Double the bitcoin: banker, bargain, hedge fund admission

The dealer and the bargain-hunter are waiting for the opportunity

In September 2017, the crypto-equity transaction was completely banned in China, and the price of bitcoin rebounded in the following months. At that time, it hit a price of nearly 20,000 US dollars in December of the same year. Then, a nightmare that has been falling is beginning.

- Bank of France Governor: Stabilizing coins have a place in the financial market

- Ethereum is expected to surpass Bitcoin as the leading currency in the future

- ETH soared 20%, leading the public chain to skyrocket, the big bull market started?

In the fourth quarter of last year, global risk assets showed a “surrender sell-off”, and bitcoin also fell simultaneously, falling to a low of nearly $3,200. However, this year, as the haze has retreated, global stock markets have violently rebounded. This round of rebounding bitcoin has not been absent, and the rebound rate is nearly five times that of US stocks.

On May 13, the global financial market value evaporated more than 1 trillion US dollars, US stocks fell nearly 3%, investors sought safe haven, US debt, yen, gold have risen, Bitcoin has become a place for safe-haven funds, in one fell swoop Breaking through the $8,000 mark.

"This round of big rises actually has the funds to enter the market last year. There are not a few large-capital or bookmakers. Since then, more people have followed suit." Insiders of Darling think tank told reporters.

In the past month, there has also been a phenomenon of “mega whale sweeping goods” – a bitcoin wallet address, sweeping goods 93947.12874454 bitcoins, for a total of 161 transactions.

In fact, since last year, there have been many fascinating stories overseas. On October 16, last year, Fidelity Investments, one of the world’s largest mutual funds, was reportedly launching an independent company that will specifically provide cryptocurrencies for institutional investors. . According to public reports, Fidelity Digital Assets has acquired its first customers and plans to go public in 2019.

In December last year, Facebook plans to launch a plan with a basket of fiat money anchored cryptocurrencies, and is also ready to apply it to WhatsApp for users to send and receive funds between peers; in May this year, postponed A few months later, Bakkt announced that it is advancing bitcoin futures products that are settled in kind, or will be tested in July. After the news came out, Bitcoin continued to rise and rose by nearly 13% on the day.

After every wave of news, there are large holders of coins that continue to raise the price of coins.

Even more strange is that on May 7 this year, Bitance's Bitcoin hot wallet, the world's most traded digital currency exchange, was hacked and stolen by more than 7,000 bitcoins, worth more than $40 million. The currency holds 2% of the total amount of bitcoin. This news also did not affect the rise of Bitcoin.

“Coin’s announced that it would make full compensation, which in turn raised the market’s buyer’s power. The Canadian currency announced that it would close the trade for a week, which led to a deeper market decline, so the price was more likely to skyrocket and fall.” Said.

Encrypted asset hedge fund expansion

Recently, in addition to international speculators, the power of institutions seems to be strengthening on Bitcoin. Overseas encryption assets hedge funds continue to expand, which has driven the market's activity.

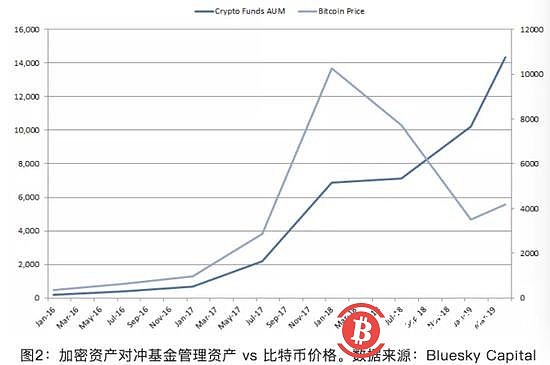

Interestingly, despite the bear market in 2018, the assets under management of the crypto asset hedge fund (AUM) did not fall. Darling think tank mentioned that Bluesky Capital's research shows that crypto-equity funds are much smaller than traditional funds, most of which are less than $10 million, and only 5% of funds exceed $100 million.

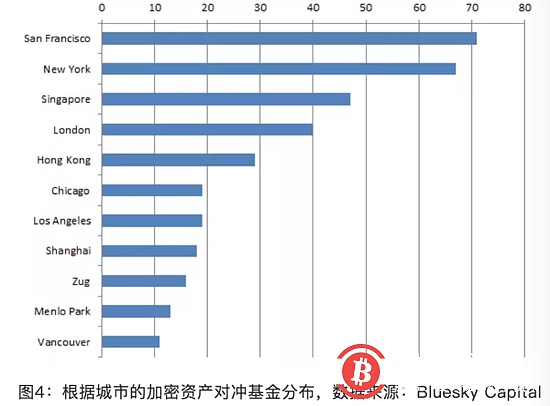

The reporter learned that in terms of the regional distribution of crypto assets hedge funds, they are globally distributed and are basically found in major large financial technology centers such as San Francisco, New York, London and Singapore. At the same time, the body of crypto assets The volume is much smaller than traditional funds, most of which are less than $10 million, and only 5% of funds exceed $100 million.

However, it is quite puzzling that if the Eurekahedge Encrypted Asset Hedge Fund Index is used to represent the performance of the crypto asset hedge fund, then Bitcoin is used as the representative of the overall crypto asset, from June 2013 to April 2019. In terms of performance, the trend of the two seems very similar, which also makes people doubt the effectiveness of encrypted hedge funds as an excess return (alpha) product.

Recently, there is no shortage of large-scale international organizations that are beginning to sell cryptographic assets. At its core, in the context of the global economic downturn and expected return on investment, adding a little bit of bitcoin in the middle of the entire asset allocation can improve the risk return of assets very well – it seems to be a little bit of chicken in the cooking. .

The Coin Research Institute uses a large amount of data to measure the optimal solution of the above asset allocation, but until now, the biggest problem is that the whole calculation is based on historical data, and no one knows what will happen in the future.

In addition, according to the design theory of Bitcoin, Bitcoin is a deflationary currency, and 2020 is halved. Therefore, the above-mentioned institutions also constantly mentioned the concept of “half the increase”. But some skeptics have said that they all say that "half will rise," but do investors really dare to re-encrypt crypto assets?

Some market participants believe that Bitcoin is the leader of this wave, because it is still the "original or lighthouse" of the crypto-asset army. There are also many people who believe in the technology behind it (blockchain), but the rest are inferior. The currency is still only speculating on a illusory "beauty concept". All walks of life also believe that the blockchain technology still needs to be hungry. It is not ruled out that some inferior coins have been speculated because of the rise of Bitcoin, but in the end it is still unable to get rid of the fate of the exit. (Sina)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Facebook will send money to Amazon will be far behind? AWS General Manager: Everything is possible

- When the bull market knocks, will you choose HOLD?

- Can the price of XRP reach $1 in the coming months?

- Xinhuanet: BTC broke through 8,000 US dollars, is the long-term chess game still a safe haven?

- With three factors superimposed, Bitcoin rushed to $8,000 overnight, and the currency was boiling.

- Bitcoin rose above $8,000: the incentive for this bull market is not in the circle, but outside the circle

- V God: Four major regulatory trends worthy of attention