The second batch of list release of the network information blockchain record concept stocks rose again (with a list of listed companies)

Text | Mutual chain pulse · Yuan Shang

On October 22nd, the blockchain concept stocks rebounded again. Julong shares, Keda shares and Hualian shares closed up, and more than 10 blockchain concept stocks rose by more than 5%. The Straight Flush blockchain index rose. 1.77% (Shanghai Composite Index rose 0.5% on the same day).

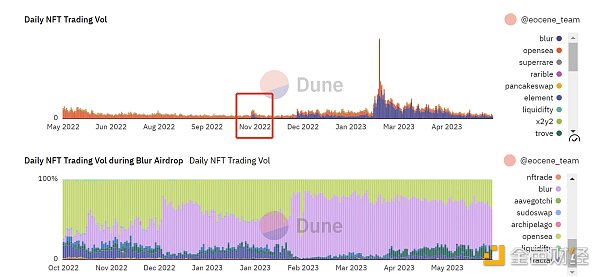

On the news, on October 18, the National Network Office issued the second batch of blockchain information service filing list, or the catalyst for the blockchain concept stocks to rise. However, the release of this filing list is not as good as the first batch of incentives for A-share investors. On March 29, after the first batch of blockchain information service filing list was released by the website, the A-share blockchain concept stocks rose for a week, and the straight flush blockchain index rose more than 11%.

According to the inter-chain pulse statistics, the second batch of filing lists involved 26 listed companies, an increase of 36.8% compared with the first batch of 19 companies. However, from the perspective of proportion, the second batch of filings increased by 56.85% compared with the first batch, and the proportion of listed companies decreased accordingly.

- Open letter from the Chairman of the Financial Stability Board to the G20 Finance Minister and the Governor of the Central Bank (full text translation)

- 12 famous people from all walks of life, why do they enter Bitcoin, Ethereum, Ruibo…

- Looking at the blockchain project from the "God perspective"

Half of the 16 listed companies are listed on the Shenzhen Stock Exchange, such as Donggang, Yuanguang Software, Information Development, etc.; 6 listed on the Shanghai Stock Exchange, including Aerospace Information, Hang Seng Electronics, Jiangsu Bank, etc.; Dak listed, including Thunder, Jingdong, Baidu. In addition, there is one each on the New York Stock Exchange, the Hong Kong Stock Exchange and the New Third Board.

After the second batch of filings, two brokers issued research reports on the filing. Guosheng Securities believes that: to a certain extent, the implementation of the record system for blockchain information services and the publication of two batches of record numbers in a short period of time represent the recognition and attention of the government's regulatory agencies on blockchain technology, blockchain industry. Development is expected to accelerate.

Guohai Securities said that 2019 is the first year of blockchain commercial application. First of all, the blockchain technology has been continuously improved, and the problems of traditional small scale and low efficiency have been partially solved. The blockchain has matured in performance, ease of use and operability, and can support large-scale commercial applications. Secondly, the district Blockchain laws, regulations and supervision systems are gradually improved. Blockchain filing is conducive to the overall development of the blockchain industry. It is the first step in the standardization of blockchain technology. More and more enterprises can apply them formally. We are optimistic that the blockchain will take the lead in supply chain finance, copyright protection, legal deposit, energy trading and other applications, and we are optimistic about the blockchain platform technology service providers with independent controllable. Guohai Securities recommends: Yuanguang Software, Xinhu Zhongbao, Easy View, Hang Seng Electronics, Jinzheng, Information Development, Anne.

This article is [inter-chain pulse] original, the original link: https://www.blockob.com/posts/info/26235 , please indicate the source!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Blockchain Weekly | American Chinese Presidential Candidate Issues Campaign Token 6 Libra Founding Members Withdrew

- Why is the blockchain so passionate about secure multiparty computing?

- Introduction | Livepeer and GPU Miners

- Conversation with Cai Weide: Compared to Libra, Fnality can really set off the blockchain financial revolution.

- Digital currency wallet mobile market is a necessary development trend

- Blockchain Weekly | The central bank released the 2020 recruitment announcement; Jia Nan Zhizhi is going to the US

- Blockchain faction: traditional giants, academics, political circles, startup companies