Cosmos ecosystem’s living water Entangle and Tenet, the dual heroes of the whole chain LSD.

Cosmos ecosystem's dual heroes of the whole chain Entangle and Tenet, the living water of LSD.For Cosmos, the most powerful response to “Cosmos is dead” is to truly launch a phenomenon-level Cosmos sidechain. The whole-chain LSD track seems to have the opportunity to become this breakthrough.

1. Introduction

“Cosmos is dead” – Recently, the criticism of Cosmos has been frequent, full of disappointment, sadness, and unwillingness from early supporters. The recent performance of Cosmos has indeed been surprising, with the ecosystem being stagnant. So, when will the next phenomenon-level Cosmos sidechain appear?

The Cosmos ecosystem is silent, but Cosmos never seems to lack innovation.

Even under the shadow of the Terra explosion, popular sidechains such as Evmos and Canto have emerged. However, the Cosmos ecosystem has been silent for a long time and no phenomenon-level public chain has appeared.

- Reddit Avatar One-Year Anniversary Layout and Insights Behind the NFT Project with the Largest User Scale

- Worldcoin in the Polkadot ecosystem? Another money-spreading project Encointer analysis

- Quick Overview of Recent Popular DeFi Narratives and Innovative Projects

But the pace of innovation by Cosmos ecosystem developers has not stopped. The project discussed in this article is based on a new track – the whole-chain LSD.

LSD stands for “Liquid Staking Derivatives,” which is a highly popular track in the crypto field this year. The core of LSD is to release the liquidity of staked PoS assets, which can earn additional defi profits while earning node staking rewards;

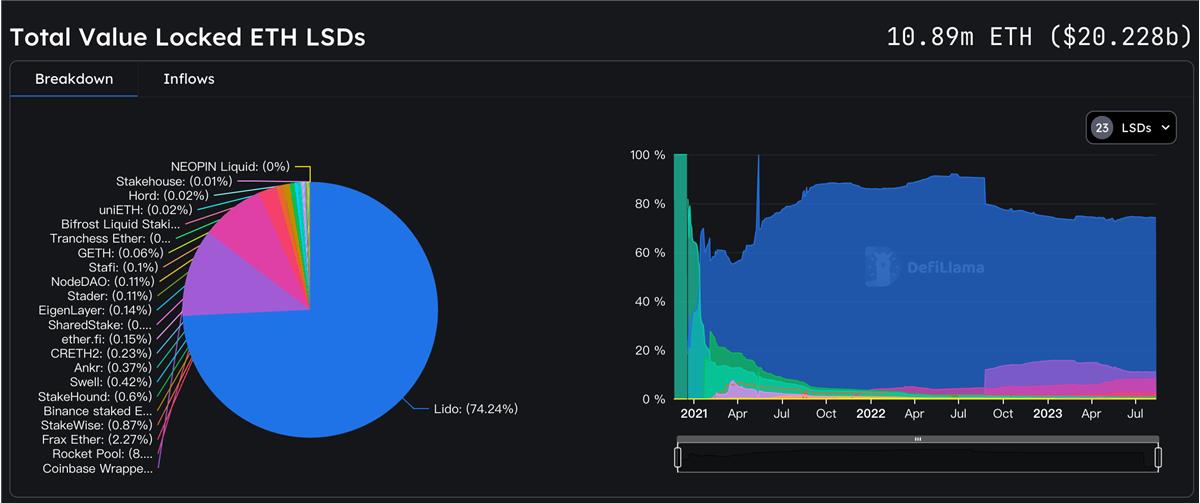

According to DefiLlama data, the market value of ETH's liquid staked assets has exceeded $20 billion.

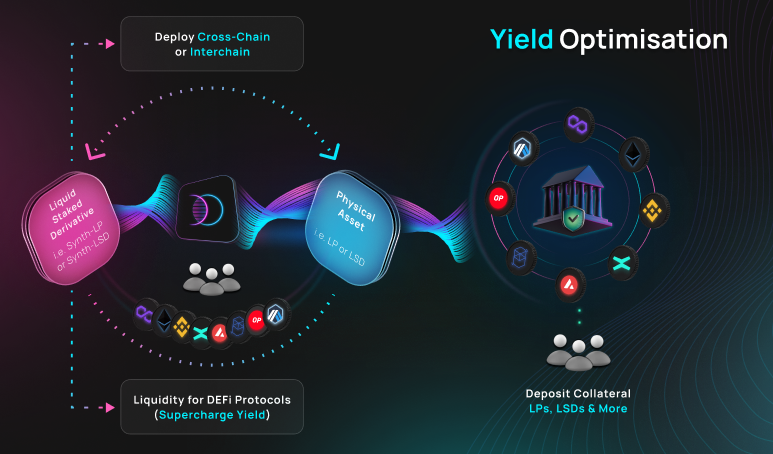

The whole-chain LSD extends the empowerment of assets to multiple chains, aiming to release the liquidity of staked assets to a greater extent and achieve more value accumulation. It can also be simply understood as adding another layer of empowerment on top of LSD.

2. The Dual Heroes of Whole-Chain LSD

Coincidentally, the whole-chain LSD protocols Entangle Protocol and Tenet Protocol both come from the Cosmos ecosystem, temporarily referred to as the dual heroes of Cosmos’s whole-chain LSD. Entangle and Tenet are application chains built on Cosmos SDK, focusing on the whole-chain LSD scene. Although their track positioning is similar, their implementation paths for whole-chain LSD are quite different.

1. Entangle Protocol

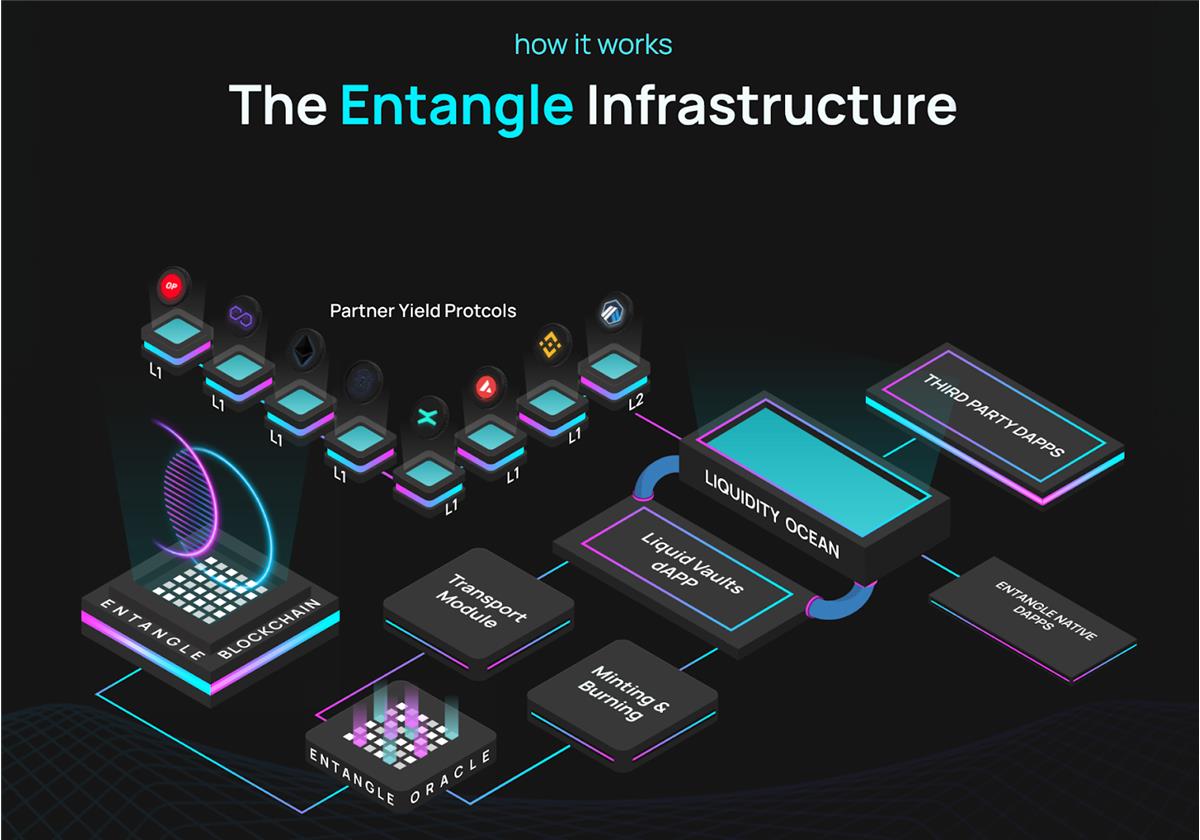

Entangle is a fully-chain LSD application chain centered around native oracles and EVM compatibility. Its “whole-chain” attribute is reflected in the ability to create cross-chain LSDs of any supported chain’s LPs on other chains, thereby achieving multi-chain profits. Let’s take a simple example: LP token holders can use Entangle to map 1 unit of AVAX/USDC LP liquidity staked assets (LSDs) on the Ethereum chain for 1 unit of AVAX/USDC LP tokens they hold on TraderJoe (a DEX on Avalanche).

Entangle's core architecture

Let’s not talk about the technical implementation principle for now. Let’s first understand why it is designed this way. In other words, why do LP token holders go through the trouble of organizing their own liquidity in this way? The reasons have been mentioned above, that is, to earn another layer of profit through Entangle, namely the profit generated by LP LSDs.

Looking at two examples more concretely:

Example 1:

1) Xiao Ming provides liquidity for stETH/ETH on Curve Finance and receives corresponding LP tokens;

2) Xiao Ming stakes LP tokens through Entangle;

3) Entangle automatically deposits LP tokens into Convex for staking and compounding;

4) Entangle issues LSD certificates for Xiao Ming’s LP tokens;

5) Xiao Ming uses LP-LSD as collateral in Curvance to earn lending income.

Example 2:

1) Xiao Hong provides liquidity for AVAX-USDC on TraderJoe and receives corresponding LP tokens;

2) Xiao Hong stakes LP tokens through Entangle;

3) Entangle automatically deposits LP tokens into TraderJoe’s yield farm for compounding;

4) Entangle issues LP-LSD on the Polygon blockchain for Xiao Hong;

5) Xiao Hong uses LP-LSD as collateral in AAVE to earn lending income (this is a hypothetical scenario, as AAVE does not actually support Entangle’s LP-LSD).

By using the above method of multiple DeFi Lego blocks with LSD assets, the liquidity of assets is greatly increased, while also bringing sticky liquidity to the protocol (explained later).

1.1 Implementation Mechanism

The above scenarios are not difficult to understand, but the technical implementation is not so easy, involving complex issues such as full-chain asset price feeding and full-chain asset anchoring. How does Entangle achieve the application scenarios for full-chain LSD?

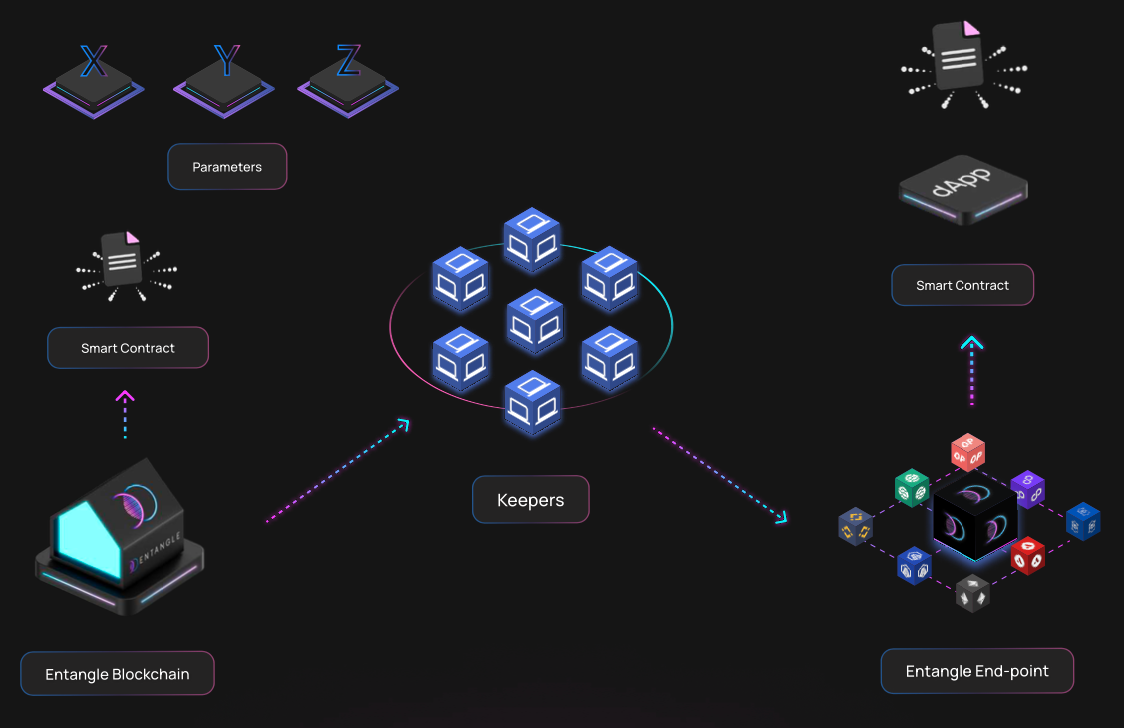

The core of Entangle’s technical implementation mechanism is the Liquidity Insurance Vaults (LV), which deploy LVs on different chains through an underlying native oracle network and multi-chain deployment.

Entangle supports the minting of LSD in LVs on Chain B based on the liquidity in LVs on Chain A at a 1:1 ratio. The supported underlying assets include three categories: LP tokens from mainstream DEXs (such as the AVAX/USDC LP on TraderJoe), lending assets (such as the USDC lending pool on AAVE), and liquidity staking tokens (such as stETH). The essence of the Liquidity Insurance Vaults is to encapsulate LP tokens and map them to other chains.

Operation process of Entangle's Liquidity Insurance Vaults

With the help of the underlying native distributed oracle solution E-DOS (Entangle Distributed Oracle Solution), Entangle provides lower-cost full-chain asset price feeding for dApps on the entire chain, without relying on third-party oracles.

Architecture of Entangle's native oracle E-DOS

1.2 Sticky Liquidity

The implementation of LP-LSD application scenarios brings more capital gains to users and, from the protocol’s perspective, also brings “sticky liquidity” to the protocol.

Many Defi projects, in order to attract users and provide liquidity in the early stages, usually adopt aggressive token economic models (high inflation rate/fast release speed). This incentive method is not sustainable, as it quickly dilutes the chips and also reduces the protocol’s revenue. Once LP (liquidity provider) returns are lower than expected, users will withdraw liquidity, and this liquidity is not “sticky”.

Entangle’s full-chain LSD (Liquidity Sensing Device) infrastructure provides cross-chain LP empowerment for users, improves liquidity incentives, and to some extent increases the “stickiness” of liquidity.

2. Tenet Protocol

Entangle provides full-chain application scenarios for LP-LSD, while Tenet provides specific application scenarios for full-chain LSD (Tenet chain staking). The former is similar to a mesh structure, while the latter is more like a converging structure. (Related reading: “Understanding Tenet in One Article: Focusing on LSD, a New EVM-based Public Chain on Cosmos”)

Tenet is also a Cosmos SDK-based EVM compatible application chain, deeply integrating the LayerZero full-chain interoperability infrastructure, enabling LSD assets at the chain level.

The core of Tenet’s full-chain LSD implementation is based on its innovative consensus mechanism – DiPoS (Diversified Proof of Stake). Simply put, users are no longer limited to protecting the network by staking the native token $TENET as validators/delegators, but applicable to full-chain LSD assets.

2.1 Supported LSD asset categories

Tenet supports a basket of assets as its DiPoS consensus staking assets, such as stETH and rETH issued by liquid staking protocols like Lido and RocketPool, as well as LSD issued by CEXs like Coinbase and Binance, such as cbETH and wBETH.

In addition, users can directly stake PoS assets through Tenet’s internal native liquid staking module without paying any management fees (note: Lido charges a 10% management fee). The first batch of PoS tokens supported for liquid staking include ETH, ATOM, BNB, MATIC, ADA, and DOT, and more PoS assets will be gradually supported in the future.

In this way, PoS asset stakers not only receive native network consensus rewards but also receive block rewards and transaction fee sharing from Tenet. This cross-chain staking method makes the connection between different chains closer and achieves a win-win positive effect – LSD stakers get higher returns, and Tenet achieves higher network security based on DiPoS.

III. Entangle and Tenet

Although Entangle and Tenet both belong to full-chain LSD application chains and are rooted in the Cosmos ecosystem, the relationship between the two seems to be more cooperative than competitive.

The core focus of Entangle is on LP-LSD, which provides cross-chain LSD services for LP assets, while Tenet focuses on DiPoS, supporting diversified LSD assets for staking consensus. Imagine that in the future, if Tenet can support Entangle’s LP-LSD as staking assets for DiPoS consensus, LP-LSD will receive additional rewards from Tenet, and Tenet will gain security assurance from LP-LSD staking. That would be a true dreamlike collaboration.

IV. Postscript

LSD Summer has brought several waves of enthusiasm to the defi, while the entire LSD chain has not received much attention from the market. As a brand new track, whether the entire LSD chain is brewing before the outbreak or perishing in the cradle, time will tell.

As for Cosmos, the most powerful response to “Cosmos is dead” is to truly launch a phenomenon-level Cosmos sub-chain. And the entire LSD chain track seems to have the opportunity to become this breakthrough.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Inventory of the 8 old projects of the transformation LSD

- Crossing the Bull and Bear The LSD Battle of the Project Party

- Crossing the Bull and Bear The LSD Battle of Project Parties

- A summary of 10 projects worth paying attention to recently DeFi, DEX, games, and on-chain tools

- Full-chain gaming becomes the market focus, in-depth analysis of the pioneering project Dark Forest.

- Using Tornado.Cash as an example to expose the scalability attacks on zkp projects.

- Multi-dimensional inventory of LianGuairadigm’s top 10 projects in the relevant fields of concern.