After raising hundreds of millions of dollars in five rounds of financing, CoinList’s co-founder, the new project Eco, launched a currency experiment four years later.

CoinList's co-founder, Eco, launched a currency experiment four years after raising hundreds of millions of dollars in five rounds of financing.Author: Jiang Haibo, LianGuaiNews

Starting from 2019, Eco, which has raised a total of $94.5 million in five rounds of financing, has recently made new progress. On July 27th, Eco announced the launch of a cryptocurrency wallet called Beam, which integrates account abstraction functionality and can be used for payments on Layer 2 solutions such as Optimism and Base.

Eco has a strong background. CEO Andy Bromberg is the co-founder of cryptocurrency platform CoinList. The project has received investments from top cryptocurrency institutions such as a16z Crypto, Coinbase Ventures, LianGuaintera Capital, Founders Fund, and Lightspeed Venture LianGuairtners. After 4 years since the project started and received financing, Eco finally tweeted for the first time on July 16th. LianGuaiNews will explain the mechanism of Eco in the following text.

Eco and Two Tokens: A Currency Experiment

Eco is a reserve and payment currency designed to be a decentralized alternative to fiat currency. Its system does not have a stablecoin pegged to the US dollar and aims to “maximize wealth within Eco” through governance. Eco can be seen as a “currency experiment”, and if the experiment is successful, Eco will also become a money game in which all players in the ecosystem share the victory.

- 9 projects with huge long-term development potential

- Revival trend in the social track, what is special about the star project CyberConnect?

- Vertical Integration of DEX Vertex Protocol Project Analysis How to Improve Asset Pricing and Capital Efficiency?

The foundation of Eco’s experiment consists of two tokens: ECO and ECOx.

ECO is the basic token of the Eco protocol, used for daily savings and payments. Its initial supply is 10 billion, but the supply can be changed based on the currency policy set by the “trustees” elected by users. The ECO token is developed using the “Weird ERC20 Token” framework, which includes some unique features:

- Supports rebase functionality. The balance of the owner can be adjusted based on the “linear inflation coefficient” in the contract, which means that ECO, like stETH, cannot be directly used in many DeFi protocols and requires a wrapped version similar to wstETH.

- Upgradeable. The ECO token can be managed through a proxy, and the core logic of the token can be modified through governance at any time.

- Pausable. There is a circuit breaker that can be paused in the event of a bug.

- Rollback. Transfers or authorizations to the zero address and failed transfers will be rolled back.

- Approvals can be updated. The allowance can be changed through decreaseAllowance and increaseAllowance, and the transferFrom method will also emit an Approval event to update the allowance.

ECOx is a deflationary token with a maximum supply of 1 billion, and it is also transferable. Each ECOx represents a certain percentage of the ECO supply and can be used to share the growth potential of Eco by holding ECOx.

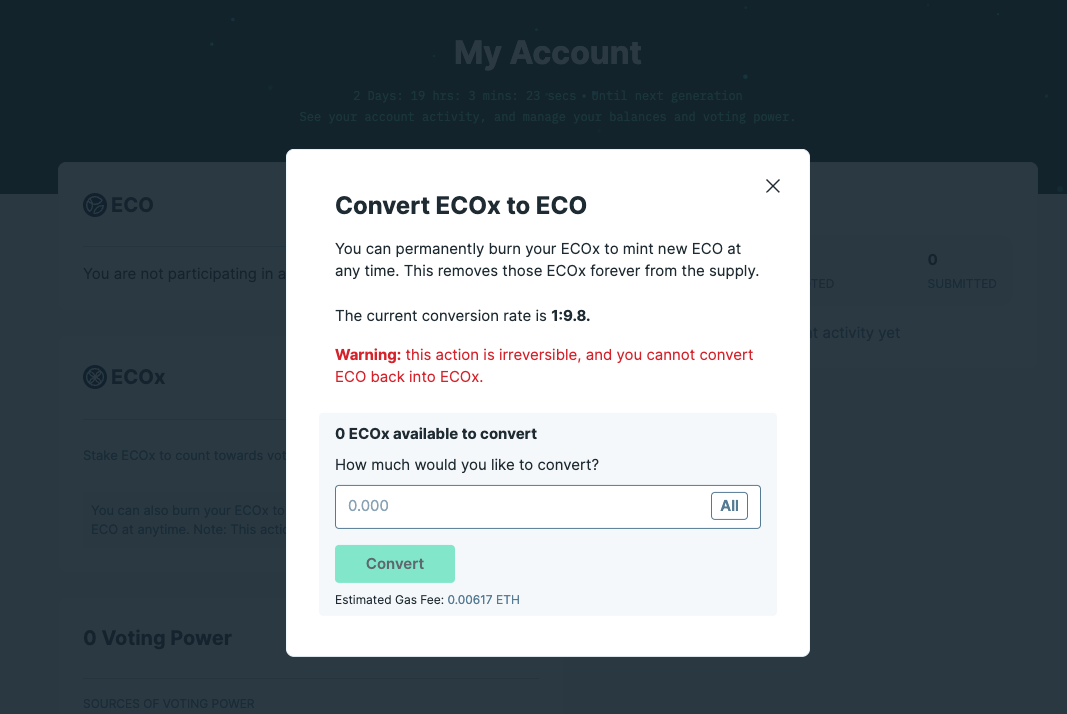

ECOx can burn and mint ECO, but this process is irreversible. Both tokens are in circulation and can be traded on Uniswap. As of August 2nd, 1 ECOx can be converted to 9.8 ECO. According to CoinGecko, in the secondary market, the price of ECOx is about 20 times that of ECO, with prices of $0.348 and $0.017 respectively.

Governance and Currency Policy

One of the features of Eco is its flexible monetary policy, which can adjust the currency supply of ECO through governance. Both ECO and ECOx can participate in Eco’s governance, with ECO having a voting power of 1 and ECOx having a voting power of 10.

Users can delegate their voting power to “delegates” after staking ECO or ECOx, and they can change the delegation at any time. Delegates are the makers of the monetary policy in Eco. Before qualifying as delegates, they need to connect their wallets to Discord or Twitter, forge an Eco ID, and make themselves known to others.

Currently, Eco’s official website has announced more than 20 elected delegates, who come from founders of the DeFi industry, former Federal Reserve employees, bank researchers, cryptocurrency researchers, and operators, etc. Their LinkedIn or Twitter links are also published on the official website. The currency governance is carried out by this group of elected delegates in cycles to maximize the total wealth held in Eco.

Users can delegate all their voting power to a single delegate. In this case, they can transfer funds without canceling the delegation, and the delegation will be automatically revoked during the transfer. They can also delegate only a portion of their voting power, and in this case, the transfer can only move the funds that have not been delegated.

The Eco governance page shows that the currently effective monetary policy only has a basic interest rate. From July 22, 2023, to November 21, 2023, locking ECO can achieve an annualized return of 7%, similar to a bank fixed deposit.

In addition, Eco has some unreleased monetary policies, including:

– Basic inflation rate, which changes the balance of holders proportionally through monetary policy.

– Random inflation, randomly distributing ECO tokens to certain addresses, similar to a lottery.

– Transaction fees, ECO transfers will generate transaction fees paid in ECO tokens, which will accumulate in staked ECOx. Delegators can also charge an additional transaction fee based on this through monetary policy.

Launching three products to promote the adoption of Eco currency:

On the basis of the Eco currency, Eco, Inc., the development company of the project, has also developed the Eco App and sponsored others to develop various applications to increase the adoption of Eco currency. Currently, the official website has announced the following three applications:

– Eco App: Positioned as a fintech company, it has payment, savings, and remittance functions. It can also be used to make payments or send Eco points, earn points during payment, and receive cashback from partners. Eco App has partnered banks and can provide insured deposit services.

– Beam Wallet: A digital wallet that allows users to make payments to anyone at any time and can be used on Optimism and Base. First, users need to connect their Twitter accounts and add a password, and then they can use ECO or USDC for transfers. Users can also spend 600 ECO to register a Beam domain name in the wallet, which can be used during transfers.

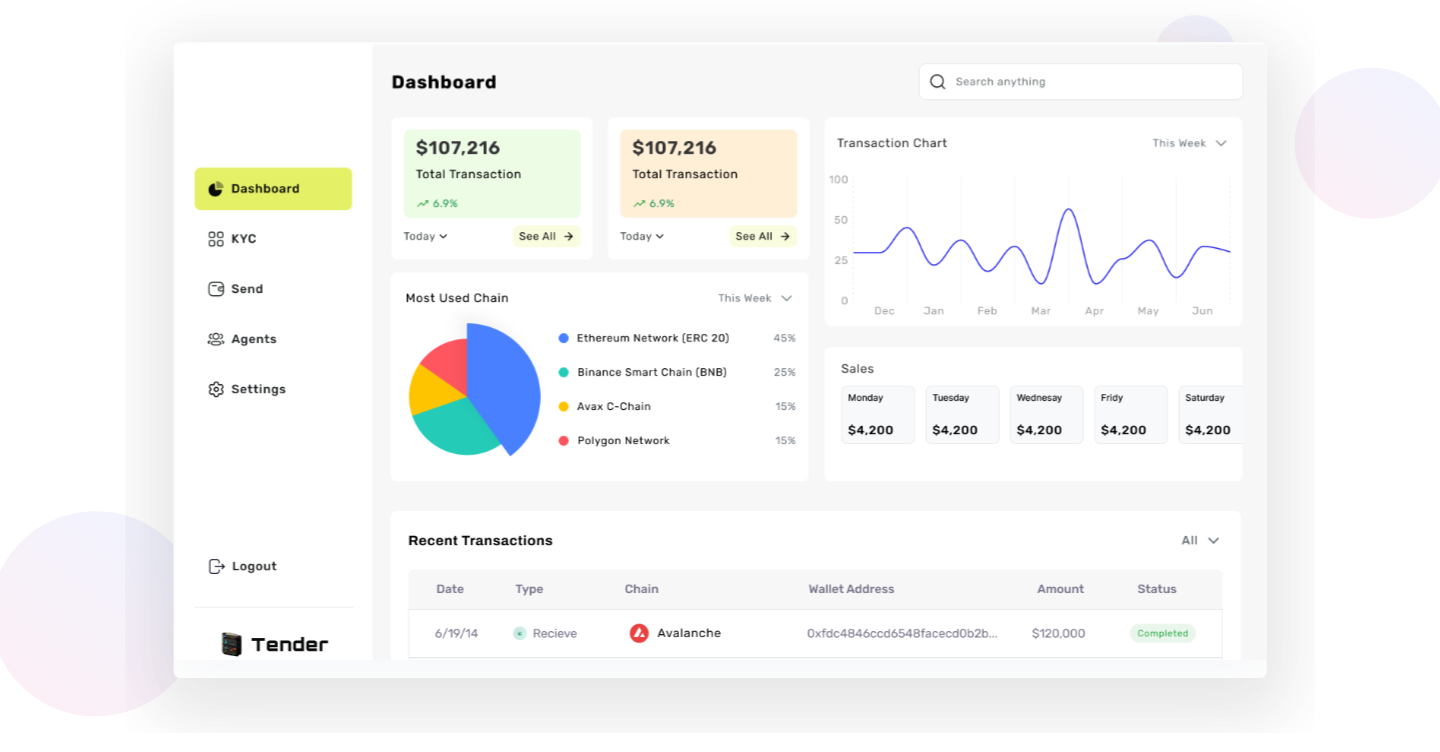

Tender: Provides instant encrypted payment functionality for merchants through a simple and user-friendly interface.

Roadmap

As a project that started in 2019, Eco’s progress has been disappointing. According to the official website, the project was launched on October 28, 2022, and the roadmap was updated in November 2022. The updated roadmap mentioned that Eco would be upgraded to be compatible with Uniswap V2 in the short term, create a wrapped version of the ECO token, activate trustee elections and monetary policies, initiate a grant program, and enable temporary governance functions. Currently, these plans have been mostly implemented.

The long-term roadmap includes several potential system upgrades and research areas.

In the first phase, Eco will initiate the distribution of the ECO token, including allocations to partners and individuals. The points previously distributed to users in the Eco App can be exchanged for tokens.

In the second phase, the monetary policy will be upgraded, governance flexibility will be improved, and expansion from Layer 1 to Layer 2 will be pursued. As mentioned earlier, the current effective monetary policy only involves locking the ECO tokens for a period of time to obtain fixed base inflation.

In the third phase, extensive governance improvements, novel economic designs, an upgrade to Eco ID V2, and the initiation of public product funding will take place.

Summary

Eco aims to create a currency system that is different from traditional products, not anchored to the US dollar, and maximizes wealth within the ecosystem through governance. Its goal is to initially become a medium of exchange and gradually transform into a store of value over time. Eco’s uniqueness may lie in its adjustable monetary policies, which are determined by trustees through governance decisions and can be adjusted based on actual economic conditions.

In terms of positioning, Eco aims to be a target for storing value similar to certain algorithmic stablecoins. However, both ECO and ECOx tokens are not anchored to the US dollar, which introduces a high level of uncertainty.

During the few years from fundraising to product launch, Eco missed the golden period of development for algorithmic stablecoin projects. Even with endorsements from top-tier VCs, it will still be challenging to introduce a new and highly volatile token in the current environment and have it widely accepted as a means of payment and store of value.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Risk and return coexist, taking stock of 9 potential projects worth long-term attention.

- Intent-based architecture and experimental projects Inventory of general intent layer and specific intent projects

- Star project MEKE’s public beta test starts with a bang, driving an increase in BNB L2 trading volume.

- Crypto ‘cult’ mentality How to identify early signs of future fanatical projects

- Project loss borne by users? Stablecoin USD discounted by 30% overnight

- What are the noteworthy catalysts after Velodrome V2?

- An in-depth analysis of LPDFi Can it spark the next wave of DeFi narrative? What are the projects worth paying attention to?