Exclusive Interview with 1inch Co-founder How does 1inch gradually innovate to grab food from the horse’s mouth in the liquidity battle?

Exclusive Interview with 1inch Co-founder How 1inch innovates to gain an advantage in the liquidity battle.Interview: Jack, BlockBeats

Editing: Jaleel, Kaori, BlockBeats

Editor: Jack, BlockBeats

Born in the 2019 Hackathon 1inch, under the boost of DeFi Summer in 2020, it successfully emerged. Led by two Russian youths Sergej Kunz and Anton Bukov, 1inch steadily climbed to the leading position in the DeFi aggregator track with its efficient and low-cost trading method.

- Extensive Article The Iron Curtain of Regulatory Control in the United States Has Fallen, What Tomorrow Will Crypto Face?

- Here is a list of cryptocurrency observations for the next week $LTC halving event, Evmos 2.0 launch…

- Outlier Ventures Data-Driven Token Design and Optimization

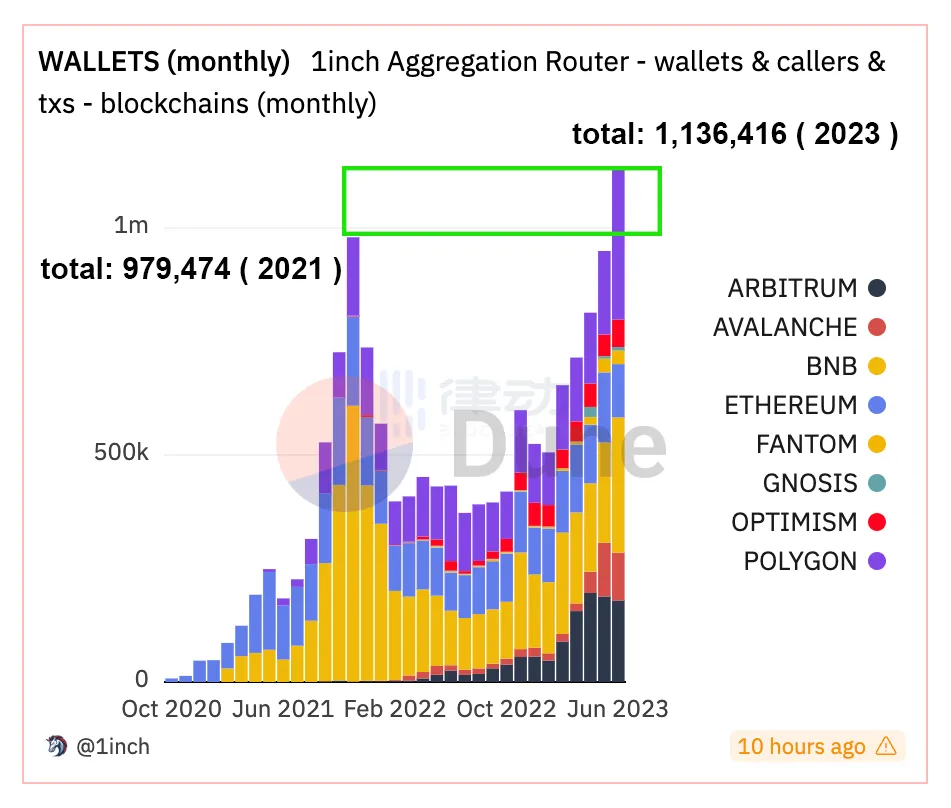

According to DUNE’s data, the number of unique wallets using 1inch has exceeded one million since last month, surpassing the peak period in 2021. Recently, 1INCH has risen above $0.5, and the team has also launched its own developer portal test version. This Web3 SaaS (Software as a Service) platform provides APIs for developing new products, including transactions, spot prices, token information, etc.

Correspondingly, another unicorn in the DeFi market has made consecutive moves. On June 13th this year, the Uniswap team announced the launch of the fourth-generation version V4, introducing two new concepts, “Hooks” and “The Singleton”. Among them, Hooks has attracted particular attention. In the eyes of many, it seems to have become the killer move for Uniswap to defeat all DEXs. And at the subsequent ETHCC conference, Uniswap launched UniswapX, launching an attack on the liquidity aggregator field. Under this successive impact, many DeFi entrepreneurs have exclaimed, “Abandon DEXs and join Hooks.”

Last week, during the ETHCC conference in Paris, BlockBeats conducted an exclusive interview with Anton Bukov, co-founder of 1inch, to delve into the development history of 1inch, his views and thoughts on DeFi innovation, and how to deal with Uniswap’s attack, and other topics.

Cunquan, 1inch’s philosophy of innovation

The name 1inch carries a strong Eastern philosophy, derived from Bruce Lee’s famous move “One Inch Punch,” which is the translation of the traditional Chinese martial arts technique “Cunquan” in international terms.

Before delving into smart contracts, Anton Bukov, co-founder of 1inch, originally worked as a C++ system engineer, then turned to iOS development because of his love for Apple development tools. However, when he encountered smart contracts, he was immediately attracted: when writing smart contracts, he needs to think and write code at a whole new level.

In 2018, through a friend’s introduction, Anton Bukov and Sergej Kunz met and instantly hit it off. Then, at the Hackathon in 2019, Sergej and Anton developed a DEX aggregator solution together, which is the origin of 1inch.

Left is Sergej Kunz, right is Anton Bukov

“The importance of accounting innovation has been greatly underestimated”

BlockBeats: 1inch has made unique contributions in the field of DeFi, and we have always hoped to have in-depth conversations with the founding team of 1inch. And from what I know, you are also exploring some new projects.

Anton Bukov: That’s right. For example, organizations like =nil; Foundation are engaged in numerous projects, both at various large conferences and outside of conferences, regardless of their size. Some people are building new features for existing blockchains and EVMs, while others are dedicated to creating new tools for the ZK in the cryptocurrency field. These projects are not just conducted within the existing frameworks of EVM and Ethereum, but more like building future solutions for the mass market of cryptocurrency proof or protocol-agnostic projects.

I am not interested in projects that do not bring any actual value. I don’t believe they can bring any real value. However, there are people doing things. For example, when I talk to them for 15 to 20 minutes, I find that they are doing something very interesting, they are solving a practical problem. Although this problem may not be big yet, it is becoming more and more important, which is very encouraging.

BlockBeats: I have briefly talked to =nil; Foundation and learned about their attempts in Proof Market.

Anton Bukov: Yes, it is worth mentioning the proof market they proposed, which is a cool thing. All participants using zero-knowledge proofs (ZK) need to create proofs, which is a resource-intensive process that includes energy, GPU, and ASIC. There are dedicated devices that can handle this work. Just as Bitcoin mining requires ASIC, creating proofs also requires ASIC.

This dedicated hardware can create proofs more efficiently and economically than general-purpose GPUs. They are trying to create a market where you can place orders, and if you are willing to pay a certain fee, someone else will generate proofs for you, and there will always be someone interested in and completing your order. Once completed, they will generate the proof and provide it to the smart contracts that can verify and pay them.

I have also done a similar project at a Hackathon, creating a smart contract that allows users to customize personalized Bitcoin addresses. The contract used a scheme based on key splitting. Therefore, no one knows the final private key, not even those who use GPU computing power to search for the private key. It is impossible. They only know a part of the private key, which is a number to be added to a number they don’t know.

BlockBeats: Is that the first smart contract you wrote?

Anton Bukov: Yes, that was the first smart contract I wrote at a Hackathon in 2017. Since I couldn’t find any libraries on Solidity that would help with elliptic cryptography, it may be one of the smart contracts with the highest and most complex cryptographic density. I needed to generate private and public keys, add the public key, and then we could calculate the address through the hash of the public key.

I implemented this logic myself, studied how elliptic curves work, and wrote the code based on Wikipedia and other documents I found, and it worked. Later, I found a library that provides some kind of intermediate representation in a more efficient way, which was very interesting to me.

BlockBeats: In 2017, many people were focused on speculative activities like ICOs.

Anton Bukov: That may have been before or maybe a few months later, around mid-2017, we made some jokes about issuing tokens. 1inch may not be as focused on code quantity as other fields or projects because we believe that the key to ensuring user security is to simplify the code as much as possible and conduct as many audits as possible within the budget.

If you have a protocol with 5000 lines of code and it goes through one audit, compared to a protocol with only 500 lines of code but goes through 10 audits, the security of the latter is 100 times higher. Because an audit does not guarantee the security of your protocol. Even with formal verification, security cannot be guaranteed. It can only guarantee that under your understanding of all possible combinations, it may be secure. But you may overlook certain threats and potential use cases.

Past experiences have shown that some projects that have undergone formal verification have also been hacked. When someone discovered that they could manipulate the price of LP tokens in the same block, they would deposit Ethereum and other assets into the Uniswap V2 pool, causing the price of LP tokens to rise. However, if you have two positions, one with LP tokens as collateral and the other with LP tokens as debt, while manipulating the price, if one position is very large and the other is negative, you can exit with a huge position and abandon the position with debt.

Therefore, if you can manipulate the price of assets, even raise the price within the same block, it poses risks to the capital market. This is something people are not aware of, and formal verification does not solve this problem. A branch of Aave was hacked because of this issue. Aave has shut down these oracle smart contracts because they were defenseless against such attacks. This is an example of how formal verification cannot make a project 100% secure.

We believe that every audit increases your security. The less code there is, the more audits there should be, the more secure it is. Of course, as engineers with 15-20 years of software development experience, we also spend a lot of time improving efficiency and gas efficiency. In terms of smart contracts, the only optimization goal is the size and gas efficiency of the smart contract code, and we try to find a balance between these two parameters.

Balance between code simplicity and functionality compactness

BlockBeats: In many people’s imagination, the code of a DeFi aggregator must be very complex.

Anton Bukov: We find a balance between code simplicity and compactness, which doesn’t mean we put everything in one line of code. We only do what is necessary and do it efficiently. When writing code, we often use data structures and algorithms to help deal with complexity and gas costs, but we found another clever way by proposing a new accounting algorithm, which is an underestimated topic in the field of algorithms, that is, accounting innovation in algorithms.

A member from LianGuairadigm also mentioned this topic on Twitter, and he also believes that accounting itself is an underestimated field and will bring a lot of innovation in DeFi. This field is. For example, in 2020, my colleagues and I created a farm smart contract. The first smart contract with a farming incentive mechanism was developed by me and my colleagues for the Synthetics protocol, and this protocol sends incentives weekly through scripts.

We joined their Discord and proposed, “You provide incentives for liquidity on Uniswap V2, but those providing liquidity own LP tokens. Why don’t you create a staking contract for these rewards?” They were surprised that we made this suggestion as soon as we arrived. I also said that we can write this contract. So we wrote this contract and it was audited by Sigma Prime. This contract may be one of the most replicated smart contracts on Ethereum.

You may remember during DeFi Summer there were many “food tokens,” which are mainly based on this smart contract. This is an example of accounting innovation because an important part of this smart contract is that people can join the “farm” and leave the “farm,” and this “farm” may have thousands or even millions of users. But how does it work when they join and leave?

The “farm” evenly distributes all funds over a period of time, for example, allocating a certain number of tokens every week, every second, every minute, and every block, but these funds are distributed according to the proportion of users’ stakes. There are only three operations here: deposit, withdrawal, and rewards claim. None of these operations involve wallet enumeration, and the complexity of this method is called constant complexity. This means that regardless of whether we have one thousand or one million users, the gas cost required for these three methods to execute is exactly the same.

BlockBeats: What attracts you to DeFi? And how did you come up with the idea of a DEX aggregator?

Anton Bukov: Because we see that there is still a lot of untapped potential in this field. Our innovative ideas in algorithms and accounting are very innovative. Despite having currency markets, AMMs, etc., the accounting aspect of this field is still severely underestimated. Take the cryptocurrency market as an example, its operation is very interesting. People deposit their assets into a pool, which mixes everyone’s money, and then you can borrow other assets.

For example, you deposit your Ethereum and then borrow Bitcoin. You are actually borrowing money from those who have deposited Bitcoin, not from a specific person, so this process is not peer-to-peer but pool-to-pool interaction. This pattern causes your debt and collateral to increase every second.

But how does it work? For example, if half of the USDC collateral is borrowed, the borrowers need to pay 6% interest annually, and their debt increases by 6% each year, but this number is increasing every second. The liquidity providers, with half of the liquidity borrowed, pay 6% interest, but the annualized return rate they receive is 3% because this half of the 6% is distributed according to a 100% deposit ratio, resulting in a 3% annualized return rate, and this number is also calculated every second.

Why is it calculated per second? Originally, when I came up with the concept of this lending concept as a black box, I thought that when you repay, you need to pay additional fees. For example, if you borrow $100, you need to pay $105 when you repay, and this money will be distributed proportionally to everyone. But if you only distribute according to the current people in the pool, there is room for manipulation.

Someone may cut in line, deposit 99% of the liquidity, and get the $5 reward, and then withdraw immediately after you. So you should distribute this $5 reward to everyone who has ever been in the pool, according to their holding proportion over a period of time. What they do is make your debt and collateral grow every second. So for manipulators, cutting in line is meaningless because the distribution has already occurred. When someone repays a debt, it doesn’t mean that they will pay a sum of money that will be distributed. This money has already been distributed, and they are just paying off their own debt. This is a great accounting innovation.

The implementation of Compound and Aave is different. Compound distributes rewards by continuously increasing the price ratio of Compound assets to underlying assets. This price increases according to a formula every second. When the loan-to-value ratio changes, they adjust this ratio. Aave’s approach is similar, but they maintain a 1:1 price ratio, so your balance keeps growing. This is a different method that can be converted between each other.

Anyone can write a token wrapper to make it behave like a Compound token. Its balance does not grow, but the price does. And you can also create a reverse wrapper token that makes the Compound token wrapper behave like other tokens, one-to-one with the underlying assets, and the balance keeps growing. I believe that someone may have already done this kind of project, such as the X token project. They usually create wrappers that allow similar functionalities, such as voting, automatic voting, delegation, etc.

As for why we choose to innovate in the DeFi field, I would say that we are not only focusing on DeFi. We are also very interested in Web3 and seek innovation in this area. Usually, we come up with unique technological innovations and ideas, and then try to understand if we can build a useful and successful product based on these innovations and ideas.

I noticed that some projects first envision a product and then try to implement it. But I think 1inch’s approach is the opposite. We first propose innovations and then try to understand how to best serve users using this accounting method or algorithm. That’s why most of our products perform well when they are launched and it is difficult for others to compete with us.

Developer Portal, what is 1inch up to?

On July 19th, 1inch Labs announced the release of the beta version of its Developer Portal, a Web3 cloud SaaS (Software as a Service) platform that provides state-of-the-art APIs for developing new products.

1inch Developer Portal provides SaaS solutions including the Swap API, which provides quotes for the amount of cryptocurrencies that users can exchange on specific blockchains; the Spot Price API, which provides the current spot price of cryptocurrencies on supported networks based on available liquidity; the Balance API, which provides accurate information on cryptocurrency wallet balances and limits; the Orderbook API, based on the 1inch limit order protocol; and the NFT API, which provides information on all NFTs in a user’s wallet, and many other functions.

According to official statements, the verified solutions provided by the 1inch Developer Portal have been successfully tested in the 1inch Wallet and 1inch dApp. Projects that have integrated the 1inch API include MetaMask, Trust Wallet, and Ledger. The 1inch Developer Portal provides a service level agreement with 99% uptime. The 1inch API offers users extremely short response times, with the lowest latency in the market. At the same time, the 1inch Swap API can access numerous sources of liquidity on multiple blockchains. The user-friendly interface allows users to access the latest documentation, advanced request statistics, and all major upgrade information about the 1inch protocol.

How should a team view industry innovation?

BlockBeats: Let’s talk about the product. How is the latest release of the 1inch Developer Portal different from the APIs previously provided to developers?

Anton Bukov: Many developers in the Web3 field have participated in or are still participating in hackathons. I believe that delivering results quickly is crucial in hackathons. There is a Pareto principle at play here, where 20% of effort can yield 80% of the results, which is the goal to strive for and achieve in hackathons. However, delivering a product to real users requires completing the remaining 20%, which will require 80% of your effort. This is exactly the problem our new Developer Portal (DevPortal) aims to solve.

We spent a lot of time building all these services for ourselves, our wallets, and our products. Then, we decided that if we could allow other developers to access all these high-quality APIs, they would be able to advance their own products faster, validate their assumptions about market demand faster, and achieve 20% of the functionality without the need for that 80% of effort.

BlockBeats: What types of applications or implementations can developers build with these APIs?

Anton Bukov: The possibilities are endless, it can be wallets or dApps. If you’re planning to create a wallet, the 20% of effort and 80% of results you get might be the user interface, which could be a mobile app or a web app. However, developing the backend to fetch all tokens in the wallet, their prices, historical changes, and transaction history, that’s the bigger task that needs to be done on-chain. But if someone wants to run a new wallet and validate if people like it, they can’t achieve that without a backend. And now, they can just try it out using our API, which is free for most people.

BlockBeats: What role will the 1inch wallet play in the entire 1inch ecosystem?

Anton Bukov: We believe that our mission is to improve this field and accelerate the development of singularity. Therefore, we believe that the only way for the company to survive is through innovation. We not only want to survive, but also want to continue to innovate, which is what drives us forward. Of course, we sometimes feel that we are competing with other projects, but this is a good thing because it is challenging for us. We started with Hackathons, and in 2019 we participated in 15-20 Hackathons. Competition is always beneficial for end users.

Competition exists in every aspect of the blockchain, between wallets, between aggregators, and in almost all markets provided by Web3, blockchain, and DeFi technologies. However, the biggest winners of these competitions are usually the users, which is great. This industry is still young and there may be significant changes in ten years. But everything we do now is beneficial for building a bright future.

We have released these APIs not only for internal use but also for everyone to use. We believe that this will drive the industry to build more applications. We are not afraid of competition because we believe that there is a huge development space in this field. Even if we only have a 10% or 15% market share in the wallet market, we don’t care. We still process more than half of the aggregated transactions and continue to strive to increase our market share.

Of course, we compete for our market share. But overall, we would rather see these markets develop faster. Our goal is not to compete in a small market, but to accelerate the development of the entire market. Having more wallets may attract more people to join DeFi, and we hope to see the entire market develop faster than it is now.

Striking a balance between product innovation and market growth

BlockBeats: Can you reveal what is currently the most profitable feature or product of 1inch?

Anton Bukov: Actually, we don’t generate revenue from swaps because we currently have sufficient funding and we are not in a rush to make money. We believe that growth is more important right now. If we need more funding, there are many ways to achieve that. But in 2023, I think we still have a long way to go before we stop growing. The entire industry may grow tenfold in the next 3-5 years, so growth is more important.

Many projects use all their revenue and investments for growth rather than making money, and many companies do the same, like Uber. Sometimes, these companies may struggle to survive due to high leverage. They try to spend more money, make more money, and invest more. But the problem is, when investors see where the money is going, they find that it is all invested in growth, usually not only in the DeFi field but also in growing markets and emerging markets. Therefore, the largest companies in the market are very focused on the overall market growth and their own growth in the market.

BlockBeats: After Fusion, what do you think will be the next major update for 1inch?

Anton Bukov: We are currently exploring potential products to focus on next, and we have designed some unreleased products. Initially, we had over 10 ideas and then brainstormed them. We sorted through these ideas and three of them sounded particularly good. We will continue this process until we decide which one best meets the current market and situation’s needs. So there is no specific decision yet. This is also why we have never publicly released a roadmap.

The market changes very quickly, and six months later, the market may be completely different, and we may develop different products. We also cannot be completely certain about what we will do in the next six months. If we have a long-term roadmap but change our minds, many people may be dissatisfied because they thought the original roadmap was good and the new one is not. Our goal is always to exceed expectations, so we do not publish roadmaps, and there will always be people who think they know better than you and will always be dissatisfied.

BlockBeats: When discussing creating new products or innovations, one must consider the issue of product delivery. The market is changing rapidly, especially in the DeFi field. How do you adjust the development direction of the product and its market adaptability in practice?

Anton Bukov: We will not spend more than half a year developing a product or the next version of a product. Typically, we need much less time, around two to three months, maybe a little more. Some development work may start with Solidity smart contracts, and then during the audit, we will have frontend, backend, and other work. It usually takes around two to three months, maybe slightly longer in some cases. If our product cycle is one year, we will be eliminated by the market. When you release it, no one may use it, and it may become useless.

For example, the Uniswap team, from what I understand, takes an average of about a year to deliver a product. They said this is Uniswap X, about the V3 version. I believe they even started promoting it more than a year before this, but they have been researching the AMM field, such as V3 being an AMM innovation, and this market has been quite stable over the past one to two years. However, when we are building in different directions and different DeFi fields, we cannot accept this situation.

Uniswap strikes again, how does 1inch respond?

Previously, the founder of Uniswap announced at ETHCC that they will soon launch a cross-AMM, Dutch auction-based aggregation protocol: UniswapX. The community and the market have mixed opinions about this upcoming new product. LianGuairadigm researcher Dan Robinson (@danrobinson) highly praised the changes brought by UniswapX to decentralized exchanges, MEV, and interoperability on social media, and listed five reasons in detail.

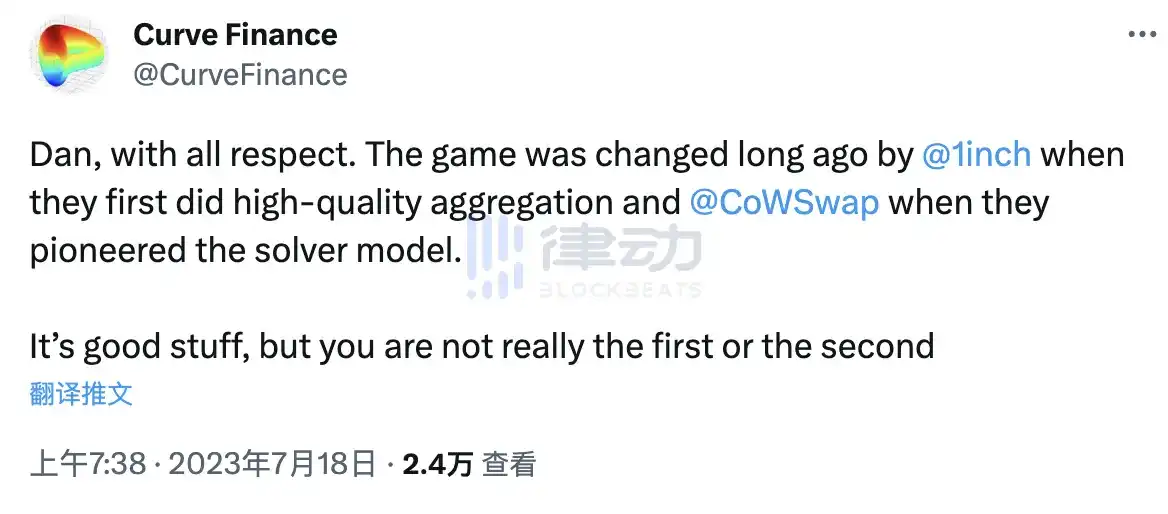

But the official account of Curve Finance has a different evaluation, and their opinion has a unique flavor: “Forgive me for being blunt. The rules of the game have changed a long time ago: when 1inch first conducted high-quality aggregation, when CoWSwap launched the Solvers model. UniswapX is good, but it is not the creator, not even the second player.” Undoubtedly, Curve Finance believes that Uniswap is copying. Some community members also question: “UniswapX = CoWSwap + 1inch?”

Pink Shadow

BlockBeats: You mentioned Uniswap, which recently released its important V4 version and UniswapX. Although other protocols have proposed similar innovations long ago, Uniswap’s secondary adoption of these innovations still outshines other protocols. I would like to hear your thoughts on this issue as a DEX team competing with Uniswap. How should DEX teams develop in the DeFi field?

Anton Bukov: When I first heard about UniswapX, my first reaction was to wonder why it looks so similar to 1inch Fusion. When we delved into their whitepaper, we found that 1inch Fusion was one of their most important references. I think this is a positive thing, which once again proves that we and other participants doing similar things in the market are moving in the right direction. This also emphasizes that we are always one step ahead. I firmly believe that our solution will continue to lead the industry.

BlockBeats: Many different DeFi protocols have made a lot of innovations, but the market has not given them enough attention. But when Uniswap implemented similar innovations, the entire market suddenly felt like a revolution.

Anton Bukov: Yes, I think some projects already have unfair advantages, where the unfair advantage refers to having some auditors who, due to the brand effect, become the key to their services. But this situation is gradually being resolved as the market adjusts itself. People are starting to realize the existence of aggregators, and when they see DEX aggregators, they almost immediately understand that although DEX is good, DEX aggregators are always one step ahead. Inequality and unfairness are almost everywhere in the market, but in free markets and loosely regulated markets, this situation is improving. The growth rate of unregulated markets is much faster than that of regulated markets, and their inequality situation is gradually improving over time.

BlockBeats: I also want to talk about the issue of licensing. After the release of Fusion, you announced the MIT license, which is significantly different from the BSL license adopted by Uniswap, and the MIT license is more open. What do you think of Uniswap’s approach to licensing and why did you choose the MIT license?

Anton Bukov: We are not particularly afraid of competition, as most of our smart contract solutions are completely open source. The MIT license allows anyone to use the code we have written for anything. We believe that not all software engineers, especially anonymous ones, will respect your license. I have already seen some unknown teams fork our project before the commercial license of Uniswap V3 expires. A commercial license may prevent some open teams or fair competitors from forking, but it cannot stop random public forks.

We believe it is a good thing if someone is inspired by our ideas. We have developed this product, and even if someone copies or modifies it slightly, we are still ahead. When we release a new version, we usually have already been working on the next version, and each new version is more advanced than the previous one. So we are usually not too worried about being copied, as we see it as a contribution to the public interest.

BlockBeats: In the DEX field, Uniswap is moving towards the extreme and heading towards monopoly. What other directions are there for entrepreneurs in the DeFi field?

Anton Bukov: I believe there is still room for innovation, there are still things to be invented. But it may not make much sense to build a project or product before inventing something important from a technical perspective. Simply making minor changes to Uniswap or other projects may not work. This will not expand market share at all. But the good thing is that if you can find a good design, XS AMM will get attention, because if your protocol can provide better prices compared to other protocols, your protocol will be immediately adopted by aggregators. If it can provide excellent prices and attractive returns for LPs, you can be successful.

It is possible that a genius will come up with a brilliant method, release a protocol, and attract hundreds of thousands of liquidity. This new AMM or DEX may be adopted by aggregators, thereby gaining its initial trading volume and bringing substantial returns to LPs. With more LPs joining, the project will gradually grow and it is possible to occupy tens of thousands of shares in the market.

Before aggregators appeared, there would be many competitors among newly created DEXs. A participant in a Hackathon may come up with a very good solution, which is put into use and gains market share. It used to be impossible to gain 10% market share, just with an idea and a bit of liquidity. You have to attract users, because no one will make exchanges, but now, you can automatically get trading volume.

So the market positioning of aggregators is different from the current business of Uniswap. After the invention of aggregators, many DEXs emerged, and many DEXs that used to disappear due to lack of users were able to survive and succeed, gaining some share to continue surviving.

BlockBeats: Currently, people’s impression of 1inch is mainly as a DeFi aggregator. How do you plan to define yourself in the DeFi market in the future?

Anton Bukov: Yes, 1inch’s main business is still an aggregator, and we don’t think the release of Uniswap X will bring about significant changes. We have seen other aggregators in the market, and we have been competing with them quite successfully over the past three and a half years. In the first six months, we were almost the only player in the market. I believe things will change, but not as drastically as some people imagine.

We have some products that are not just aggregators, and we will have more diverse products. Subsidiary DeFi may be regulated for different markets, such as subsidiary DeFi for the US and Europe, and we should also add subsidiary DeFi for China because it is a very large market. There may be other markets as well, such as Japan, which is also a large economy, and we can consider it based on the scale of the country or a group of countries.

BlockBeats: Are you concerned that the future liquidity of Uniswap will be too strong and affect the large-scale acquisition and usage of 1inch?

Anton Bukov: They have always had a lot of unfair trading volume, which means that the aggregator distributes the trading volume fairly based on the prices provided by different DEXs. When a user group trades on Uniswap without using other DEXs or aggregators, they may have some trading volume. If this trading volume is disproportionately high relative to their liquidity and prices, it is what I call unfair trading volume.

Based on our measurements one or two years ago, this issue was very serious, but it is gradually improving now. This market, like all other markets, is getting better. Many people trade on Uniswap because they heard about it on TikTok and are not aware of the existence of other DEXs or aggregators, but they will eventually pay the price for it because this market is just too crazy.

How do you view the future of DeFi?

BlockBeats: Some people say they are shifting their strategy to build something on V4 hooks instead of developing new DeFi applications. From your perspective, what is the best strategy?

Anton Bukov: You can introduce some innovations of decentralized trading platforms through V4 hooks. You can innovate on top of existing decentralized trading platforms and add additional features, such as oracles or similar things. Uniswap has seen its protocol forked many times, but these changes are minor and haven’t actually changed the logic of swapping. They have changed other aspects.

This forked V4 will allow other developers to add their own features on top, charging or not charging, or anything else, without forking their code. They will still be able to trade through these pools, just with some hooks, and now they won’t trade through SushiSwap or any other platform.

Anton at ETHCC Venue

BlockBeats: But will this shrink the market or reduce people’s motivation to build their own trading platforms and use aggregators to obtain instant liquidity, thus reducing the technical stack in the market?

Anton Bukov: The focus of the discussion is not to reduce the number of trading platforms, but to reduce the forks of existing trading platforms. You can have your own Hooks, and we would be happy to charge fees or anything else. But if you want to copy Uniswap without any significant innovation, please don’t create forks, as it makes no sense. We may see fewer Uniswap forks, but there may be more Hooks.

BlockBeats: Many developers have abandoned their plans to create DEX and turned to study Hooks.

Anton Bukov: They can still achieve it to some extent through DEX, but competition has indeed become more difficult compared to Uniswap’s V3 and V4 solutions. I believe V4 will be more powerful than V3. V3 has not completely replaced v2, possibly because v2 has much lower GAS fees, which is why v2 still has a lot of liquidity, and Uniswap and its routers still support v2 and V3. But it is likely that V3 will fully transition to V4 because V4 is better. It doesn’t make sense to retain liquidity in V3, but I believe their routers will support V3.

We have had some ideas about proprietary oracles and other things, but we always struggle with the need to maintain an entirely new AMM and all its liquidity. However, we believe that Uniswap has made good moves in improving this market. Therefore, we are exploring what exactly we can offer, what Hooks we can develop that can significantly improve certain aspects, improve oracles, or increase LP profits. We are exploring all of this and may come up with some combinations that could be successful and attract a large amount of liquidity to the Hooks we develop.

BlockBeats: Perhaps this is where aggregators come into play, not necessarily DEX aggregators, but many other things?

Anton Bukov: Yes, there are already aggregators for yield, DEX, and bridging. I think each market is different, and when we aggregate DEX, we are not increasing the user’s risk. We can add many DEX from day one, and the users won’t bear any new risks because our smart contracts handle all the risks. But when we talk about yield aggregation, this brings new risks to users, and fundamentally, it shouldn’t be like 1inch. We can hide everything behind a transaction, but I think they should still show selectivity to users. Users should decide which bridging to use, which is faster, whether to get 10 dollars more in 2 minutes instead of 20 minutes. You can’t make decisions for users.

BlockBeats: I remember you also mentioned the regulatory issues of DeFi at ETH Denver last year, but recently there have been more discussions about regulation, such as those related to RWA. Do you still think that DeFi may need to seek its own solutions in issues like stablecoins?

Anton Bukov: Regarding regulation, what I can say is that different countries and regions have different requirements and ideas about regulation. But the problem is if they try to regulate by making protocols or users follow rules that are incompatible with non-regulated DeFi, this wouldn’t harm DeFi, it would create a sub-market of DeFi, a sub-DeFi.

DeFi allows a subset of users and protocols to interact in terms of self-restriction and regulation, so they can’t regulate DeFi, they can only create a regulated sub-DeFi in some way. We might see regulated sub-markets for the US and Europe, we already have quite a large DeFi market, and if some countries want their economy to integrate with this emerging industry, they need to accept it.

Regulation is possible, but it should be very weak, it shouldn’t be something that prevents the acceptance of existing DeFi. For example, a few months ago we saw a stablecoin created by a bank in Paris, and people mocked it on Twitter. Its token looked like an ERC20, but it was completely incompatible with ERC20 and wouldn’t work with most existing protocols in DeFi. You can try to make it work, but it might break things.

Because the existing protocols assume that ERC20 works as described in the standard, if your token works differently, it might break things. For example, Uniswap V3 wouldn’t work at all because when they track changes in balances when depositing for trading or providing liquidity, the previous versions transfer from the source or smart contract, and they think the transfer happened and the balance updated, but it actually didn’t, so strange things might happen, and their token won’t be accessible in existing DeFi. They are creating a new market, and I’m curious if there will be at least one protocol that supports their solution. It’s very likely that it won’t happen, they won’t succeed.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- EIP-7377 An excellent solution for migrating from EOA to smart contract wallets before the popularization of account abstraction.

- LianGuai Daily | Sequoia Capital reduces the size of its cryptocurrency fund to $200 million; French privacy regulatory agency launches investigation into Worldcoin.

- African Gold Rush I Help Chinese Citizens with Worldcoin KYC, Earning up to 20,000 RMB per day

- Interview with EthStorage Founder How to Scale Ethereum’s Storage Performance through Layer 2 Expansion?

- The Fit21 encryption bill of the American Republican Party has been approved and will enter the full deliberation of the House of Representatives.

- LianGuai Paradigm Stablecoins have their unique characteristics and should not be included in the regulatory frameworks of banks and securities.

- Raft’s ten thousand character research report Decentralized lending protocol, the second largest LSD stablecoin $R issuer.