Dialogue with Hong Ning: The areas where the blockchain is most likely to have a disruptive impact are banks and media.

Author: Rainforest

On February 9, 2011, the price of Bitcoin reached $1 for the first time, but at that time few people were interested in Bitcoin born in the geek community, and few people could expect the impact of Bitcoin on a global scale. . However, in Hong Ning's view, “the emergence of bitcoin is a subversion of the existing monetary and financial system” (Hong Yuning, 2011).

- Popular science | Privacy protection is worrying? Encrypted data warehouses show their talents (core use cases and requirements analysis)

- Jianan will be listed, and these 20 A-share “mining concept stocks” will know in advance?

- The World Blockchain Conference closed, we discovered these new phenomena

He made such a judgment in 2011. He also worked at the Nanjing Branch of the People's Bank of China. With his great interest in Bitcoin, he published the first academic paper on the systematic study of Bitcoin in China. Bitcoin: A New Type The challenge of money to the financial system, many of the ideas in the text are not outdated today, so some people call Hong Yuning "bitcoin prophet."

Hong Yining is still a firm bitcoin believer, but he has already devoted more energy to the research and promotion of blockchain technology. He said that his later life will "closely and blockchain." Bundled together."

Zero Financial has seen Hong Yining at a recent blockchain industry conference and has had a simple exchange with the industry's opinion leaders on hot topics. Although the time was short, he still left us with a sharp impression.

Concise and concise, see the essence through phenomena

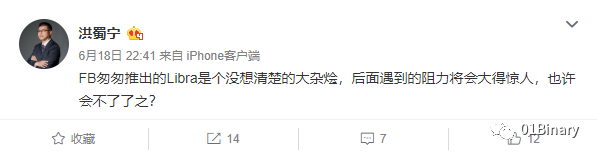

For example, we talked to Li Wei of Facebook about Libra. He said that after reading Libra's white paper, he judged that Facebook's idea is good, but "it is basically impossible."

Views on the central bank DC/EP

First of all, regarding the relationship between DC/EP and the blockchain , “I said last year that the central bank’s DC/EP has nothing to do with the blockchain, and it has nothing to do with the stable currency. In 2016, the People’s Bank of China established the Digital Money Institute. The blockchain is also relatively hot. Everyone thinks this is a big advantage for Bitcoin. I judged that this thing has nothing to do with Bitcoin and blockchain. The central bank’s digital currency is likely to use the database instead of Use blockchain to do it."

Secondly, regarding DC/EP and RMB internationalization , “DC/EP is digital cash, and our RMB is regulated. In the future, DC/EP may not be able to use it for export. It can only be used domestically. No one can say clearly at present. How to do the internationalization of the RMB and ensure that the exchange rate will not be affected after the internationalization of the RMB."

Again, regarding the application scenario of DC/EP, "The biggest difficulty of DC/EP is that there is no application scenario. Under what circumstances do I need to use DC/EP? For C-end users, how can people with no bank accounts? Is it possible to use the DC/EP mobile app? Of course, it is not excluded that in some scenarios administrative measures will be used to promote the use of DC/EP."

Finally, regarding possible arbitrage , “the monetary policy of DC/EP and the monetary policy of banknotes are likely to be different and isolated. Once the monetary policy is very different, the speculative forces of the market will come in. The difference is narrowed down, commonly known as arbitrage. In order to avoid the existence of such arbitrage, administrative means may be needed to completely separate the application scenarios, but this is very difficult. There is a greater risk of artificially dividing a currency into two markets."

Looking to the future of blockchain technology

For the banking industry, “the main business is deposit and loan, and these are all intermediary services, all of which can be replaced by blockchain technology. Remittance services currently have a large number of blockchain alternatives, such as bitcoin. And the loan business can automatically meet the needs of the fund providers and borrowers through the intelligent contract of the blockchain. In the future, the bank will continue to retain its core business – risk control, and provide professional risk control services for the blockchain financing business.”

For the media industry, “At present, the Internet has partially decentralized from the media, but it still has to rely on centralized systems such as Weibo and WeChat. By using blockchain technology, decentralization can be further realized, reaching everyone’s The ultimate goal of publishing information without threshold. The application of blockchain in the media may not be as good as the application of the financial industry at this stage, but it must be one of the future directions."

end

Hong Yining said that he once thought about using Bitcoin to do DeFi. His instinct is that Bitcoin can also implement MakerDAO. "There is limited energy now, and many ideas have not yet been put into practice. If I am Vitalik, then I still lack a Gavin."

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- If the Internet is turned off, how does the blockchain survive?

- How does the blockchain drive the decentralized network and count those blockchain projects that fit into Web 3.0?

- Dark Net Silk Road drug dealer pleaded guilty about this dark world, how much do you know?

- How far are we from the real DAO?

- From the arguments of NGC Zhu Weiyu and Dovey, talk about Cosmos

- How to measure the value of Token from the cost?

- IOTA co-founder announces retreat and clears all cryptocurrencies