Everyone only pays attention to the next halving of Bitcoin, but ignores this information.

Original: cryptobriefing

Source: First.VIP

“Gold's inventory flow ratio is 58 and bitcoin is 25.8. After halving, the number increases to 53.”

More and more hype about the upcoming bitcoin halving, halving is scheduled to happen in May 2020, about 190 days from now. This information is well known, and the number of bitcoins awarded to miners will be halved every four years, and the third is halving.

- Smart Contract Series 1: The Cornerstone of the Digital Society – Smart Contracts

- The Grin Development Fund has once again received an anonymous donation from 50 BTC. The donor is the Bitcoin “Antiquities Group” in 2009-10.

- Why is decentralization significant? Talking about three trends of Web 3

Currently, approximately 1,800 new bitcoins are produced each day, and every time a block is mined, the miners receive a reward of 12.5 BTC, which will drop to 6.25 in May next year.

Due to the lower incentives for miners, they will stop mining or retain their own bitcoins until the new price compensates for the cost involved in mining. Similar to other commodities/assets, the supply and demand of Bitcoin will change in tandem, creating a new equilibrium price for the increasingly scarce asset bitcoin.

Special statement: This article represents the author's personal point of view, the first-class warehouse always adheres to objective neutrality, presenting diverse information to readers.

Third halving

This will be the third halving of Bitcoin. The first time was in November 2012, the block reward dropped from 50 BTC to 25 BTC, which had a huge impact on the price of Bitcoin. The second time was in July 2016, which triggered a bull market that lasted for a year and a half, bringing the BTC price from around $650 to nearly $20,000, which is still the highest level ever.

Of course, many people familiar with the field of cryptocurrency saw the potential for profit before halving, and began to change their positions for a long time before the incident. The following BTC historical price chart clearly shows the price increase before and after each halving:

(First Class Note: Bitcoin Price History)

Bayern LB has applied a stock-to-flow ratio to predict bitcoin prices after halving next May, which is often used for commodity analysis. (First class note: inventory flow ratio = quantity of existing goods / quantity produced per year)

The inventory-to-traffic ratio of gold is 58, and bitcoin is 25.8. After halving, the number increases to 53 . Based on this model and studying the price behaviors that have been generated around the halving event in the past, they suggested: “If the inventory ratio of Bitcoin in May 2020 is included in the model, the price of Bitcoin may reach $90,000. This means the upcoming The halving effect has not yet been reflected in the current price of Bitcoin."

In fact, Bitcoin is not the only cryptocurrency in which supply growth is slowing.

The supply growth of a series of altcoins will also decline in 2020-21, and some of them have dropped this year. From this year to the next year, the inventory ratio of many mainstream cryptocurrencies has fallen sharply. In theory, if demand remains the same, their prices should rise.

Ethereum ETH

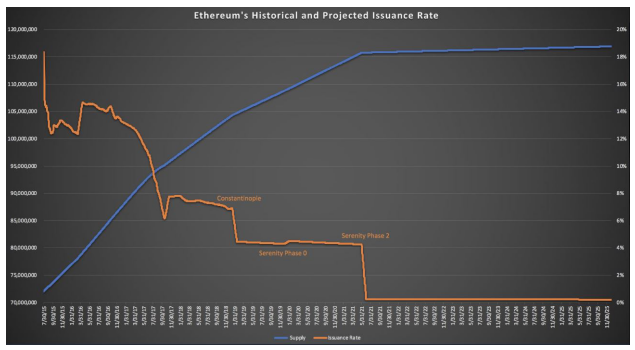

Ethereum does not have a hard supply ceiling like Bitcoin, but after the hard fork of Constantinople was finally implemented on February 28th, the block reward was reduced from three ETHs to two. In theory, this has led to a 33% drop in new supply per year for Ethereum and a new circulation of approximately 4.5% per year for Ethereum.

By 2021, with the launch of the Serenity phase of the Ethereum, the growth of Ethernet supply is expected to decline further by 75%. The upgrade of the quiet phase of Ethereum will introduce fragmentation, PoS consensus and many other upgrades. The quiet phase will be set to be carried out in three phases. Once the third phase is reached, the ETH's increase will be slowed down.

(First class note: blue is the supply curve of Ethereum, orange is the inflation rate)

Ruibo XRP

In order to move to XRP's "more conservative volume benchmark," Ripple Labs significantly reduced the token sell-off in the third quarter of this year, and this downward trend will continue to increase. Ripple Labs said that in the third quarter of this year, its sales of XRP coins were approximately $66.24 million, a drop of nearly 70% from the $251.51 million in the second quarter.

This downward trend seems to continue into the fourth quarter and next year. Ripple said unequivocally, "Looking forward to the fourth quarter, we will continue to pay close attention to changes in trading volume and intend to maintain similar practices. The transaction volume in the fourth quarter will be comparable to that in the third quarter." Having said that, the price of XRP There is no positive response to reducing the XRP.

Bitcoin Cash BCH

Root Coingecko said that it is about 153 days to halve the bitcoin cash (BCH). The halving process of BCH follows the halving process of Bitcoin, and the reward for each block is halved from 12.5 BCH to 6.25 BCH.

However, bitcoin cash lacks historical data to show that its price will be significantly affected by a halving. However, from a structural point of view, doubling the inventory flow ratio of its BCH will at least put supply pressure on the bitcoin cash price.

Block.one's EOS

In early June, the EOS community voted in favor of a proposal to reduce the “inflation rate”, that is, the new annual rate of EOS tokens was reduced from 5% to 1%. Block producer rewards remain unchanged at 0.25%+0.75%, which means that more than 4% of EOS will hit the eosio.saving account is locked (first class note: some system accounts can be controlled on the EOS blockchain ) A variety of corresponding features, these accounts have a prefix of “eosio.”, where the eosio.saving account stores 4% of EOS inflation) . On March 5 this year, the “eosio.saving” account had a balance of more than 28.75 million euros (about $108 million) and was growing every day (first-class position: this means an increase in EOS that was dug up and circulated to the market). Less and less) .

EOS experienced a short-term price increase throughout the time, setting a new annual high. However, according to Coinmarketcap's data, this joy is short-lived, and the price of EOS has been declining since then.

(First class note: orange line is 2019 EOS price performance, source: CMC)

Monroe XMR

The inflation rate of Monroe has fallen faster than Bitcoin. XMR's overall block award fell below the Bitcoin award for the first time this year, and in August, the daily supply growth was lower than the benchmark for Bitcoin (the first position note: Monroe's third reduction on November 6 this year Half, the block reward dropped to 2.190923256 XMR) .

The inflation rate of Monroe has been 4.1% since 2019 and fell to the expected 2.39% by the beginning of 2020. This made 2020 an important year for XMR, and its inventory flow ratio eventually exceeded Bitcoin. According to Bitwise, Monroe’s annual circulation will fall by 41% next year.

Dash DASH

Dash's "inflation" adjustments are more frequent. Bitcoin block rewards are halved every four years, but Dash reduces the issuance by 7.14% every 383 days (a little more than a year). DASH's overall block rewards are more frequent but more mitigating, making the reduction in supply more subtle and more stable.

Due to the uncertainty of the maximum total supply, DASH will continue to be mined for 192 years until a single year is required to mine a single Dash. By 2209, only 14 DASHs could be dug up, and it took 231 years to dig out the last DASH.

Despite the complicated algorithm of DASH supply , DASH's supply growth is expected to drop by about 7% every year . In theory, if other conditions remain unchanged, this will bring continuous price increase pressure.

Litecoin LTC

Litecoin halved in 2019 saw the trait of 'purchasing rumors, selling news', and the price rose from $20 at the beginning of the year to $140 in August. However, there has been no rebound after halving, and this rising bullish price activity can be explained by the re-bullish sentiment of Bitcoin.

Conclusion

Since the last half of Bitcoin, the encryption market may have matured significantly, but with the approach of May 2020, it may be a splash. Whether through community consensus or through algorithmic design, these mainstream cryptocurrencies, like bitcoin, will undergo radical changes in supply between 2019 and 2021.

As bitcoin is halved, encryption technology has also become the focus of attention, and the price increase of these digital assets may lag behind. As Bayern LB said, half of the price has not been reflected in the expectations.

Reprint, please keep the copyright information, thank you for reading.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- For the public chain, the story of the application layer is dead.

- Double 11 e-commerce platform is vying to adopt blockchain, hundreds of millions of buyers: Have a half-money relationship with me?

- Bakkt launches agency-level hosting business: market saturation? nonexistent

- International Monetary Fund Liu Yan: Digital currency is unlikely to become a mainstream currency soon

- Comment: Developing blockchain technology is both positive and secure

- Blockchain talent expert think tank expert: governance chain, financial chain, industry chain for the new economy troika

- Market analysis: shrinking and falling, the most grind