Viewpoint | The virtual reality of the combination of real estate industry and digital securities

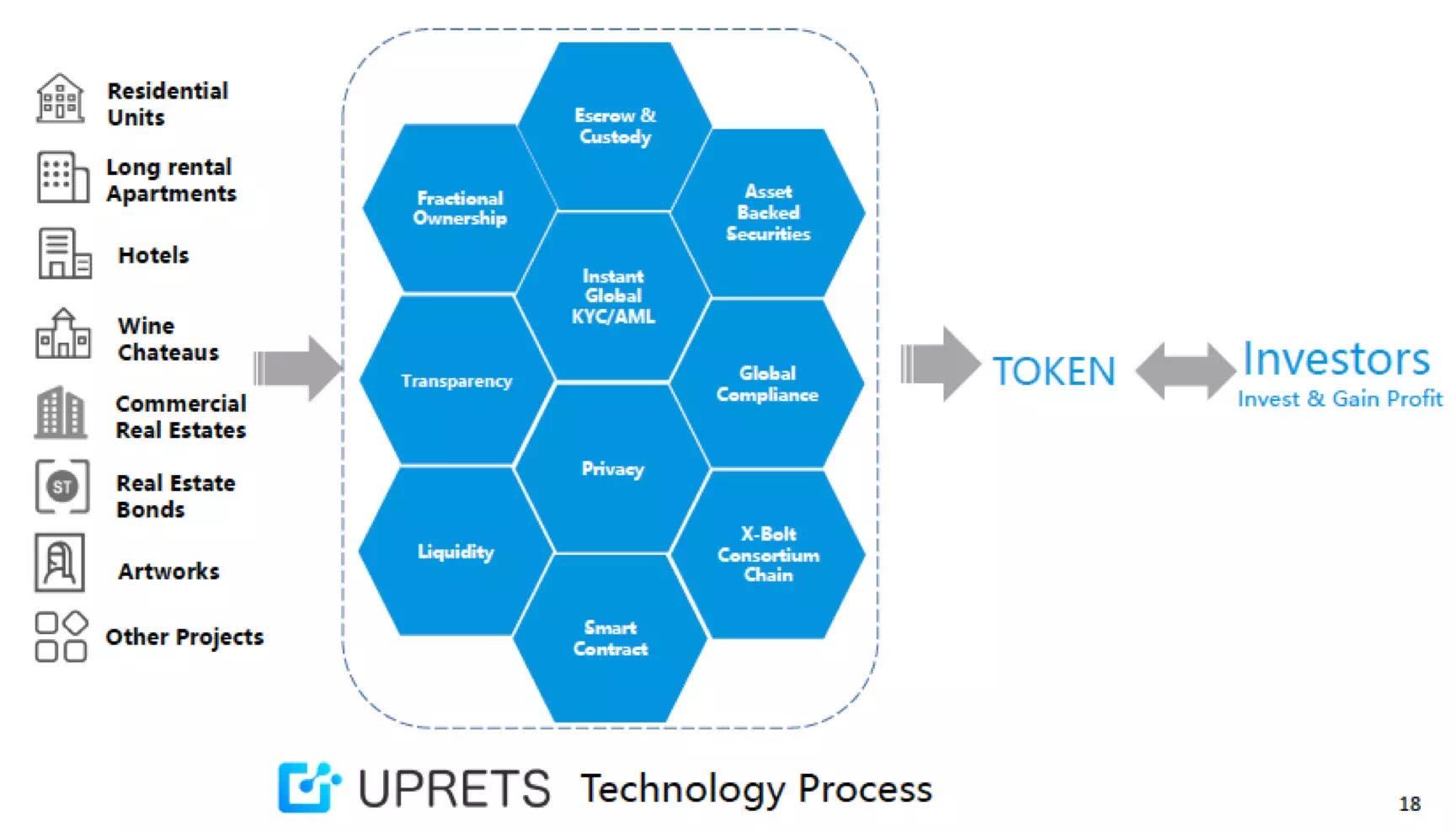

As early as 2015, the idea of combining the real estate industry with blockchain technology has been proposed in the United States. Since 18 years, the early realists in the traditional real estate industry have begun to take action. UPRETS, Resolute, Securitize and other platforms are helping. Overseas real estate has achieved new changes through technological and financial innovation, and has become an early case in the entire traditional real estate industry.

Wei Ran mentioned: "At present, the matching between the global asset end and the capital end is still not good enough. At present, all cross-border real estate investment channels are relatively lacking, and the emergence of Security Token allows us to see the real assets become more A method of liquidity. Through the pass, the transfer of this share will become the next point of view in the real estate market.” This interview records Wei Ran’s exploration of the real estate industry in the blockchain field, and The experience sharing in the real estate digital real estate issuance process, hope to give inspiration to industry practitioners and asset issuers.

Digital securities in the eyes of real estate developers

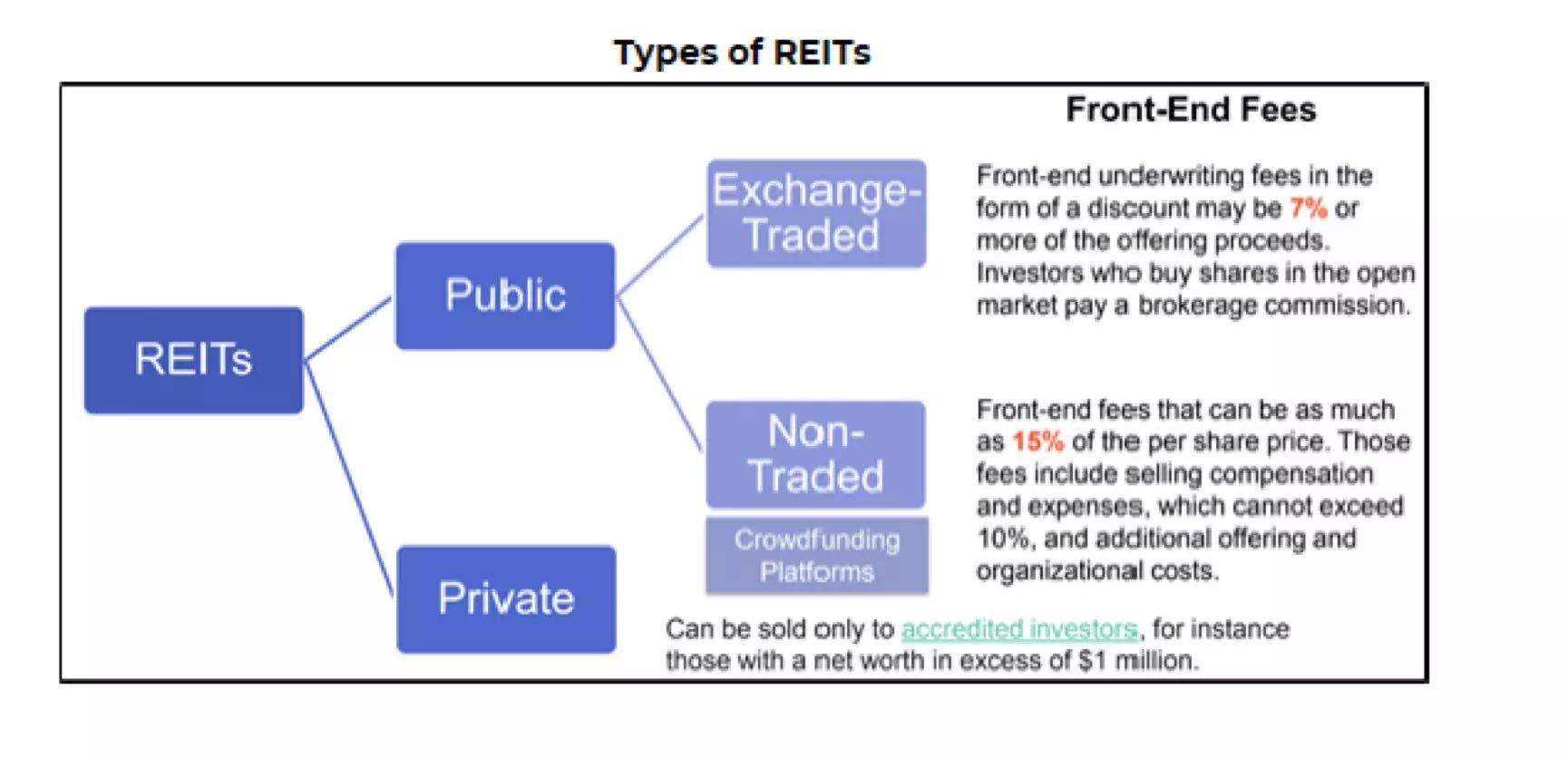

From the perspective of traditional real estate developers, the real estate industry is also constantly seeking change. Many real estate developers have experienced a process of expanding from a regional market to a national market and then expanding into a global market. From residential to commercial real estate to shared office and tourism real estate, the entire real estate industry has gradually transformed into a collection of functions, with the emergence of ABS, REITS, and even Security Token, real estate and cutting-edge technology and finance. The combination of tools has gradually formed a development trend, which is inevitable.

The main motivations for real estate developers to choose STO are many:

- Notes | Coingecko Industry Quarterly Report: Defi is unstoppable

- When will the inflection point of the blockchain industry emerge?

- Talking about how to solve the privacy requirement on the public blockchain

Wei Ran starts from a simple phenomenon: in the traditional real estate industry, the high debt ratio is not an absolute bad indicator. For real estate developers, no debt means no investment, and real estate developers exist. The demand for "seeding" has the need to buy undervalued assets. In this case, the motive is not simply “lack of money to finance” or simply “poor asset quality.” Real estate developers who already have good assets have been seeking to “invest in the current market through a more liquid approach.” Undervalued assets , STO is naturally compatible with the DNA of many overseas assets and has become a new solution.

Through STO, real estate developers can sell real estate assets through a smaller share, and get more liquidity. They can also use the blockchain technology they develop, in line with their strategic development direction. Real estate agents have a good solution.

The main steps of real estate certification include from the initial consulting services (such as the initial due diligence of the asset side), legal structure setting, compliance setting, technology issuance (ie the process of securitization and certification), and then The fundraising process (investment acquisition and management, etc.), and the subsequent listing and trading links.

The liquidity of real estate digital securities and the new "debt market"

On the way to real estate developers' practice of STO, the UPRETS team looks at a "new" and "bigger" market:

Looking at the development of the entire blockchain industry, from the 1.0 version of the digital currency represented by bitcoin, to the 2.0 version of the 1CO represented by ETH, in a certain sense, this is equivalent to the first currency, and then There has been "equity financing" (only this stock price volatility is very large, sometimes irrational), and from the perspective of the securities market, there is still a huge debt market, which is a huge fixed income. Market , this market should have existed in the financial market, and it must be grafted with the real economy.

Wei Ran said: "STO and IPO, 1CO and other models should be parallel, and STO opens up a new market."

At present, most people in this market will mention the hope that "Old Money will enter the market". The "Old Money" here mainly includes some investment institutions, family funds, etc. For the old money, the logic of investing in digital assets is mainly "In order to maintain the global ranking of its current wealth, it is necessary to prevent potential threats such as bitcoin and other digital assets, so it is necessary to use 5% of its assets to purchase digital assets such as Bitcoin . " According to Wei Ran's observation, in fact, many investors of this type agree with this logic. They often choose to let their asset managers configure digital assets in this proportion and purchase derivative products such as Bitcoin index funds. There are even blockchain believers such as Tim Draper (the famous angel investor in Silicon Valley) and his son Adam Draper, who believe that BTC will rise to $250,000 and set up Boost VC to focus on investing in blockchain companies.

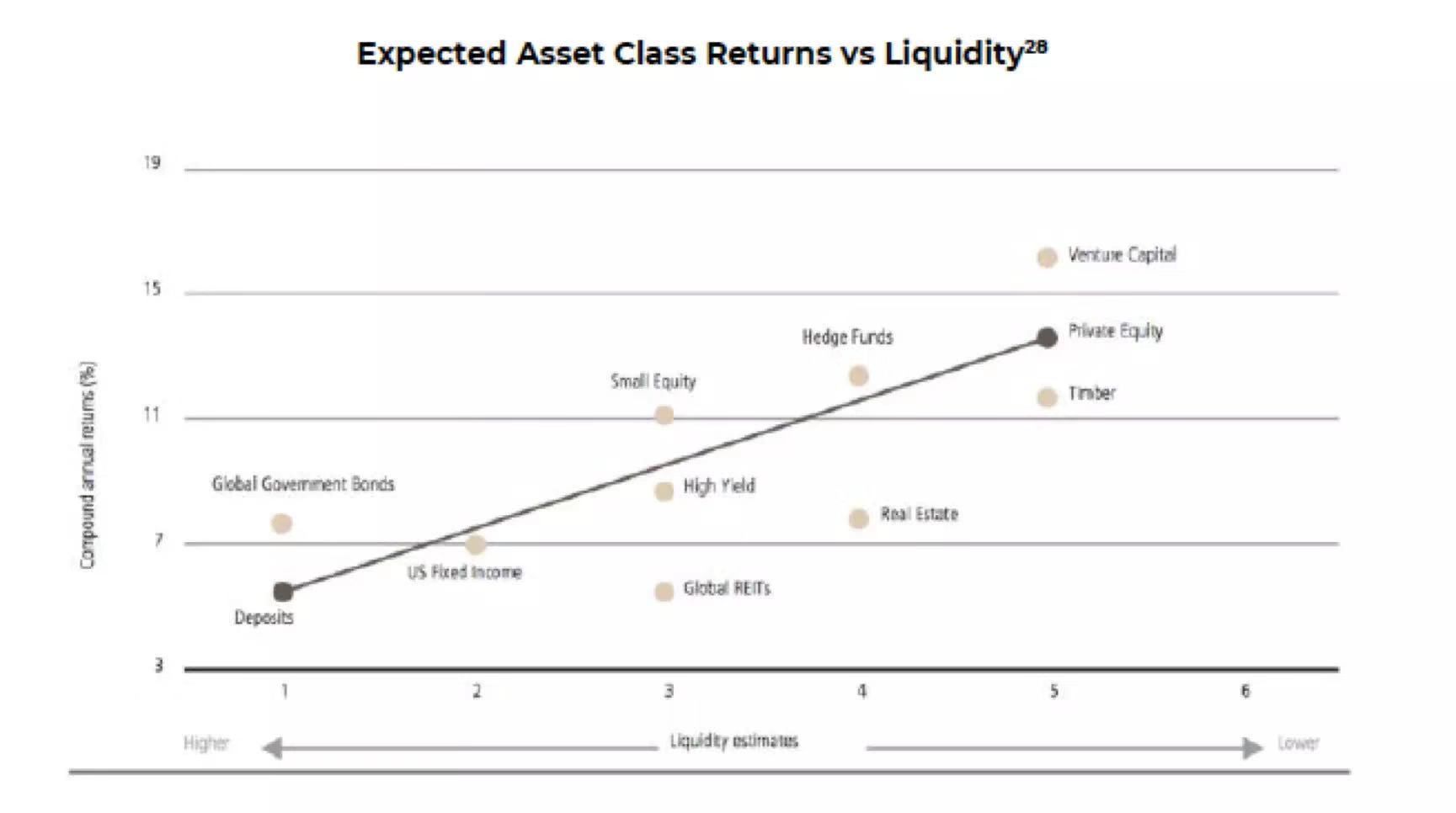

"But we believe that the potential of digital assets is not limited to high-risk asset markets with less than 5% of the market, and 95% of the funds remain to be tapped. Currently, 95% of assets are still allocated to real estate, government bonds, real estate. Among the funds and other products, the reason is that these varieties are stable and safe, and the annual yield of 3%-10% is enough to meet the needs of large-scale but low-risk preferences. At present, many traditional investors hope to invest in digital assets. They are optimistic about the form innovation brought about by technology, such as making cross-border investment extremely simple, but only guilty of the lack of real asset support and price volatility. "

Wei Ran further mentioned, "If we can provide a financial product that has both real underlying asset support and technology to reduce investment thresholds and trading frictions, then digital assets can reach 95% of the market from 5% . In the future, the number of users facing digital securities will far exceed that of previous currency users .

She is optimistic about the entire market: "At the time of the birth of Bitcoin, its advantage was to make cross-border payments surprisingly simple and safe; in 1CO, its advantage lies in faster than equity exit, than the effect of stocks. Stronger, and investors can buy stocks from all over the world through exchanges. If the global credit market can also be reformed in this way, while eliminating price volatility and lack of supervision, then the figures The advantages that securities can bring will also be accepted by traditional investors."

On this basis, Wei Ran discussed the issue of industry liquidity.

Wei Ran believes that talking about the "good" and "bad" of liquidity requires the definition of liquidity. The "liquidity" mentioned in the industry is mainly divided into two cases. The first one refers to the first. It is not good to raise funds when selling, and the second is when there is no liquidity in the second transaction.

In the first case, the difficulty of fundraising actually depends on the high cost performance of the assets. The value of ST is based on the underlying assets. In the traditional capital market (such as the market for real estate financial products), there are many private equity funds with transfer demand, but it is difficult to find a specific buyer (the threshold is too high), the total assets It has not reached the magnitude of publicly traded transactions. Therefore, there will be an asset that is "high and not low" and will be willing to sell its assets/shares in the form of ST to N buyers (compliant under RegD/S). At this time, the form is not important, focusing on asset cost performance.

Source: Tokenized Securities & Commercial Real Estate MIT

Another reason for the difficulty in fundraising is the bias in fundraising channels. On the retail side, especially the so-called "coin" investors prefer high-risk, high-yield, small-scale investments, even speculative products, so such low-yield products are not attractive to the retail investors. Traditional fundraising channels have a strong ability to digest such products.

For the second case, the liquidity problem in the second transaction, Wei Ran said: "We should note that the security of the Security Token should be compared with Security , and should not be directly compared with Token . Real estate is essentially a low liquidity asset. It is unrealistic to expect the liquidity of its secondary market to be as high as the Token of the 1CO period. It is expected to be the frequency of circulation and the nature of gambling. Some Tokens are just as impossible."

Source: Tokenized Securities & Commercial Real Estate MIT

Real estate digital securities issuance experience and advice to domestic asset issuers

In the actual experience of UPRETS, Wei Ran summed up the following experience and hope to give more inspiration to asset issuers:

1. The asset end, the professional team, the law firm, and the fundraising channel. These points are the resources accumulated by the traditional industry players for many years. It is very necessary to have an in-depth understanding of the industry. The entrepreneurial team with a native or pure technical background in the blockchain industry is not sufficiently capable in this respect. Therefore, the traditional industry players have a natural advantage in the STO field.

2. In which country is compliant, it is necessary to design a compliance structure in accordance with the laws of that country. For example, under the US compliance framework, it is necessary to build an SPV (such as a real estate fund) and then link the Token to the fund's share of equity, which needs to be reflected in legal documents and technical aspects. In the subsequent sales process, because of the sale of certain securities, it is also necessary to find institutions with successful fundraising experience and compliance licenses to sell under legal compliance.

3. Really high-quality assets will not be limited by the distribution method. Technology and compliance are indeed important, but the most important thing is that issuers currently need to find out their target markets and find out where the real demanders are.

Indeed, some industries face “discrimination” in the indirect financing market. The real estate industry is one of them in the current industry environment. However, new technologies are giving new solutions to these industries, let us wait and see.

Text / Song Wei

Topic planning / Meng Yun

Edit / 岚雯

Source/Blocklike interview text summary

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Love and mourning in the alliance chain (sequel): Performance is not the most decisive factor

- The market “falls” endlessly, can the recent major changes in EOS reverse the overall situation?

- Introduction to Asymmetric Encryption: Vernacular Analysis of Private Keys, Public Keys, RSA

- Love and mourning of the alliance chain: development is difficult, where is the source?

- Visit: What is behind the brush of the digital currency exchange?

- Interview with famous economist W. Brian Arthur: historic changes are taking place, blockchain will enter everyday life

- Viewpoint | Say goodbye to traffic and funds, is there still value in digital currency?