Inventory of the current situation of top NFT fragmentation protocols: the overall market has turned cold, with both trading volume and user activity plummeting.

Current status of top NFT fragmentation protocols: market is down with low trading volume and user activity.Author: Nancy, PANews

Recently, the NFT fragmentation protocol Tessera (formerly Fractional) and its NFT market Escher announced that they will end all operations in the coming weeks, shocking the NFT community. The liquidity problem is the key to breaking the development bottleneck in the NFT field and will capture tremendous value in the future. This has also led to the emergence of many fragmentation schemes designed for different types of NFTs to promote NFT liquidity, improve price discovery, and lower participation thresholds. This article takes Tessera, NFTX, and Unicly as representative protocols to see how the development of the fragmentation track is progressing and whether it can effectively help the NFT market overcome liquidity difficulties.

Tessera (Fractional)

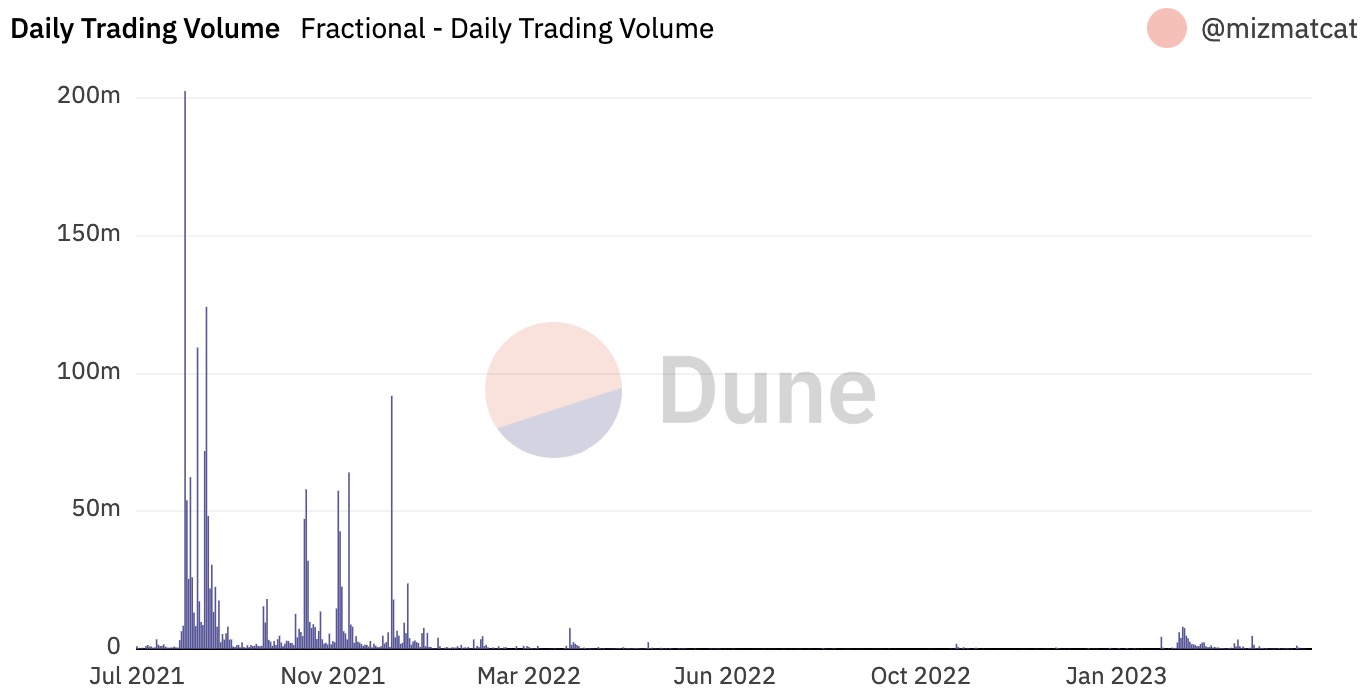

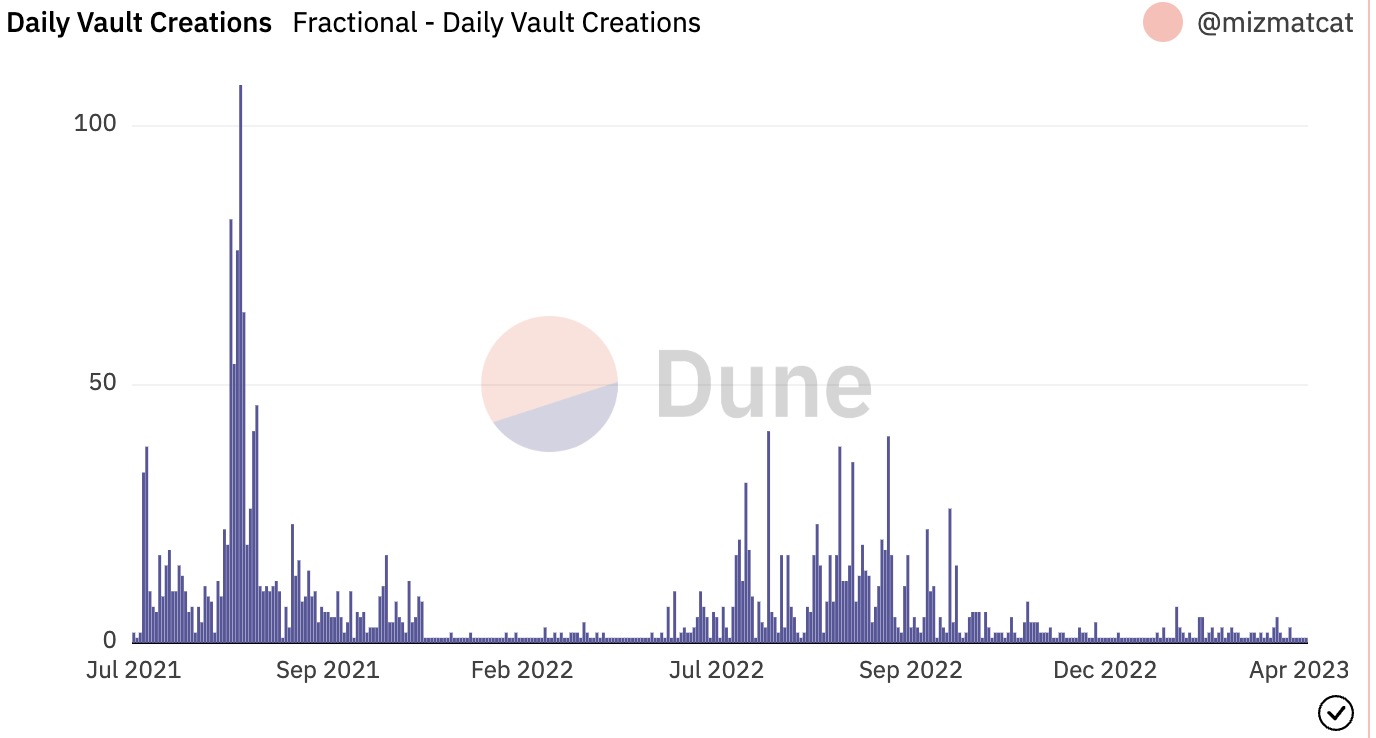

Since the NFT market went bearish in 2022, Tessera’s market performance has been unsatisfactory. According to Dune data, as of May 16, Tessera’s cumulative trading volume reached US$190 million, and the total liquidity market value reached US$82 million, with a total of 2,441 Vaults created.

- Is the BRC-20 that cuts through the night sky a nova or a meteor?

- Deep observation of the NFT market in 2023

- Opinion | When Bitcoin prices plummet in the next few years, gold will "land on the moon"

In terms of daily trading volume, although Tessera once reached a daily trading peak of US$200 million in August 2021, the daily trading volume has fallen sharply since entering 2022, only a fraction of previous years. In terms of Vault creation volume, Tessera’s total creation volume is 2,442, and the highest daily creation since 2022 is only 49 Vaults. After October 2020, the creation volume is only in single digits; not only that, Tessera has accumulated approximately 52,000 traders, and growth has slowed significantly since 2022, with only a short-term rebound in March 2023.

NFTX

NFTX is a project that focuses on the floor NFT track. The liquidity Vault is composed of 49,000 NFT assets such as CryptoPunks, Milady, Remilio Babies, Chromies Squiggle, and Meebits, and the current active Vault is only 120. In addition, there are only 7 tokenized NFT projects with an NFTX liquidity pool of over 100 ETH.

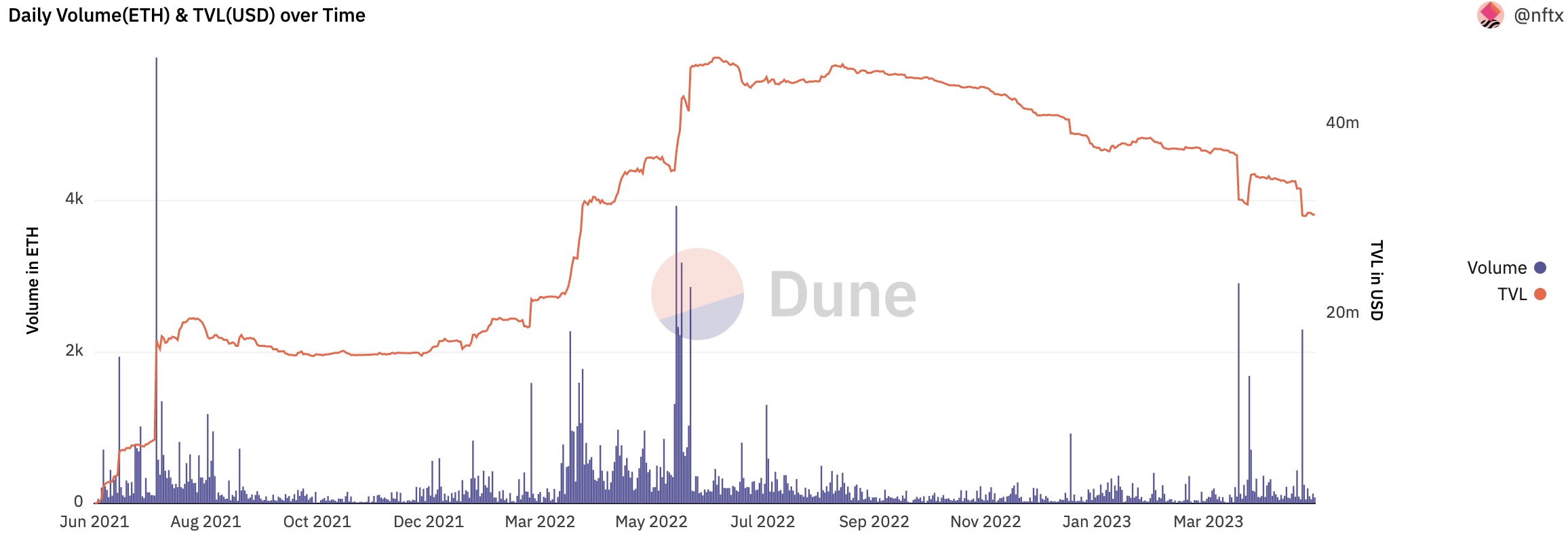

According to Dune data, NFTX’s TVL doubled in half a year after entering 2022, but then began to decline. As of May 16, NFTX’s TVL is US$30.43 million, a decrease of about 13.8% from a year ago. At the same time, the highest daily trading volume in the past year was 1,910 ETH, far from the historical high of 5,894 ETH.

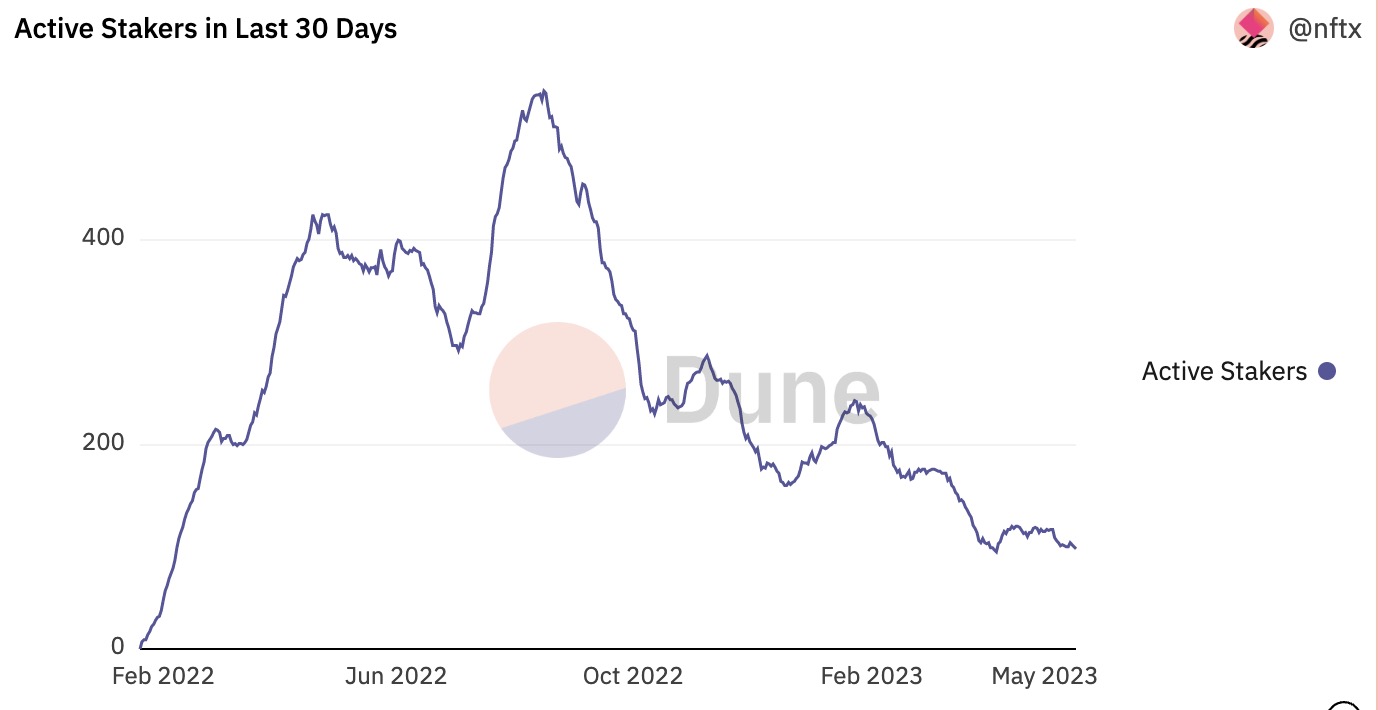

The total number of pledgers in NFTX has grown by only 10.1% since October 2022, and the growth rate of inventory and liquidity pledgers has slowed significantly. Meanwhile, the number of active pledgers has dropped rapidly, down more than 72.8% from a year ago.

Unicly

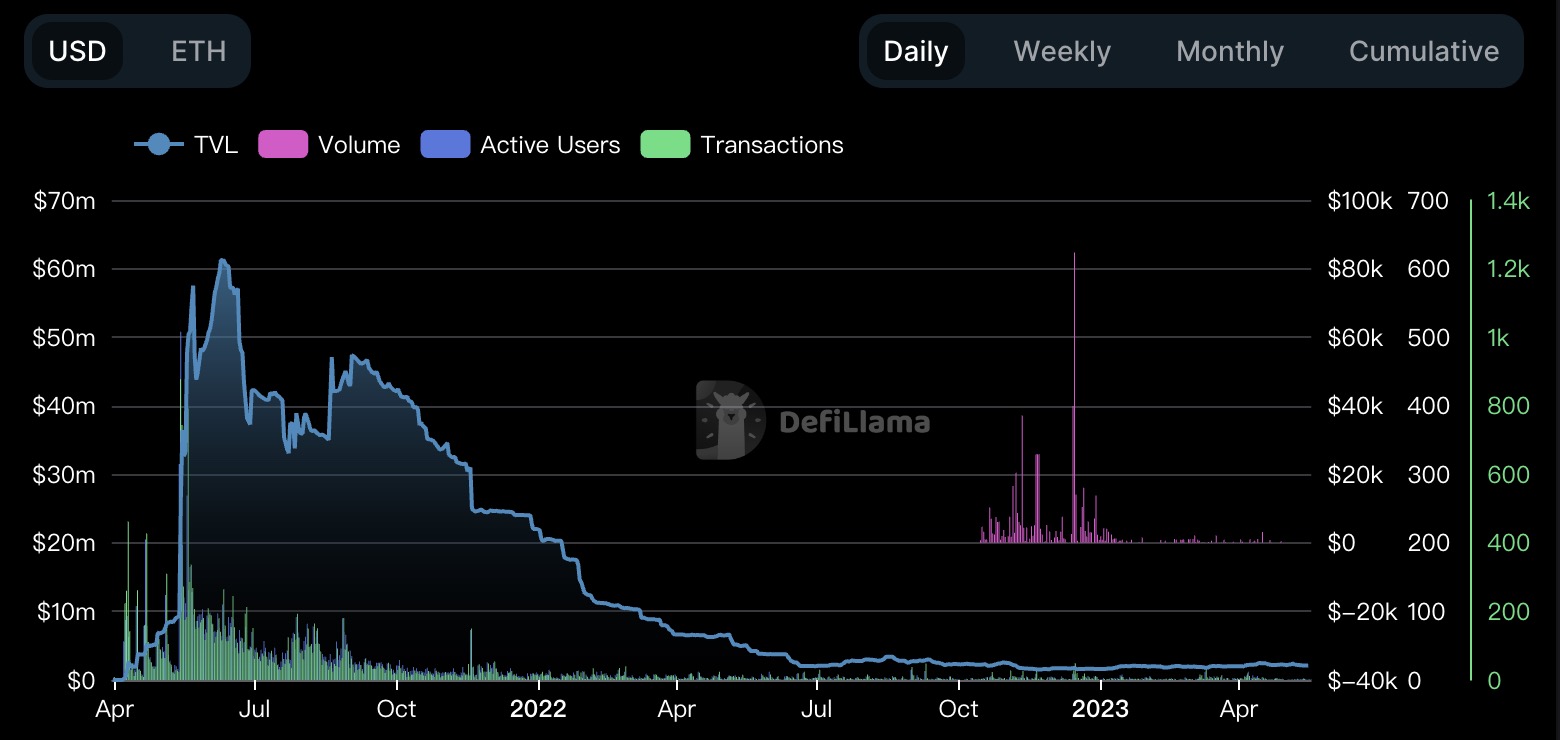

Unicly is the first platform to support NFT fragmentation trading. Unicly Vault NFT projects include MAYC, BAYC, Meebit, etc., with only MAYC#3780 having higher liquidity, while others are below $1,000.

According to DefiLlama data, as of May 16th, Unicly’s TVL is $2.13 million, which has been declining since September 2021, and its TVL exceeded $61 million in June 2021. Not only that, but Unicly’s daily transaction volume and active user count have also fallen to single digits. In addition, from the monthly transaction volume, only $55,000 has been traded since 2023, which is only about one-fifth of the $236,000 transaction volume in December 2022.

Currently, the top 5 tokens in Unicly protocol liquidity ranking are ETH ($940,000), uPunk ($460,000), uGLYPH ($290,000), UNIC ($160,000), and uMask ($50,000), with overall fragmented token liquidity being low and no short-term rebound trend.

Although these NFT fragmentation protocols have been updated to improve user experience on the basis of the original product, such as NFTX launching Goerli Testnet using Uniswap V3 to create centralized liquidity positions on the platform, Tessera launching game NFT aggregation services and art NFT aggregation platform Escher, etc. However, from various data, these protocols have shown a trend of slowing growth after peaking in 2021, and even some have experienced a sharp decline. The reason for the weak business of these protocols, in addition to being related to the overall trend of the NFT market, is that fragmentation is mainly aimed at blue-chip NFTs, which is not friendly to long-tail NFTs, and the holders of high-value assets are a minority and are easily manipulated by whales. In addition, the yield of most liquidity protocols is not attractive enough to investors, especially compared to NFT new projects that can have several times the yield.

Overall, although the NFT fragmentation track once flourished and the market discussion heat remained high, with the cooling of the overall NFT market and the rapid decline in activity, the fragmentation track is no longer as prosperous as it used to be. At the same time, from the market performance of head fragmentation projects, it can be seen that the liquidity and transaction activity of the NFT market have not had a significant effect, so the closure of Tessera is not unexpected.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Institutional investors boost Bitcoin to $ 7,000

- Babbitt column | How to predict the extreme price of cryptocurrency? Here are a few data to help you

- QKL123 market analysis | It is obviously related to dark web activities, and the demand for Bitcoin has dropped sharply? (0402)

- Over 30% of mined BTC is inactive, and the exchange becomes the largest HODLer

- For a story after a thousand years-Github bitcoin source code freezes Norway

- Max Kaiser: Gold is the “toilet paper” of the rich and Bitcoin is the “toilet paper” of the poor

- Bitcoin broke through $ 7,200 in the early morning, and the surge in US unemployment applications made Bitcoin a safe-haven asset?