DCEP is good, Libra to testify

When your opponent starts to fear you, it shows your strength.

There is no doubt that China has taken the lead in the world in terms of the central bank's digital currency (DCEP). Especially in the context of Libra's emergence and global shock, the Chinese central bank's DCEP is ready to let the Chinese people look forward to let the foreigners fear.

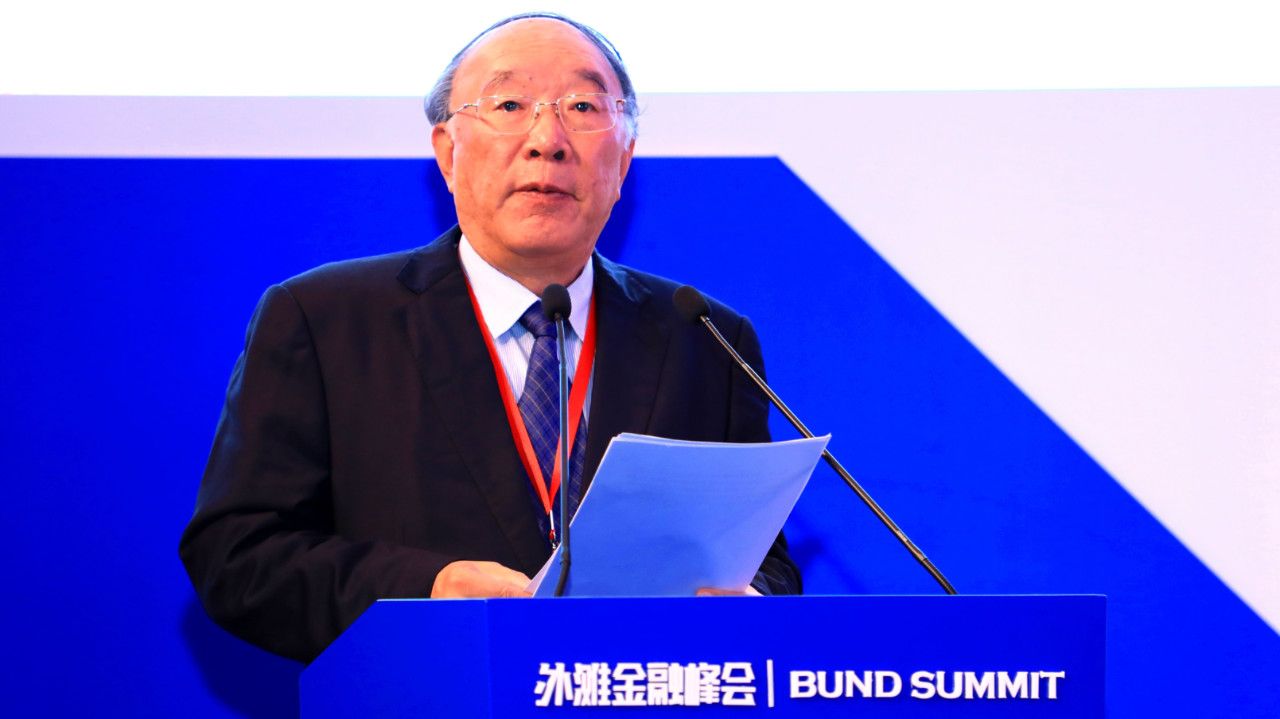

On October 28, Huang Qifan, vice chairman of the China International Economic Exchange Center, said at the first Bund Financial Summit that the People's Bank of China is probably the first central bank to introduce digital currency in the world. This statement is out, all circles are uplifting.

- A share observation | inventory blockchain concept stocks, the chairman was arrested can not stop the stock price rise

- Comment: Blockchain and Red Flag Act

- Count the history of China's policy on the blockchain in these years

What is more concerned and more tense than the Chinese is the United States that has always been in the throat. On October 23, Zuckerberg repeatedly stated at the congressional hearing that China is likely to launch a digital currency similar to the Libra concept in the coming months, which will challenge the US financial leadership, and the tensions and concerns are beyond words.

DCEP is good, Libra to testify

Huang Qifan believes that the digital currency introduced by the central bank will be exchanged for commercial banks or institutions and then redeemed to the public. The significance of this is not the digitization of the existing currency, but the replacement of M0, which is conducive to the circulation and internationalization of the renminbi. Delivery and monetary policy development provide a strong reference.

Obviously, the internationalization of the renminbi and the expectation of DCEP under the Belt and Road framework will affect the hegemony of the US dollar, which is the last thing the United States wants to see.

What's more interesting is that the power of DCEP is actually not used by the Chinese themselves. Looking at the Facebook hearing, you can see that the hearing has almost become the Chinese DCEP's spit–the Americans' fear, which shows China's strength.

At the hearing, Zuckerberg and several lawmakers expressed great concern about China's DCEP.

Zuckerberg said that China is currently Libra's main competitor and will affect the US's financial leadership and the US sanctions against other countries. The United States should have a choice, whether it is worried about the risks brought about by building a new system, or whether it will make China's financial system a global standard in the future. Once the Chinese standards become a reality, it will be difficult or even impossible for the United States to impose sanctions on other countries. He is very worried about this.

To a large extent, this is also the reason that Zuckerberg took the opportunity to use the national crisis to persuade Congress to support Libra, and this new strategy seems to be quite effective, infecting a group of parliamentarians to join Tucao China and support Libra camp. .

Kentucky State Houseman Andy Barr said that US competitiveness and its competition with China are national security issues, and Facebook and Libra are good for US national security.

This may once again confirm the logic above – when Americans feel that national security is threatened, perhaps when China's national security is defended.

Innovation is the last word

Up to now, the two chambers of the United States have held too many hearings on Libra-related issues, and only the top level of Facebook has attended three games. However, what makes Members and Libra quite embarrassed is that Libra's related issues have not been answered by the hearing.

In the hearing of the hearing, Congressman Patrick McHenry said bluntly: "The 6-hour hearing ended. As a policy maker, I confessed that I was not sure what I heard. We talked a lot about the topic, but still Not sure about Libra's operating mechanism."

Even worse, questions about Libra have extended to questions about the spirit of American innovation. For example, Patrick McHenry questioned why the Libra Association chose its headquarters in Switzerland because Switzerland has a better environment for innovation, or is the United States unable to give better policies? Other members pointed out whether they could move the Libra Association headquarters back to the United States.

Although Libra is still a long way forward, if it is sloppy that China's DCEP has already crushed or slammed Libra, it may be overstated that the two are not even comparable.

Some Members pointed out that the challenges and competition that China brings to Libra are actually not at one level. This is because it is Zuckerberg, which is promoting Facebook, and it is the national decision-making level and government agencies that promote China's DCEP. Commercial companies, business figures and national and national decision-making levels are two different things.

From this perspective, Libra's grand concept can be born in the business world, driven by the business world, and it is worth pondering. After all, as the national decision-making layer clearly accelerates the development of blockchain technology and industrial innovation, more blockchain-related innovations will occur in the business world, and it is necessary to create innovative markets, regulations, and even legal environments for the development of new technologies.

Of course, it must be pointed out that the blockchain has its own special features. When it comes to the transaction of legal currency and digital currency, there will be no room for survival. For the castle in the air, even challenging sovereignty will not work in any country.

As Huang Qifan said when talking about Libra, Libra challenges sovereign currency. This decentralized currency based on blockchain is separated from sovereign credit. The issue base cannot be guaranteed. The value of the currency cannot be stabilized. It is difficult to form social wealth. I don’t believe Libra will. success.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Case editing | Which industries have been innovated in the blockchain of one night?

- Viewpoint|Does the blockchain technology really have nothing to do with the price of the currency?

- Getting started with blockchain | Hope the blockchain "talking words" friends, you can understand here

- Comment: Blockchain, a new round of economic growth engine

- Li Guoquan: How can the blockchain industry be more easily recognized for regulatory approval?

- Weekly News | Important economies have expressed their stance on digital currency, digital currency rebound resistance

- The second batch of list release of the network information blockchain record concept stocks rose again (with a list of listed companies)