Will Libra with multiple currencies/assets be more “stable”? – Libra operating mechanism conjecture

More than a month has passed since the release of the Libra white paper, and discussions from all over the world have not cooled down, and even become more intense. This time it was not only market participants and IT technicians, but even the regulatory authorities of all countries joined the discussion, which was extremely rare in the history of digital currency distribution. However, it seems that more discussion focuses on its impact on the existing monetary system. There is little discussion of Libra's stability mechanism. This report will focus on this topic and give a glimpse of the advantages and risks of Libra's design.

Libra's structure of low-volatility asset collateral denominated in French currency and multiple currencies is very similar to the International Monetary Fund's (IMF) SDR and traditional money market funds (MMF).

- The fissure of the world economy – the civil war, the foreign war and the full battle of money

- Research | Model currency principle analysis and prevention guide

- Economic Daily | Libra, is the super currency coming? Zhou Xiaochuan said this

According to the changes in the composition of the IMF's currency, the “super-sovereign” currency needs to have excellent international influence and high free use. In addition, excellent sovereign credit, moderate inflation rate and low volatility It is also an indispensable condition.

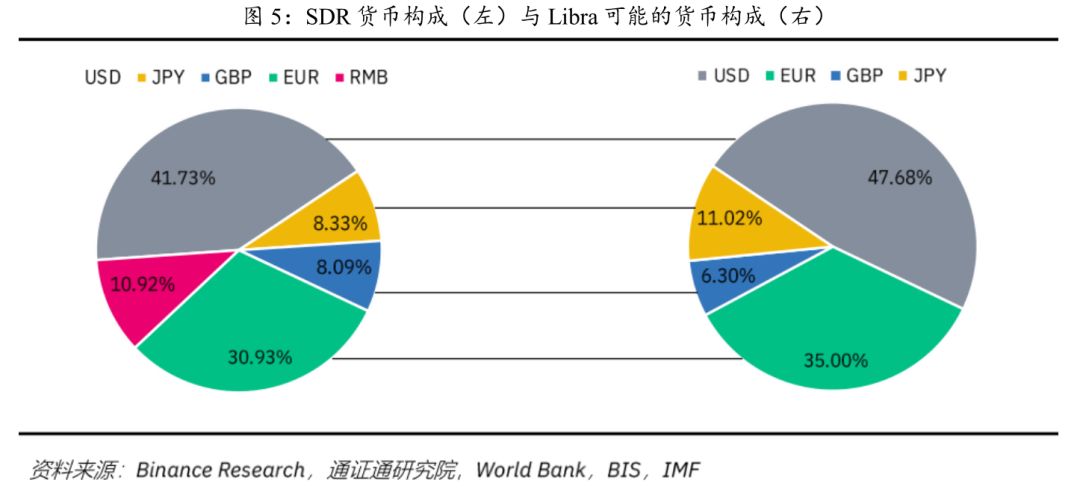

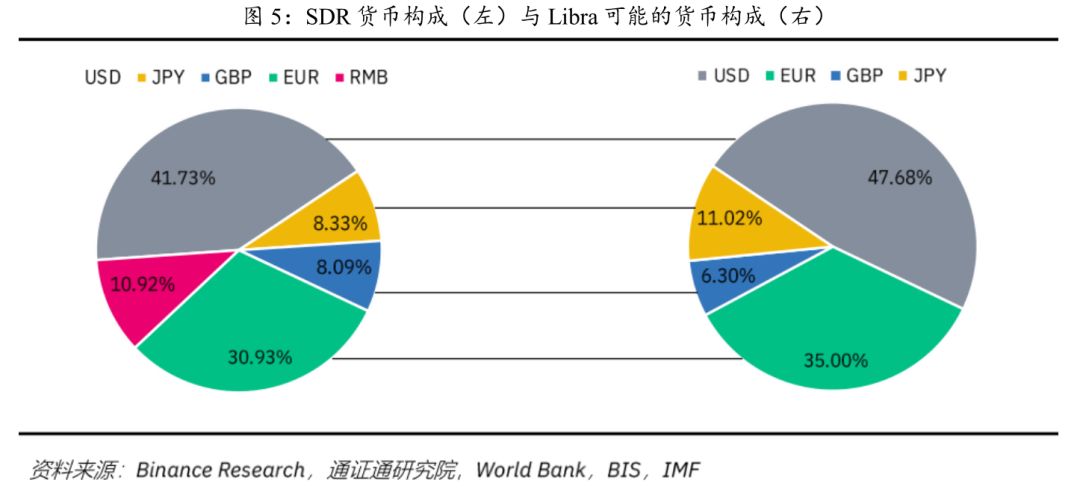

Based on the 2015 SDR valuation calculation method, we have weighted the annual inflation rate measured by GDP deflator in several countries, and obtained a long-term inflation rate, and the inflation rate is also higher. Low combination. This currency combination showing a similar SDR has a more stable purchasing power than a single country. Based on this, we speculate that if Libra's basket of currencies consists of US dollars, euros, Japanese yen and British pounds, their weights may be 47.68%, 35.00%, 11.02%, 6.30%, respectively.

Libra's goal is to provide convenient, low-cost, and reliable global financial services that need to be effectively linked to high-liquidity, low-volatility assets in the real world . The current asset composition of mainstream money funds can provide useful lessons.

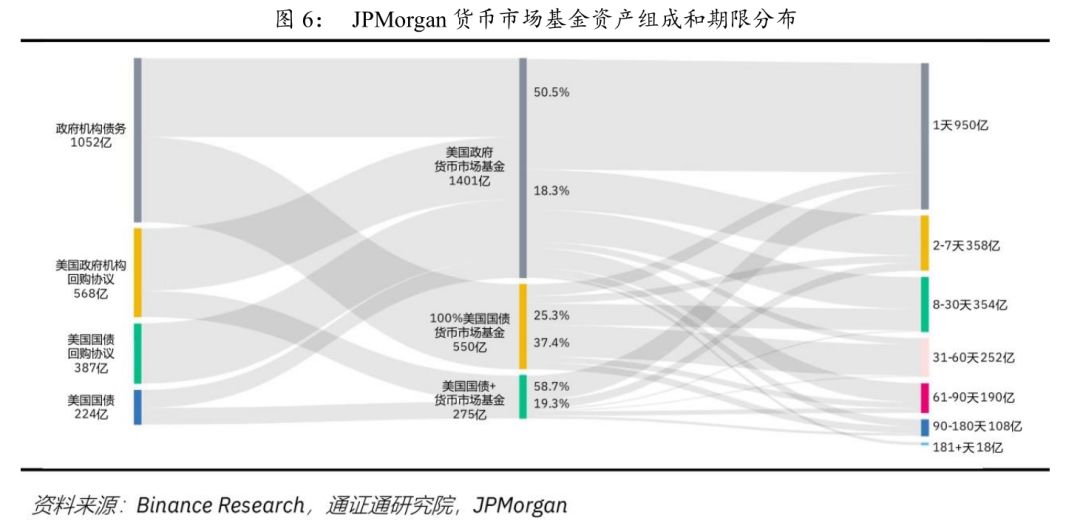

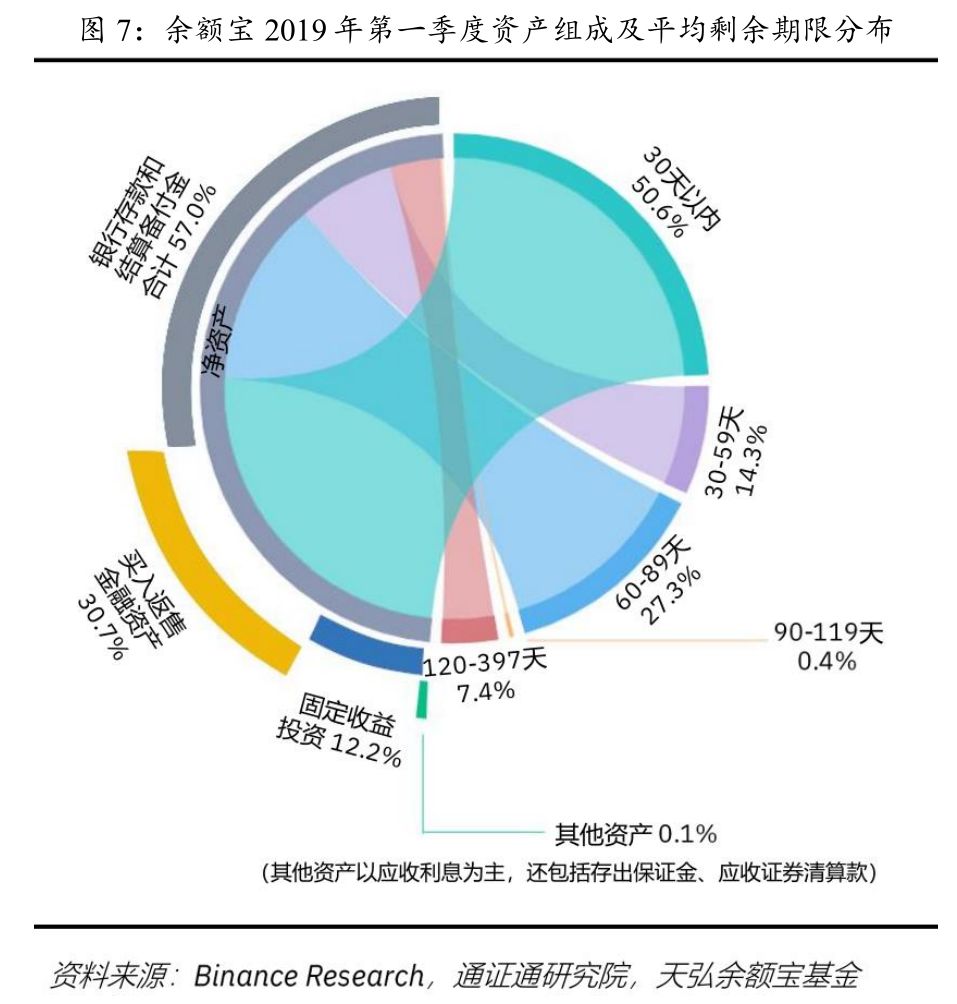

Among the three Monetary Funds with the largest net assets of JPMorgan, two assets with a maturity of one day accounted for more than 50% of the net assets, and the three funds accounted for more than 70% of the assets within two months. The long-term structure of the world's largest monetary fund, “Tianhong Yubao” is similar: in the end-of-term portfolio of the first quarter of 2019, the average remaining period of assets within 30 days accounted for 50.57%, and for the 120 days or more, only 7.40%. The liquidity and safety of fund assets are high. The biggest difference is that Yu'ebao holds a large amount of bank deposits for real-time reimbursement, while JPM's funds are all securities.

Libra is also significantly different from ordinary money funds. For example, the reserve assets are relatively complex, but they are also more flexible because they do not need to provide users with revenue.

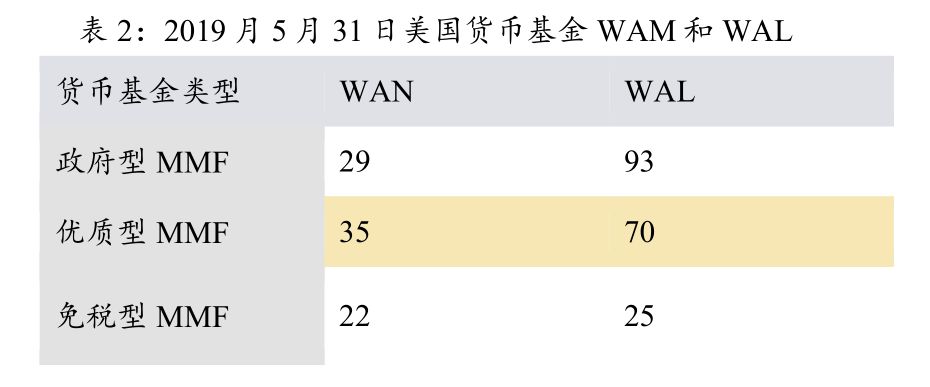

In addition, how Libra guarantees the security of reserve assets while providing T+0 customer service is also worthy of special attention. Referring to the relevant regulatory bills, Libra will introduce various financial products as its own asset reserves, or will introduce regulatory indicators such as WAM, WAL and other monetary funds to screen various financial assets. Moreover, some monetary fund reform proposals, such as floating net asset value, liquidity fees and redemption thresholds, capital buffers and minimum risk balances , may also be adopted by Libra.

1 How Libra implements the official introduction of “stability”

2 “Super Sovereignty” currency grows into

2.1 The Origin of SDR: Antidote to Triffin's Dilemma

2.2 SDR: from simple to simple, five years and one more

2.3 Four currencies or leading Libra currency baskets

3 Libra's conjecture as a multinational money market fund (MMF)

3.1 Libra: Unrecognized Monetary Fund

3.2 Low risk, high liquidity is the commonality of mainstream financial and monetary fund assets

3.3 Differences between Libra and traditional money funds

3.4 Lessons from the Money Fund to Libra

Libra's goal is to be a stable digital pass that combines the best currency features of stability, low inflation, global acceptance and interchangeability. Libra will use the Libra Reserve as a collateral, and its criteria for selecting reserve assets are consistent with Libra's own goals, which minimize volatility. There are not many descriptions of the stability mechanism and reserve assets in the white paper , mainly the following paragraphs:

Libra uses bank deposits denominated in stable currency and short-term government securities as reserve assets. For reasons of hedging and stability, Libra will not use assets with relatively high volatility such as gold as reserves, but instead adopt a series of low-volatility assets, including bank deposits denominated in a stable and reputable central bank-issued currency and short-term. Government securities.

"Instead of backing Libra with gold, though, it will be back by by a collection of low-volatility assets, such as bank deposits and short-term government securities in currencies from stable and reputable central banks."

— Libra White Paper

Short-term government bonds: Low probability of default, and it is unlikely that high inflation will stabilize the government-issued bonds. The Libra white paper further defines short-term government securities, which are low probability of default and are unlikely to have high inflation and stable government-issued bonds.

"On the capitalpreservation point, the association will only invest in debt from stablegovernments with low default probability that are unlikely to experience highinflation."

— Libra White Paper

Diversification of reserve assets. Libra chose multiple governments, not just a government bank deposit and short-term government securities, to diversify reserve assets and reduce the risk of potentially high inflation or debt defaults.

"In addition, the reserve has been diversified by selecting multiple governments, rather than just one, to further reduce the potential impact of such events."

— Libra White Paper

From these descriptions we can see the structure of such low-volatility asset collaterals denominated in multiple currencies, much like the International Monetary Fund's (IMF) SDR and traditional money market funds. Next we look at the "stability" problem from these two traditional cases.

2.1 Origin of SDR: Antidote to Triffin's Dilemma

SDR is the product of the IMF's attempt to resolve the " Triffindilemma" . In 1944, the Bretton Woods system officially established the value ratio of the dollar to gold. Under this system, the US dollar, as an international currency, assumes the functions of international trade settlement and reserve. With the recovery of the international economy after the war, the supply of the dollar should continue to grow to meet international trade settlement and reserves, which means that the United States needs to maintain a trade deficit for a long time . However, as the international currency, the dollar needs to maintain the stability of the currency. The United States must be a trade surplus country , and the "Triffin dilemma" is born.

To solve this problem, the International Monetary Fund (IMF) has launched Special Drawing Right (SDR), a kind of share allocation based on IMF member countries, which can be used to repay IMF debt and make up for members. A book asset of the balance of payments deficit between countries.

SDR is a super-sovereign "currency" that replaces the dollar and gold. SDR maintained a ratio of 1SDR=0.888671 grams of gold for a long time between 1969 and 1974 (but could not be exchanged for gold). It was equivalent to the US$1 at that time and became another important reserve asset in addition to gold and US dollars. . As the dollar is officially decoupled from gold, the ratio of SDR to the dollar has gradually increased, and the valuation linked to gold has become meaningless because neither SDR nor the dollar can be converted into gold. Thus, in 1974, SDRs were generated based on 16 sovereign currencies. In 1981, the number of baskets of currencies was reduced to five in order to facilitate calculations and acceptance by mainstream finance. At present, SDR has basically become a “currency” widely used to balance international trade balances and provide international reserve channels for member countries.

In essence, SDR is also a “virtual currency”, but it does not run on the blockchain:

- SDR is a unit of account. It is not a “currency” issued and recognized by the government. The same is true of most digital currencies. The main purpose is to keep accounts and reward in their own ecosystems.

- SDR has a reserve function . IMF members accept SDR as their unit of account in the IMF's reserves, and some digital currencies also have reserve functions, such as Bitcoin and Ethereum.

- SDR has the function of a value scale. The exchange rate of SDR is calculated by weighting a basket of currencies. Digital currencies also have similar characteristics as more and more goods and services are quoted in digital currencies (especially those on the blockchain network).

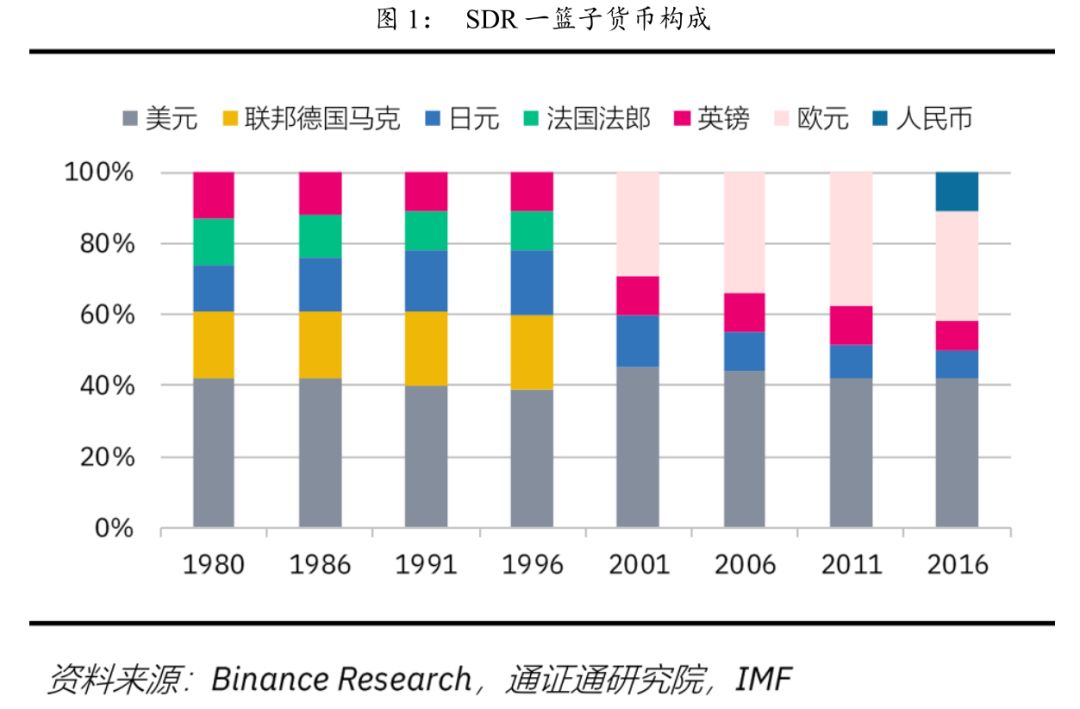

2.2 SDR: from simple to simple, five years and one more

To increase the attractiveness of SDR as a reserve asset, SDR valuation follows three basic principles :

- The relative weight of a basket of currencies should reflect its relative importance in the global trade and financial system;

- The composition of the SDR currency basket should remain stable and will only change after significant progress has been made in each review;

- The SDR valuation method should be continuous and the valuation method will only be revised if there is a significant change in the currency in the basket.

Since the 1980s, there have been three changes in the SDR valuation principles and methods . among them. Between 1974 and 1980, the number of SDR baskets of money was reduced from 16 to 5, and the unit SDR was valued as the sum of the five currencies based on exchange rates; in 2000, the SDR currency basket was introduced into the euro, and the board agreed to adopt a currency-based Valuation method; in 2015, the SDR valuation method became “export + financial variable (reserve + foreign exchange trading volume + international banking liabilities + international debt securities)” .

In the calculation formula of the currency weight of the SDR basket, the proportion of export weights gradually decreases, and the evaluation of financial variables becomes an important part. In the two reviews of 1974 and 1978, sovereign currencies, which accounted for more than 1% of world exports, were included in a basket of currencies. From 1980 to 2010, SDR gradually paid more attention to the evaluation of the reserve situation. In a recent review, the SDR Board adopted a new weighting formula: 50% export + 50% financial variable . Among them, financial variables include: reserves, foreign exchange market trading volume, International Banking Liabilities (IBL), International Debt Securities (IDS), weight calculation using 33.3% reserve + 33.3% foreign exchange trading volume +33.3% (IBL+IDS).

The value of exports of goods and services is one of the criteria for selecting currencies in the SDR basket. The value of exports of goods and services reflects the relative importance of a country in global trade. A large enough export value of goods and services ensures that the country has sufficient capacity to provide reserve assets while limiting the amount of money in the basket. According to the decision of 2000, if one currency is to be substituted for another currency in the basket, one of the necessary conditions is that the export value of a member or currency union whose currency is not included in the SDR currency basket exceeds a certain period during the relevant period. Its currency is included in the basket's members or currency union and exceeds at least 1%.

Freely available, it is another standard for SDR basket selection currency. The standard was added to the second criterion for currency selection in 2000 to take into account various indicators of the breadth and depth of financial markets and to ensure that the SDR currency basket is the most representative of the currency in the world trade and financial system. The currency of the usage.

“ Freely usable currency” in Article 30(f) of the IMF Agreement means “to be determined by the IMF: in fact widely used in the payment of international transactions; currency that is widely traded in all major foreign exchange markets ". A currency must have both "wide use" and "wide trade" elements in order to be determined to be freely usable. The purpose of the widely used elements is to ensure that the relevant currency can be used directly to meet the balance of payments needs of a member of the IMF. The assessment includes the share of money in official reserves, international bank liabilities and international debt securities; It is to ensure that the currency can be used indirectly, that is, it can be exchanged into another currency in the market to meet the balance of payments needs of a member, and will not have a big impact on the international exchange rate. Freely usable currencies must be traded in more than one major foreign exchange market. The assessment includes the volume of transactions in the foreign exchange market (ie total trading volume), official foreign currency assets, international debt securities issuance, and share of cross-border payments and trade finance.

The SDR interest rate is the basis for calculating the interest charged by the IMF's regular (non-concessional) loans to the borrowing member countries and the interest paid to the funding member states. Interest paid on SDR holdings of member countries and interest charged on their SDR allocations are also calculated at this rate. The SDR rate is determined weekly based on the representative interest rate of the short-term debt instruments of the money market in a basket of currencies (three-month US short-term government bond market yields; the euro zone central government announced by the European Central Bank for three months with a rating of AA and above) Bond coupon rate; three-month Japanese treasury discounted bill; three-month UK short-term government bond market yield; three-month Chinese government bond benchmark yield).

Decision No. 12281-(00/98) G/S, adopted on October 11, 2000, the SDR currency basket is reviewed every five years to ensure that the SDR reflects the currency in the world trade and financial system. Relative importance. The review covers the SDR valuation methodology, the criteria and indicators for selecting a basket of SDR currencies, and the initial currency weight for each currency (units) in the SDR basket.

2.3 Four currencies or leading Libra currency baskets

According to information published in the Libra white paper, Libra or a valuation method based on a basket of currencies similar to SDR has the attributes of a “super-sovereign” currency .

According to the information already disclosed, Libra will initially be supported by a basket of four currency-denominated assets: the US dollar, the British pound, the euro and the Japanese yen , which were first included in the Libra reserve. Broadly speaking , we mentioned in the previous report that for any asset (whether or not it is a legal currency), in order to be included in the reserve in the long run, three key criteria should be met:

There is no correlation between them : for example, for legal currency assets, only free-funded legal currency is eligible, and Libra reserves do not need to be bound or soft-linked to each other (such as the Hong Kong dollar and the US dollar).

The decision-making process must be linked to public organizations (ie, central banks) or freely available assets (eg, commodities).

Quotability: Assets must be widely recognized in all jurisdictions and have the value of programmatic quotes. For example, Apple's stock (AAPL) can only be traded with a single quote currency: US dollars. Therefore, the stock lacks additional quotations and cannot serve as a way to value other assets in various jurisdictions. Alternative assets, such as gold or bitcoin, can better serve as a tool because they are traded across multiple markets around the world and can therefore be included in a basket of assets to determine the Libra value of end users worldwide.

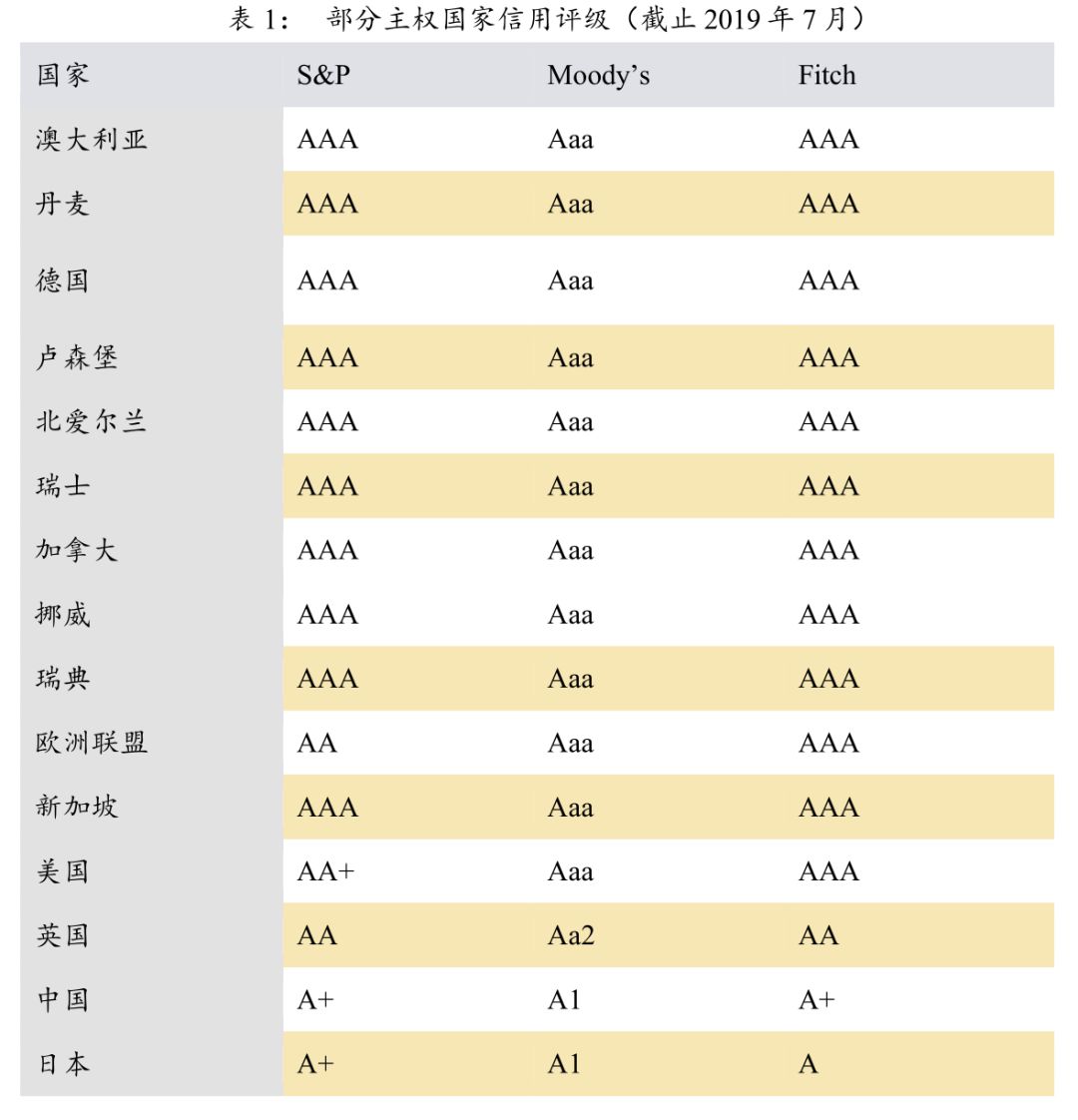

In a narrow sense, the short-term claims of government bonds or high-rating institutions should be the main force for the allocation of illicit currency assets. In the case of bond assets, good sovereign credit should be the benchmark requirement for Libra to choose a currency. The credit rating of a sovereign country from a three-party rating agency is a judgment of the central government's credit willingness and credit ability to perform debt service obligations as a debtor. The main indicators include a country's GDP growth trend, foreign trade, and international balance of payments. , foreign exchange reserves, total foreign debt and structure, fiscal revenue and expenditure, policy implementation and other factors affecting the ability of the country to repay debt. At present, the credit ratings of developed countries such as Europe and the United States are generally higher, and they have better solvency and willingness.

It can be seen that the US sovereign credit rating is not the highest, and the S&P gives it a rating of AA+ below its highest rating of AAA. There are 11 countries/regions with higher sovereign credit ratings .

It should be noted that the amount of currency in the currency basket is not as good as possible. Referring to the change process of the number of SDR currency baskets, it can be found that the excessive amount of money is unfavorable for the value estimation, convenient circulation and acceptance of “super-sovereign” currency. In addition, not all high credits. Rating countries have excellent international influence.

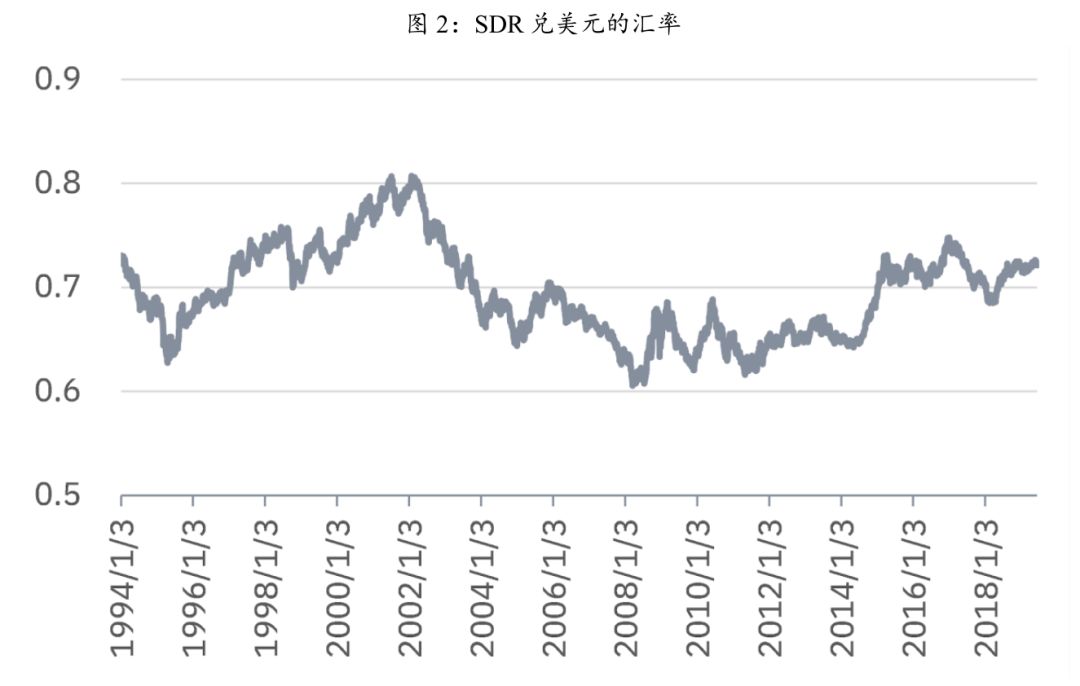

However, the purchasing power of multi-currency portfolios is more volatile than most single currencies. Although its inflation rate is not the lowest, considering that moderate inflation is conducive to debtors to alleviate a certain debt burden and stimulate enterprises to expand investment and promote economic growth, it cannot be easily asserted that moderate inflation is harmful.

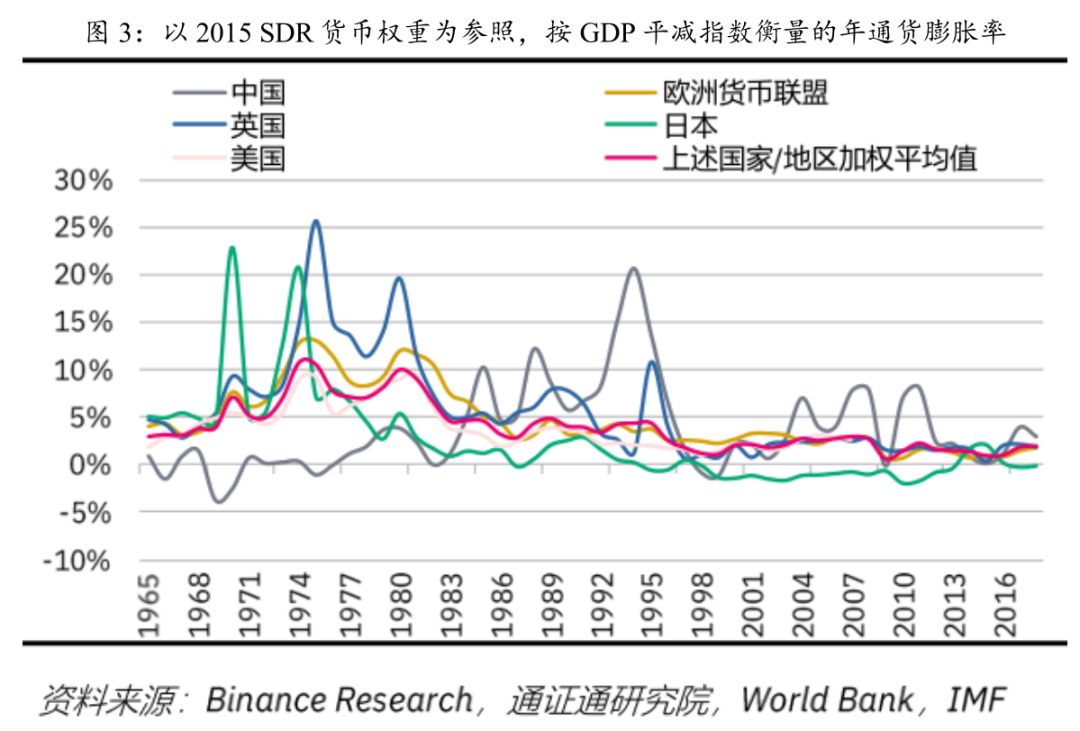

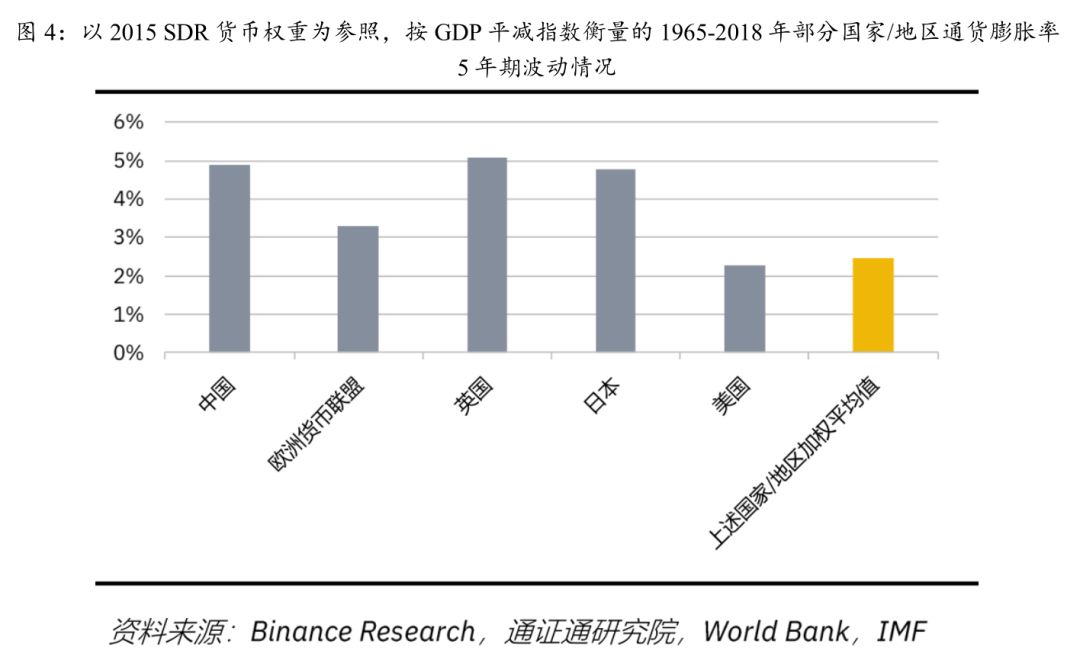

Here we use the annual inflation rate as measured by the GDP deflator as the reference coordinate for whether the purchasing power of money is stable. Since the GDP deflator is based on the price change of the subsequent items and labor totals in a fixed year, the inflation rate based on the obtained inflation rate can better reflect the real money purchasing power rise/fall.

According to World Bank data, between 1971 and 2017, the inflation rate of the major economies in a single year was as high as 25.8%, while the inflation rate of the multi-currency combination calculated by the 2015 SDR currency distribution weight was 10.6%.

In addition, in the long run, the fluctuations in the inflation rate of the major economies' currency portfolios are more stable than in most single economies, as shown in the chart below, by calculating the five-year inflation rate of the above countries during the period 1965-2018. The standard deviation shows the fluctuations. The inflation fluctuations in Japan, the UK and China are around 2.0, of which 2.5 is in Japan and the highest in the latest SDR currency portfolio; the European Monetary Union and US inflation are low, between 0.6 and 0.8. . The inflation volatility calculated using the 2015 SDR currency weight is 0.8, which is significantly lower than most countries. Considering that the national economy in the SDR basket is large and stable, if it has more purchasing power than other developing countries. obvious.

With reference to the experience of selecting currency standards in the SDR basket, the high probability of the US dollar, euro, pound and yen will be first selected in the Libra currency basket:

- The currency composition is maintained at 1-5. On the one hand, Libra's stability can be maintained. On the other hand, less currency is less difficult in terms of exchange rate calculation, high frequency update (or even real-time update), and it is easier for traditional financial institutions. accept;

- Sovereign countries that are selected for currency must have a high credit rating, strong economic strength, and the currency itself has market depth and extensive use.

The specific selection process, first, the sovereign countries that screen high credit ratings (such as comprehensive Trading Credits less than 75, not included in the ranks of candidates), and second, GDP as a measure (such as GDP accounted for more than 3 in the world total) %), third, delete overlapping data (for example, France, Germany and the European Union occur simultaneously, with reference to SDR in the EU), and fourth, to optimize the proportion of sovereign currencies in international foreign exchange reserves. Accordingly, the Libra basket of currencies may include the US dollar, the euro, the pound and the yen.

According to the SDR valuation method review (2015) report currency weight calculation formula (50% GDP + 50% financial variable), speculate that Libra currency weights are:

USD 47.68%, Euro 35.00%, JPY 11.02%, GBP 6.30%

(Note: Libra data source: GDP is World Bank data for 2018; official foreign exchange reserve currency is composed of IMF 2018 data for the fourth quarter; foreign exchange trading volume survey is conducted once every three years, this time using 2016 data; IDS data is used for 2018 In the fourth quarter; as of October 2015, the Bank of International Settlements will no longer publish International Banking Liabilities Tables 5A and 5D, so this time IBL uses the second quarter of 2015 data).

The structure of this speculative combination was confirmed to some extent by project leader David Marcus at the Libra House hearing on July 17, US time. Missouri Rep. Ann Wagner asked Facebook how to launch a global currency without damaging the dollar or undermining global economic stability. Marcus replied that more than half of Libra’s initial reserves were in US dollars, so against the US dollar. The impact is small .

3.1 Libra: Unrecognized Monetary Fund

Libra endorses the reputation of the world's top institutions, using stable assets from multiple countries as a reserve, with the goal of creating a borderless currency and a financial infrastructure that serves billions of people. Libra's attempts to solve problems include higher cost of global financial services, greater volatility in encryption and non-compliance.

Libra wants to provide convenient, low-cost, and reliable global financial services, including instant payment, fast redemption, and exchange of multiple currency .

Libra's value stability and fast redemption requirements are reflected on the asset side as assets should maintain high liquidity and security. In terms of asset composition, Libra needs to control financial risks. If the portfolio is not liquid or safe, high-intensity redemption will lead to the collapse of the entire ecosystem .

This demand determines that Libra must be effectively linked to assets with high liquidity and low volatility in the real world , such as bank deposits or short-term government securities. Libra's white paper also clearly stated that it will use a basket of bank deposits and short-term government securities and other low-volatility assets as collateral.

Financial products that satisfy assets with high liquidity and low risk are easy to find benchmarks in current mainstream financial markets, namely Money Market Funds (MMF) . Money market funds, also known as money funds, refer to investment in only liquid currency instruments with good liquidity (such as cash, bank deposits with a maturity of 1 year or less, bond repurchases, central bank bills, interbank deposit certificates, etc.). A mutual fund that can be purchased or redeemed at any time, and its asset composition is usually based on cash or a short-term ticket with a high credit rating (generally less than one year).

In addition to the fact that Libra users will not receive returns from reserve assets in the early days, Libra's functions are very similar to those of money funds: investing in low-risk assets, fast redemption, and some money funds can be used for immediate payments . This means that the asset composition of the IMF can provide some useful references for Libra.

3.2 Low risk, high liquidity is the commonality of mainstream financial and monetary fund assets

The United States is the first country in the world to issue money funds, and is currently the largest country in the money fund market. It has many mature money fund management companies, such as BlackRock, JPMorgan, and Fidelity. The investment targets of the US Monetary Fund are mostly US government agencies or Treasury repurchase agreements, US government agencies or Treasury debts, commercial papers, deposit slips, municipal bonds, etc. According to the statistics of the American Investment Corporations Association on May 31, 2019. The most invested assets of the US Monetary Fund were various repurchase agreements, accounting for 35.3%; US Treasury bonds ranked second, accounting for 21.6%, and US government agency bonds ranked third, accounting for 21.6% .

As one of the largest financial services institutions in the United States, JPMorgan has established a number of different types of money funds. We selected the three funds with the largest net assets of the fund and analyzed their asset composition.

The main assets of these three money funds are US government agency repurchase agreements or government bond repurchase agreements, US government agency debts or government bonds, which are all assets with higher security. The maturity of the assets of the US government money market fund, US Treasury bond and money market fund accounted for 50.5% and 58.7% of the net assets in one day respectively , indicating that the liquidity of its assets is very high. The assets of the three funds with a maturity of two months account for more than 70% of the net assets . It can be seen that the liquidity requirements of the money funds are very high.

Domestic mainstream financial and monetary funds also have similar characteristics. At present, China is already the second largest country in the world's money fund market. The well-known “Yuebao”, the Tianhong Yubao Fund , has a scale of 1,035.12 billion yuan and is currently the largest money market fund in the world .

Analysis of the asset composition of Tianhong Yubao Fund can also find similar characteristics: low-risk short-term assets such as bank deposits and other settlement provisions, supplemented by other assets, and do not accept assets with high volatility such as stocks. . In the end of the first quarter of 2019, the balance of assets in the first quarter of 2019 accounted for 50.57% of the assets with an average remaining period of 30 days, and only 7.40% of the assets of 120 days or more. The liquidity and safety of the fund assets were relatively high.

Compared with ordinary money funds, Yu'ebao has a special function of real-time settlement. Therefore, Yu'ebao holds a large amount of bank deposits and settlement provisions, which account for 57% of the total. This kind of assets is in JPMorgan's money fund. Can't see it.

The purchase of resale financial assets is a financing agreement between Yu'ebao Fund and financial institutions. The purchase resale financial assets do not include the buy-back resale financial assets of the buy-back repo, which guarantees the stability of the assets to a certain extent.

Fixed-income investments are mainly bonds of various types, mainly consisting of interbank deposit receipts and financial bonds, as well as some national bonds, corporate bonds, corporate short-term financing bills and very few medium-term notes.

Based on the analysis of JP Morgan's money funds and domestic money funds, the commonality of mainstream financial money market funds is that assets are highly liquid, generally investing in low-risk assets such as bank deposits or short-term government securities. This coincides with the composition of assets disclosed in the Libra white paper.

3.2 Differences between Libra and traditional money funds

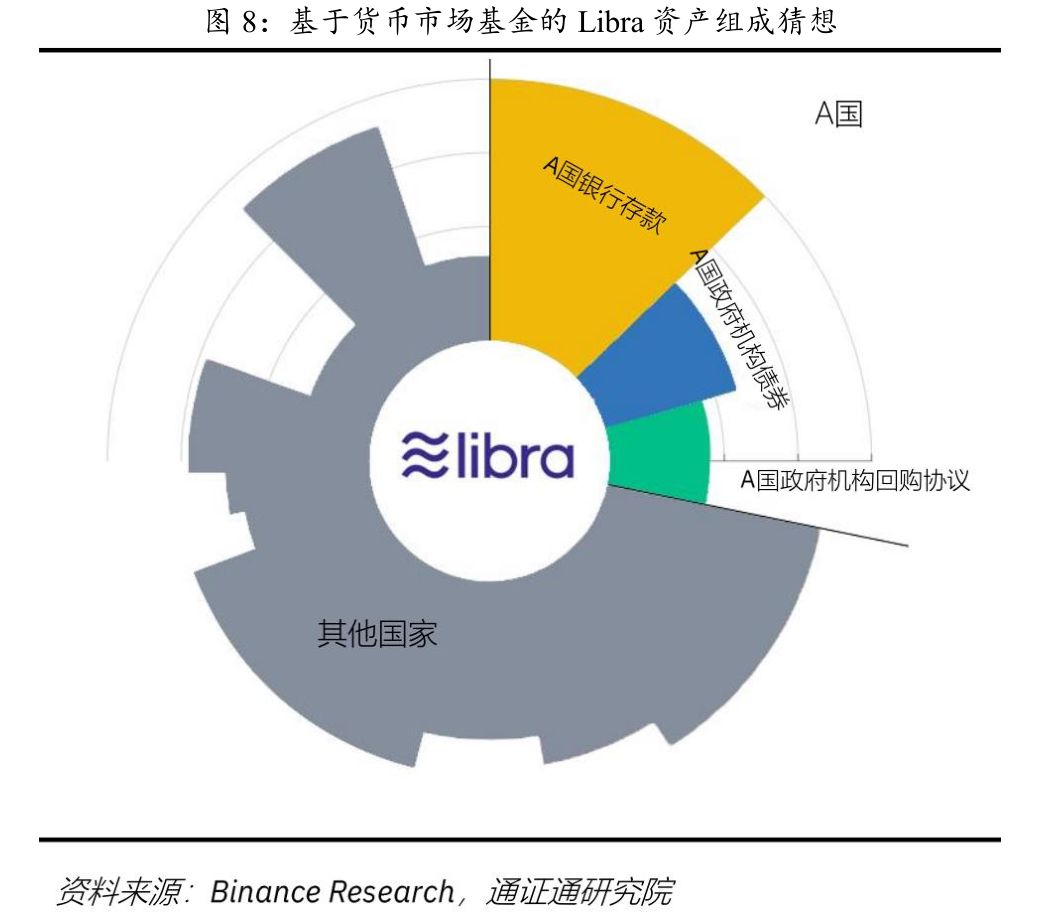

On the above conjecture of Libra's currency composition, reference can be made to the money market fund to establish a conjecture on the composition of Libra's assets. Assuming that the currency of country A is part of Libra's currency composition, in the investment for country A, in order to meet the needs of value stability and rapid redemption, part of Libra's reserve assets is bank deposits, part of which is short-term government securities, with reference to mainstream money fund assets. In the composition, short-term government securities in Libra's reserve assets may mainly include government agency bonds and government agency repurchase agreements.

However, Libra is still significantly different from ordinary money funds in some aspects. For example, Libra's reserve assets will consist of a variety of government bank deposits and short-term government securities, which will make Libra's asset composition relatively more complicated. In addition, Libra does not need to provide users with revenue, so it only needs to be configured on the basis of ensuring security and liquidity, which is relatively more flexible.

In addition, given that the Monetary Fund has been subject to stricter regulation since the 2008 financial crisis, Libra's similarity to money market funds in terms of operating methods and asset composition makes it difficult for Libra to be protected from similar regulation. Libra's development may also be affected. influences.

3.4 Lessons from the Money Fund to Libra

If Libra like a money fund wants to become a "super-sovereign" currency, providing T+0 customer service is a priority, but this function is actually not provided by most money funds.

In the current money fund, Yubao relies on the “T+0” quality customer experience to attract large inflows of funds. Its business model is: On the one hand, Yuebao adopts the purchase and redemption of funds to clear the difference, and on the other hand, it uses the “padding” method to complete the real-time redemption application. Libra is positioned to be a “currency” between Facebook and its global partners, maintaining a high level of liquidity for Libra to perform functions such as high frequency payments and value scales. Yu'e's successful experience is worth learning. For example, its assets are mainly composed of high-liquidity products such as demand deposits, and real-time redemption is provided through the method of liquidation and liquidation.

The difficulty of Libra is how to maintain the appropriate proportion of reserves in different countries. Excessive provision will reduce the profit on the asset side and put pressure on the long-term operation of the network. In addition, although the Monetary Fund generally uses assets with higher security as reserves, there are still certain risks. For example, in 2008, Lehman Brothers went bankrupt. The Reserve Primary Fund held a large number of Lehman Brothers commercial papers. As a money fund, its net worth fell below $1, triggering a redemption of the entire US panic currency fund.

In order to strengthen the risk control of money market funds, the US Securities and Exchange Commission has revised the regulatory framework for the money fund market. In 2010, the US regulatory authorities amended the “2a-7 Rules” of the Investment Company Act to impose stricter restrictions on the liquidity, maturity, asset quality and decentralization of the Monetary Fund's investment portfolio. This includes reducing the weighted average combination term (WAM) of the Monetary Fund portfolio from no more than 90 days to no more than 60 days, introducing a weighted average duration (WAL) indicator, and the combined WAL must not exceed 120 days, in addition to liquidity and redemption. Etc.

To become a “super-sovereign” currency, Libra needs to select asset reserves with high standards and reduce asset risks. In order to strengthen its ability to resist the risk of run-off, Libra will use various financial products as its own asset reserve, or will introduce regulatory indicators such as WAM, WAL and other monetary funds to screen various financial assets. In addition, some monetary fund reform proposals, such as floating net asset value, liquidity fees and redemption thresholds, capital buffers and minimum risk balances, etc., may also be adopted by Libra to select asset reserves at high standards and build as much as possible. A lower risk portfolio.

Reference materials:

1. James M. Boughton, Silent Revolution: The International Monetary Fund 1979–1989, 2001

2. IMF's Finance Department, Review of the Method of Valuation of the SDR, October 26, 2010

3. IMF, Review of the Method of Valuation of the SDR, 2015

4. "JPMorgan Chase Money Market Fund Annual Report 2019"

5, "Tianhong Yubao Money Market Fund 2019 First Quarter Report"

6. Zhao Wei, "Viewing the "Yuebao" Supervision from the US Monetary Fund"

7. Wei Yinghui, "Regulatory Reform and Enlightenment of the US and European Money Market Funds"

8. Revisionsto Rules Regulating Money Market Funds

9, FireWire Quick Review: Analyze the stable currency Libra that everyone expects

10. US lawmakers hammer Facebook exec over Libra's threat toprivacy

Note:

For some reasons, some of the nouns in this article are not very accurate, such as: pass, digital pass, digital currency, currency, token, Crowdsale, etc. If you have any questions, you can call us to discuss.

Text: Song Shuangjie, CFA; Tian Zhiyuan, Wang Xingang, Jin Jiahao, Coin Research Institute

Tongxuntong Research Institute × Coin Security Research Institute

Source: Tongxuntong Research Institute

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- This college student can help you forge the transaction volume, online CoinMarketCap, only 15,000 US dollars

- Carry out the cryptocurrency road to the end! The Japanese government is creating a global cryptocurrency payment network similar to SWIFT

- At the Libra hearing, I found an alternative member of the book about Ben Satoshi and Bitcoin.

- Lost! In this cryptocurrency innovation competition, the United States is too late.

- QKL123 market analysis | Bitcoin dark moments, waiting for the dawn (0718)

- A Preliminary Study of Cryptography: The Art of Hidden Information——The Eleven of the Blockchain Technology

- BTC "blood sucking" is fierce, only 6 coins have won BTC in the past year