Recent Quick Overview of POW Projects Dynex, Microvision Chain, Neurai

Quick overview of POW projects Dynex, Microvision Chain, Neurai.Since Ethereum shifted to POS mode, most of the public chains that have received market attention have also followed the POS mode. Nevertheless, the POW mode is still evolving. A typical example is KAS, which has proposed a new POW blockchain model. With the continuous rise of KAS, new POW projects have gradually attracted the interest of investors and communities. This article introduces several recent POW projects that have performed well in the market.

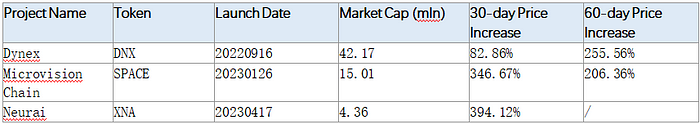

1. Market Performance

- After raising hundreds of millions of dollars in five rounds of financing, CoinList’s co-founder, the new project Eco, launched a currency experiment four years later.

- 9 projects with huge long-term development potential

- Revival trend in the social track, what is special about the star project CyberConnect?

Note: The data is accurate as of August 1, 2023.

The table shows that these projects were launched less than a year ago, with a market capitalization of less than $50 million, and have achieved significant price increases in the past two months.

In addition, the teams behind Dynex and Neurai remain anonymous, while the co-founder of Microvision Chain (Twitter: @Jason_K0001) is Chinese, and the official website does not disclose specific experiences.

2. Narrative

Each new POW project emphasizes its unique narrative, in line with current market trends.

Dynex

Dynex is a neural morphology supercomputing blockchain based on the DynexSolve chip algorithm. It uses Proof of Useful Work (PoUW) to improve the speed and efficiency of decentralized networks.

DynexSolve can run “neural morphology chips,” which outperform traditional computing methods in various tasks. Neural morphology computation is a natural platform for many artificial intelligence and machine learning applications today. Dynex aims to provide computing power for artificial intelligence, machine learning, fintech, biopharmaceuticals, etc.

Dynex primarily uses GPU computing power. According to hiveon.com data, DNX currently accounts for 14% of the platform’s computing power, making it the largest POW token within the platform’s computing power range.

Microvision Chain

Microvision Chain aims to establish a highly scalable POW public chain as the second layer of Bitcoin, improving efficiency and reducing costs. The protocol focuses on three improvements: 1) application development based on UTXO account smart contracts; 2) built-in decentralized identity protocol that supports cross-chain, where all chain data belongs to one ID; 3) to attract new users, Web3 applications do not require the purchase or holding of cryptocurrencies.

The official website shows that the core team applied for a patent titled “Method, System, and Storage Medium for Layered Data Segmentation in Blockchain Transactions” in November 2021. The testnet was launched in May 2022 and verified by the High-Performance Computing Center of the University of Science and Technology of China to have an intelligent contract execution speed of over 5K TPS.

Neurai

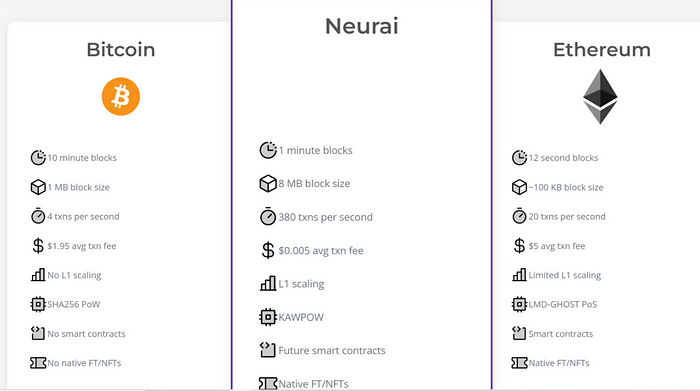

Neurai aims to become a comprehensive platform that utilizes artificial intelligence algorithms for data analysis, predictive modeling, decision-making, and connecting blockchain assets to IoT devices. Compared to Bitcoin and Ethereum, Neurai has the following main technical parameters:

As you can see, Neurai seeks to improve transaction volume per second, reduce transaction costs, and aims to support the implementation of future smart contracts.

III. Computing Power

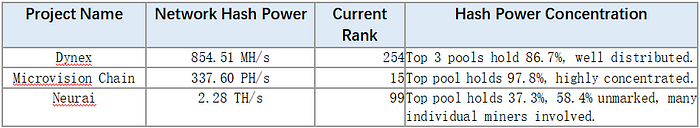

According to mining pool data, the computing power of various projects is as follows:

Note: The unit of computing power is H/s, which represents one random hash collision per second, abbreviated as H/s.

1 KH/s = 1000 H/s, 1 MH/s = 1000 KH/s, 1 GH/s = 1000 MH/s, 1 TH/s = 1000 GH/s, 1 PH/s = 1000 TH/s, 1 EH/s = 1000 PH/s.

Comparing the computing power rankings of some leading and well-known POW public chains: BTC ranks first, BCH ranks seventh, BSV ranks twelfth, KAS ranks twenty-ninth, DASH ranks thirty-first, and LTC and DOGE rank thirty-eighth and thirty-ninth, respectively. Microvision Chain ranks relatively high.

It is worth noting that according to data from hiveon.com, DNX currently has a 14% share of computing power, making it the largest within the platform’s tracked GPU computing power, surpassing the KAS token. The difference in statistics may be due to different statistical methods.

Below is the computing power trend chart displayed by Miningpool:

Dynex: Overall, it is on an upward trend. It has recently declined due to algorithm upgrades.

Microvision Chain: The computing power fluctuates without significant growth or decline.

Neurai: The recent growth trend mainly comes from individual miners, while the known mining pools are declining.

Overall, Dynex has an advantage in GPU computing power and is generally on an upward trend. However, it has recently declined due to algorithm upgrades, but it should gradually recover. Moreover, as KAS shifts to using dedicated mining machines, its previous GPU computing power has been redirected to DNX mining, further enhancing DNX’s computing power. Microvision Chain ranks relatively high, but it has a high concentration and centralization trend. Neurai has a high degree of decentralization with a large number of individual miners, and its computing power is on an upward trend.

4. Economic Model

Dynex

No ICO, no pre-mining, no team reserves. The total supply is 100 million tokens, with 64.61 million tokens already released, accounting for 64% of the circulating supply. The issuance speed is relatively fast, and it is expected that about 80% of the tokens will be in circulation within two years.

The following chart shows the token issuance schedule and the number of tokens rewarded per block over time. The block rewards gradually decrease according to a specific formula, forming a smooth curve.

Currently, the reward per block is approximately 173 DNX, with one block generated every 2 minutes. Based on this calculation, the monthly issuance of tokens is approximately 2.67 million, with a value of about 2.2 million USD when calculated at $0.6 per token.

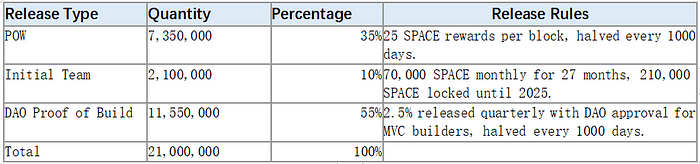

Microvision Chain

The token issuance of Microvision Chain is not purely based on the POW model. It also includes reserves for project and DAO builders, more like a combination of POW and POS models.

According to this release rule, approximately 274,000 tokens are released monthly in the first 1000 days, with an annual release of about 3.28 million tokens and a total release of 9.86 million tokens in three years. After three years, the circulation ratio will reach 47%. If calculated at $12, the monthly issuance value is 3.28 million USD and the annual issuance value is 39 million USD.

Neurai

The total supply of tokens is 21,000,000,000, with a current circulating supply of 5,873,595,098, accounting for 28%.

If calculated at a price of 0.00081, the monthly appreciation amount is approximately 810,000 USD, accounting for about 17% of the current market value.

It can be seen that the token allocation of Dynex and Neurai follows a complete POW model. 65% of the tokens in Microvision Chain are not distributed based on the POW model, and the project team has significant control. Early miners hold a large number of tokens for these three projects. These tokens are both potential selling pressure and potential buying power.

5. Concerns

In the above three projects, the team’s strength and the feasibility of the technology are the most easily scrutinized. In the Dynex and Microvision Chain communities, occasional FUD (fear, uncertainty, doubt) is expressed towards the project teams. The main concern is that the papers published by the project teams seem to be “patched together” from various sources, and the videos they present do not represent new technologies but merely the appearance of concepts.

These three projects require strong research capabilities and technical development capabilities. Dynex and Neurai are operated by anonymous teams, without leaking member information; although Microvision Chain does have semi-public co-founders (for example, through Twitter and interviews), they lack industry recognition and experience in other well-known projects.

Currently, many investors involved in such projects have profited from KAS investments. There is a certain degree of overlap within the community.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Vertical Integration of DEX Vertex Protocol Project Analysis How to Improve Asset Pricing and Capital Efficiency?

- Risk and return coexist, taking stock of 9 potential projects worth long-term attention.

- Intent-based architecture and experimental projects Inventory of general intent layer and specific intent projects

- Star project MEKE’s public beta test starts with a bang, driving an increase in BNB L2 trading volume.

- Crypto ‘cult’ mentality How to identify early signs of future fanatical projects

- Project loss borne by users? Stablecoin USD discounted by 30% overnight

- What are the noteworthy catalysts after Velodrome V2?