Global Blockchain Industry Development March Report: Digital currency supervision speeds up, and the monthly financing amount of the blockchain breaks 500 million US dollars

In order to better understand the development status of the global blockchain industry in March 2020, Zero One Think Tank and the Digital Asset Research Institute, from the blockchain investment and financing, mainstream encrypted digital currency market, policy guidance, domestic industry development trends and global news, etc. Dimension, the latest trend of "decrypting" the blockchain industry.

1. Quick overview of the industry in March

January , March domestic news

1) Hunan released the digital economy development plan, focusing on the implementation of "blockchain integrated application project";

2) The first provincial-level blockchain industrial park in Hunan settled in Loudi;

3) Harbin Industry and Information Bureau will promote "blockchain + new technology cluster" and build a digital asset exchange;

- QKL123 market analysis | BCH, BSV halved before BTC, how do miners react? (0408)

- Will Bitcoin have a 10-fold increase? Mining or the blue ocean market? And listen to mining giants explain mining evolution in detail | Babbitt Cloud Summit

- Market analysis: The market's upward trend is blocked, and it falls slightly below $ 7200

4) Xiong'an Blockchain Lab was officially unveiled on March 31;

5) Xinhua JD Blockchain Index is officially released;

6) Guizhou Province released 4 blockchain local standards including "Blockchain Application Guide";

7) Xintongyuan launched a personal itinerary and health management platform based on blockchain digital identity;

8) Koala Haigou announced the upgrade of the full-chain traceability system for commodities, and the introduction of new blockchain traceability technology.

2. International news in March

1) Officials of the Russian State Duma: The encryption law has been finalized, but will not be passed before the spring of 2020;

2) A special financial law was passed at the plenary session of the Korean Parliament, covering the crypto exchange license system;

3) Russia will create a regulatory sandbox to legalize blockchain and cryptocurrencies;

4) The Monetary Authority of Singapore announces the exemption list of digital currency related payment services;

5) Petroleum giant Shell joins the blockchain alliance EWF;

6) Bitcoin was selected as the "Top 100 Best Design Products in Modern Times" by Fortune Magazine.

3. Investment and financing highlights

1) In March 2020, a total of 26 financing events occurred in the global blockchain industry, with financing of USD 530.4 million;

2) Strategic investment remains ahead, and the overall distribution of financing rounds shows signs of shifting backwards;

3) The number of millions of dollars is stable, and large-scale financing has recovered from February;

4) The United States leads the way in the amount of blockchain financing, and China's monthly monthly financing volume in 2020 is almost a discount from 2019;

5) The popularity of digital assets continues unabated, and the performance of the real economy and industrial services continues to be sluggish;

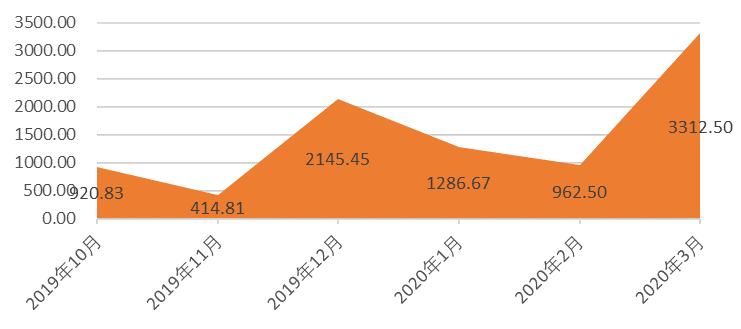

6) The average monthly single financing amount in March reached a new high of nearly half a year, at 33.12 million US dollars per transaction.

4. Performance of mainstream digital currencies and other capital markets

1) The encrypted digital currency market has stabilized after the plunge in February, and the prices of mainstream digital currencies have picked up;

2) Most of the world's stock indexes have fallen sharply compared with the beginning of the year. The relative declines of China's Shanghai Stock Index and Shenzhen Component Index have been relatively small, and the GEM index has gained 9.55% against the trend;

3) The spot price of gold in London rose by 9.2% compared with the beginning of the year, and the overall performance of "digital gold" bitcoin has not been as good as gold this year, with an increase of less than 1%;

4) Except for Bitcoin, the prices of other mainstream encrypted digital currencies (such as ETH, XRP, EOS, etc.) have all risen to a certain extent.

2. Overview of Investment and Financing

According to incomplete statistics of Zero One Think Tank, there were 26 financing events in the global blockchain industry in March 2020, 16 of which revealed the specific financing amount, and the total financing amount exceeded 530.4 million US dollars (based on the exchange rate on April 7).

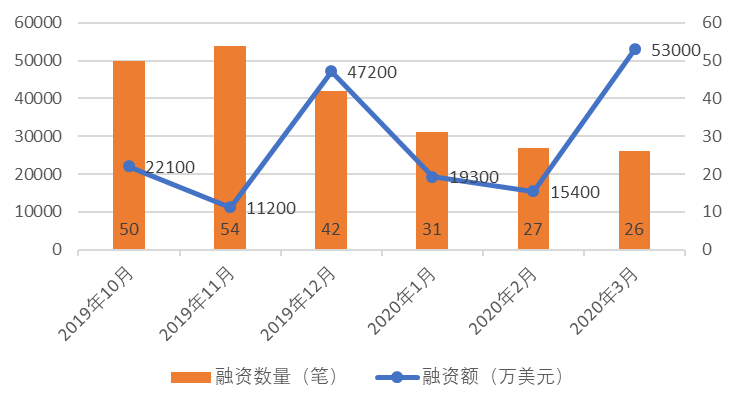

Judging from the situation in the past six months, the amount of global blockchain financing has started to decline, and the amount of financing before March has also clearly declined. The amount of financing in March was the same as that in February , but thanks to several large-scale financing, the amount of financing rose by more than 244% compared with February . The average monthly single-funding amount reached a new high of nearly half a year, reported at 33.12 million US dollars / pen.

Figure 1: The number and amount of blockchain investment and financing from October 2019 to March 2020

Data source: Zero One Think Tank

Figure 2: The trend of the average monthly financing amount of the blockchain from October 2019 to March 2020; data source: Zero One Think Tank

1. Strategic investment stays ahead, and the financing round shows signs of moving backwards

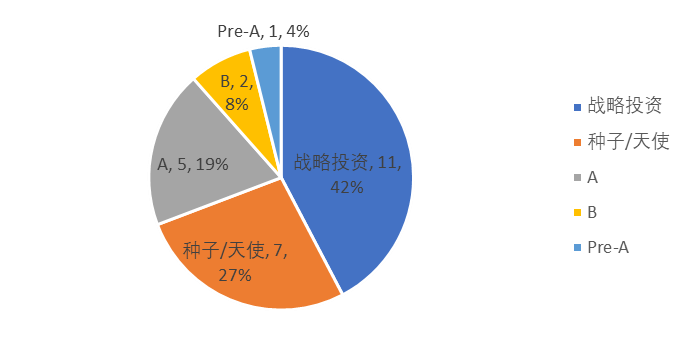

From the perspective of the rounds of global blockchain financing events, strategic investment was still the mainstay in March, with a total of 11 occurrences, accounting for up to 42%; seed / angel round financing and A round financing followed closely, with 7 Pen and 5 pens, accounting for 27% and 19%. In terms of mergers and acquisitions, there was only one occurrence in the blockchain field in March: the enterprise credit card platform Brex announced the successful acquisition of three startups, including the blockchain startup Neji.

Figure 3: Distribution of blockchain investment and financing rounds in March; data source: Zero One Think Tank

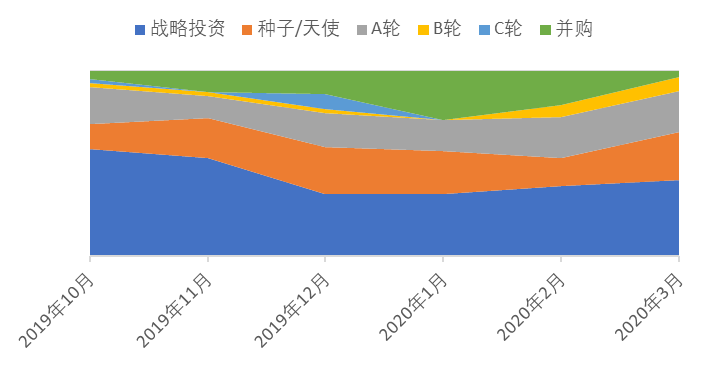

From the perspective of the distribution of blockchain financing rounds in the past six months, although the strategic investment has always maintained a leading position in terms of quantity, the actual proportion has declined significantly, and the total proportion of rounds A and B has appeared to a certain extent. Rising, the overall distribution of financing rounds showed signs of shifting backwards.

Figure 4: The proportion of blockchain investment and financing rounds from October 2019 to March 2020; data source: Zero One Think Tank

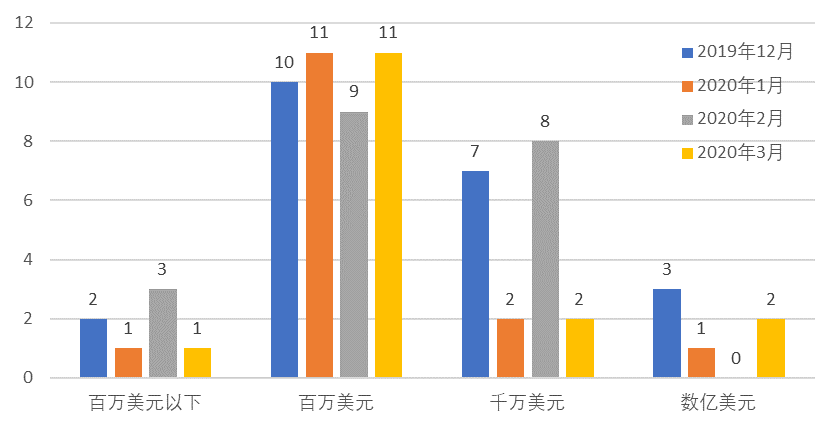

2. The number of millions of dollars is stable, and the large-finance market is picking up

The amount of blockchain financing in March remained concentrated. Among the companies that have disclosed the amount of financing, the number of companies with a financing amount of 1-10 million US dollars is the largest, with 11 in total, accounting for more than half of the total; tens of millions of US dollars have fallen significantly from February, but financing events of more than 100 million US dollars There were 2 cases of recovery.

Judging from the situation in the previous months, the amount of blockchain financing has always been relatively concentrated, the number of millions of dollars is basically stable, and the number of millions of dollars below has always remained low, while the tens of millions of dollars and hundreds of millions of dollars have relatively large fluctuations.

Figure 5: Interval distribution of blockchain investment and financing amount (unit: USD); data source: Zero One Think Tank

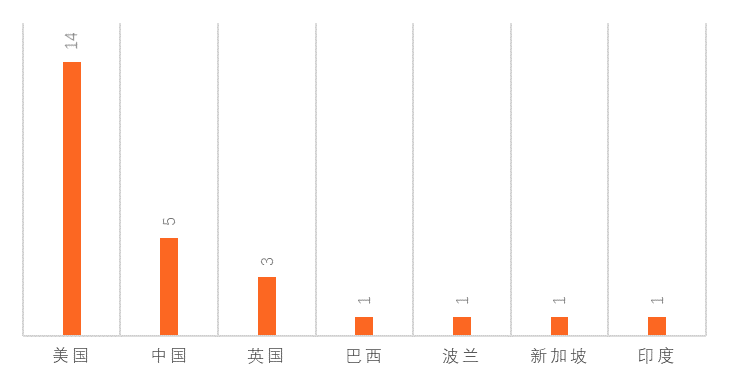

3. The leading amount of blockchain financing in the United States, the number of monthly financing in China is almost a discount from 2019

The regional distribution of blockchain financing in March was similar to that in February. The United States, China, and the United Kingdom maintained their top three positions. The United States is the world's most active country in blockchain investment and financing, with a total of 14 cases, accounting for 53.84%; China ranks second, with a total of 5 blockchain-related investment and financing events, and the UK ranked third with 3 cases.

In addition to this, one each occurred in Brazil, Poland, Singapore and India.

From the perspective of the distribution of domestic blockchain investment and financing, only Beijing (2 transactions), Shanghai (2 transactions) and Chengdu (1 transaction) experienced blockchain financing events in March.

Figure 6: Regional distribution of global blockchain investment and financing events in March (unit: pen); data source: Zero One Think Tank

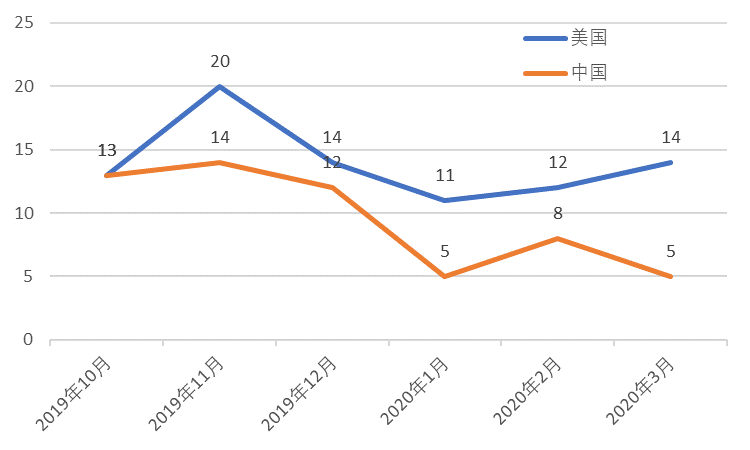

In the blockchain investment and financing market, competition between China and the United States is fierce. From the perspective of the number of financings alone, the number of single-month financings in the United States has always been higher than 10 since October 2019. Since 2020, the number of single-month financings in China has never exceeded 10, which is almost a cut compared to the fourth quarter of 2019.

Figure 7: Trends in the number of blockchain investments in China and the United States (unit: pen); data source: Zero One Think Tank

4. The popularity of digital assets is not reduced, and the real economy and industrial services are not performing well

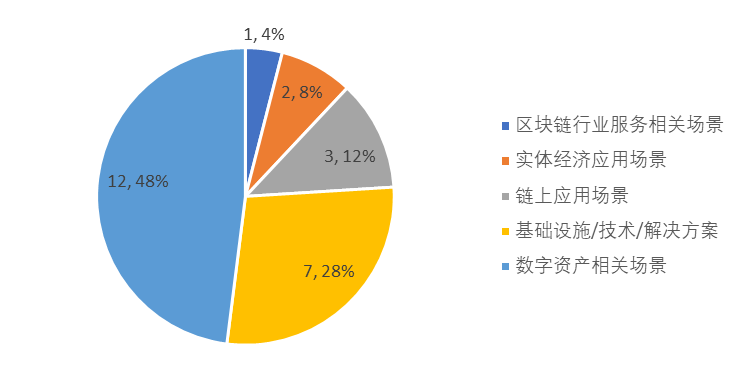

With reference to the blockchain industry classification standards of many institutions such as the Tongtong Research Institute, the Information Center of the Ministry of Industry and Information Technology of China, and combining the experience of Zero One Think Tank, we have subdivided the blockchain industry into basic technical facilities & solutions, digital asset-related, Financial application scenarios, physical application scenarios, other on-chain applications (except for digital assets), industry services, and other seven categories, each of which is further subdivided into nearly 60 specific categories.

From the first-level classification, digital asset related categories (including exchanges / trading platforms, digital currency wallets, digital asset management, etc.) are the most popular circuit in March in the capital market. A total of 12 companies have received financing, accounting for up to 48 %; Blockchain infrastructure / technology / solution service providers are closely followed, with 7 projects getting financing; real economy applications and blockchain industry service projects performed poorly in March.

Figure 8: Major categories of blockchain investment and financing tracks in March; data source: Zero One Think Tank

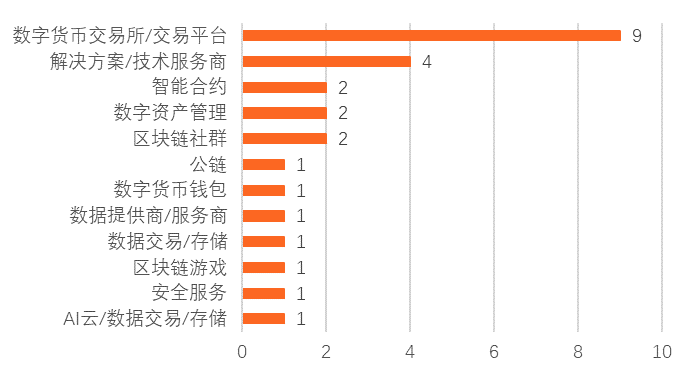

From the second-level scenario, the digital asset exchange / trading platform has been the hottest segment in a single month for several consecutive months, and it is clearly ahead of other segments; the position of the blockchain technology solution / technical service track is also stable , Maintained the 2-3rd position in the subdivision track for many consecutive months, and smart contracts, digital asset management, blockchain community and other tracks were also the subdivision areas where capital was concentrated in March.

Figure 9: The distribution of blockchain investment and financing breakdown in March; data source: Zero One Think Tank

5. Britain and the United States continue to dominate the list, China lags behind in large-scale financing

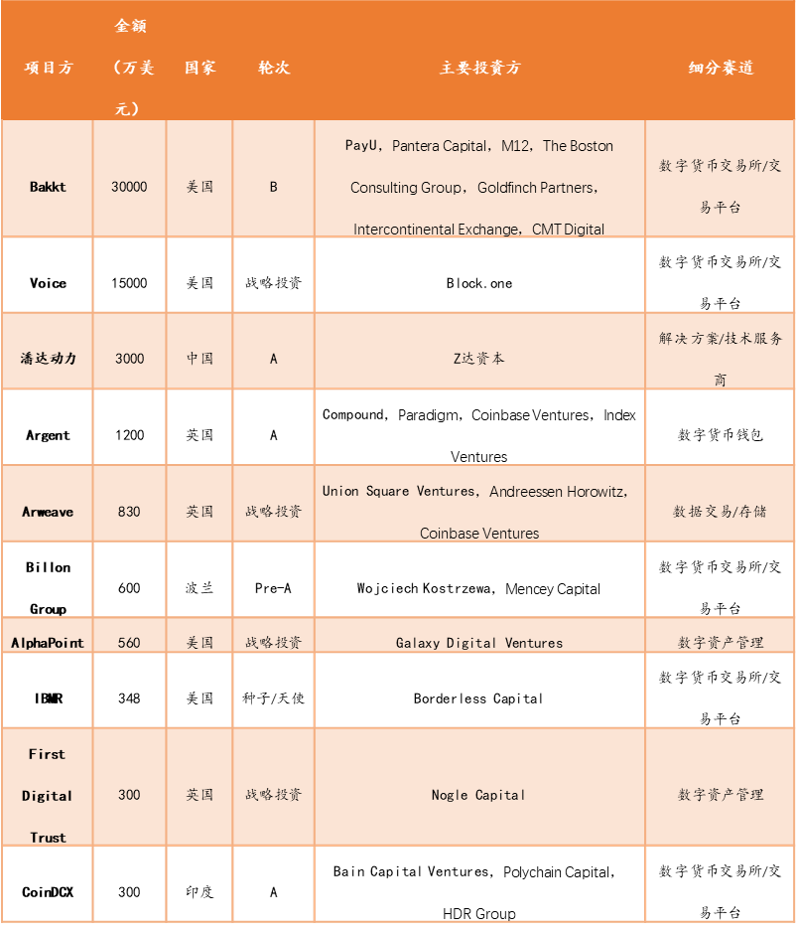

From the list of top10 projects in the blockchain field that have disclosed specific information in March:

1. The top 10 list of financing amount in March is basically based on British and American projects / enterprises, 4 projects in the United States are selected, and 3 projects in the United Kingdom are selected;

2. China has only one or no projects selected for the Top10 financing amount for many consecutive months, and there is still room for improvement in large-scale financing;

3. The amount of blockchain financing in March rebounded significantly from January and February 2020, and two projects received hundreds of millions of dollars in financing in a single month;

4. Among the TOP10 financing amount, there are 8 projects related to digital assets, of which nearly half are in the digital currency exchange / exchange track; blockchain technology / solution service providers and data transaction / storage have 1 project each Shortlisted.

Table 1: Top10 investment and financing amount of blockchain industry in March

3. Performance of digital currencies and other mainstream assets in March

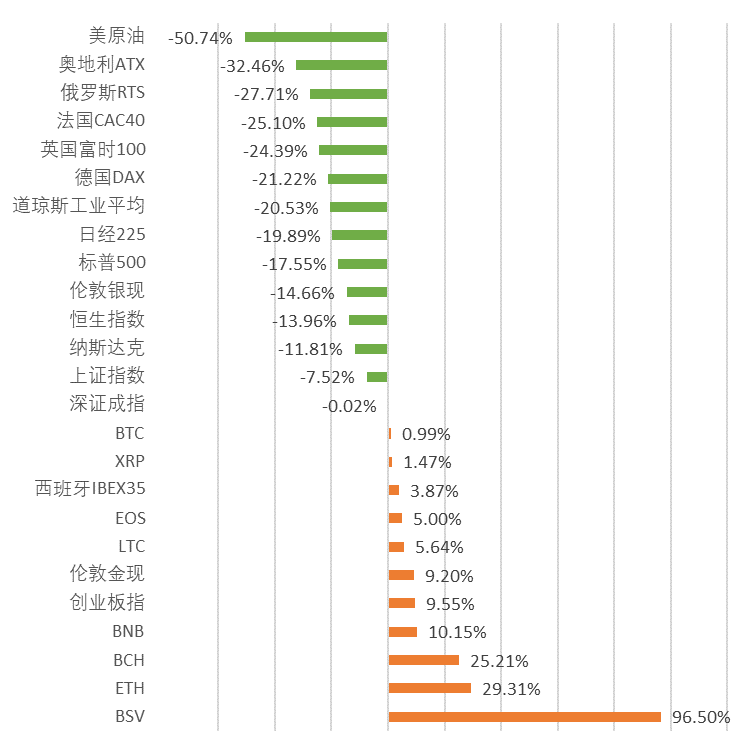

In March, global capital markets continued to fluctuate. After the cryptocurrency experienced a plunge in February, the market gradually stabilized and the prices of mainstream digital currencies rebounded.

Judging from the performance of global mainstream assets, most stock indexes have fallen sharply from the beginning of the year. The relative declines of China's Shanghai Composite Index and Shenzhen Stock Index have been relatively small. US crude oil prices fell again in March, and have fallen by half compared with the beginning of the year.

As a safe-haven asset in the traditional sense, gold has recently performed well, and spot gold prices in London have risen 9.2% from the beginning of the year. Bitcoin is called "digital gold", but this year's overall performance is not as good as gold, with an increase of less than 1%. Except for Bitcoin, the prices of other mainstream encrypted digital currencies (such as ETH, XRP, EOS, etc.) have increased to a certain extent. Among them, BSV has benefited from the rising market in early 2020, and the price has so far increased by 96.50%.

Figure 10: Year-to-date performance of mainstream cryptocurrencies and other assets (as of April 6, 2020); data sources: Zero One Think Tank, CoinMarketCap, Flush

4. Interpretation of industry news

1. Domestic policy orientation

【Hunan's first provincial-level blockchain industrial park settled in Loudi】

A few days ago, the Hunan Provincial Department of Industry and Information Technology approved the establishment of the Hunan Provincial Blockchain Industrial Park (Loudi Wanbao) based on Loudi Wanbao New District, which was also the first provincial-level blockchain industrial park established in Hunan Province. In recent years, Loudi has clearly regarded blockchain as an important breakthrough for transformation and development, and has compiled the "Lodi City Blockchain Industry Development Plan", which has gathered a batch of Beijing Gold Stock Chain, Hangzhou Fun Chain, Chengdu Qingshu, Shenzhen German Fangzhi Chain, etc. An industry leading enterprise with core technological advantages, and has achieved remarkable results in technological innovation and application of the blockchain industry.

[Hunan publishes the digital economy development plan, focusing on the implementation of "blockchain integrated application project"]

Recently, the Hunan Provincial Department of Industry and Information Technology has issued the "Hunan Digital Economy Development Plan (2020-2025)" ("Plan"), and the "Plan" proposes to implement 10 key projects, including blockchain integrated application projects. "Planning" pointed out that accelerating core key technological breakthroughs. Encourage the research and development of the underlying blockchain technology for domestic operating systems and chips, and make breakthroughs in core technologies such as encryption algorithms, consensus mechanisms, smart contracts, side chains, and cross-chains. Establish an application incubation center integrating industry-university-institute research, make rapid breakthroughs in application framework, distributed storage, trusted execution environment, etc., and create an industry-oriented blockchain application technology system.

Cultivate the blockchain industry ecology. Promote the in-depth integration of blockchain and artificial intelligence, big data, Internet of Things and other cutting-edge information technologies, promote integrated innovation and integration applications; nurture and develop a number of leading blockchain enterprises, accelerate the development of enterprise alliance chains, private chains, and explore areas New model of deep integration of blockchain technology and real economy; actively expand blockchain application scenarios, promote the application of blockchain technology in the fields of social governance, social assistance, intellectual property, supply chain, industrial inspection and certification, and explore digital economic models Innovation; promote the application of blockchain technology in financial fields such as SME loans, bank risk control, and education, employment, pension, precision poverty alleviation, medical health and other livelihood fields; rely on the construction of new smart cities and explore blockchain data sharing models, Promote the joint maintenance and utilization of government data across departments and regions.

By 2025, establish five provincial-level blockchain industrial parks, expand a number of typical application scenarios, and form 10 leading blockchain enterprises with national influence.

[ Guizhou Province released "Blockchain Application Guide" and other 4 blockchain local standards ]

Recently, Guizhou Provincial Market Supervision Bureau issued "DB52 / T 1466-2019 Blockchain Application Guide", "DB52 / T 1467-2019 Blockchain System Evaluation and Selection Specification", "DB52 / T 1467-2019 Blockchain System evaluation and selection specifications "and" DB52 / T 1468-2019 blockchain-based data asset transaction implementation guide "4 local standards of blockchain.

[Harbin Industry and Information Bureau will promote "blockchain + new technology cluster" and build a digital asset exchange]

In order to promote the full application of "Blockchain + New Technology Cluster" in Harbin, and to help and empower the development of Harbin New District, Harbin Industry and Information Technology Bureau and Shenzhen UBI Information Technology Co., Ltd. (UBI) jointly promoted " "Blockchain + new technology cluster" reached a consensus in Harbin, and signed a cooperation agreement. The total investment of the project is expected to be 1 billion yuan. The focus of the cooperation between the two parties is to build a digital asset exchange, explore the application of blockchain scenarios, and promote the construction of blockchain incubation parks.

[Ministry of Industry and Information Technology: To create a trusted blockchain innovation collaboration platform to provide testing and certification services for SMEs]

According to the official website of the Ministry of Industry and Information Technology, on March 19, the General Office of the Ministry of Industry and Information Technology released the "Special Action Plan for Digital Empowerment of Small and Medium-sized Enterprises" (hereinafter referred to as the "plan"). The plan pointed out that in order to promote small and medium-sized enterprises to achieve resumption of production through digital network intelligent empowerment, one of the key tasks is to consolidate the functions of the digital platform, build an industrial APP test and evaluation platform and a trusted blockchain innovation collaboration platform, Small and medium service providers and SMEs provide testing and certification services.

2. Domestic industry dynamics

[Xiongan Blockchain Lab officially unveiled on March 31]

On March 31, the Xiong'an Blockchain Lab was officially inaugurated, signifying that the blockchain innovation practice of the Xiong'an New District has entered the stage of organization and scale. Xiong'an Blockchain Lab is a comprehensive scientific and technological innovation service platform, with the goal of creating an open innovation base and exploring new models of laboratory economy, focusing on technological innovation, evaluation and certification, standard research, policy consulting, ecological collaboration and other aspects. Corresponding capabilities, and adopt three modes of operation: talent inbound, institution inbound, and project inbound to provide high-quality services for governments, enterprises, and other institutions.

[Xintongyuan launches personal itinerary and health management platform based on blockchain digital identity]

In order to help scientific epidemic prevention and resumption of production, the China Academy of Information and Communications Technology has developed a personal itinerary and health management platform based on blockchain digital identities based on the country ’s top nodes and communication big data platform, named "Xin E Tong" Invited institutions have been targeted for trial and will be released publicly soon. "Xin E Tong" adopts blockchain technology and uses the network logo to assign a permanent digital ID to each user. Trusted user information is desensitized and on-chain, locally encrypted and saved information, and part of authorized information is encrypted and shared to ensure user privacy and safety, travel healthily, and resume work with ease.

[Beijing issued the first blockchain electronic invoice, and the parking lot of the whole city can realize automatic integration of toll collection and invoicing from now on]

Beijing's first blockchain electronic general invoice was issued in the parking lot of Hanwei International Plaza in March, which means that Beijing's tax service management entered the era of blockchain for the first time. The Beijing Municipal Taxation Bureau announced on March 4 that in the future, the parking lot of this city will be able to realize automatic integration of toll collection and invoicing. After scanning and paying, citizens do not need to wait for invoices. They can issue and save blockchain invoices online without saving paper invoices , Ticket experience is further optimized. In the future, taxpayers in Beijing's parking lots and other enterprises will no longer need to spend manpower for invoicing fees, and will no longer need to travel to and from the tax bureau to purchase tickets. In the future, blockchain electronic general invoices will expand more application scenarios and cover more industries and ticket types.

[Xinhua Jingdong Blockchain Index Officially Released]

On March 23, the "Xinhua Jingdong Blockchain Index" (989002) jointly compiled by Xinhua Finance and Jingdong Digital Technology Group was officially released. The index uses JD.com's AI technology and uses blockchain heat value as a key indicator to select the relevant listed companies in the blockchain industry that have low market attention, less speculation and a certain investment potential during the selected period. , Comprehensively reflect the industry investment value under the theme of blockchain, and further enrich the indexed investment tools. The index is managed and operated by Xinhua Index (Beijing) Co., Ltd.

[SF Express accelerates the application of "Big Data + Blockchain Technology" to break through information barriers and achieve accurate traceability]

According to the China Federation of Logistics and Purchasing, the outbreak hit the Spring Festival, the express companies were generally out of service, and Wuhan and other regions with severe epidemics in Hubei faced great difficulties in material transportation. How to safely and quickly realize the effective delivery of materials has become an urgent matter for SF Express. . In addition to the application of big data, the blockchain technology that has attracted much attention has also become a new measure and a new "weapon" in response to the epidemic. It is reported that SF Express focuses on its distributed storage, traceability, and irreversible characteristics. Therefore, it has vigorously promoted the role of blockchain technology in the prevention and control of epidemic situation and the construction of material traceability system.

[Koala Higo announces the upgrade of the full-chain traceability system for commodities and the introduction of new blockchain traceability technology]

According to the news on March 17, a few days ago, Koala Haigou announced the upgrade of the full-chain traceability system for commodities. In the original anti-counterfeiting and anti-malicious unpacking technology, a new blockchain tracing technology was introduced to achieve one-click traceability of commodities.

3. International dynamics

[Russian State Duma official: The encryption law has been finalized, but it will not be passed before spring 2020]

According to Cointelegraph, due to the impact of the new coronavirus epidemic, the passage of Russian cryptocurrency laws will be postponed again. Anatoly Aksakov, chairman of the Russian State Duma Financial Market Committee, said that the country's encryption law (ie, the "Digital Financial Assets" Act) has been finalized, but will not be passed before spring 2020. The previous extension of the bill was caused by differences between local authorities over new asset types. The central bank opposed the legalization of cryptocurrencies, while the National Duma Financial Market advocated some cryptocurrency initiatives.

[Special Financial Law passed by the Plenary Session of the Korean Parliament, covering crypto exchange license system]

The Plenary Session of the Korean Parliament has passed the amendments to the "Report and Utilization of Information on Certain Financial Transactions (Special Financial Law)", which will be implemented one year later (that is, March 2021). According to previous news, the special financial law includes the encryption exchange license system, and the bank supports real-name registration of encrypted exchange accounts.

[Petroleum giant Shell joins blockchain alliance EWF]

Oil giant Shell has announced plans to use the blockchain platform Energy Web Foundation (EWF) to open up new markets. Sabine Brink, the director of Shell's blockchain project, said that blockchain and AI are important emerging technologies for Shell. We have set up a dedicated team to do our best to achieve this technological leap forward for the company worldwide.

[Russia will create a regulatory sandbox to legalize blockchain and cryptocurrencies]

According to Bitnovosti, Russia will create a “regulatory sandbox” within which blockchain and cryptocurrencies will be legalized. The “sandbox” will be supervised by Russian banks, and the corresponding bill has been submitted to the state by the Ministry of Economic Development.

[Singapore Monetary Authority Announces Exemption List of Digital Currency Related Payment Services]

According to official sources, the Monetary Authority of Singapore (MAS) has officially published a list of exempt enterprises for payment service operation licenses. The entities on the list have obtained licenses and operating rights for specific payment services or digital currency related payment services during the exemption period, including Singapore entities such as Alibaba, Alipay, Amazon and other large institutions are on the list.

[Singapore Monetary Authority publishes anti-money laundering guidelines, involving token transaction traceability]

On March 16, the Singapore Monetary Authority issued a new 73-page guide to provide guidance for electronic payment token service providers. "The recent rapid technological advances have had a profound impact, including in the field of payment. In particular, advances in financial technology have opened up new opportunities for faster and more efficient payment methods. However, these new payment methods have also brought about New money laundering (ML), terrorist financing (TF) and proliferation financing (PF) risks. "In particular, the Central Monetary Authority of Singapore recommends that“ to trace back ”previous token transactions as early as possible to determine whether there are any suspicious Happening.

[Bitcoin was selected as the "Top 100 Best Design Products of Modern Times" by Fortune Magazine]

"Fortune" magazine recently released the list of "The greatest designs of modern times" (The greatest designs of modern times). "Bitcoin" was selected and ranked 90th. IDEO founder David Kelley gave a review of Bitcoin ’s selection: Bitcoin was designed to allow a wide range of stakeholders-developers, investors, companies, miners, individuals-to adopt it in an incentive mechanism A brand new digital currency without the need for any centralized issuer or management agency. In the more than 10 years since its launch, Bitcoin has been worth close to US $ 200 billion and has been adopted by millions of people around the world. I don't think there are any other products in the history of the world that can guide themselves so effectively.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- After the crisis, where is the Bitcoin price opportunity in 2020?

- Within 26 days, the price of Bitcoin has doubled: What is the real reason behind the big rally?

- The latest report of CoinMetrics: after halving BCH and BSV, miners will distribute more computing power to BTC in a short time

- BCH production cuts soon, shortcomings in computing power

- The dynasty of bitcoin miners: track S9 and S17 miners through nonce distribution

- March scan of data on the bitcoin chain: the month of the plunge and shuffle, all three HBO trends are revealed

- 2020 Blockchain Development Report: Financing transaction activities are shifting from the US to China, CBDC is about to appear