Curve rescue the nation? A detailed explanation of how Opensea’s new Deals feature solves the liquidity problem of NFTs.

Curve rescues the nation Opensea's new Deals feature solves NFT liquidity problem.Original: “In-depth Explanation of Opensea’s New Deals Feature: Bartering in the NFT World”

Author: How to Be

Today, Opensea released a new feature called Deals, which allows users to exchange a series of NFT combinations with other users’ NFT combinations.

According to Odaily Star Daily, in fact, Opensea introduced this peer-to-peer “NFT combination trading model” when it launched the Seaport protocol in May this year, but the front-end of Opensea has not opened this feature.

- Exclusive Interview with Xian Diyun, Acting CEO of Zhongan Bank Virtual Assets Will Become a New Growth Point

- What new things has XMTP brought to Web3 social with its partnership with Coinbase and Lens?

- Quick Look at Velodrome V2 Further Enhancing Asset Efficiency, Strengthening OP Super Chain Vision

During the bear market, NFTs have been criticized for their lack of liquidity, and NFTs held by collectors (especially non-blue-chip and non-utility NFTs) have little use other than self-appreciation (or secret regret). As a result, a number of platforms have emerged to address the liquidity issue of NFTs, either by using lending or leasing models to release liquidity, or by further “FTizing” them with the help of financial derivatives. However, fundamentally, non-standard NFTs still have a single trading model.

Opensea, as the former dominant NFT trading platform and today’s second only to Blur, ignited hope for “solving the liquidity problem of NFTs” when it launched the Seaport protocol. Today, the related feature Deals is finally online. Odaily Star Daily will verify its working principle and effectiveness through experience, introduction, and analysis, and also share some ideas about the competition in the NFT market.

Introduction to the Deals Feature

The Deals feature is derived from the Seaport protocol, which is a decentralized smart contract protocol used to create and fulfill orders for ERC721 and ERC1155 tokens. Each order contains a token combination provided by the supplier and a token combination required by the recipient.

The Deals feature allows buyers to apply to purchase a certain number of NFTs from the seller by bundling a certain number of NFTs and tokens of equal value on the same chain.

For example: User A wants to exchange two Azuki tokens worth 5 ETH at the current value for a Bored Ape token worth 30 ETH in the possession of User B. User A needs to search for User B’s address through the Deals interface, select the Bored Ape token in User B’s wallet to generate a purchase order, and then select their own two Azuki tokens, use WETH to make up the difference in current market value, and initiate a transaction request to User B. Once User B agrees, the transaction is completed.

Through the example, you may notice one problem: this peer-to-peer bundling trading model is more suitable for the exchange of NFTs of equal value, such as Doodles and Azuki during the bull market. Of course, Opensea has also considered this and introduced WETH to make up the difference, thereby increasing the flexibility of “non-like-for-like transactions” and further improving the possibility of NFT liquidity.

(Attached: Opensea’s official Deals introduction video.)

In the Face of Strong Competitors, Opensea Seeks Change

From the launch of the new Seaport protocol in May this year to the release of the Deals feature today, Opensea’s update pace has clearly accelerated compared to the past slow progress. The reasons behind this are not difficult to understand:

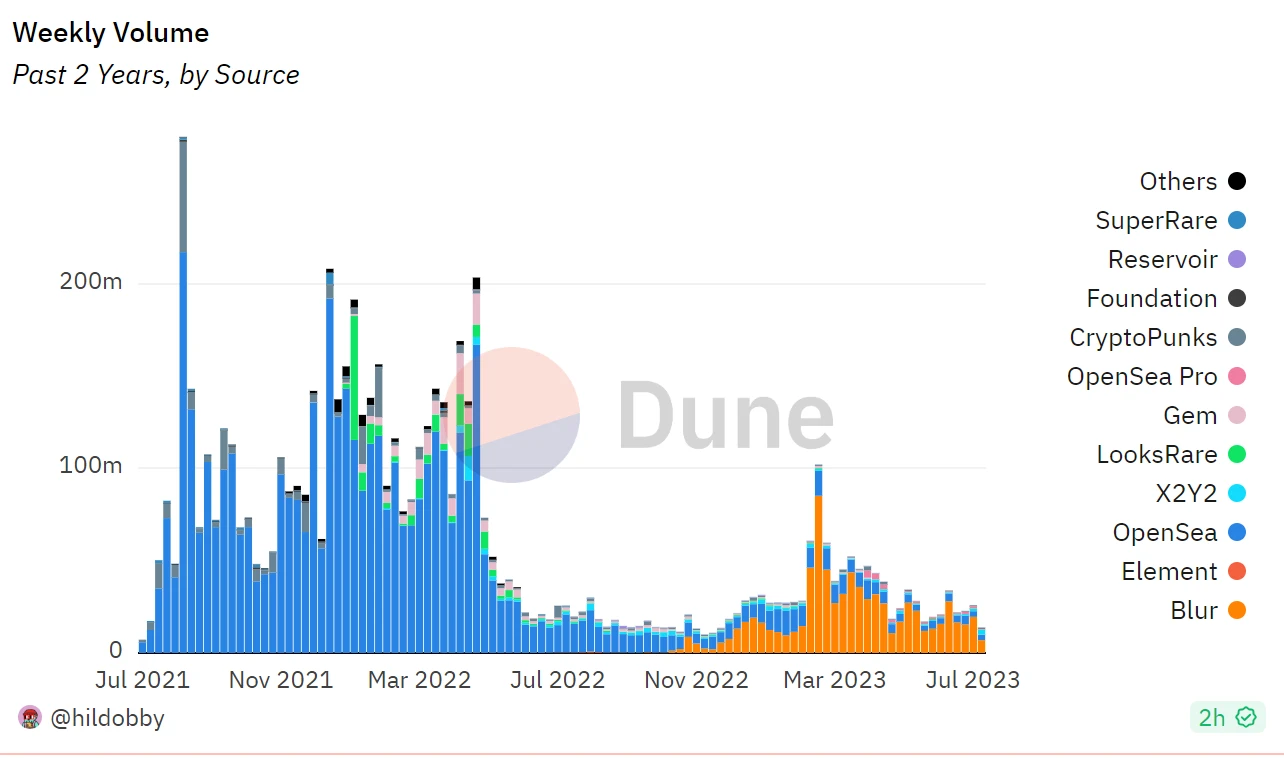

The above figure is a representation of the weekly trading volume of the major NFT trading platforms in the past two years on the Dune dashboard. It can be seen that from the end of last year to now, Opensea has been gradually losing market share to Blur, prompting Opensea to innovate and regain its dominance in the market.

Aside from tokenomics, Blur’s rise is also attributed to its product model and supporting operations. Blur focuses on the model of bulk selling and bulk buying, coupled with the newly launched NFT lending platform Blend, forming an NFT trading matrix to enhance the liquidity of NFTs.

In comparison, Opensea’s previous functionality was relatively limited, only allowing single purchases through tokens, which was not conducive to bulk purchases by large-scale buyers. This has resulted in a significant loss of market share. Can Opensea’s newly launched Deals reverse the situation and reclaim its previous position?

The Deals feature is a transaction model that differentiates it from other platforms, adopting an interactive combination trading model to solve the liquidity problem of NFTs by facilitating direct exchange between NFTs and tokens. What are the advantages of this model?

Using Blur as an example, its transaction model involves bulk selling and bulk buying, which essentially follows the steps of traditional transactions – paying and receiving goods. It only improves convenience from the user’s perspective but does not enhance the liquidity of NFTs. On the other hand, Opensea’s Deals allows buyers to exchange their NFTs and tokens for the NFTs held by sellers, eliminating the need for buyers to sell their own NFTs separately.

The Deals model also has its drawbacks, such as the inefficiency caused by the lack of real-time interaction. After the buyer submits an application, there is no further step to facilitate the transaction, and they can only wait for the acceptance or rejection by the seller. This process also increases the time cost.

Both Blur’s bulk model and the Deals model have different application scenarios. Blur is more suitable for periods of high NFT liquidity, such as during a bull market, as its usage is relatively user-friendly. Deals are more suitable for the bear market phase, improving the possibility of trading during periods of low market liquidity.

(By the way, I would like to suggest to Opensea that adding a chat window plugin for buyers and sellers may promote the success of Deals transactions.)

NFT Projects Fade, NFT Platforms Warm Up

As many NFTs fall into obscurity, platforms focused on NFT trading are also facing challenges. Compared to 2021, the overall trading volume has significantly declined this year. The shortcomings of NFT liquidity are becoming more evident.

However, there is hope with the emergence of ERC6551, Blur’s Blend lending, and Opensea’s Deals feature.

These three provide new vitality for NFTs from different dimensions:

-

ERC6551, as a new smart contract protocol, can enhance new combinatory gameplay for NFTs, improving the operability and utility of NFTs at the foundational level (NFT as a wallet, NFT as an identity). It is applicable to multiple fields, which makes me think of the possibility of combining NFTs and FTs into a whole for sale, such as in a new project’s airdrop.

-

There are many NFT lending protocols, and the integration of Blend with Blur, which currently holds the largest market share, can stimulate the release of NFT liquidity and enhance market vitality.

-

Opensea’s Deals feature changes the existing NFT trading process by eliminating transaction steps. It may be a powerful tool to stimulate the improvement of NFT liquidity, but further observation is needed.

It is gratifying that practitioners are still committed to innovation and have not been complacent. And these small iterations in the bear market may be the killer apps in the future bull market.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- LianGuai Observation | Opepen’s Rekindling A Community’s Co-creation and Win-win

- LianGuai Daily | RISC Zero raises $40 million; Manta Network developer p0x labs raises $25 million.

- Elon Musk establishes x.AI, aiming to snipe OpenAI or tell a new story of capital?

- LianGuai Observation | L2 Networks Go Live in Large Numbers, Ethereum’s Scaling Battle Begins in the Second Half of the Year

- Opepen Threadition has been online for 2 days and has received over 37,000 mintings. Why is Jack Butcher always able to create phenomenal NFTs?

- How to track smart money in cryptocurrencies? The first step to tracking crypto trends

- Injective, the pioneer of native order book chain, is a DeFi public chain based on COSMOS.