Babbitt column | Inclusive finance and blockchain entrepreneurship opportunities in underdeveloped countries

According to incomplete statistics, at least 2 billion people in the world cannot or have restricted access to formal financial services.

Written in front

Financial Inclusion refers to providing many non-bank users with more choices and affordable financial services. “Digital financial technology”, including blockchains, and many solutions based on blockchain technology, let us see the possibility of using some decentralized financial services. Obama once said a word in my speech, "Economy works best when it works for all of us." In an economy, if economic and financial services can be affordable for everyone, then The whole system will work perfectly.

In this article, I would like to discuss whether the blockchain technology has found the pain points of the industry in developing countries, or in poor countries and regions, or in some areas where there are no banks. And some existing solutions.

- Bitcoin callback to $6,000? Analysts say "very likely"

- Don't have a face, is there a letter from Facebook's cryptocurrency?

- QKL123 market analysis | The key moment is coming, bitcoin $ 9,000 bottoming? (0717)

1. Changes brought about by the big environment – entrepreneurial opportunities brought by blockchain

Distributed ledger systems that support cryptocurrencies currently affect the underlying structure of many financial services, such as value transfer, financing, asset recognition, reduced settlement time, real-time tracking transactions, distributed databases, information protection, smart contracts, lightning networks, etc. wait wait wait. This diversified application clearly demonstrates the existence of entrepreneurial opportunities. In 2013-2015 alone, more than $1.4 billion in investments were injected into the industry, and more than 2,500 patents related to distributed ledgers were patented. Paradoxically, Bitcoin, the world's largest blockchain technology, has many questions about scalability, network timeliness, flexibility, resource unsustainability, and lack of acceptance.

While there are many other cryptographic common senses that redesign blockchains in a number of ways to improve some of these flaws (such as different consensus algorithms or increase the processing power per second of transactions), on the other hand, many blockchain projects are At the expense of transparency and centralization, despite all these redesigns, the blockchain-based protocol proposal is still far from the mainstream payment system, which can handle thousands of transactions and liquidation in seconds. Interested in reading my previous article "Bitcoin Clearing System".

However, entrepreneurial opportunities do not exist only in cryptocurrencies and related business models. When it comes to financial services, then credit, insurance or savings are essentially different payment services. In my opinion, blockchain entrepreneurial opportunities derived from this technical operation of Tokens can give customers the opportunity to access other alternative financial services. The current financial system may not be able to meet this demand. To put it simply, the formation of a generalized economy, in a sense, reduces the cost of using people to access finance and to access finance. But the problem now is that credit costs are much higher than the cost of use. Unlike legal currency, the legal endorsement of legal currency such as RMB is the central bank of China, and the credit value of cryptocurrency originates from the community, from the goodwill node, from the open source algorithm and many other factors, and condenses into a bowl. Half-baked porridge. But if there is a problem with one of the rice grains (such as the team running; the community becomes a pyramid scheme; the algorithm is attacked) will have a huge impact on this bowl of porridge. Because of the credit value principle of cryptocurrencies and their communities, the blockchain actually encourages a new type of inclusive entrepreneurship for the people at the bottom of the pyramid, creating social, economic, welfare, etc. for members who are separated from society. Related opportunities. According to incomplete estimates, financial inclusive represents a $380 billion business [1]. In addition, social networks and big data companies have found opportunities in communities that do not have financial services. For example, recent Facebook published Libra's white paper, and Libra's slogan shows the characteristics of inclusive finance.

Perhaps the blockchain and inclusive financial entrepreneurship opportunities exist in the perspective of financial practitioners often dismissive – informal. The distributed architecture of the blockchain is equivalent to the fact that most people choose to use informal (or unofficial) financial systems. In China, this is called the private industry. So from this perspective, this scalability and efficiency are secondary. The main reason is that the industry has filled the gap that is currently being ignored by the formal financial system.

However, in terms of technology adoption, network effects, and most importantly, we all need to pay attention. Therefore, the perception of using blockchains for inclusive finance is diverse.

To help resolve this conflict, the second part of the paper describes five very sensitive blockchain entrepreneurial opportunities, namely pain points, in less developed countries. Such as cash management, loans, remittances, and identification, and illustrate some of the sensitive relationships that blockchain-based startups need to be aware of when considering the application of inclusive finance. What I want to show is that if the blockchain entrepreneurs can understand the unofficial or informal financial system and understand the hidden rules that appear in certain countries and regions, then the entrepreneurs from the bottom of the pyramid, your ambitions The ambitious goal is achievable.

2. Blockchain and digital currency – unofficial practice

Although the decentralized architecture of the blockchain is intended to allow dispersed users and participants to join the entire bookkeeping, not only in China, but many financial practitioners continue to advocate that blockchain technology should be present in a nation-state. Some are implemented within the framework of the financial system. This top-down financial architecture does not recognize the bottom-up needs of people. Many sensitive factors such as war, religion, and marginal politics will greatly affect the local financial environment. Those who do not have a deposit at all or who have a financial record have many restrictions on formal financial services. Next, I conclude that blockchain entrepreneurs should probably incorporate these pain points into their inclusive financial solutions, as well as existing solutions.

2.1 Preference for the use of cash in less developed countries

Cash transfer behavior is commonplace in less developed countries, especially in paying wages and small payments (such as grocery shopping). People in these countries have a cash trading habit. This is the same as China, where Alipay and WeChat are not popular. But unlike China, blockchain entrepreneurship in these countries faces major challenges. Because for those who do not have a bank account, a large part of the cost of education is required to skip the bank account directly from them and enter the digital currency payment phase. So, based on those individuals who have cash preferences and those who are financially excluded, what are their reasons and how to move from a cash-based trading system to a digital trading system?

2.1.1 Mobile Banking – Mobile Payment

In some less developed countries, this solution for mobile banking provides a bridge from cash to digital currency economy. For very simple reasons, users are gradually aware of the drawbacks of cash, and the benefits of mobile banking in terms of theft prevention, transaction speed and usability are far greater than cash. Material Ecosystems: Theorizing (Digital) Technologies in

Socioeconomic Development [2] This research paper is a good analysis of the application of mobile banking in the Republic of Uganda, and has proved successful in this way, where people will choose mobile banking as a way to hold and trade currencies. Interested in the recommendations to read more. In my opinion, blockchain technology can rely on the advantages of mobile device access. In some countries with limited financial infrastructure, it can be used as a secure and transparent network to save and transfer money, especially for those one-time payments. Salary and so on. Of course, blockchain entrepreneurs also need to recognize that when financial infrastructure is available, it can combine official and unofficial, which is a core consideration in the design of inclusive financial solutions. However, based on the different policies of various countries, in the developing country of China, mobile payment has become a unicorn and monopolistic behavior in the combination of “official and unofficial”, making it difficult for entrepreneurs in the blockchain to move. The emphasis of the practical application of "landing" is that without the combination of official and unofficial, the "landing" has become a one-time commitment, and the promises have become a second-time run. China’s blockchain entrepreneurs are reluctant to set up overseas companies and endorse overseas laws under this policy of not allowing and doing it, so that they can continue to draw their own promises in China’s “entertainment circle”. The Ark of the Ark, carrying its own dreams, team, and technology, marched forward in a vast ocean, holding the luck, and hoped not to overturn the ship. The domestic ship is steadily moving forward and can't wait for the policy. It is still wandering; the overseas ships continue to swim in the gray area, and PlusToken may have loaded too much cargo and returned home with full load, realizing a real “landing”. As for the people in the Ark, they seem to have forgotten their motto – the French Open is restored, not leaking.

2.2 Loan behavior in less developed countries

In all cases, a core habit of lending (whether to a financial institution or an individual) as a low-income group persists. In less developed regions, the sensitive point of borrowing (to banks) from relatives, friends and private individuals is worthy of attention by blockchain entrepreneurs. This suggests that this demographic structure tends to be coordinated by friends and relatives relative to borrowing from financial institutions. Although such informal borrowing behaviors tend to be untrustworthy or squandering, it often creates many pain points.

In a specific context, when an individual is used by local usury, and when he cannot choose a regular bank, the blockchain can reduce the intermediate transfer cost. Existing solutions, such as WeTrust ( www.wetrust.io )'s Trusted Lending Circles and Outlier Ventures' Money Circles project, etc., use blockchain technology to create a platform for a trusted social lending circle. Official financial services institutions become more inclusive, less costly and more reliable. These blockchain entrepreneurs have discovered the pain points and designed financial credit services with the potential to improve the existing loan structure, with security and effectiveness.

2.3 Transfer and remittance

As in the three models mentioned in my previous article, "Open Finance – Exploring Bitcoin's Clearing System and Payment Process," the blockchain has a unique advantage in technology at the clearing level. Recently, the use of mobile devices has eased the transfer of actual funds and reduced transaction costs. In the past five years, mobile broadband subscribers have grown by more than 20% annually, and global mobile broadband subscribers are expected to reach 4.3 billion by the end of 2017. Despite the high growth rates of developing countries and LDCs, the number of mobile broadband users per 100 inhabitants in developed countries is twice that of developing countries and four times that of LDCs. In the least developed countries, the use of fixed broadband is still very limited, with only one fixed broadband subscriber per 100 inhabitants. In most developing countries, mobile broadband is cheaper than fixed broadband services. However, in most LDCs, mobile broadband prices account for more than 5% of per capita GNI, so most populations cannot afford it. (Data from ICT [4]).

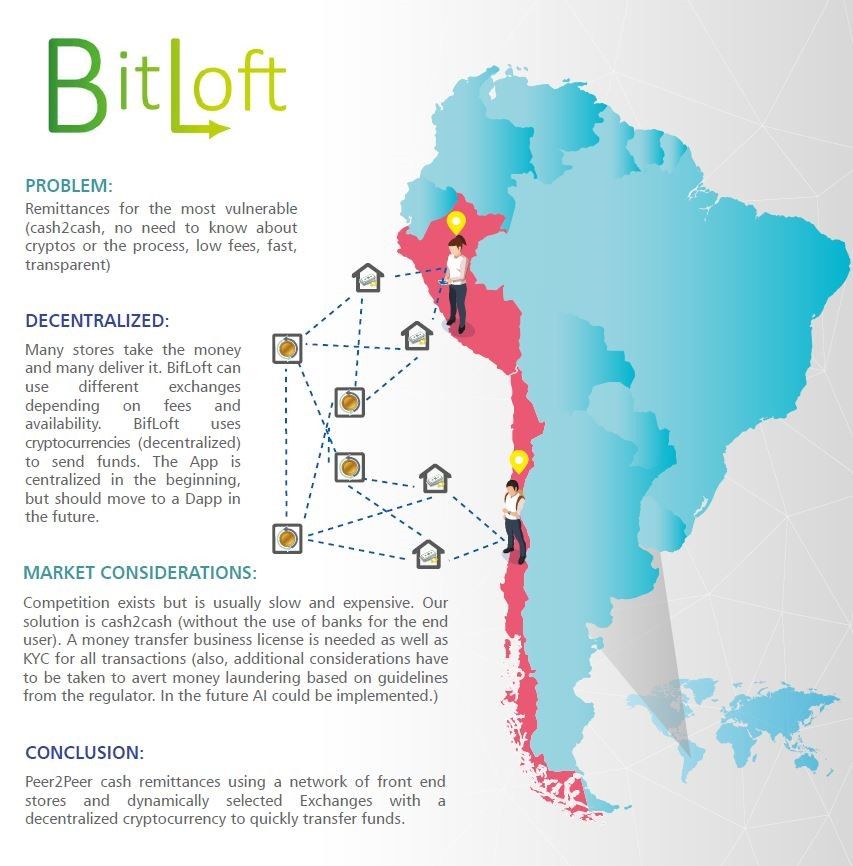

Still, in my opinion, mobile banking continues to show huge room for growth. Similarly, the blockchain entrepreneurial opportunity lies in the solution, does not require a bank account, but mimics its functionality. The concept of e-wallet can not only meet the purpose of remittance, but also related services such as purchasing goods. There are many existing solutions, such as Coins (coins.ph). Including my own postgraduate project design, our team proposed the concept of BitLoft (BitLoft.world) for cross-border remittance solutions. (Interested can look at the tubing introduction video https://youtu.be/sRtijutGHM4 ) Although it is only an assignment, our group has seriously improved the whole system.

With regard to remittances, due to the number of intermediaries and regulations involving international transactions, it may take several days to settle, and frequent small remittances are not even allowed. In this case, as long as the regulatory requirements are still not applicable, dealing with digital currencies becomes very attractive. If so, blockchain technology can be a cost-effective and efficient solution for remittances, and existing projects such as Everex (Everex.one).

2.4 Unofficial verification

The World Bank has counted at least 2.4 billion people in 2015 without legal status [5]. At the end of 2017, at least 110 million people could not provide their ID cards at all. The lack of identity authentication is also a pain point in less developed countries. These unidentified people cannot formally obtain institutional financial services, especially in terms of credit.

Corresponding existing solutions such as the concept of global point-to-point lending with bitcoin. For example, a company like BTCJam. BTCjam was ventured into Ribbit Capital in Silicon Valley in 2013, but unfortunately announced the suspension of the entire project in 2017. However, in 2016, the company provided services for more than 16,000 loans in 121 countries, many of which came from people without bank accounts and were described as “the largest bitcoin-driven microfinance to date/ Microfinance website [7].

Another decentralized solution, such as the concept of timestamps, is available, for example, OriginStamp (app.originstamp.org). OriginStamp is a trusted digital content timestamp service. You can use its services to prove that you have data or files, such as PDFs, images, images, etc., at anonymized and free of charge. [8] For underdeveloped regions, where a bank needs collateral, only one smart phone is needed to verify assets such as livestock and provide electronic copy of these collateral. For Babbitt, preventing columnist articles from being reprinted without permission to fetch traffic is not a solution. Unofficial verification, as a supplement, can also provide trusted identity using technologies such as ChainAnchor. About ChainAnchor, an initiative of the Massachusetts Institute of Technology (MIT), ChainAnchor is also a solution to better comply with anti-money laundering (AML) and KYC regulations.

2.5 Financial and institutional restrictions

In general, the current goal of inclusive finance is to extend the boundaries of formal financial services to more individuals without bank accounts. In less developed countries, the reason for not having a bank account, “poor”, is considered to be the most common cause.

Officially, the lack of funds makes it impossible for individuals without bank deposits to seek formal financial services. For the electronic payment, the cost of establishing a financial infrastructure such as ATM in an underdeveloped area is very high.

Successful cases within the existing financial framework have to mention M-PESA from Kenya. The biggest advantage of M-PESA is that the parent company Safaricom is a telecommunications company, so the grocery stores that can pay for telecommunications in the village are almost all Safaricom agents. These grocery stores are like ATMs in the M-PESA system, but in Kenya. More than 40,000 such grocery stores. According to the World Bank's statistics in 2018, 73% of Kenyans use mobile payments, saying that M-PESA has made Kenya the world leader in mobile payments [9].

Another one worth mentioning is GCash from the Philippines. It is also the investment of Ant Financial in February 2017. GCash can now carry out “two yards in one” with Alipay, and a QR code supports Alipay and GCash payment at the same time.

In Mexico, certain retail stores have been allowed to provide financial services, including the creation of a simplified e-banking account for a bank branch, which has largely reduced the cost of inclusive finance.

However, in China, leading companies such as WeChat and Alipay monopolize the financial industry. In my opinion, in China, the strict control of financial licenses and payment licenses is a necessary protection for the Chinese economy. Imagine that if China and the Soviet Union Gorbachev proposed the "new economic policy," the decentralization and privatization of state-owned assets allowed foreign investment, then the consequences of the Chinese economy could not be imagined. Therefore, it can be concluded that in the 70 years since the founding of the People's Republic of China, the ruling party has the ability to cope with domestic and world economic changes. For entrepreneurs, in China, the demand for financial pain is far less than owed. Developed regions and countries. In Sun’s series of articles “Cryptographic Currency and Hierarchical Crossing”, a concept was thrown, “Cryptographic currency is not a perfect class crossing scheme”, “but the problem is that if you don’t choose cryptocurrency, this generation What are the options? Do they still have to spend a few more years to find a new turning point in fate?". Perhaps the skyrocketing cryptocurrency in China's current system is an option for a rich overnight. The concepts of “value investment” and “lying money to make money” really attract young people who are squeezed by the economy and society. If you increase your salary by 3 times, do you still feel poor? Believe me, the money and rights of the world are not enough for human greed. Any money you don't know how to make it will go back. When the People’s Bank of China announced the development of its own cryptocurrency,

When a company like Facebook joins the cryptocurrency industry, do you still need private companies to continuously send ICOs, IEOs, or speculative coins? Assuming that cotton has risen 10,000 times, it is estimated that it is not a variety of blockchain+ projects, but cotton+.

to sum up

In order to effectively solve the inclusive financial problem, the existing financial system faces important limitations in underdeveloped regions and countries. Policies such as the Kenyan government have successfully allowed other industries such as telecommunications and retail to provide financial services directly. These examples show that when the emergence of the existing financial system is “rigid”, more entrepreneurial opportunities can be created. Recognizing that these rigidities are an opportunity, it will provide opportunities for many blockchain entrepreneurial models.

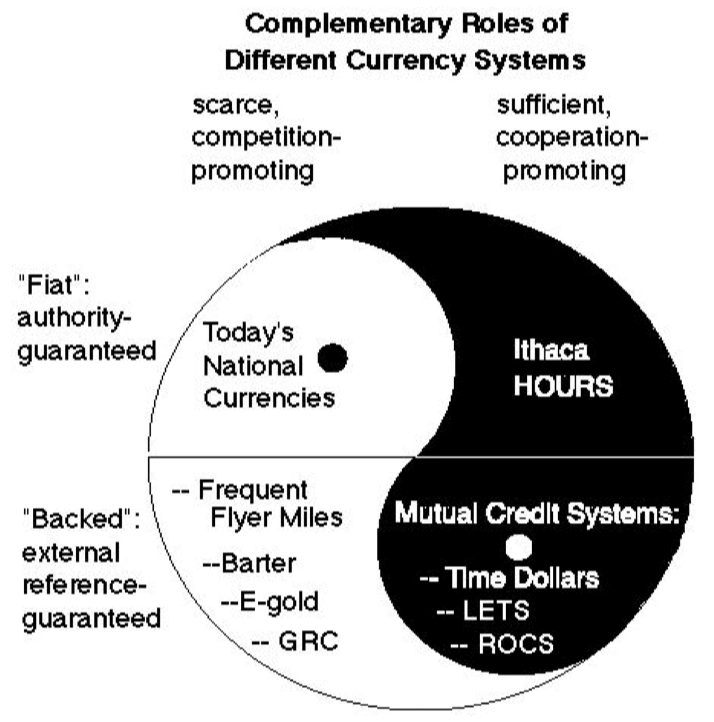

In the first lesson of my graduate student, "Money and Banking," the same picture is very interesting:

The professor abstract uses a Taiji diagram to represent the classification of money. Here is a question for the reader: What bitcoin is in that area? If you want to know more about the content of this lesson, please leave a comment below, I am trying to take the time to do some interesting content to share with everyone.

Reference

[1]https://insights.careinternational.org.uk/publications/within-reach-how-banks-in-emerging-economies-can-grow-profitably-by-being-more-inclusive

[2] https://www.itidjournal.org/index.php/itid/article/view/1472

[3] https://link.springer.com/chapter/10.1007%2F978-3-319-42448-4_10

[4] https://www.itu.int/en/ITU-D/Statistics/Documents/facts/ICTFactsFigures2017.pdf

[5] http://pubdocs.worldbank.org/en/553511442506682828/1603399-TransportICT-Newsletter-Note-19.pdf

[6] https://www.worldbank.org/en/news/press-release/2017/10/12/11-billion-invisible-people-without-id-are-priority-for-new-high-level -advisory-council-on-identification-for-development

[7] https://en.wikipedia.org/wiki/BTCJam

[8] https://originstamp.org/home

[9]http://www.mpaypass.com.cn/news/201811/01200952.htm

The text was first published by the Barbit columnist Rickkk. It is strictly forbidden to reprint without written permission.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What is the anxiety of the US Congress in a hearing that triggered a market earthquake? Will Libra be banned in the end?

- Will Grin and Beam be forked, and will the privacy currency be fired again?

- Getting started with blockchain | What is ASIC mining?

- After the Libra hearing, the BTC fell sharply. Is this bull market ending?

- Dissatisfied Libra hearing, lying on the coin circle

- Interpretation | Banking Regulatory Commission: Encourage the use of new technologies such as blockchains to regulate supply chain finance

- US blockchain gold rush? 90% annual salary is higher than 80,000 US dollars