Quick Overview of Recent Popular DeFi Narratives and Innovative Projects

Overview of Popular DeFi Narratives and ProjectsAuthor: Crypto Ann; Translation: Baize Research Institute

If you are not a cryptocurrency “professional”, it can be very challenging to keep up with the various subfields of cryptocurrency/DeFi. That’s why I think it’s a good idea to widely promote the “narrative” of all cryptocurrency subfields (as well as the interesting protocols associated with them).

Real World Assets (RWA)

While Bitcoin is trying to break into TradFi through ETFs, assets such as bonds have already infiltrated the DeFi world.

Enthusiasts believe that RWA is a way to bring more institutional funds to DeFi. Recently, we have seen a lot of discussions about RWA, and market interest has translated into excellent performance of RWA-related tokens such as MakerDAO.

- Inventory of the 8 old projects of the transformation LSD

- Crossing the Bull and Bear The LSD Battle of the Project Party

- Crossing the Bull and Bear The LSD Battle of Project Parties

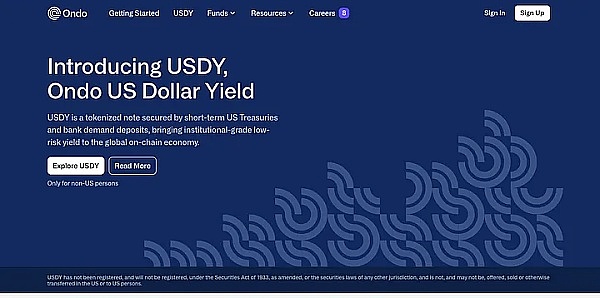

In addition to existing participants such as MakerDAO, Synthetix, and Tether, a new RWA protocol called Ondo Finance has also attracted attention. Ondo Finance aims to provide access to various TradFi assets, such as the US money market and on-chain US Treasury bonds. This is an extremely convenient way for non-US investors who cannot enter the US market.

Some previous RWA protocols have attempted to bring TradAssets onto the chain, with a concept similar to Ondo, but they have never been fully successful. The biggest obstacle is credibility. After all, RWA is semi-custodial, as the protocol acts as a “bank” responsible for custodianship of your real-world assets (bonds, stocks). Ondo stands out with the influence and experience of BlackRock, a TradFi asset management company.

Are there risks to RWA?

I have my own doubts about the concept of RWA. It is more about the assets themselves rather than a DeFi/cryptocurrency concept. Take US Treasury bonds as an example. With recent credit rating downgrades and the looming debt crisis caused by unsustainable debt interest payments, RWA brings another risk to the DeFi field – a significant risk.

Tether and DAI face criticism due to their heavy reliance on US Treasury bonds. If their claims are true, Tether could become the largest holder of US Treasury bonds globally. Given that USDT is one of the most famous stablecoins and is paired with almost all tokens, any possible default by the US government could potentially cause USDT to decouple and potentially disrupt the entire cryptocurrency market and ecosystem.

At least, RWA is not just about US Treasury bonds, which is also the focus of some RWA protocols at the moment. Ondo Finance’s product USDY represents short-term US government bonds and bank demand deposits, rather than long-term US Treasury bonds that caused the collapse of Silicon Valley Bank earlier this year. I think this is a better approach in uncertain market conditions. Even Warren Buffett only buys short-term US Treasury bonds.

Fixed Income

Recently, in the field of DeFi liquidity mining, people are increasingly inclined towards fixed investment returns.

In times of market uncertainty, guaranteed returns are reassuring. Take the staking yield of Ethereum as an example, it is known to fluctuate. The returns during a bull market may be different from those during a bear market, and it is difficult to predict or quantify how much money you can earn.

The concept of fixed income is very simple. When you invest, you usually receive a series of returns over a period of time.

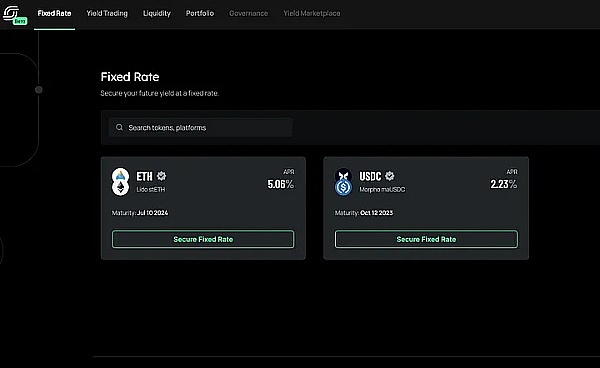

Pendle and Spectra

Pendle is one of the protocols with rapid growth in TVL this year. They provide fixed interest rates for various staked assets such as Lido’s stETH, RocketPool’s rETH, GMX’s GLP, and even stablecoins.

Each pool on Pendle has an expiration date, which is the date when the fund pool stops earning income.

Spectra is a newcomer to the fixed income narrative. Its operation is very similar to Pendle, although currently you can only stake Lido’s stETH and USDC in this protocol.

Fixed Loans

In addition to staked assets, another area where DeFi investors have a strong demand for fixed income is the lending market. Just like in the real world, although interest rate policies may change, you can still earn interest during the loan period – another excellent hedge against market uncertainty.

In DeFi collateralized lending protocols, when the value of the collateral deposit exceeds the value of the loan, the lending protocol operates smoothly, allowing borrowers to access liquidity without selling the assets they deposited into the protocol. However, when the value of the collateral deposit decreases or the value of the loan increases, borrowers may have an incentive to default on the repayment, which could put both the lender and the borrower in a difficult situation.

That’s why liquidation exists, which is an operation triggered when your collateral assets are not enough to cover your loan. Liquidation will result in your collateral assets being bought by others, and you may need to pay a certain penalty.

Recently, the founder of Curve almost got liquidated in the Curve hack incident because his loan interest rate surged to 70%-88%. This liquidation mechanism is necessary in collateralized lending protocols. As market conditions deteriorate, borrowers will be forced to repay the loan.

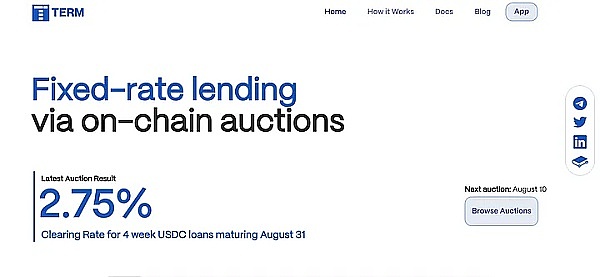

Term Finance

I recently stumbled upon an interesting protocol. Term Finance allows you to borrow money at a fixed interest rate within a set period of time (e.g., 4 weeks at 4%). The interest rate is determined through an auction. The borrower sets a bid, and the lender sets a bid. The number resulting from the “bargaining” on the bids will become the final interest rate. The auction starts/ends every Thursday.

veToken

veToken has been a narrative in DeFi for a long time, possibly as a result of developers’ continuous experimentation with DeFi. More importantly, veTokens are one of the best strategies for accumulating assets and earning profits in such a bear market.

Currently, most veToken protocols are blue-chip DeFi projects that have survived in the bear market, such as Curve’s CRV, Balancer’s BAL, Frax’s FXS, etc.

However, what interests me is not these native veToken protocols, but the protocols built on top of them.

Because unless you are a “whale,” the veToken mechanism is not so profitable. From yield to voting rights, these aspects are usually not so impressive for individuals with smaller holdings.

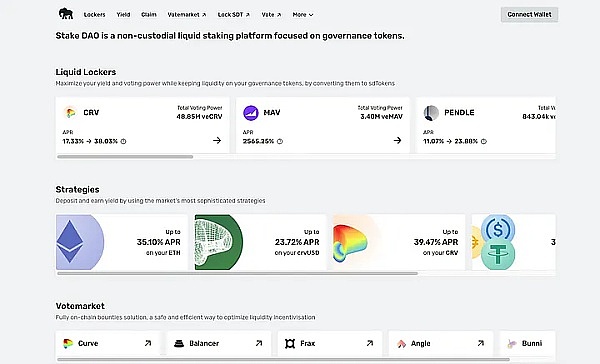

So, what’s the solution? You can stake your veToken through protocols like StakeDAO.

StakeDAO

In the veToken narrative, StakeDAO sits at the top. The goal of this protocol is to be the ultimate destination for your veToken.

In StakeDAO, you have the opportunity to combine your assets with others’ assets to increase your yield and gain additional benefits from a larger capital pool, such as increased voting rights.

StakeDAO supports various veTokens, and APR often hovers in the double-digit range. For example, the current annual interest rate for staking veCRV through StakeDAO is 38%. Another attractive feature I found about this protocol is that they constantly add more pools from new veToken players. Recently added features include vePendle from Pendle and veBPT from the new NFT platform BlackPool.

LSDFi

The DeFi community is constantly striving to maximize the use of staked ETH.

For example, EigenLayer proposed the concept of “re-staking,” which allows you to stake ETH again to protect other protocols (e.g., data availability chains).

Recently, a new project in LSDFi caught my interest, Prisma Finance. Although it is currently in the pre-launch stage, the project is intriguing enough to raise a question: Could Prisma Finance become the ultimate protocol for LSD, similar to converting DAOs into veTokens?

Since the project’s official website is not online yet, I can only learn about their plans through their blog. Highlights:

-

Users will be able to mint stablecoins backed purely by LSD tokens. Therefore, apart from ETH itself, the underlying assets will not bring additional risks.

-

veToken mechanism. (Will StakeDAO also support this project?)

-

Various LSTs from Lido, Frax, RocketPool, etc.

Conclusion

In addition to the aforementioned DeFi narratives, there are currently many popular narratives in the wider cryptocurrency industry.

For example, the “AI + Crypto” narrative, which projects like Giza Tech are attempting to transform machine learning models into smart contracts. However, projects in this narrative are typically made up of tools and are not truly worth investing in.

You may have also noticed that I haven’t introduced the recent “hyped but non-mainstream” narratives. These narratives are not only easily influenced by rumors, but also do not support sound investments aside from speculation. Examples include the one-way bridge on the Base chain and the unverified DEX (LeetSwap) that led to hackers exploiting vulnerabilities, as well as people recklessly sending cryptocurrencies to wallets created by bots (Telegram Bot).

Risk Warning:

The above-mentioned projects and opinions should not be considered investment advice. DYOR. In accordance with the “Notice on Further Preventing and Handling the Risks of Virtual Currency Trading Speculation” issued by the central bank and other departments, the content of this article is for information sharing only and does not promote or endorse any business or investment activities. Readers are strictly advised to comply with local laws and regulations and not engage in any illegal financial activities.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- A summary of 10 projects worth paying attention to recently DeFi, DEX, games, and on-chain tools

- Full-chain gaming becomes the market focus, in-depth analysis of the pioneering project Dark Forest.

- Using Tornado.Cash as an example to expose the scalability attacks on zkp projects.

- Multi-dimensional inventory of LianGuairadigm’s top 10 projects in the relevant fields of concern.

- Recent Quick Overview of POW Projects Dynex, Microvision Chain, Neurai

- After raising hundreds of millions of dollars in five rounds of financing, CoinList’s co-founder, the new project Eco, launched a currency experiment four years later.

- 9 projects with huge long-term development potential