A summary of 10 projects worth paying attention to recently DeFi, DEX, games, and on-chain tools

10 noteworthy projects in DeFi, DEX, games, and on-chain tools.Author: Leo

The author has selected 10 innovative projects worth paying attention to, including DEX, Game, on-chain tools, etc. In addition to DeFi innovative projects, there are also two insurance projects worth noting: BTC-backed life insurance projects and platforms that provide insurance for linked assets. It is common for DeFi projects in the crypto industry to be attacked, so insurance-related new projects are worth paying attention to and may be part of the future narrative. Another good project is an on-chain gaming platform relying on luck, which is simpler and more straightforward than traditional gambling and may be liked by users. The following are the projects worth paying attention to:

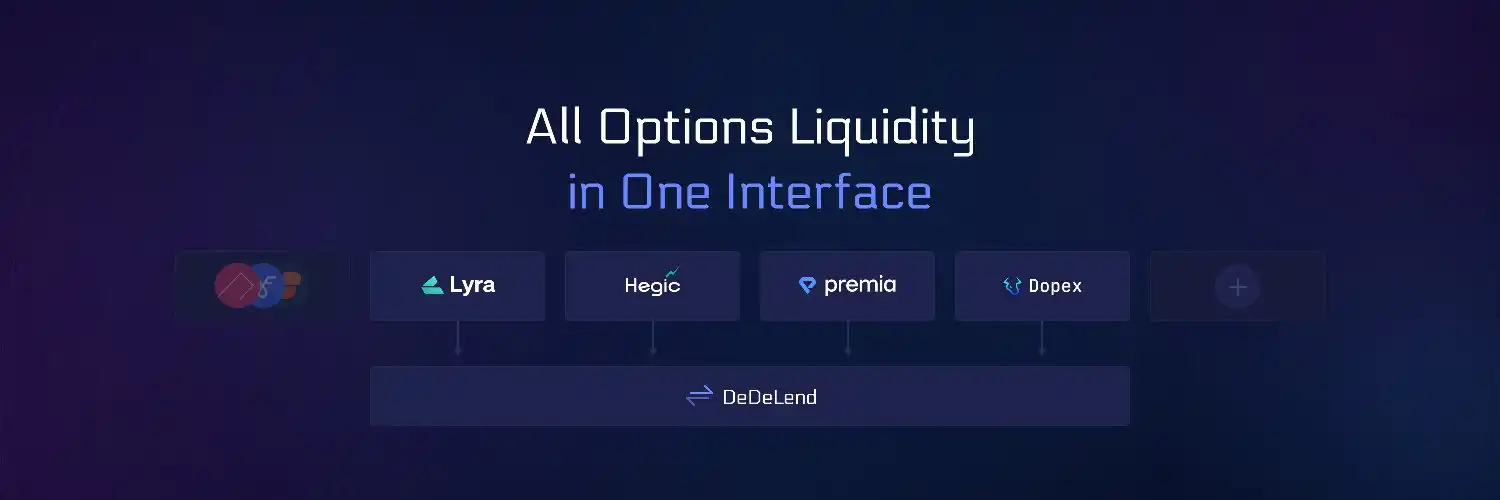

DeDeland

DeDeLend is the first on-chain options aggregator platform, where users can trade through its simple and intuitive UI, including perpetual swaps (GMX and Gains) and options (Hegic, Lyra, Premia, Dopex).

- Full-chain gaming becomes the market focus, in-depth analysis of the pioneering project Dark Forest.

- Using Tornado.Cash as an example to expose the scalability attacks on zkp projects.

- Multi-dimensional inventory of LianGuairadigm’s top 10 projects in the relevant fields of concern.

The biggest problem facing DeFi options is the fragmentation of liquidity, and DeDeLend is here to solve that problem. Unlike options platforms like Deribit, decentralized solutions seem unable to accumulate liquidity for large-scale transactions, which is exactly what DeDeLend is suitable for. One example given by the team is “For example, you can create a Strangle by combining Hegic’s Call option with Lyra’s Put option.”

The two main features of DeDeLend are: Unified trading terminal and margin account.

The unified trading terminal is similar to aggregators like bungee (cross-bridge asset aggregator). For example, when users are conducting perpetual trades, they can choose GMX or GNS, and when conducting options trades, they can choose Hegic or Lyra, and find the most suitable trading platform with just one click. In addition, DeDeLend allows setting take-profit or stop-loss orders (only applicable to trades conducted through Hegic and Lyra), automatically closing positions when the predetermined loss level is reached, without the need for users to constantly monitor asset price fluctuations, effectively managing risks and preventing significant losses. Additionally, the unified trading terminal greatly enhances the user experience.

The margin account is also an important product of DeDeLend, which provides practical features such as multi-collateral, full-margin, and leverage of up to 5x. It allows users to effectively manage trading activities, use multiple assets as collateral, and gain greater purchasing power.

Overall, DeDeLend opens up a new dimension for DeFi options trading, but the platform has not mentioned tokens or a roadmap yet. We look forward to further updates on this project.

Bingo0x

The narrative of gambling GameFi has been going through cyclical cycles, and Bingo0x is an on-chain gambling gaming platform that can be watched as the next new gambling gaming project in the next cycle, perhaps the main participant in the next gambling narrative.

The gameplay of Bingo0x is very simple. Players need to purchase a card/ticket with their chosen numbers, and then watch as random numbers with letters (such as A-7) are drawn until a player completes a “Bingo” pattern. Similar to scratch cards, the winning card must have a collection of winning numbers or partial numbers. The prize for the winner is paid in cryptocurrencies and stablecoins. Perhaps the platform will support other luck-based games in the future.

Bingo0x does not engage in complex casino-like games like most GambleFi platforms. Compared to other on-chain gambling platforms, Bingo0x’s advantage is that the game is simple, direct, and transparent.

Currently, there is not much information about Bingo0x. Bingo0x is supported by UltiverseDAO and will launch its testnet BETA version on opBNB next week.

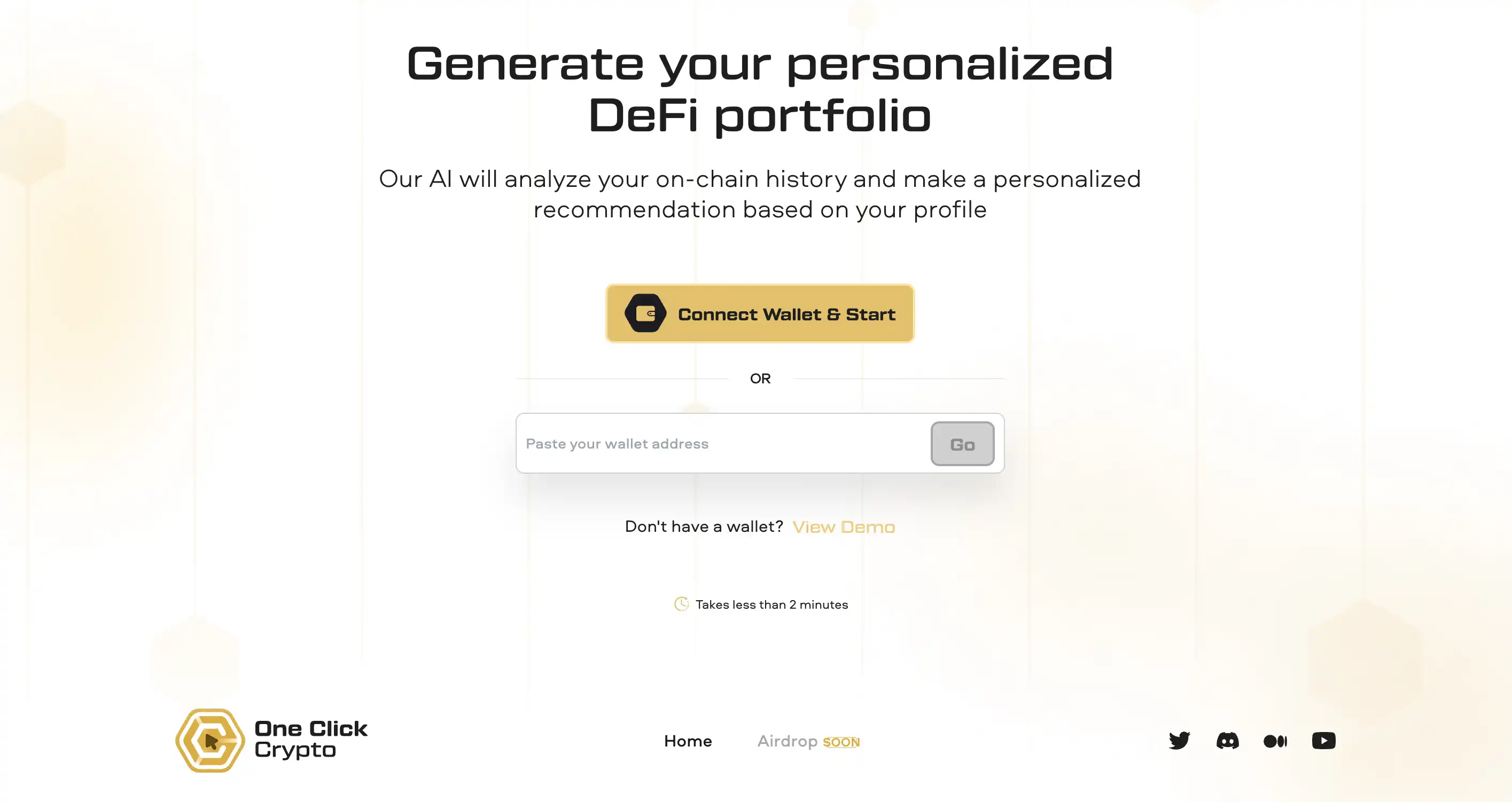

One Click Crypto

1CC is a platform that evaluates users’ risk aversion through AI. The AI will analyze users’ on-chain transaction history through their wallets and build personalized recommendations based on their profiles. For the crypto world, the form of generating investment portfolios through answering questions is quite innovative.

First, the system will prompt users to answer a few questions, and then evaluate their risk aversion based on their answers and on-chain history. Then, the AI will generate an investment portfolio that is most suitable for the user. With just one click, the AI creates an investment portfolio that utilizes 5 protocols and 10 pools on the blockchain, with an average APY of 28.34%.

In addition, the project’s token 1CC will be launched soon. The airdrop plan has been revealed, where a snapshot of OBT token holders will be taken 7 days before the launch of 1CC. The rewards will be distributed through an airdrop on the following day, with every 3.5 OBT holders receiving one 1CC token. For more information on OBT, please refer to this link. DYOR!

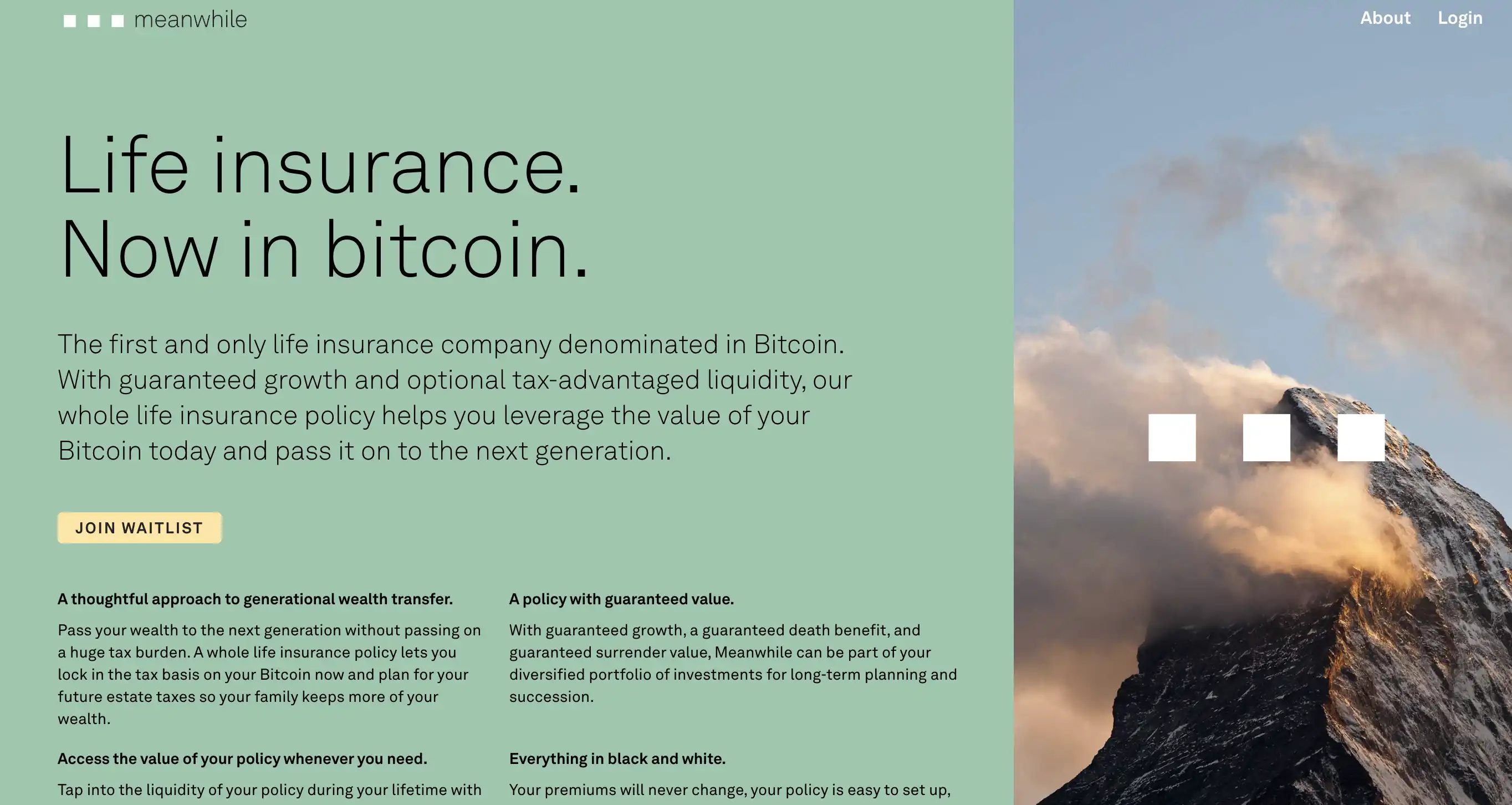

Meanwhile

Meanwhile is the industry’s first Bitcoin-supported, AI-driven life insurance company that accepts BTC as premiums and pays out all claims in BTC. The company’s leaders and some investors believe that BTC is becoming a global store of value and functional currency.

Here are the reasons why Meanwhile is worth watching:

– It is the first life insurance company supported by BTC and driven by artificial intelligence, and it has already been listed.

– It raised $19 million in a $100 million valuation. The first seed funding round was led by Sam Altman, the CEO of OpenAI, and Lachy Groom, a former employee of payment giant Stripe. The second seed round was led by Gradient Ventures, a Google-backed venture capital fund.

– This life insurance company is licensed and regulated in Bermuda, complies with US tax laws, and currently accepts only US users.

– It is also a good method for intergenerational wealth transfer in the encryption industry. For example, if you purchase death insurance for 10 bitcoins, your next generation will have the opportunity to receive 25 bitcoins in the future. Imagine how much the value of bitcoins will be in years.

The company uses AI to publish claims and assess the health risks of applicants, and only trades in bitcoins. Customers pay premiums monthly with cryptocurrencies, and claims are paid with cryptocurrencies as well. At the same time, like many other life insurance providers, a portion of the monthly premiums collected is used for lending, earning interest.

Cordyceps

Cordyceps is a DeFi insurance and options platform. As part of the Root ecosystem, Cordyceps is a platform that provides insurance for pegged assets, such as stablecoins or liquid staking derivatives. Users can collateralize and arbitrage assets that have decoupling risks.

In addition, Cordyceps is a full-chain platform, and the market it brings is very promising. It can occupy a large portion of the market share. The DeFi industry is constantly innovating, and the number of DeFi derivatives is also increasing. However, due to the underutilization of the growing asset pool, derivatives lack universality. In order to comprehensively cover the DeFi insurance field, Cordyceps will also provide a wider range of market coverage in the future, not just collateralizing pegged assets.

Marginly

Marginly is a smart contract-based margin trading and derivatives application that allows users to go long/short assets with up to 20x leverage on various platforms such as DEX and AMM (e.g. Uniswap, SushiSwap, Curve, Balancer, etc.).

Marginly provides a flexible leverage swap interface built with a mobile-first approach and simplifies integration with DeFi aggregators, routers, and wallets. Features include:

-Marginly Trading: Up to 20x leverage trading (long and short) through connected DEX liquidity pools.

-Marginly Liquidity: Provide liquidity to independent funding pools on Marginly as loan instruments available for leveraged trading by other users.

-Options Strategies: Marginly introduces combinations of Uniswap v3 liquidity positions and market positions to simulate complex options strategies, allowing for profit-making in sideways/range markets.

Marginly highlights include:

-Fully Decentralized: Marginly does not use off-chain information and relies on Uniswap v3 oracles.

-Risk Isolation: Each Marginly liquidity pool consists of a single risky asset plus stablecoins. With this approach, risks are completely isolated to a single volatile asset, making it more predictable and manageable. The Marginly risk framework allows for the most efficient use of borrowed capital while ensuring strict control over the liquidity pool’s solvency.

– Infinite liquidity loop: Margin can realize a self-reinforcing loop where the assets generated from transactions can be used as leverage for reverse transactions by the counterparty. In the end, the long pays the short and the short pays the long.

– Deleveraging and liquidation: In the case of additional margin, the system automatically reduces the amount of debt in the portfolio by reversing transactions in the pool instead of auctioning positions on the linked DEX.

– Order routing: Marginly aims to execute spot transactions across multiple DeFi protocols in different blockchains, which helps aggregate liquidity and facilitate trading of long-tail assets.

AKMD Finance

AKMD is a community-managed decentralized derivatives trading platform. It supports spot, perpetual, options, and copy trading. The protocol allows for additional customization of markets and derivatives through governance.

For LPs, liquidity providers provide liquidity funds for AKMD and lock them on-chain through the ERC-4646 standard vault. Users can deposit and withdraw these funds anytime. Additionally, the tokens received by users can be used as collateral for leverage. In terms of governance, idle assets can also be reinvested in other DeFi protocols, and AKMD’s dynamic deposit rate attracts liquidity and manages risk well.

For spot traders, traders on AKMD can enjoy the lowest trading fees, with fees as low as zero. For perpetual traders, AKMD currently supports leverage of up to 100x. When collateral is locked, the exchange also provides:

– Lowest fees, even as low as zero

– Contracts with leverage of up to 100x

– Participation in liquidity mining through margin, earning additional income.

– Borrowing against available collateral positions.

– On-chain replication of trades allows tracking of other traders’ strategies.

Crust Finance

Crust Finance is a decentralized trading platform and AMM built on the Mantle network, focusing on providing efficient token swaps and deep liquidity for stablecoins and other assets. Crust Finance uses the ve(3,3) system to maximize the potential earnings for ecosystem users.

Crust Finance stems from the vision of Solidly, where all participants in the ecosystem can create a revenue loop through collaboration. Users can lock their tokens into the protocol with CRST to receive veCRST tokens, which can vote on which liquidity pools receive CRST token emissions and receive fees and bribes generated by liquidity pools as rewards.

ETHEREAL SYSTEMS

Ethereal is a stablecoin protocol on the L1 protocol Radix, inspired by MakerDAO and Liquity. The project believes that MakerDAO is difficult to resist upward uncoupling, and Liquity has low capital efficiency. Based on this, Ethereal proposes the EtherealUSD model, which introduces instant redemption functionality, focuses on capital efficiency and ensuring pegging ability, and focuses on synthetic assets pegged to the US dollar. However, the prerequisite for minting any asset only requires a reliable exchange rate between the synthetic asset and the collateral asset.

However, the project is still in an early stage, only proposing a model, and the subsequent operation has not been announced yet. However, unlike other DEXs, the project announced the Initial Validator Offerings (IVO) activity for the platform token on July 1st. IVO is a new fundraising mechanism that allows users to redirect staking rewards to their chosen projects and receive project tokens as returns.

The operation of IVO is as follows:

– DAO sets a validator

– Users delegate the required assets to the DAO validator for a period of 6 months

– The variable fee is adjusted to 100% (sending all staking rewards to the DAO vault)

– Hourly snapshots are taken to reserve tokens for IVO participants proportionally

– The first airdrop to participants is distributed before the token is launched

– The second airdrop takes place after the end of IVO

Radpie

Radpie is a yield optimizer project launched in collaboration between Magpie and Radiant Capital. Prior to this project, there were Magpie and Penpie. “Related reading: Governance Yield Aggregator Magpie’s Innovative Advantages and Play”. Similar to Penpie and Magpie, Radpie also locks assets to obtain dLP and converts dLP into mdLP to increase user returns. Users can stake mdLP on Radpie to earn RDNT and additional RDP (Radpie’s governance and revenue-sharing token) rewards and protocol fees.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Recent Quick Overview of POW Projects Dynex, Microvision Chain, Neurai

- After raising hundreds of millions of dollars in five rounds of financing, CoinList’s co-founder, the new project Eco, launched a currency experiment four years later.

- 9 projects with huge long-term development potential

- Revival trend in the social track, what is special about the star project CyberConnect?

- Vertical Integration of DEX Vertex Protocol Project Analysis How to Improve Asset Pricing and Capital Efficiency?

- Risk and return coexist, taking stock of 9 potential projects worth long-term attention.

- Intent-based architecture and experimental projects Inventory of general intent layer and specific intent projects