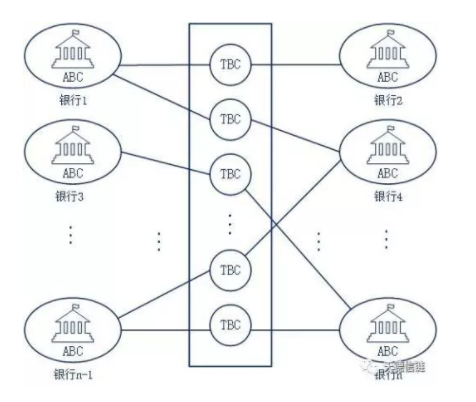

The Panda model solution proposed by Cai Weide in 2016 uses the ABC-TBC architecture to separate account information from transaction information, ensuring privacy. Each bank uses an ABC to store account information, and each two banks use one or more TBCs. Each ABC does not talk to other ABCs to protect the privacy of each bank customer. There is only transaction data on the TBC, there is no balance information, and other encryption methods can be used to protect transaction privacy. Different TBCs can process transactions in parallel, increasing speed.

The Panda model can have a 4-D architecture: 1) multi-chain, not as single-chain as the previous two designs; 2) multiple nodes per chain; 3) multiple servers per node; 4) each Multiple storage on the server. This 4-D architecture guarantees the reliability of system data.

This design is "hard isolation", which is maintained by different servers and protects privacy. It can be both a decentralized design and a SWIFT (central node). If SWIFT exists, you can design to see only the data of the TBC, and you can't see the data of other banks' ABC.

This article is [inter-chain pulse] exclusive, the original link: https://www.blockob.com/posts/info/25368 , please indicate the source!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Viewpoint | The virtual reality of the combination of real estate industry and digital securities

- Notes | Coingecko Industry Quarterly Report: Defi is unstoppable

- When will the inflection point of the blockchain industry emerge?

- Talking about how to solve the privacy requirement on the public blockchain

- Love and mourning in the alliance chain (sequel): Performance is not the most decisive factor

- The market “falls” endlessly, can the recent major changes in EOS reverse the overall situation?

- Introduction to Asymmetric Encryption: Vernacular Analysis of Private Keys, Public Keys, RSA