Why is everyone choosing to create platforms instead of making games?

Why are people choosing to create platforms instead of making games?Recently, DeGame released the GameFi track analysis report for Q1 2023. VeDAO Research Institute observed some interesting data in the report, reflecting the current development status of the GameFi industry, and also made some prospects for the future of the track. Therefore, in this article, VeDAO Research Institute will explore the development and future trend of the GameFi track with you, using DeGame’s report as an introduction.

First, the conclusion: overall, the development of the GameFi track is still showing a sluggish trend, which is in stark contrast to the hot trend in 2022. On the other hand, there is currently an interesting phenomenon that a considerable number of Crypto Game projects finally choose to platform themselves…

Current development of the Crypto Game track

Despite the market’s continuous rebound, the concept of Crypto Game seems to be less than satisfactory. According to DeGame data, the total transaction volume of the entire GameFi track in Q1 this year was 420 billion US dollars, and the total number of players was about 700,000, most of which were distributed on the traditional GameFi public chain WAX. Although there are many GameFi projects on BNB Chain, Polygon and other networks, the number of players and funds they absorb is extremely rare.

This is largely related to the outdated concept of GameFi, low product quality, and short life cycle of the economic flywheel. In view of the fact that there are too many miscellaneous GameFi products, investment institutions are gradually beginning to take a rational look at this track.

- The World Cup is targeted by Web3 on a global stage

- The Fed’s worst nightmare: other factors that are getting closer to a turnaround

- Foresight Ventures: Review of meme coin investment rules

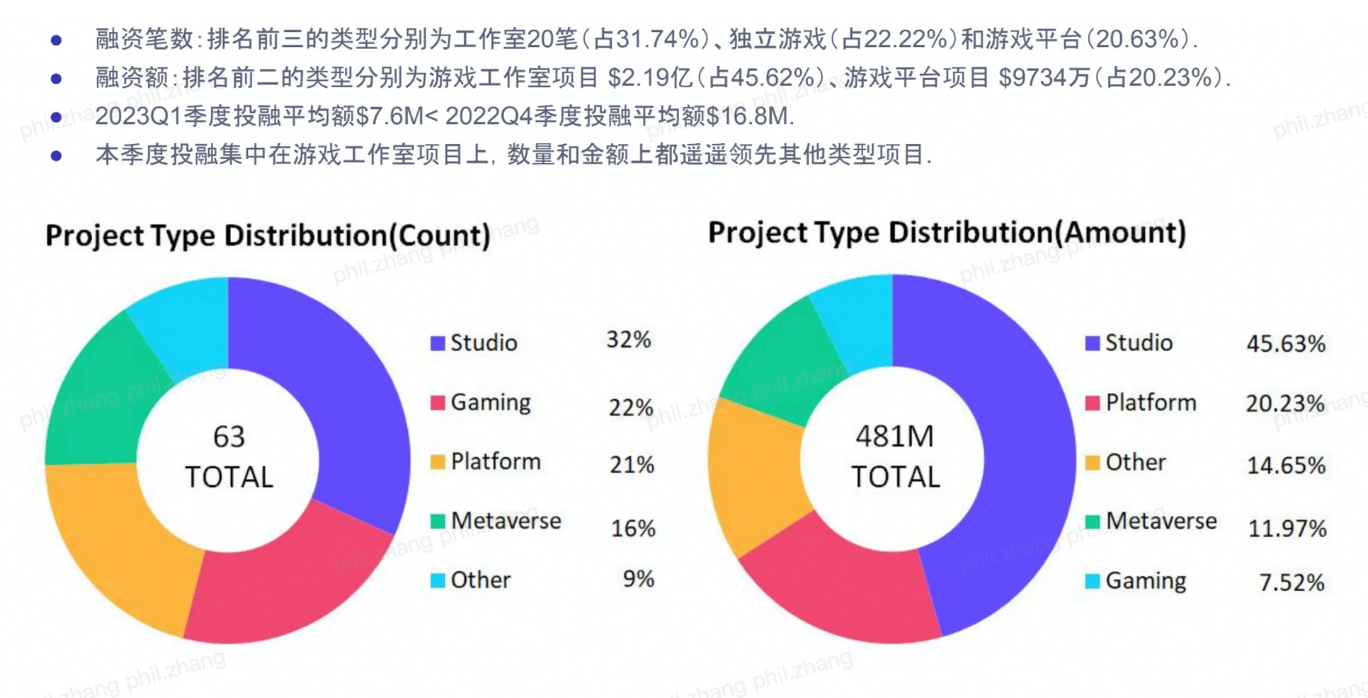

According to DeGame data, in Q2 of 2022, the GameFi track raised a total of 1 billion US dollars, of which independent games accounted for 40.06% (403 million US dollars) and game studios accounted for 30.64% (308 million US dollars). It is estimated that platform financing accounts for about 30%, or about 300 million US dollars.

Image source: DeGame 2023Q1 GameFi report

Image source: DeGame 2023Q1 GameFi report

However, in Q1 this year, under the premise that the total financing amount was greatly reduced to only 481 million US dollars, the financing amount of platform projects ranked second, accounting for 20.23%, close to 100 million US dollars, while the financing amount of game studios accounted for 45.62%, which was 219.5 million US dollars, and the financing amount of independent games accounted for less than 25%.

In terms of the number of financing, the number of independent game financing in Q1 this year was 22.22% (14 transactions). This is very different from Q1 and Q2 of 2022. At that time, the most favored financing type by capital was independent games, accounting for 61.17% (63 transactions) and 52% (52 transactions) of the financing transactions at that time. It can be seen that independent games are gradually losing the favor of capital. In contrast, there is a significant increase in the number of financing transactions for game studios and platform financing.

For game studios, the percentage of financing in Q1 and Q2 of 2022 was 26.21% and 11%, respectively, and this year’s Q1 was 31.74%. For platform-based products, the percentages were 4.85% and 13% in Q1 and Q2 of 2022, respectively, and this year’s Q1 was 20.63%.

Note: In the context of games, studios are generally development teams supported by Web2/Web3 giants; the latter are aggregate products that are not limited to a single game.

From the above data, we can clearly see that as the concept of GameFi develops, the capital market’s interest in low-quality, simple gameplay, and high-risk single GameFi products is decreasing, while interest in traditional giants that enter the game industry as studios is gradually increasing.

Moreover, the current development of GameFi also reflects a phenomenon: most Web3 teams have begun to transform into game platforms.

The most intuitive example is Axie Infinity, the once-popular GameFi product, which chose to develop its own public chain and provide infrastructure services for third-party game releases. In addition, Mirror world has also developed a set of mobile-based SDK toolkits, dedicated to optimizing user experience issues and attracting more Web2 and Web3 users. The earlier metaverse public chain project Cocos-BCX also announced its GameFi platform plan at this year’s Hong Kong Web3 Conference and renamed itself COMBO to build the next-generation decentralized game infrastructure with a new name and image.

Even many traditional giants have also chosen to enter the field as platforms. For example, Giant Network, which owns the classic IP “Conquer Online,” launched the ZTimes platform, which is committed to creating a game ecology while issuing GameFi; Wang Feng, one of the “Kings of Jinshan,” also launched his own Web3 game service platform NAGA.

Why is everyone keen on building game platforms?

In summary, there are three reasons: natural demand for incremental growth, demand for reducing the entry barriers for off-domain players/developers/funds, and the need to tell bigger stories/consensus games.

First of all, whether it is for the entire Web3 industry or specific manufacturers in the industry, there is a natural motivation to continue to introduce external traffic/capital based on their own development needs.

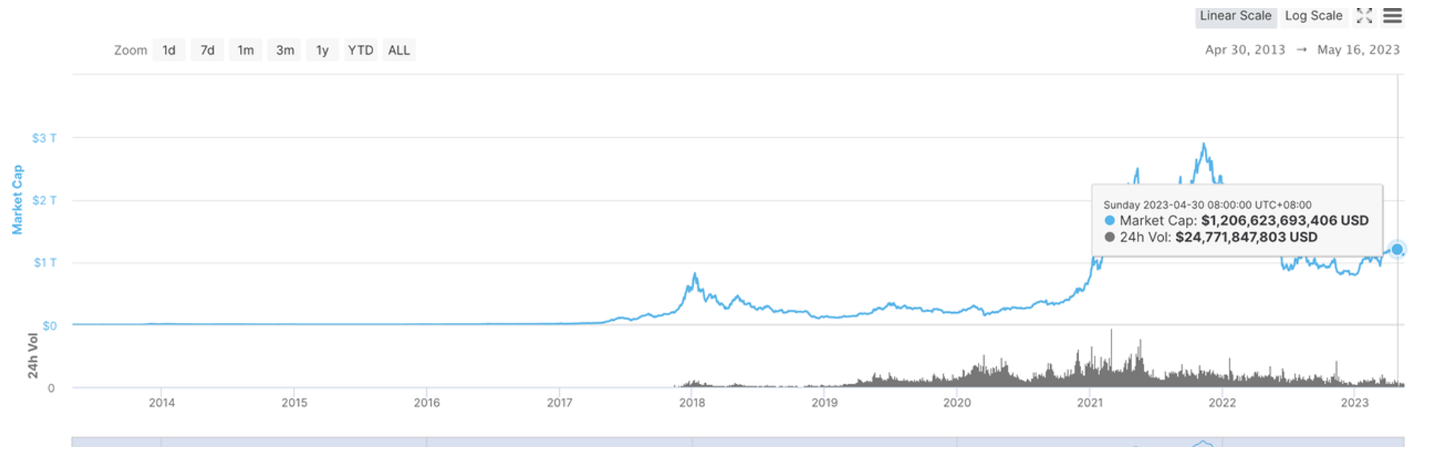

Since the total market value of cryptocurrencies reached a historical high of US$2.8 trillion in November 2021, until now, although the market has rebounded somewhat, it is still only about 30% of the high point, about US$1.1 trillion. The long trough has caused a flurry of capital to flee the market, and only more money and people coming in can make crypto great again. DeFi is too cold, and doing it in the name of games can achieve twice the result with half the effort.

Moreover, a widespread problem in Web3 (and a difficult problem to break) is the lack of universal use cases.

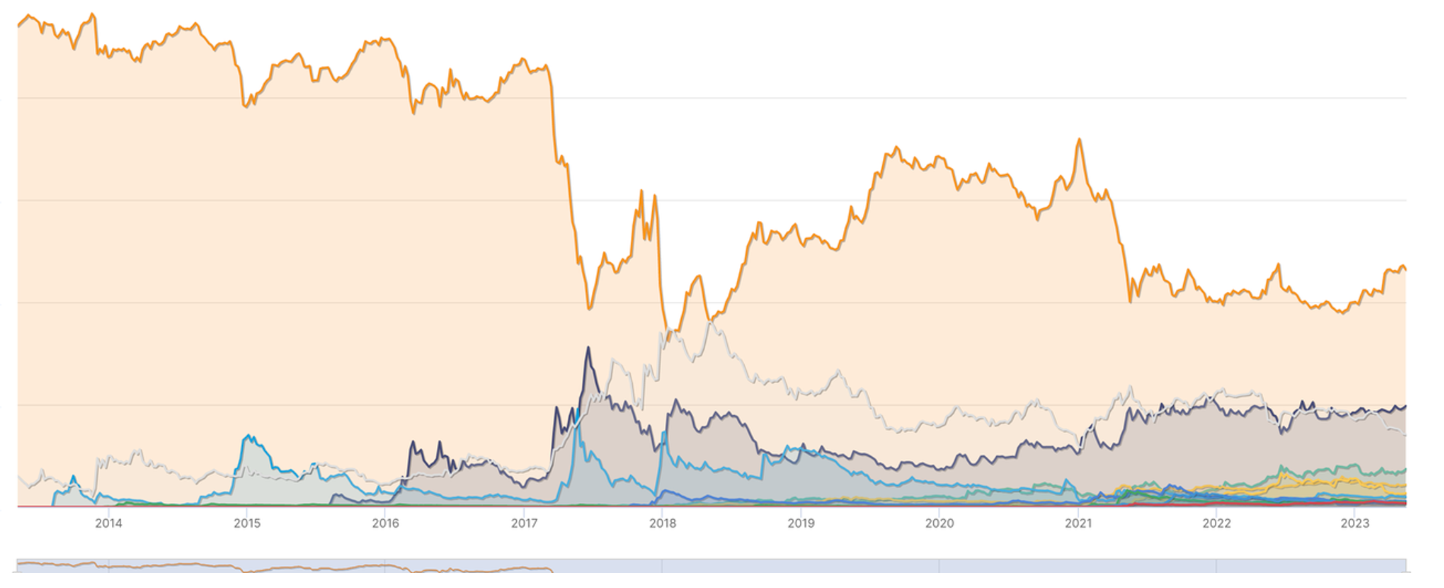

Taking BTC as an example, a BTC without any application has absorbed half of Crypto’s market value, while the diversified ecosystem of applications can only roll up a small part of the remaining market value. As shown in the figure below, although there are occasional setbacks, the gap between the market value of BTC and other ecosystems is narrowing. This is also one of the reasons why Ordinals are valued and the BRC-20 protocol will appear.

Past links: https://mirror.xyz/

For companies represented by exchanges, the landing of application scenarios can complete the industry’s external-to-internal flow suction (this external flow will often fall directly on specific companies); it can also achieve the import of industry flow to the company.

For start-up teams, entering from the GameFi perspective can bring a higher success rate for entrepreneurship. After all, in an ecosystem, only one DEX with the same function may survive in the end. However, GameFi with similar gameplay and different content can survive at the same time. This also gives start-up teams more possibilities for success. Therefore, we can also see that the number of GameFi projects has been increasing and financing information has been continuously released in the past two years.

It seems that the blockchain gaming industry is attracting talents and funds from all aspects as never before. For example, former CEO of Riot Asia-Pacific and former head of the game department of TikTok have successively established blockchain gaming companies. However, it is undeniable that there is a natural gap between traditional players and chain players in their views and pursuits of games.

Traditional game manufacturers rudely implant Tokens and NFTs in games; traditional game publishers believe that asset chaining of games is a predatory act; traditional game players believe that the implantation of NFT elements destroys the game experience…

How to further eliminate differences and provide blockchain reform services for games may be a good idea. From the perspective of web2 game developers, it is quite difficult to enter web3. Data on the chain, airdrops, tokens, management of NFTs, and so on all require a certain industry understanding plus tedious work. This is not very friendly to developers.

And the role of the platform is reflected here. By integrating the technical aspects of Gamefi with NFT/blind box issuance, management, and sales; token airdrop management, token lock-up, team token ownership lock-up, and other related tools, these functions can help developers quickly understand some of the web3 functions. Moreover, through a convenient interface, a one-stop on-chain game management tool is achieved. These functions effectively break down the barriers from web2 to web3, facilitating the on-chain process of traditional games and providing a possibility for the rapid transformation of traditional games.

But that’s not all. With the entry of traditional game giants, a new role has been provided for Crypto Game: Web3 game publisher, an important promoter to help games promote and enter the market. This task can often only be performed by platforms that aggregate multiple functions. Examples include Gala, YGG, and others.

From the perspective of game platforms rather than just single game products, in addition to the objective factors mentioned above, there is also the most attractive factor for the market and capital, which is the long-tail expectation brought by the platform’s multiple game relationships and rich stories, compared to a single game.

From Game to Platform’s Inherent Drive

First of all, we cannot deny the profound financial attributes behind GameFi, which is gambling.

Participating in market behavior means participating in gambling behavior. After evaluating the average consensus of all participants in the market, the winner must behave below the average consensus in order to win. If the participant’s behavior is higher than the average consensus, they will surely fail.

Here, we need to first talk about a small number game.

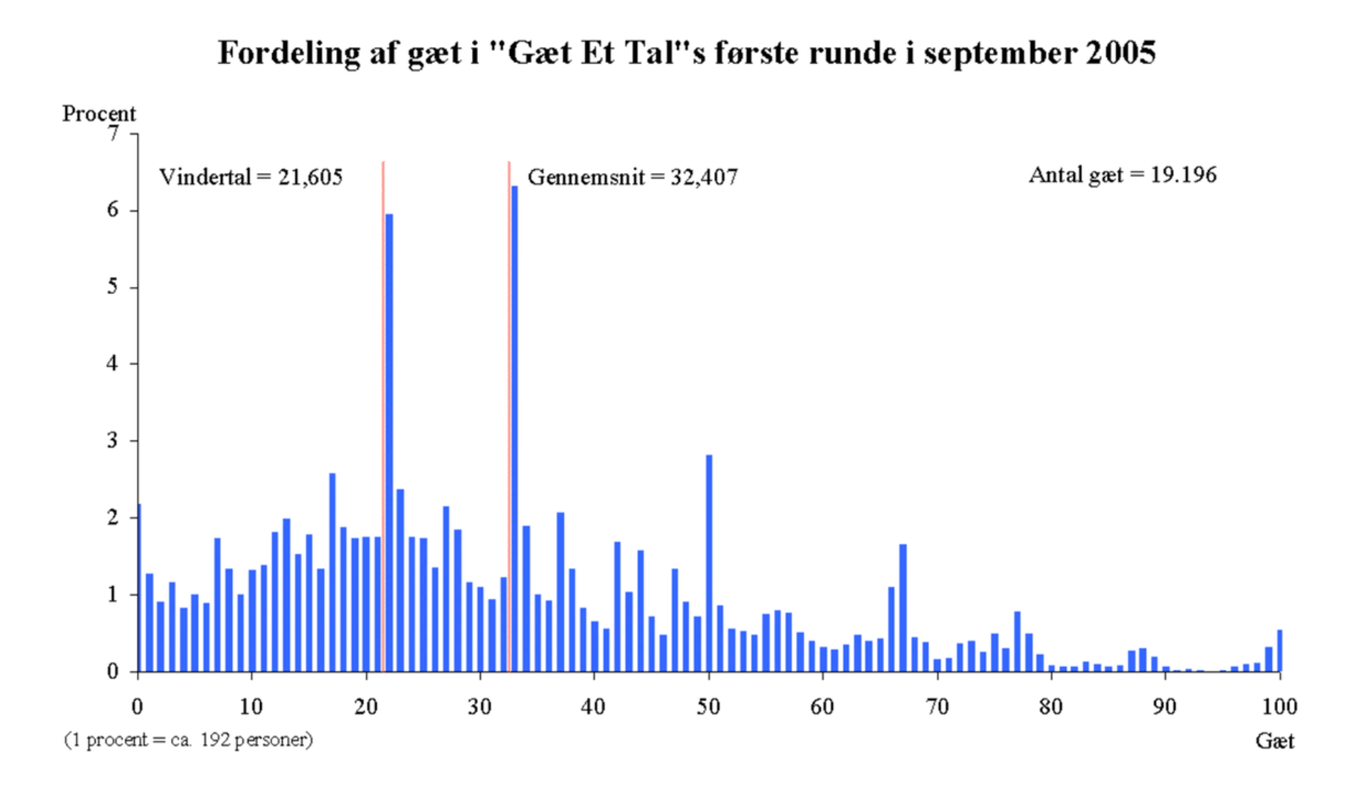

In “Misbehavior” by Nobel Prize winner Richard Thaler, an interesting gambling game is proposed: guess 2/3 of the average.

Each participant is asked to choose an integer from 0 to 100. The participant who chooses a number closest to 2/3 of the average of all users wins the game. For example, if there are three contestants who guess 20, 30, and 40, respectively, the average is 30, and 2/3 is 20. Then the person who guessed 20 is the winner.

In this game, if there are only two participants, there is an absolutely dominant strategy (strictly dominated strategy, which means that no matter what strategy choice other participants make, the best strategy for each participant is unique). Choosing 0 has a higher chance of winning than choosing any number greater than 0.

For example, if the two sides choose 0 and 100 respectively, then 2/3 of the mean is 50*2/3=33.3. Player who chooses 0 wins because 0 is closer to 33.3. When there are more than two players in the game, we face a more complex situation because the existence of new players forces all players to re-evaluate the psychology and behavior of other players. The optimal strategy changes from an absolute dominant strategy to a relatively dominant strategy.

Compared with the essence of two-player games, which is to compare who has the smaller number, the freedom of players in multiplayer games is higher. The essence of the game is for each player to estimate the average number of others. Therefore, choosing 0 directly will not help you win. Therefore, in multiplayer games, the key issue is not the arrival of the Nash equilibrium of the game. The key issue is how far the current system is from reaching the Nash equilibrium when considering all participants in the game.

For example, the first group of users who played this game will have the following selection distribution: more than 6% of users choose 33, nearly 6% of users choose 22, and the final winning number is 19. If these users participate in the game again, it can be foreseen that the winning number will be close to 0. When all participants realize that the integer “0” is the final solution, no one will become the loser of the game. Ironically, the game is declared over, and there is no real winner.

As a classic game in the field of finance, the game paradigm of “guessing 2/3 of the mean” is reflected in the game between blockchain players’ perception of project information, token price expectations, and future business operations.

The result of the game, regardless of the outcome, the Nash equilibrium will always come, and the balance of GameFi often comes too fast: a game with a three-month life cycle will basically fall into a death spiral.

This is the disadvantage of a single game. A story will always be told quickly, and if you introduce other stories when a story is about to end, or tell a complex story from the beginning, the expectation will be exponentially magnified.

There are currently two ways to complicate simple stories. One is to give more practical value to game behavior, which is not the mainstream. For example, SpartaDEX.

Previous link: https://mirror.xyz/

The more mainstream approach is still platformization, creating more possibilities. Taking Axie as an example, for more complex participants in the Axie development team and community, they have a clearer understanding of the direction and outcome of the project when they are playing the game with other participants. At the same time, they have a panoramic view of the average consensus of players, which provides them with convenience for consensus management: continuously introducing external funds, creating new gameplay, converting speculators into value investors, and finding new usage scenarios for Tokens.

Axie Infinity is actively exploring new identities. The launch of the Ronin sidechain and its native infrastructure, as well as the development of multiple new projects, has transformed Sky Mavis (the parent company of Axie Infinity) from an application developer to an infrastructure provider. In other words, the current “game” players can seamlessly participate in the next round of new consensus games.

Every consensus game will have an outcome, but at the same time, new consensus games will continue to emerge. This also provides many GameFi project parties with a convenient idea: to pass value to the platform, not the game. After all, the narrative of a game is very short-lived, but if it is platformized, more games are connected, and the platform becomes prosperous, then this story can be told for a long time.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The ATOM 2.0 white paper is about to be released, can the value capture capability of Cosmos be improved?

- How Blockchain Is Impacting Online Poker

- Canada Overtakes U.S. in Percentage of Cryptocurrency Investors

- Viewpoint | How will bitcoin prices react when US companies reopen?

- Market analysis: bearish pattern continues, BTC may test $ 5800

- CITIC Securities Research: What are the deep meanings behind the central bank's digital currency acceleration?

- DeFi total market value returns to 1 billion US dollars, new DeFi agreement surges