Li Guoquan: How can the blockchain industry be more easily recognized for regulatory approval?

This article is the speech of Li Guoquan, a professor at Singapore's Xinyue Social Science University, at the 5th Global Summit of Blockchains. In his speech, Professor Li elaborated on the concept of chain deep technology and put forward his own suggestions on the regulatory approval of the blockchain. The 5th Blockchain Global Summit was hosted by Wanxiang Blockchain Lab, which was guided by the Shanghai Economic and Information Commission and the Shanghai Hongkou District People's Government. It also received PlatON, Weizhong Bank, Qtum, MYKEY, Nebulas. Irisnet, Blockstack, Harmony, Qiming Ventures and other companies work together to support.

The full text is compiled from the on-site shorthand draft, and some of them do not affect the original intention. Click: The 5th Blockchain Global Summit: Li Guoquan can view the live speech video.

Hello everyone! What I want to talk about today is the rise of Pratt & Whitney's deep technology. During the two days of the summit, most of the speech will focus on these two points: the digital currency issued by the central bank (CBDC), and the digital currency CBC issued by the company, such as Libra.

The central bank's views on digital currency have been somewhat convergent: 1. The digital version of the central bank's currency should have a potential advantage over the substantive legal currency; 2. The digital version significantly accelerates the transaction speed and transaction costs of domestic and cross-border payments; 3. The CBDC issued by the central bank can provide stability without restricting innovation. 4. The bank protects credit by creating money, but the bank begins to have bad debts, and the business model is under great pressure. 5. The cryptocurrency issued by the company is in circulation to international capital. It will have the impact of monetary and fiscal policies, while the volatility of emerging markets will increase.

- Weekly News | Important economies have expressed their stance on digital currency, digital currency rebound resistance

- The second batch of list release of the network information blockchain record concept stocks rose again (with a list of listed companies)

- Open letter from the Chairman of the Financial Stability Board to the G20 Finance Minister and the Governor of the Central Bank (full text translation)

In fact, the central bank has eight points of concern in terms of supervision: 1. It has a major impact on the implementation of traditional monetary policy; 2. Before the technology of encrypting digital currency is mature, when the market is under pressure, it will make everyone lose confidence; 3. If there is no endorsement Multi-systems (private chain, public chain, alliance chain) may become a channel for risk transmission in the crisis of trust; 4. Decentralized technology is still not satisfactory, which may lead to major economic and financial damage; The mechanism poses many challenges to regulatory and financial stability, especially in stabilizing the financial system; 6. Cryptographic and digital currencies will challenge domestic authority; 7. Emerging markets face challenges of capital flows and exchange rate fluctuations, generating currency spillover effects and spreading 8. Possible cross-in capital flow channels such as money laundering, illegal activities, evasion of control and reporting requirements.

In the development of the entire blockchain community, it is important to understand what the regulatory concerns are, and it is important to understand which agency is responsible for regulation and the government's policy support for the blockchain industry.

I believe that there are five main drivers of electronic money issued by the central bank: payment security, domestic payment efficiency, implementation of currency implementation, inclusive finance, and cross-border payment efficiency. From the perspective of government and regulation, inclusive finance is a very important driver, and cross-border payment costs are very high. The real development of blockchain projects on a large scale must begin with inclusive finance and cross-border payments.

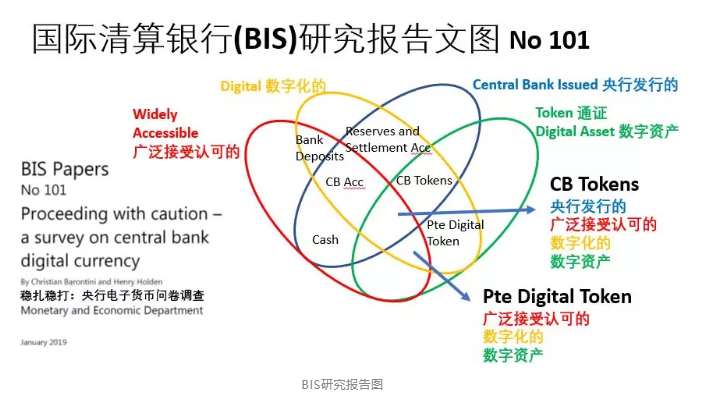

In January of this year, the Bank for International Settlements (BIS) issued a report that clearly shows the characteristics of digital currency clearly in elliptical graphics.

The blue part is the cash issued by the central bank, the red is the digital currency issued by the company, the golden yellow means digital, and the green means digital assets. There are two important points in the report, which are also important for the blockchain community. First, at this stage, because the technology is not really mature, most central banks know the challenges of issuing central bank electronic money, but they are not sure that the advantages outweigh the disadvantages. . The vast majority of the digital currencies are believed to be emerging economies. The plans of the 10 ASEAN countries to issue digital currencies have been around for 10 years, but they have not been successful. Second, inclusive finance creates a clear task for the central bank, but it still lacks infrastructure. This has led to the central bank's electronic money can only bring limited subversive effects, while further promoting the use of new technologies. At the same time, the central bank will be more likely to accept inclusive finance and will minimize the regulatory and compliance costs of all blockchain industries.

There are ten major factors driving the development of electronic inclusive finance, and it is also the point that the blockchain industry should focus on: 1. Distributed networks. Through the blockchain, fast and stable distributed mesh network access can be realized. If the communication network is not distributed, then half of the decentralization technology we are talking about is empty talk. In this respect, we must try to pass the "spider web" through the zone. The blockchain has developed rapidly. 2, interoperable executable value transfer portal, interoperability is very important. 3. User privacy protection. This is very important in the world. If you want to reduce the operating costs of the blockchain, you must work harder on the user's privacy protection technology. 4. Network architecture security. This will make a big contribution to the blockchain private key, public key and so on. 5. Open source and trusted distributed governance. Research and R&D will take some time before governance has reached a certain level. 6, digital and UX basics. 7, digital identity. National digital identities are not necessarily cross-border and must be broken from distributed digital identities. 8, easy to comply. The cost of compliance may be higher for the blockchain industry and may not continue to develop if it is not developed in an easy-to-comply industry. 9. Comprehensive data and the prophetic ecosystem including Oracle. In this regard, the blockchain community is developing slowly. 10. Talent, knowledge and skills.

These ten aspects can help us achieve good results, but look at the statistical data of distributed application software (Dapp) in the blockchain industry, the progress is not as ideal as imagined. As you can see from Dapp's data, there are less than 10 million transactions in 24 hours and less than 3,100 Dapps. Because the application of smart contracts is mainly based on Ethereum, half of the more than 3,000 Dapps are not operated and applied, and there are other reasons for not running in Dapp. The number of new Dapps is getting less and less, and it has already slowed down. It can be said that we are getting slower and slower in this regard.

Since the beginning of this year, DeFi and Web3 have been talked about in the industry, but the feasibility of these technologies is not as fast as that of mainstream institutions. The progress of mainstream institutions is much faster than that of the blockchain community. In terms of digital assets, Switzerland has issued cryptocurrency banking licenses to two major financial institutions, Swiss Financial Service and SYGNUM, to synthesize the function of the French bank and the cryptocurrency operation into a banking license, not only to practice the business of the currency bank, but also Can do encryption and Token business. On the corporate side, Facebook has made great progress.

Facebook has 2.7 billion users, and there are only 180 million users in the United States. There are probably 2 billion users in China's various payment and online banking, but most of them are highly coincident. The real users are only about 1 billion. They are all based on the Chinese language group. How does it involve cross-border? Especially how to cross culture? Facebook has been cross-cultural, cross-border, and has begun to cross-regulation, but also across international technology. The ability to cross-culturally cross-regulatory and cross-international technologies is a very big challenge for digital currencies.

Libra is equivalent to the “five things” that are close to the standard. From the perspective of inclusive finance, it has scale, legal currency stability, and decentralized consensus consensus algorithms. From the offline, there are 100 members, as long as more than two-thirds of the members agree, you can perform many important decisions online. From an online consensus perspective, less than one-third of the evil components are needed. However, Libra did not mention privacy protection, and only mentioned the coinage competition in the white paper. The Fed has already talked about Libra's worries, and the EU has raised concerns, and many banks have also raised it. Libra is a delicate balance. If there is no government endorsement, there is no way to implement it. It also needs the support of other institutions. Privacy protection is a tool used to monitor premiums. Unless people's dignity is protected, it is impossible to achieve people-oriented. This is the most basic business ethical requirement of central power for such projects.

In any case, it can be seen that the blockchain has made a big subversion to traditional enterprises, including HSBC has done a lot of letter of credit transactions. On September 2, HSBC has opened the first block based on the RMB in the blockchain. This is worthy of your attention.

The battlefield of true digital certificates is in a variety of legal currency, cross-border currency issued by enterprises, and distributed ledger technology. Later Libra may be a cross-border, distributed ledger. If there is no enterprise endorsement, it will be exactly the same as Bitcoin.

What we are pursuing is the inability to monopolize the traditional system. It is a cross-border, cross-cultural, cross-regulatory, and interoperable functional node based on “inclusiveness”. The Internet of Things distributed and distributed communication network, the main pursuit is the combination of software and hardware, distributed incentives, P2P privacy, these are required to pass the certificate. The real value of blockchain is open source, open, plus private chain, alliance chain, to achieve distributed communication, distributed trust, distributed privacy protection.

We now often talk about "ABCDEF", namely AI/AR/VR (Artificial Intelligence/Virtual Reality) Blockchain (Clock Chain), Cyber Security/Cloud, Data Analytics/Digtal Devices (Data Analysis/Digital) Equipment), Environmental Friendly Technology (Environmentally Friendly Technology / Environmental Technology), Financial Inclusion Tech (Inclusive Technology). But these are not enough. There may be 30 new technologies in the next decade that are deep technology and need to be combined with blockchain. “Using the potential of blockchain technology to bring good use to society,” said the Singapore Central Bank’s general manager. In order to develop the Singapore Puhui blockchain project, it is necessary to pass the non-securities welfare certificate. The most important thing is to jointly move into the combination of blockchain and deep technology, namely “chain-depth technology”.

The “6D (six)” of the Welfare Pass is very important – Digitalisation, Disintermediation, Democratisation, Decentralisation, Diminishing Oneself, Data Privacy Protection ( Data privacy protection). Without decentralization and self-reduction, there is no way to establish a blockchain ecosystem. Without privacy protection, there is no way to achieve DeFi, and there is no way to do DAO, so this "6D" is what we must pursue.

How to pursue? The Singapore Media and Telecommunications Development Bureau has a very detailed technical development map, which can be downloaded online. Singapore is actively developing software + hardware, plus blockchain + embedded software + prefabrication technology. At the same time, to build an ecosystem, the former Assistant Director-General of the Association, Yang Guoguang, set up a “chain deep meeting”, which mainly contributed to the unity of blockchain enterprises and manufacturing. The software has already begun to integrate with the hardware, and Singapore is already doing a deep chain development.

Singapore’s future prime minister, the current deputy prime minister, Wang Ruijie, said that “Singapore can become a global technology, innovation, and enterprise Asia node”. Singapore is not a business hub, a financial center, but a node of the world. This is the idea of blockchain. Don't regard a country as a center. It must be cross-cultural, cross-border, and cross-payment. Therefore, it should respond to the slogan of the Singapore Bank. If the blockchain is to succeed, it must pursue innovation, inclusiveness, and tolerance. To reduce the cost of compliance, technology must be instructive, so that the blockchain industry will receive worldwide supervision, which will help us to spread the industry to the world, in the next 10, 20, 30 years. Really develop it.

From this perspective, blockchain and deep technology have emerged. This time, I came to China to give a speech and hope to pass on the information to everyone. The blockchain industry must be cross-border and cross-cultural. When everyone enters the global market, from the perspective of investors, it is necessary to reduce the cost of compliance when going out. To reduce the cost of compliance, we must cooperate with the supervision and promote cooperation. We must work together to promote the development of inclusive finance and inclusive technology, and include all aspects of the public chain, private chain, and alliance chain, and regard our blockchain as the whole. The nodes in the blockchain can quickly expand the ecosystem.

Thank you for listening!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- 12 famous people from all walks of life, why do they enter Bitcoin, Ethereum, Ruibo…

- Looking at the blockchain project from the "God perspective"

- Blockchain Weekly | American Chinese Presidential Candidate Issues Campaign Token 6 Libra Founding Members Withdrew

- Why is the blockchain so passionate about secure multiparty computing?

- Introduction | Livepeer and GPU Miners

- Conversation with Cai Weide: Compared to Libra, Fnality can really set off the blockchain financial revolution.

- Digital currency wallet mobile market is a necessary development trend