UniswapX Opening the Gateway to Uniswap V4 DeFi Experimental Base

UniswapX opens gateway to Uniswap V4 DeFi base.

UniswapX, which was recently launched, is currently in the opt-in beta version. It is expected that Uniswap X will play the role of a full-chain router, which will have a structural impact on existing aggregators and cross-chain bridge tracks. Currently, the most direct impact is that it will siphon trading volume from the aggregator market (such as 1inch, Cowswap, etc.) in the race for transaction fees. After the launch of UniswapX, the price of 1inch has experienced a significant decline.

UniswapX is essentially a non-custodial trading protocol based on Dutch auctions. The protocol allows third-party Fillers to execute transactions (as takers). Fillers can be liquidity providers on-chain or off-chain, such as market makers, MEV searchers, DEX, etc. The competition between Fillers is realized through Dutch auctions, which is a way of parameterizing the starting price of Dutch-style orders. The starting price of the Dutch auction is determined through RFQ, an off-chain inquiry system, where some Fillers are voted on (market makers are incentivized to use private transaction relays to route orders to on-chain liquidity pools). At the same time, in order to incentivize Fillers to provide the most favorable prices, UniswapX allows orders to specify a Filler to have the exclusive right to fill the order for a short period of time. After that, the Dutch auction begins and any Filler can execute the order. The RFQ + Dutch auction model has been implemented by Cowswap’s Coincident of Wants early on, and 1inch Fusion also implemented the integration of professional market makers for off-chain order matching last year. UniswapX chooses to integrate professional market makers and combines them with later V4 compositionality, providing more diversified choices for the market.

Optimizations and problems solved by UniswapX

(1) MEV revenue is internalized, with some subsidies going to swappers (in the form of lower execution prices) and some being obtained by Fillers, returning profits to users;

- Twitter renamed X, Musk ignites the X universe! From AI to exploring space, the prototype of a universal app emerges.

- Tokyo and Kyoto, the rising encrypted ‘twin stars

- a16z In-Depth Analysis What New Gameplays Will AI Create?

(2) Off-chain signing of transactions, user-friendly for retail investors. Fillers will perform comprehensive calculations between optimizing gas fees and optimizing actual exchanges, utilizing this complexity to produce the best results. When trading across multiple pools, there is no need to pay gas fees multiple times, and trading can be done without native gas tokens; gas is not needed for failed transactions;

(3) Meets the needs of cross-chain transactions.

Some criticisms:

(1) In some cases, certain single-path tokens may already have the optimal price in regular mode, using UniswapX may result in repeated charges and may not necessarily save money;

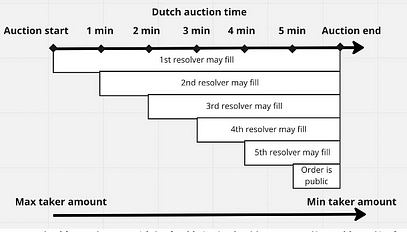

(2) Dutch auctions have inherent transaction speed delays (see figure below), which can cause losses due to market price fluctuations, or Fillers may wait for prices to drop before executing transactions (UniswapX expects to solve this problem through a reputation system);

(3) The RFQ model of Fillers is relatively less decentralized.

Dutch Auction Process

I. How to help users save gas fees and get better prices (although it may not save money in some scenarios)

The principles of UniswapX and 1inch Fusion are the same in terms of optimizing user transaction fees, but UniswapX is more permissionless and does not have 1inch’s whitelist system.

For users, the 1inch Fusion model appears to be a normal swap exchange, but technically, Fusion is actually implemented through the limit order model, reflected in the price exchange rate being filled by a third party called the “Solver” (similar to the Filler in UniswapX). The exchange rate of the order will gradually decrease from the initial rate to a smaller amount (Dutch auction), until the Solver is profitable to fill the order. Multiple Solvers compete for the order to ensure it is filled before the exchange rate reaches the minimum return amount. Here are some opportunities for Solvers to profit:

- Dutch auction continuously lowers the order exchange rate;

- Savings on gas fees when filling matching orders;

- Savings on gas fees due to batch filling.

- UniswapX’s Filler also profits through the above methods. In addition, Filler competes with Uniswap v1, v2, v3, and v4 after launch, and the competition between Fillers can provide users with better prices.

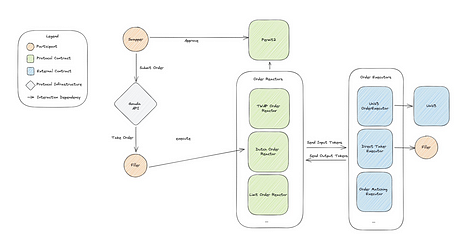

UniswapX Transaction Process Diagram

In this process, the transaction is submitted to the Reactor Contract and the Filler pays for the gas. If the transaction fails, the gas loss will be borne by the Filler. Although gas is eventually reflected in the user’s transaction price, users no longer need a large amount of gas tokens, only a small amount of gas is required to complete the initial authorization. Price competition, reduced MEV losses, and lower gas fees will ultimately result in better prices for users during transactions.

II. How to achieve MEV protection

By introducing a permissionless Filler network, Fillers can choose various Reactors for settlement. Through methods such as auctioning a batch to complete transactions and mempool confidentiality, MEV protection for users is achieved to a certain extent, making users beneficiaries of MEV profits.

Let’s briefly explain how MEV occurs. MEV (Maximal Extractable Value) refers to the maximum value that miners or other traders can extract by prioritizing processing transactions, reordering transaction sequence, or selectively including or excluding transactions during the transaction process. MEV is caused by the nature of the transaction sequence and consensus mechanism of the blockchain.

Using CoW Swap as an example, CoWSwap uses multiple protocols to match orders to avoid sandwich attacks. Here are some MEV protection data for CoW Swap in 2022: In 2022, there were approximately 1.9K sandwich attacks targeting CoW Swap transactions. Compared to 239K transactions, sandwich attacks accounted for only about 0.8% of the total transaction volume of CoWSwap. Sandwich attacks extracted approximately $1.3 million from CoW Swap’s Solvers. Compared to the total fee income of $8.55 million for CoW Swap, sandwich attacks accounted for only about 1.5%. Through CoWSwap, the percentage of attacked transactions is an order of magnitude lower than the total percentage of sandwich attacks in Uniswap or Curve. In addition, compared to other decentralized exchanges, the percentage of attacked transaction volume for CoW Swap’s batch value is only about 0.7% of the total transaction volume, also lower by an order of magnitude.

Currently, the most severely attacked contracts are Uniswap V3 and Uniswap V2. UniswapX is a protocol developed to address this issue. If there are better pricing methods and resources, people will definitely prefer to choose them, and over time, more trading volume will be transferred from the original version of Uniswap to UniswapX.

In the use of UniswapX, traders first authorize Permits through signature to provide the right to transfer tokens. This process requires payment of a certain amount of gas token fee. Next, traders need to sign and specify some transaction parameters, including the type and quantity of input tokens, the type and quantity of output tokens, etc., and authorize the Reactor Contract (the relevant contract for settlement) to spend tokens. Fillers compete with each other to compete for orders, and the winning Fillers will submit batch transactions to the Reactor Contract. The Reactor Contract calls the Executor Contract to execute the transaction. The Executor Contract obtains the output tokens from the Fillers and sends them to the traders. The Reactor Contract checks whether the execution result of the transaction is consistent with the submitted transaction parameters and settles the transaction.

In this process, traders directly trade with Fillers, and attackers lack the opportunity to conduct MEV arbitrage. Even if MEV attacks occur (Fillers may also be MEV searchers), the profits are shared to some extent with the traders.

In the UniswapX scenario, through auctions, the price decays over time. As long as someone believes that including this transaction is profitable, they will submit the auction, and the order has already been executed before the tolerance threshold is reached, at which point the order has made a profit. This way, arbitrageurs will not be able to front-run transactions on the trading target as before. This system ensures that someone completes an order when the first profitable opportunity arises, which is itself a MEV protection mechanism. For example, if there are a bunch of transactions off-chain at the same time, a submitter can discover all the transactions and complete them simultaneously, which means they will submit orders early in the entire cycle. In price auctions, the earlier you auction, the higher the price, and the less value leakage.

III. How to support cross-chain transactions

The UniswapX protocol can be expanded to support cross-chain transactions, where traders can trade their holdings on the source chain to obtain the desired assets on the target chain. Off-chain signed orders not only solve the complexity problem of the pool but also solve the complexity problem of bridging. The complexities are all solved by the same service provider and the same submitter.

UniswapX achieves the following functions for cross-chain transactions

(1) Fast exchange – as long as there is a message transmission bridge between two blockchains, UniswapX can provide fast asset exchange between any two chains;

(2) Simplified operation – exchange and bridging are merged into a single operation, eliminating the need for users to directly interact with the bridge, maintain gas tokens on each chain, or wait for settlement delays;

(3) Quick exit – UniswapX can achieve almost instant exit from the second-layer chain to its parent chain;

(4) Local asset exchange – traders can specify receiving local or normalized assets on the target chain instead of bridged assets. For example, ETH on the mainnet can be directly exchanged with AVAX on the Avalanche chain;

(5) Minimize passive bridge risk – Traders do not bear any bridge-related risks when exchanging local assets, and Fillers only bear bridge risks when rebalancing between chains through bridging.

Simplified version of cross-chain UniswapX protocol:

Traders sign an off-chain order, which includes additional parameters in addition to the same parameters as single-chain orders:

(1) Settlement Oracle: A one-way oracle that can prove the occurrence of an event on a target chain. It can be a canonical bridge, a light client bridge, or a third-party bridge between the parent chain and the second-layer chain.

(2) Filling Deadline: The order must be filled on the target chain before the deadline.

(3) Filler Guarantee Amount and Asset: The margin that Filler must deposit on the source chain.

(4) Proof Deadline: The time before Filler must provide proof of filling on the source chain.

The trader’s order is propagated through the Filler network, and Fillers compete to execute the order and submit the order together with the trader’s funds and Filler’s margin to the reactor contract on the source chain. Fillers fill the order by transferring the assets required by the trader on the target chain. The reactor contract on the target chain records the orders filled before the specified deadline and passes the message to the reactor contract on the source chain through the settlement oracle to confirm the fulfillment of the trader’s order. Then, the trader’s assets and margin are released to the Filler on the source chain. If the Filler fails to execute the order before the proof deadline, the trader will withdraw their input assets and Filler’s margin from the reactor contract on the source chain.

The Optimistic cross-chain protocol can address the problem of settlement oracles being too slow or expensive. In the Optimistic cross-chain protocol, Fillers complete orders on the target chain, and if no one challenges the filling of the order within the challenge deadline, Fillers will receive the trader’s funds and Filler’s margin on the source chain. Anyone can challenge the filling on the source chain using the reactor contract before the challenge deadline expires. If the Filler can provide valid proof of filling before the proof deadline, they will receive the challenger’s margin. If the Filler fails to provide valid evidence, the Filler’s margin will be allocated to the challenger and the trader, and the trader’s funds will be refunded to them on the source chain.

Hayden Adams believes that in the future, most assets will exist on their native chain, or on the safest chain, or on the most typical asset chain, rather than on bridges. That is to say, if a submitter conducts a cross-chain exchange, they will obtain tokens on the native chain of the tokens. In this way, the use of bridges seems to be really minimized. Rather than saying that cross-chain bridges are bridges for assets, it is better to say that in this model, cross-chain bridges are only used to transmit the final information. Even that data packet is not necessary unless the submitter is lying. This can be called the minimum viable bridging, and users will only bear bridge risks when trading across bridges. Once the trader obtains the output token and the submitter obtains the input token, neither party will have any bridge risk anymore.

So, UniswapX minimizes the degree to which people need to bridge, and also abstracts them, such as this system can support any possible bridging. It can be imagined as a bridge aggregator, where submitters can use any bridge, but each transaction has a specific cross-chain bridge, which is the “settlement oracle”, which can be any bridger, or any other system, and can use multi-signature systems, governance systems, or unilateral systems, or trust submitters.

IV. Differences between UniswapX and 1inch Fusion

UniswapX’s trading orders allow Fillers to accept and submit without permission, which is more open than 1inch’s whitelist system.

The Solver in 1inch Fusion receives order flow in turn based on the amount of 1Inch tokens they have pledged. This means that in the first minute of the order, only one Solver can match the transaction. Even later, the competition is very limited. In other words, to fill an order, the Solver must be added to the whitelist and have enough balance to pay the order fee. The process of being added to the whitelist is as follows:

(1) Obtain enough unicorn power to be listed among the top ten registered Solvers. There are two ways to increase Solver’s unicorn power:

· Pledge more 1inch tokens or extend the pledge period.

· Attract more delegates through farming to delegate their unicorn power to the Solver.

(2) Register as a Solver in the whitelist and delegation, and set a work address.

(3) Deposit 1inch tokens into the FeeBank to pay for the settlement of transactions.

The ranking of the top ten whitelist pledgers is determined by their “unicorn power”. Pledgers can lock 1inch tokens in the pledge contract to obtain st1inch tokens. The lock-up period can be set from 1 month to 2 years. st1inch tokens give pledgers “unicorn power”. The longer the lock-up period, the more unicorn power the pledger obtains. The growth of unicorn power is not linear, but follows the following rules:

- Lock-up for 2 years, each lock-up of 1 1inch token will give the pledger 1 “unicorn power”.

- Lock-up for 1.5 years, each lock-up of 1 1inch token will give the pledger 0.47 “unicorn power”.

- Lock-up for 1 year, each lock-up of 1 1inch token will give the pledger 0.22 “unicorn power”.

- Lock-up for 0.5 years, each lock-up of 1 1inch token will give the pledger 0.1 “unicorn power”.

- Expired lock-up, each lock-up of 1 1inch token will only give the pledger 0.05 “unicorn power”.

UniswapX adopts a permissionless admission system, uses a reputation system to mitigate the possibility of Fillers acting maliciously, and has the priority trading right of the best bidder and the reputation system (preventing Fillers from waiting for the price to drop before making a transaction). The pricing system may benefit from the use of accompanying reputation or penalty systems to limit Fillers’ abuse of the choice provided by this monopoly, and ensure that traders’ user experience is not affected.

Others are similar.

5. Revenue Growth Forecast

UniswapX charges a transaction fee of 0.05%. Based on the current daily trading volumes of 1inch (35 million) and CoWSwap (22 million), even if Uniswap obtains half of the trading volume from these two platforms, calculated based on the existing market share, it will increase by 25 million * 0.05% ($12.5k) per day. Compared to Uniswap’s current daily revenue of nearly 1 million, this represents a growth of 1.25%, which is not significant.

Summary

In terms of marginal changes in revenue growth, UniswapX will not fundamentally change the revenue of Uniswap itself in the short term, but will have a greater impact on other protocols in the same field. Uniswap’s layout in wallets, NFT markets, aggregator markets, etc. has not been widely accepted by the market in terms of squeezing other protocols in the stock market. UniswapX is just one of the protocols where we can see the potential empowerment of V4. With the introduction of Uniswap V4, Uniswap is expected to overcome criticisms of not focusing on its core mission of building a better ecosystem and become an important infrastructure that supports various applications. Its diversified layout in different fields will gradually develop it into a huge experimental base that cannot be ignored in the market.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Another animal coin gains popularity, this time it’s the real version of the on-chain hamster race Hamsters.gg.

- LianGuai Daily | Google Cloud is planning more Web3-centered products; Celsius reaches a key settlement, customers may receive compensation by the end of this year.

- Former CEO of stablecoin TUSD sues the company, claiming to have been ousted during negotiations for acquisition by Tron.

- Curve rescue the nation? A detailed explanation of how Opensea’s new Deals feature solves the liquidity problem of NFTs.

- Exclusive Interview with Xian Diyun, Acting CEO of Zhongan Bank Virtual Assets Will Become a New Growth Point

- What new things has XMTP brought to Web3 social with its partnership with Coinbase and Lens?

- Quick Look at Velodrome V2 Further Enhancing Asset Efficiency, Strengthening OP Super Chain Vision