LianGuai Daily | Sequoia Capital reduces the size of its cryptocurrency fund to $200 million; French privacy regulatory agency launches investigation into Worldcoin.

Sequoia Capital reduces cryptocurrency fund to $200 million; French privacy agency investigates Worldcoin.Today’s headlines:

1. UK and Singapore agree to jointly develop and implement global cryptocurrency regulatory standards

2. Binance responds to CFTC charges: requests judge to dismiss the lawsuit

3. MakerDAO proposal to increase DAI savings rate approved, interest rate temporarily raised to 8%

- African Gold Rush I Help Chinese Citizens with Worldcoin KYC, Earning up to 20,000 RMB per day

- Interview with EthStorage Founder How to Scale Ethereum’s Storage Performance through Layer 2 Expansion?

- The Fit21 encryption bill of the American Republican Party has been approved and will enter the full deliberation of the House of Representatives.

4. Sequoia Capital reportedly reduces the size of its crypto fund from $585 million to $200 million

5. FTX and Genesis reach preliminary agreement, request court approval for settlement

6. French privacy regulatory agency initiates investigation into Worldcoin

7. Bank of Spain approves eToro as a virtual asset service provider

8. Data: Meta’s Reality Labs, the metaverse division, reports a loss of over $21 billion in 18 months

Regulatory News

The US House Agriculture Committee has passed the 21st Century Financial Innovation and Technology Act

The US House Agriculture Committee has passed the 21st Century Financial Innovation and Technology Act. This bill will establish a federal regulatory framework for cryptocurrencies in the United States. After several hours of debate and voting on amendments, the House Agriculture Committee passed the bill by voice vote and referred it to the full House of Representatives. Members debated several amendments to the bill, including provisions regarding customer information disclosure and asset management protection. Previously, the House Financial Services Committee voted in favor of the bill on Wednesday night, along with other legislation focused on cryptocurrencies. The House Financial Services Committee also held a meeting on Thursday to discuss stablecoin legislation.

The top five cryptocurrency exchanges in South Korea announce compliance strategies to monitor illegal activities

According to a statement released by the Financial Services Commission (FSC) of South Korea, a meeting was held between the financial intelligence department and virtual asset service providers (VASPs) to enhance regulatory compliance. The top five cryptocurrency exchanges in South Korea, including Upbit, Bithumb, Coinone, Korbit, and GoLianGuaix, have all established compliance systems to monitor illegal activities.

The meeting revealed that Upbit has utilized artificial intelligence (AI) to create an abnormal transaction detection system. Bithumb has developed a feature that automatically terminates a trading application when a remote control application is detected and money laundering transactions are identified. Coinone has strengthened the management and monitoring of “risk wallet addresses” related to financial incidents. Korbit has introduced a real-time management system and a secondary review system for suspicious transaction reports (STRs). GoLianGuaix has established a hotline to respond immediately to requests for freezing accounts related to crimes such as voice phishing.

Through collective commitment, the participants pledged to strengthen the common dialogue around improving compliance capabilities. They plan to hold meetings every 2-3 months in the future to maintain this commitment.

Binance responds to the US CFTC’s allegations: Requests judge to dismiss the lawsuit

Binance has officially responded to the lawsuit filed by the US Commodity Futures Trading Commission (CFTC) accusing it of offering illegal commodity trading products to US residents, and has requested that the US federal judge dismiss the lawsuit. In its response, Binance stated that the CFTC’s attempt to sue Binance exceeds its jurisdiction. The document states that Binance does not operate in the US, and its CEO, Changpeng Zhao, does not reside in the US. The first six allegations made by the CFTC “do not apply to foreign conduct alleged here,” and several of the allegations do not meet the legal standards required by law.

The US House Financial Services Committee has passed the “Payment Stablecoin Transparency Act”

The US House Financial Services Committee has officially announced on Twitter that it has passed the “Payment Stablecoin Transparency Act”. After fifteen months of bipartisan cooperation, this milestone bill is one step closer to becoming law.

UK and Singapore agree to jointly develop and implement global cryptocurrency regulatory standards

The UK and Singapore have agreed to jointly develop and implement global regulatory standards for cryptocurrencies and digital assets as part of their ongoing financial dialogue and partnership. The two countries also discussed their respective attitudes towards Central Bank Digital Currencies (CBDCs). Both countries emphasized the importance of being part of international standard-setting bodies such as the International Organization of Securities Commissions and the Financial Stability Board. The UK and Singapore also agreed to continue their dialogue and collaboration in other areas such as cryptocurrency and digital asset regulation, sustainable finance, fintech, and innovation.

French privacy regulator supports Bavarian authorities’ investigation into Worldcoin

The French privacy regulator has launched an investigation into Worldcoin, stating that the legality of the biometric data collection and storage by Worldcoin “seems problematic.” The French privacy regulator is providing support for Bavarian authorities’ investigation into Worldcoin.

It is reported that Bavaria is a federal state in southeastern Germany.

NFT

Project Updates

CoinList Twitter account regained control

According to official sources, the CoinList Twitter account has regained control, and the related phishing tweets have been deleted. CoinList stated that it will strengthen the security management of its social media accounts in the future. Earlier, on July 23, the CoinList Twitter account was hacked and phishing tweets about launching a native token were posted.

MakerDAO proposal to increase DAI savings rate approved, interest rate temporarily raised to 8%

In the governance vote that ended on Thursday, the MakerDAO community voted in favor of the proposal to introduce the “Enhanced DAI Savings Rate (EDSR),” which may temporarily increase the interest rate for DAI holders to 8%. The proposal received 99.93% of the vote. MakerDAO is starting to use more income-generating assets such as government bonds to support DAI and share part of the income with users. Last month, the protocol raised the DSR to 3.49% to increase the attractiveness of DAI. The EDSR interest rate will be determined based on the amount of deposits in the DSR facility and the base reward rate, and will decrease as usage increases.

“The Wall Street Journal”: Sequoia Capital Reduces Size of its Cryptocurrency Fund from $585 million to $200 million

According to sources cited by The Wall Street Journal, Sequoia Capital has reduced the size of its cryptocurrency investment fund from $585 million to $200 million. In addition, the company has also reduced the size of its ecosystem fund, which invests in other venture funds, from $900 million to $450 million. Sequoia Capital disclosed in March this year that it planned to reduce the size of these two funds due to the long-term downturn of the market. In the future, the cryptocurrency fund will be used to support start-ups rather than large companies facing challenges under current conditions. It was previously reported that Sequoia Capital had restructured its venture investment team and laid off two cryptocurrency investors. Last year, the company wrote off its investment in the cryptocurrency exchange FTX.

FTX and Genesis reach a preliminary agreement and request court approval for settlement

FTX and Genesis have reached a preliminary agreement to resolve a dispute involving Chapter 11. The legal representatives of both institutions wrote a letter to the bankruptcy judge on Thursday, stating that the claims between the two parties will be resolved through the agreement. They plan to file a motion with the bankruptcy court to approve the transaction. No details of the settlement were provided in the letter. Previously, FTX filed a lawsuit claiming that the cryptocurrency lending institution Genesis owed it up to $3.9 billion, but Genesis denied the claim. The amount was later reduced to a maximum of $2 billion.

Mysten Labs to launch Bullshark Quests 2 today, rewarding 5 million SUI tokens

Sui development company Mysten Labs announced that the first Bullshark Quests mission is about to end, and the next Quests mission will start at 15:01 Beijing time on July 28 and end at 14:59 on August 29. The eligibility for participating in Quests mission 2 will be expanded to SuiFrens Bullshark or Capy holders. Users must have SuiFrens Capy or Bullshark in their accounts and can join at any time during the mission. The DApps that can participate in Quests mission 2 include NAVI Protocol, Turbos Finance, Scallop, and Typus Finance. Like Quest 1, Mysten Labs is collaborating with the Sui Foundation to provide players with another reward of 5 million SUI tokens in Quests 2. The reward consists of two pools of 2.5 million SUI tokens, which will be distributed after the end of mission 2.

Previously, Sui development company Mysten Labs announced the launch of Bullshark Quests, a new way for Bullshark holders to earn SUI rewards. Mysten Labs has launched the first Quest, which includes a reward pool of 5 million SUI tokens. Bullshark holders can compete for rewards based on their participation in the Polymedia, Mini Miners, DeSuiLabs, and Ethos Wallet applications.

Arthur Hayes: AI Will Use DAO for Self-Organization in the Future

Arthur Hayes, the founder of BitMEX, stated in a post that artificial intelligence will use decentralized autonomous organization (DAO) structures for self-organization in the future. DAO relies on public blockchains – rather than nations – to operate. DAO structures will allow collaboration between AI and humans and serve as organizational structures that enable the development and prosperity of the AI+human economy. Nations cannot control AI, and DAOs will raise funds and trade tokens such as debt, equity, and utilities on non-traditional centralized exchanges (CEX) hosted by DEX. Platforms for trading all forms of DAO tokens may become natural monopolies. Identifying these DEX and purchasing their governance tokens will generate huge profits.

The Bank of Spain approves eToro as a virtual asset service provider

The Bank of Spain has approved the multi-asset investment platform eToro as a service provider for the exchange of virtual currencies for legal tender and the custody of electronic wallets.

Important Data

Data: FalconX has withdrawn a total of 8,951 MKR from Binance in the past 7 days

According to Lookonchain, FalconX has withdrawn a total of 8,951 MKR (approximately $10.5 million) from Binance in the past 7 days when a16z and LianGuairadigm deposited MKR into Coinbase.

Data: Meta’s Reality Labs division has incurred a loss of over $21 billion in 18 months

According to Fortune, Mark Zuckerberg’s Meta’s Reality Labs division has incurred a loss of over $2.13 billion since the beginning of 2022. The overall loss of Meta (since Q4 2020) is slightly less than $34 billion.

LianGuaiNews APP Points – PT (Grape) officially launched, participate in Read to Earn together!

PT (short for Grape in Chinese) is the points reward that LianGuaiNews users can earn by participating in interactive activities such as reading news, sharing content, and liking and bookmarking on the LianGuaiNews website and app. PT Grape cannot be traded or transferred, and can only be used to redeem various prizes in the “Points Mall” of LianGuaiNews and participate in various daily activities. Experience it now!

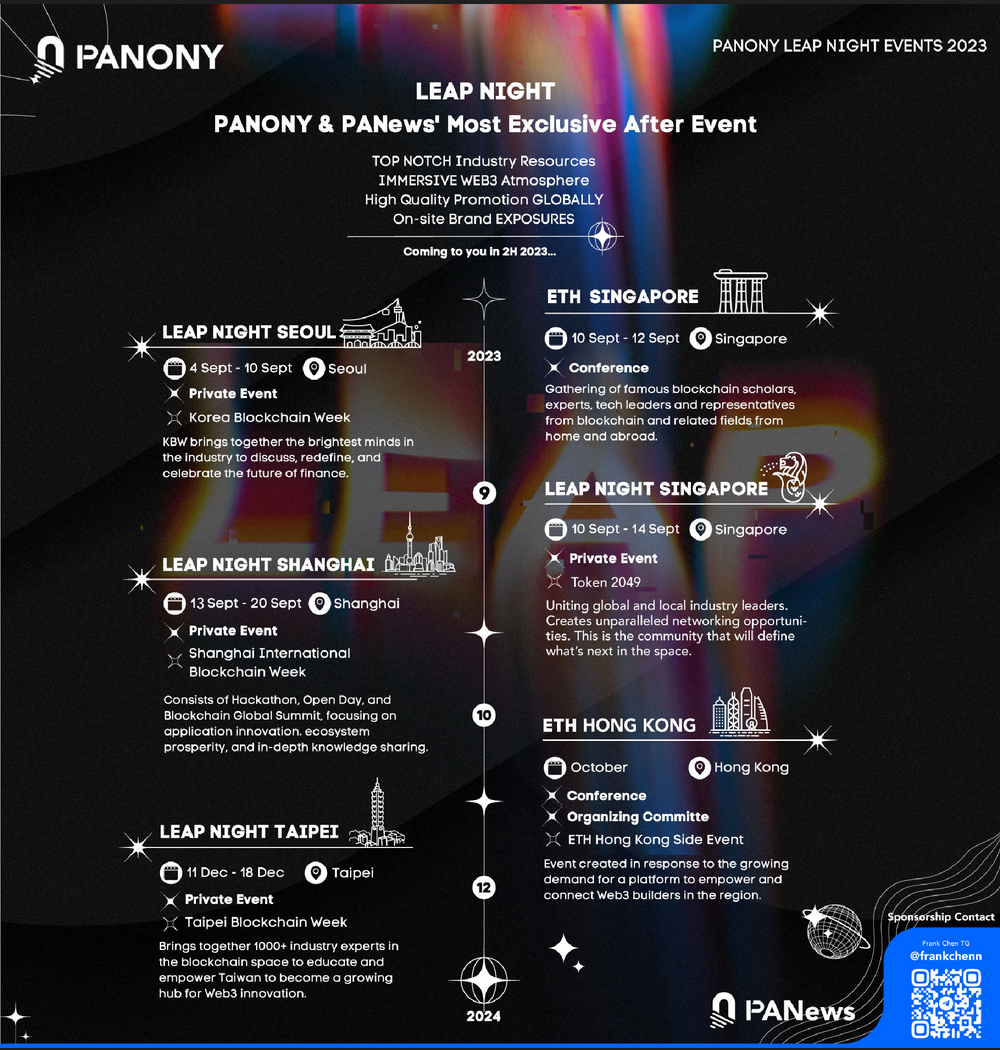

LianGuaiNews launches the global LEAP tour!

Seoul, Singapore, Shanghai, and Taipei will gather from September to December to witness a new chapter of globalization!

📥Activities are being jointly organized in multiple locations, welcome to communicate!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- LianGuai Paradigm Stablecoins have their unique characteristics and should not be included in the regulatory frameworks of banks and securities.

- Raft’s ten thousand character research report Decentralized lending protocol, the second largest LSD stablecoin $R issuer.

- Be vigilant of hidden Rug Pulls, as well as exit scams caused by contract storage.

- LianGuairadigm proposes ten potential trends, and intent-centric ranks first. What is intent-centric?

- Web3 Mobile Review Can the encryption industry usher in an iPhone moment?

- Another example of a flash loan attack, analysis of the LianGuailmswap security incident

- Comparative Study Differences and Similarities between ANS and ENS