The "Bitcoin Giant Whale" gray company continues to move in 2019, indicating that there may be great changes in 2020?

Original: a poplar

Source: Vernacular Blockchain

In the cold winter, with the continued sluggishness of the stock market, the hope of a warmer market and the subsequent outbreak of the entire industry are pinned on the admission of mainstream investors and institutional funds. In the market's high expectations, Grayscale Investment is undoubtedly one of the most important roles.

As a specialized subsidiary of Digital Currency Group (DCG) in 2013, Grayscale Investment provides investors with a compliant investment channel in the form of a trust fund. The current cryptocurrency management scale (AUM) is as high as USD 2.1 billion. And more than 90% of the funds come from institutional investors and retirement funds. It is already the world's largest digital asset management institution.

- Perspectives | Stateless Clients: New Trends in Ethereum 1.x

- One article to understand why 2019 is the year of DeFi and 2020 is the year of DeFi

- China Europe Business School Gong Yue: DAO and Alliance Chain, a dispute that began with Hayek and Keynes

The market therefore laughed that if one day Old Money (referred to as wealth inherited) chooses digital assets such as Bitcoin, grayscale will undoubtedly be one of the institutions most likely to cooperate with them. So, at the end of 2019, what kind of answer sheet is the grayscale called "mainstream investors and friends of institutions"? Under the circumstances, what kind of prospects does the digital currency market expect for incremental funds in 2020?

01Singing the "giant whale"

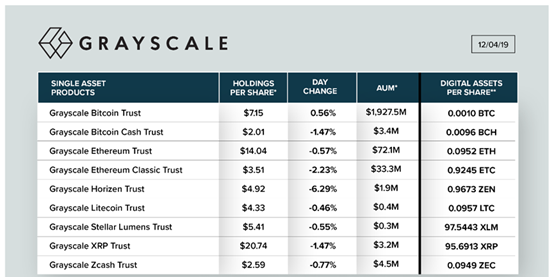

As a “friend of the institution”, grayscale investment preferences have always been stable, limited to mainstream assets and established currencies. In its single trust fund, which currently occupies 99%, it includes nine types of cryptocurrency assets: Except BTC, ETH , XRP, BCH, LTC, and XLM are among the top ten currencies by market capitalization. They also include ETC, an established mainstream currency, and ZEN (Horizen) and Zcash, two anonymous currencies.

At the same time, the gray level claiming that “institutional investors have been investing”, at the beginning of 2019, when the market was once desperate, stated publicly that this round of bull market is brewing and will be led by institutional investors. “Many institutional investors believe that the current The situation is worth cutting in, and their position in crypto assets will strengthen in the future. "

In response, Grayscale has been “buying, buying and buying” for nearly a year. The total size of custody assets has soared from US $ 825 million at the end of December 2018 to US $ 2.1 billion (as of December 4, 2019), which also makes Holding 260,000 BTC, it successfully won the title of "the world's largest BTC holding institution".

As a "giant whale" who always sings in multiple markets, gray positions have steadily increased over the past year, and the scale of various assets has continued to expand:

BTC trust fund size was 1.927 billion US dollars, but the first quarter of 2019 was less than 800 million US dollars, an increase of nearly 300%;

The size of the ETH trust fund is USD 72.1 million;

BCH trust fund size of $ 3.4 million;

ETC trust fund size is US $ 33 million;

LTC trust fund size of $ 400,000;

The size of the XRP trust fund is USD 3.2 million;

The size of XLM Trust Fund is USD 300,000;

Zcash trust fund size of $ 4.5 million;

The size of the ZEN Trust Fund is $ 1.9 million.

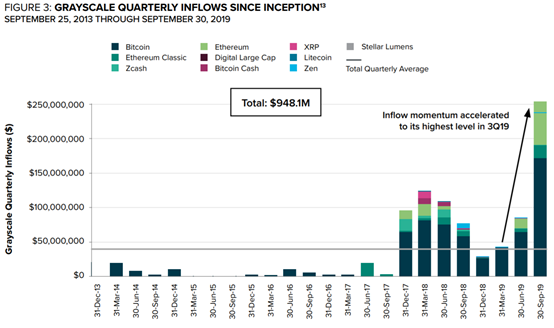

Although the expansion of the management scale has benefited to some extent from the rebound in the market since the beginning of this year, from the perspective of total assets, grayscale custody has continued to expand in 2019. "The layout is enthusiastic.

Especially in the past six months, although the entire digital asset market has fallen again, its investment inflows of funds have tripled from the previous quarter. In the third quarter of 2019 alone, Grayscale received USD 255 million inflows of capital, which is a sharp increase from the same period last year Increased by 300%, accounting for nearly 27% of the total cumulative inflows of various trust products of grayscale since its creation.

The cold winter still can't stop the eagerness of off-site funds. Ye Zhichun, 2020 will undoubtedly be a year full of hope, and it is also destined to be a big test year for many asset management service providers.

02 The Dilemma of "Entrance Infrastructure" for Cryptocurrencies

As one of the few crypto digital assets compliance trust funds currently established, the six-year-old gray scale has been doing its best to help mainstream investors and institutions avoid the tedious steps of holding bitcoin and the uncontrollable risks of possible theft, New boundaries are also being expanded:

According to the official website of Grayscale Investment, it has submitted a voluntary registration application file on Form 10 to the US Securities and Exchange Commission (SEC) on November 19, "hoping to attract more investors to join its dedicated cryptocurrency fund."

If the application document is approved within 60 days, Grayscale ’s trust fund “will become the first digital currency investment tool to obtain SEC reporting company status”, which also means Grayscale will be open to more investors-many Mainstream investors or institutions have not previously preferred or been allowed to invest in trust products that have not been filed with the SEC.

At the same time, after filing, investors will be able to sell their trust fund shares after six months, instead of the one-year mandatory holding period previously set. Such liquidity loosening will undoubtedly further increase investors' Attractive.

Holding about 1.3% of the total BTC, constantly increasing holdings of various mainstream assets, and actively trying to provide more friendly entry methods, as the grayscale of the "most mainstream institutional investors" who are most likely to enter the market, but still It seems difficult to sustain: even if it recovers to the peak of December 2017-the scale of 3.5 billion US dollars, compared to the entire cryptocurrency market and the possible demand for huge amounts of money to enter, it is still a fortune.

According to CoinMarketCap data, as of December 5, the total market value of the cryptocurrency market was only $ 190 billion (Bitcoin accounts for 69% of the market value of $ 132 billion), which means that the direct value of the entire industry is even lower than Maotai (200 billion USD), not to mention the 1.2 trillion dollar Internet giants such as Apple and Microsoft.

Even Bitcoin, which has been benchmarked against gold, has a value of 7-8 trillion, which is more than ten times, and gold accounts for less than 1% of the total global value creation, compared to huge amounts of off-site funds and the future. The possible expansion volume, the current infrastructure of the cryptocurrency industry, is obviously far behind the demand.

"To get rich, build the road first", this phrase is quite appropriate for the current crypto digital currency market. 2020 will undoubtedly be a crucial year for mainstream investors and institutions to enter the market. It will also be a year that needs to be fully prepared for entering the world of digitally traded assets. For the turbulent ocean of incremental funds outside, it will improve the "entry basis" "Facilities" is perhaps one of the most pressing things now.

03 Gale starts at the end of Qingping

Of course, things are slowly changing. With the agitation of Facebook's main promotion of Libra this year, the accelerated rollout of fiat digital currencies in various countries and the increasing correction of the blockchain industry have become an irreversible trend. Interest in encrypted digital assets has also increased around the world, and entry channels for mainstream investors and institutional funds have been further improved and expanded.

1.2020 may be the last of the Bitcoin ETF next year

Although "passing seems to always be in the next year", although the Bitcoin ETF has been rejected time and time again, it seems that it is getting closer and closer to the final expectation. US Securities and Exchange Commission (SEC) chairman Jay Clayton bluntly stated, "We are closer to the Bitcoin ETF" in a CNBC interview in September. 2020 may really be the last "next year" of the Bitcoin ETF.

Once adopted, it will completely open the way for traditional mainstream investors to invest in cryptocurrencies, and may promote the large-scale acceptance of Bitcoin and other Wall Street, making crypto asset allocation more widely recognized.

2. "Super Bull Engine" Bakkt is slowly starting

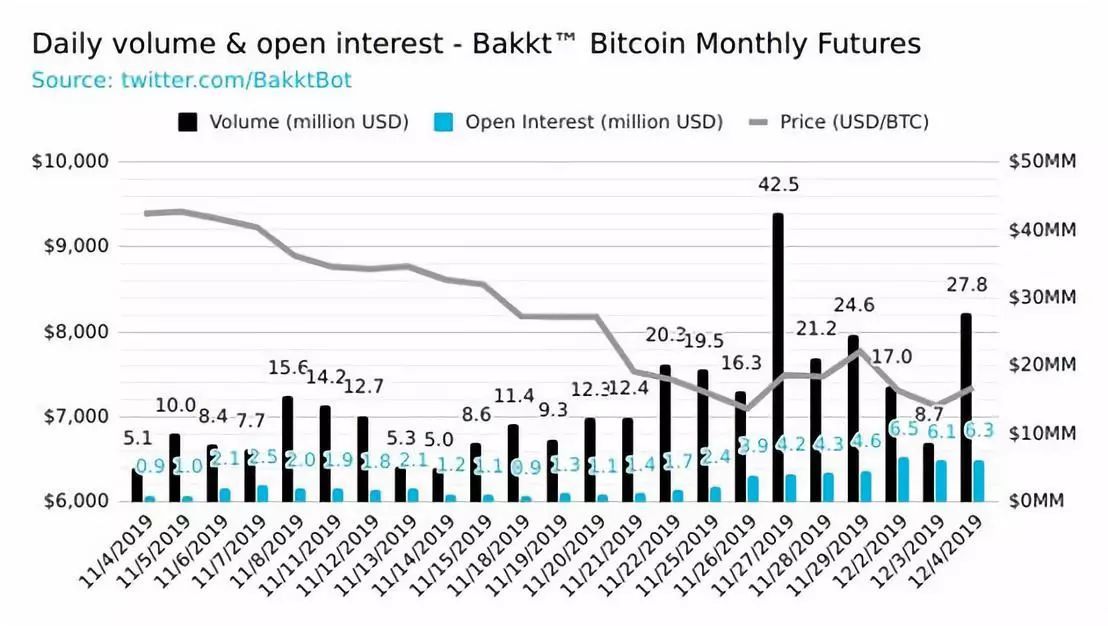

At the same time, although Bakkt, which went live on September 23, opened bleakly–in the first 24 hours, 71 Bitcoin futures contracts (71 BTC) were traded. The first nine trading days were also bleak, with only 865 contracts changing hands.

However, it seems that the return of the king is also being staged recently: the day-to-day trading volume continues to rise, and on November 27, it broke through 5,000 BTC to reach 42.5 million U.S. dollars, and the transaction volume at the lower point has increased by more than 100 times. "Super bull engine" seems to be slowly starting.

3. Options for Bakkt and CME are on the way

On December 9th, Bakkt will launch its own bitcoin options product. CME also announced the details of launching related contracts on January 13, 2020. More derivatives services are continuously building a complete investment infrastructure for crypto assets.

The gale started at the end of Qing Ping, and Ju Tao rose between Wei Lan. The enthusiasm of the industry that cannot be masked under the cold winter of 2019 is destined to be a key turning year. Let us look forward to the great changes in 2020.

Issue 393: According to the grayscale whale's move in 2019, what do you think the industry may change in 2020? Welcome to share your views in the message area.

——End——

"Disclaimer : This article is the author's independent opinion, does not represent the vernacular blockchain position, nor does it constitute any investment opinions or suggestions. The copyright of the article and the final interpretation right belong to the vernacular blockchain. A

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Vitalik's latest thinking: what kind of subversive effect the second party payment will bring

- Nobel laureate Tirole: Humanity is facing a new round of currency war, this round of war is likely to include cryptocurrencies

- Weekly Bitcoin Positions Report | Many types of accounts show a bearish attitude and further callback danger signals appear?

- Featured | Five-Minute Quick Tour of the 10-year History of the Blockchain; Ethereum 2.0 Information Collection

- Trojan attacks, 5,000 computers reduced to mining "black labor"

- Big Brothers Call | Chain Node's 2nd Anniversary Special Show Talks Tonight

- Babbitt weekly election 丨 Beijing takes the lead in piloting the "fintech supervision sandbox"; Europe and the United States appear to have divergent views on central bank digital currencies