QKL123 market analysis | BCH, BSV halved before BTC, how do miners react? (0408)

Summary: The market stepped back and stabilized, and it was good to be halved tonight. BCH's performance was eye-catching in a short time. Because the halving of BCH and BSV precedes BTC by one month, the mining unions switch their computing power due to the sharp decrease in income; at the current price, the old mining machine is brought back to life, but after the BTC is halved, the old mining machine can not escape the fate of being eliminated .

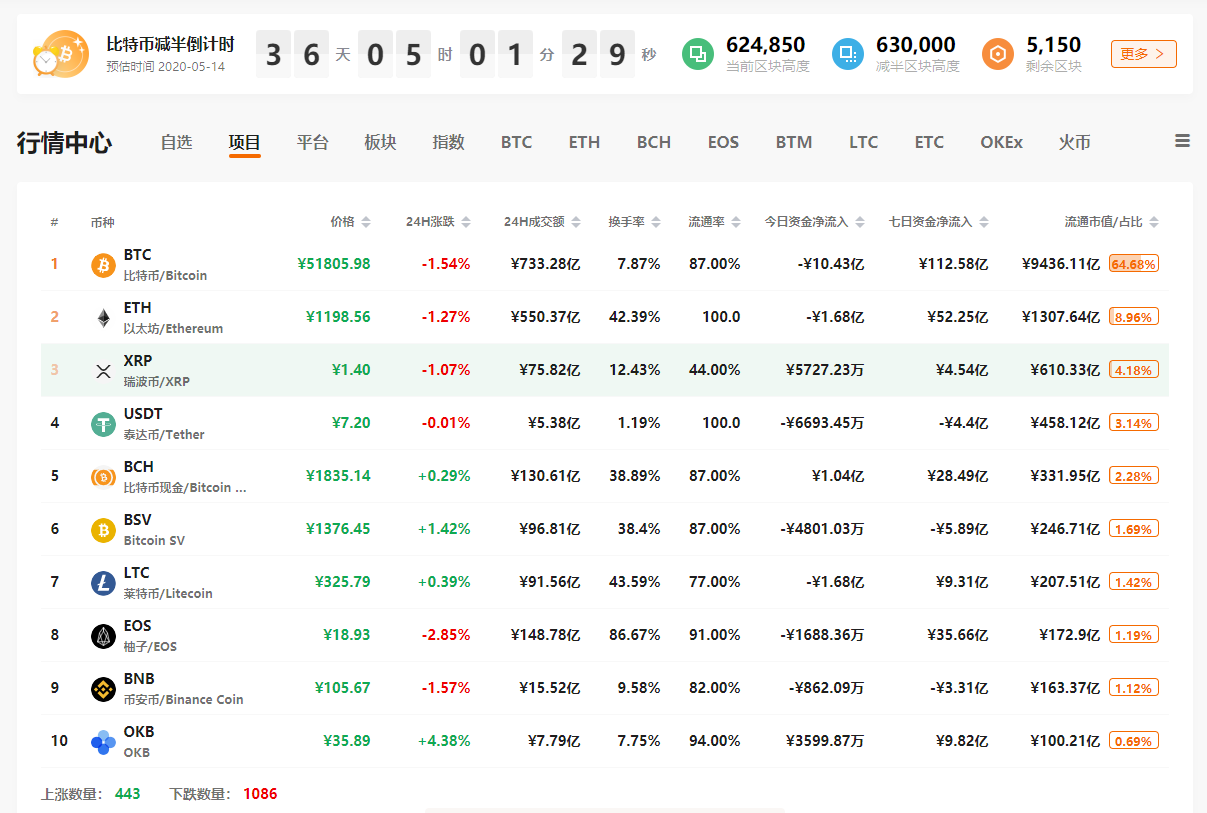

At 11 o'clock today, the 8BTCCI broad market index reported 10578.14 points, with a 24-hour increase or decrease of -0.48%, reflecting the market's volatile decline. The Bitcoin Strength Index reported 92.34 points, with a 24-hour increase or decrease of -0.68%. Bitcoin ’s relative performance in the entire market has weakened ; ChaiNext USDT OTC Premium Index reported 101.51, and the 24-hour increase or decrease was + 0.15%, USDT The OTC premium level increased slightly .

Analyst's point of view:

- Will Bitcoin have a 10-fold increase? Mining or the blue ocean market? And listen to mining giants explain mining evolution in detail | Babbitt Cloud Summit

- Market analysis: The market's upward trend is blocked, and it falls slightly below $ 7200

- After the crisis, where is the Bitcoin price opportunity in 2020?

Later today, BCH will usher in a block reward halving. Similar to BTC and BSV, the next half will reduce the annual pass rate from 3.6% to 1.8% instantaneously, and the corresponding daily output will be reduced from about 1800 to about 900. Due to the instability of early algorithm mining, BCH and BSV halved the block reward earlier than BTC. Therefore, for the miners who mine the first two, due to the recent sharp decline in mining revenue, they will switch part of their computing power to BTC, and then continue to switch back to achieve a new balance.

The halving has the most direct impact on the behavior of miners. The current 7000 USD BTC price has brought the old mining machine such as Ant S9 back to life. But after the halving, if other conditions remain unchanged, the BTC shutdown price of this type of mining machine will rise to about 12,000 US dollars. Under the same conditions, the shutdown price of new mining machines such as S19 will be around US $ 5,000. That is to say, if the recent computing power of the entire network and the price of Bitcoin have not changed much, the new mining machine can continue to benefit after halving, and the old mining machine will be eliminated.

The halving should have a good expectation for the market. However, under the global epidemic and the U.S. debt crisis, the Black Swan incident caused the BTC-linked U.S. stocks to plunge last month, and the crypto asset market entered the bottoming out again. Bitcoin has the dual attributes of safe-haven assets and risk assets. On the one hand, it will be linked to the price of gold, and on the other hand, it will be linked to the US stock market. Although the cloud of the capital market has dragged down the encrypted asset market, the floods of the central banks of various countries have given the opportunity to get rid of the linkage.

For now, with the recent sharp rebound in US stocks, the continuous release of half of the positive expectations will help the linked rebound of the crypto asset market. However, the cloud of the capital market has not receded, the US stocks are not at the end, and the subsequent crypto asset market will be affected by it.

1. Spot BTC market

BTC has dropped from yesterday's high of $ 7,470. Today's lowest touched $ 70,80. The short-term shock fell to adjust, and the overbought state eased. At present, altcoins are highly volatile and net outflow of funds from the market has not fallen below the upward trend. After stepping back, the inertia is more likely to rise, and the upper space sees near $ 7,800 .

Second, the spot ETH market

ETH fell back after a big rise, and it is currently receiving short-term support at $ 160. It is long and short, and the amount released can be relatively balanced. There is a clear divergence between large and small market capital orders. After short-term shock adjustment, the possibility of accumulating upside is greater.

Three, spot BCH market

BCH's performance today is eye-catching, and it is obviously stronger than BTC and ETH. It is expected that the block reward will be halved tonight, and it is not appropriate to chase up the price in a short time. If BTC cannot follow up, the risk of subsequent fall is greater.

Fourth, spot LTC market

LTC fell back from $ 48 yesterday, and the amount released can be similar to ETH, with a hammer-shaped support below $ 43. In a short period of time, it stabilized and went up, mainly linked BTC.

Five, spot EOS market

The trend of EOS is similar to that of LTC, and it stabilized upward in a short time.

Six, spot ETC market

ETC fell back shortly and once again reached a recent high, mainly linked to BTC.

Seven, analyst strategy

1 . Long-term (1-3 years)

Although the long-term trend of BTC is going bad, the good time for TunCoin's fixed investment can be referred to the hoarding currency index . Smart contract platform leader ETH, altcoin leader LTC, DPoS leader EOS, BTC fork currency leader BCH, ETH fork currency leader ETC can be configured on dips.

2 . Midline (January-March)

Affected by the financial environment, it is difficult for the market to get out of the bottom in a short time, and those who do not have a heavy position will intervene in batches . Those with heavy positions can continue to hold and wait for the halving to be favorable.

3 . Short-term (1-3 days)

Step back on the line and the camera moves.

Appendix: Interpretation of Indicators

1. 8BTCCI broad market index

The 8BTCCI broad market index is composed of the most representative tokens with large scale and good liquidity in the existing blockchain global market to comprehensively reflect the price performance of the entire blockchain token market.

2. Bitcoin Strength Index

The Bitcoin Strength Index (BTCX) reflects the indicators of Bitcoin exchange in the entire Token market, and then reflects the competition strength of Bitcoin in the market. It is used to measure the degree of change in the relative price of Bitcoin to the package of Token. The larger the BTCX index, the stronger the performance of Bitcoin in the Token market.

3. USDT OTC discount premium index

The ChaiNext USDT OTC INDEX is obtained by dividing the USDT / CNY OTC price by the offshore RMB exchange rate and multiplying by 100. When the index is 100, it means USDT parity. If the index is greater than 100, it means USDT premium. If it is less than 100, it means USDT discount.

4. Net capital inflow (outflow)

This indicator reflects the inflow and outflow of funds in the secondary market. By calculating the difference between the inflow and outflow of the global trading platform (excluding false transactions), a positive value indicates a net inflow of funds, and a negative value indicates a net outflow of funds. Among them, the turnover is counted as inflow capital when rising, and the turnover is counted as outflow capital when falling.

5. BTC- coin indicator

The coin hoarding indicator is created by Weibo user ahr999, and assists Bitcoin fixed investment users to make investment decisions in combination with the opportunistic strategy. The indicator consists of the product of two parts. The former is the ratio of the price of Bitcoin to the 200-day fixed investment cost of Bitcoin; the latter is the ratio of the price of Bitcoin to the fitting price of Bitcoin. Generally, when the indicator is lower than 0.45, it is more suitable to increase the investment amount (bottom bargaining), the time interval accounts for about 21%; when the indicator is between 0.45 and 1.2, it is suitable to adopt a fixed investment strategy, the time interval accounts for about 39 %.

Note: Encrypted assets are high-risk assets. This article is for decision-making reference only and does not constitute investment advice.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Within 26 days, the price of Bitcoin has doubled: What is the real reason behind the big rally?

- The latest report of CoinMetrics: after halving BCH and BSV, miners will distribute more computing power to BTC in a short time

- BCH production cuts soon, shortcomings in computing power

- The dynasty of bitcoin miners: track S9 and S17 miners through nonce distribution

- March scan of data on the bitcoin chain: the month of the plunge and shuffle, all three HBO trends are revealed

- 2020 Blockchain Development Report: Financing transaction activities are shifting from the US to China, CBDC is about to appear

- Lawyers' View | From the Telegram ban, see the legal risks of ICO in the US