Featured | Binance Launches DAO Research Report; Bitcoin Will Not Be A Medium Of Exchange (MOE)

Today's content includes:

1. Binance DAO Research Report: Theory and Practice of DAO

2. Growdrop: Reinventing Ethereum's DAICO with DeFi

3.What the Bitcoin job market will look like in 2019 and beyond

- Saudi and UAE leaders confirm digital currency launch

- 2020 Preview: 5 Trends of Blockchain Cannot Be Missed

- Technical Primer | Zk-stark: Low Degree Testing

4. Bitcoin will not become a medium of exchange (MOE)

5. Decred market strategy summary and guidance

Binance DAO Research Report: Theory and Practice of DAO

This is Binance ’s DAO research report. I personally think that the research is quite good, very comprehensive, and very cutting-edge. However, I also feel a little too focused on DAO. Perhaps it will be more perfect from the combination of crytpocommons.cc from the governance of different projects to DAO.

Key takeaways

– Binance Research defines DAO as: "A form of organization that coordinates members' work and resources through a priori consensus, formal and transparent rules that are agreed in a multilateral manner."

– DAO's working prototype has taken many different forms. These include blockchain, ecosystems, protocols, natural resources or mutual insurance.

– DAOs can be classified according to four main elements: multilateral agreements, resource management, and discussion and voting processes.

– DAO and law have two options: legal entity with legal personality: integrate DAO into the existing legislative environment because it can directly control off-chain resources and participate in legally binding agreements; usually by BBVA or ITAS, etc. Legislative activation; legal entity without legal personality: this is closer to the purist vision of an organizational form that is independent of the existing legislative environment; usually enabled by "qualified code references".

– When reaching a balance of interests between members and DAO, an incentive model based on game theory research is needed to overcome issues such as prisoner's dilemma, control of the commons and avoid Byzantine behavior.

– In order to overcome the governance decision problem of extremely low voter turnout, a well-designed incentive mechanism is particularly needed: DAOs that can truly expand and coordinate a large number of members have not yet appeared.

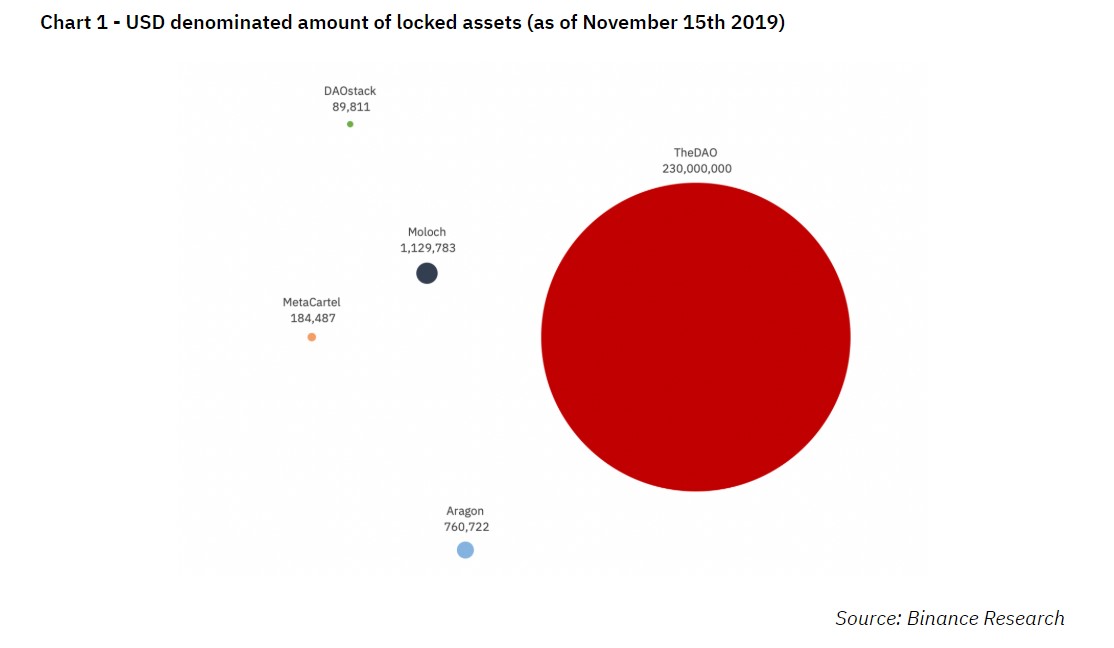

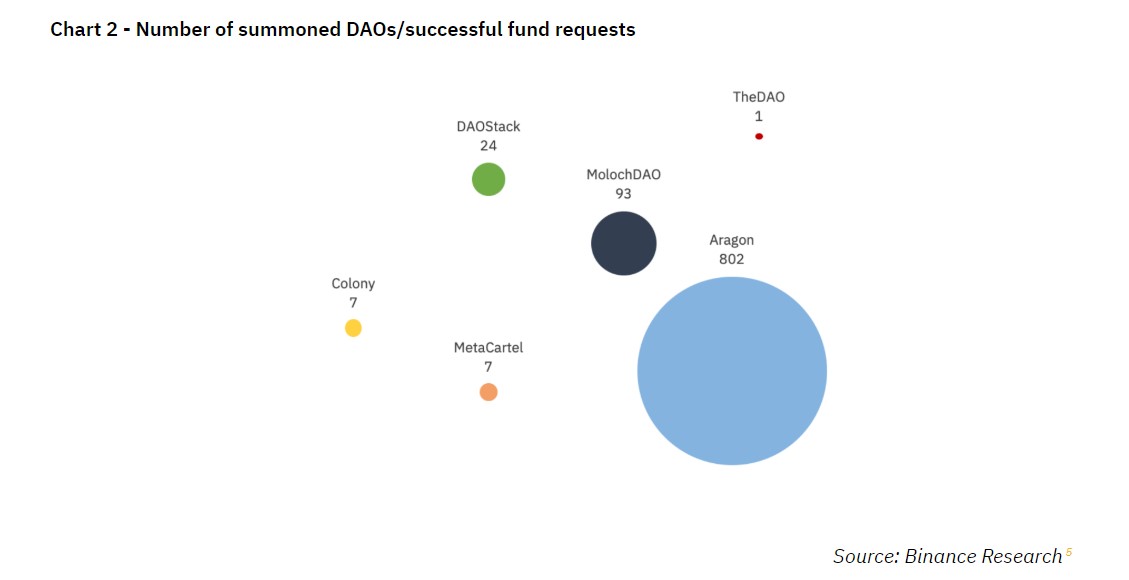

These two pictures are good:

Full text link https://research.binance.com/analysis/dao-theory

Growdrop: Reshape Ethereum's DAICO with DeFi

After evaluating various crowdfunding models in the past, the author proposes a new crowdfunding method called Growdrop, which can minimize the trust costs of existing third parties, and deposit investment funds into DeFi's Lending Protocol's liquidity pool, Growdrop. Investments can be made in the project, greatly reducing the risk of seed investment by supporters, and the project will slowly build communities to help promote public relations and technology development. Here, in the early Ethereum community, it was very similar in nature to DAICO.

But here is one point, users can use the interest generated in the Defi loan agreement to obtain the principal and invest in the project. At the same time, Growdrop supports not only token crowdfunding, but also donations.

Since the DeFi market is still an emerging market, there are risks that may cause side effects caused by interest fluctuations, and it is still active only in the Ethereum ecosystem. Of course, the project's interest rate may be small, but with Growdrop, open source projects can get seed funding and form a community culture with natural supporters, rather than expensive financing like ICO and IEO. Growdrop is a new financing model. This makes Growdrop a new option to contribute to open source projects and break the vicious circle of financing

Full text link https://medium.com/growfi/growdrop-funding-the-revolution-of-blockchain-ecosystem-with-defi-1ad89ddefcf0

What the Bitcoin job market will look like in 2019 and beyond

Cryptocurrency, blockchain and Bitcoin work at a glance. This is a data report article depicting the job market.

Searches for bitcoin, blockchain and cryptocurrency positions are declining, but employer demand is skyrocketing. Over the past year, the percentage of cryptocurrency job postings per million dollars on Indeed has increased by 26%, while the proportion of searches per million jobs has decreased by 53%.

From writing smart contracts to designing user interfaces for cryptocurrency applications, to building decentralized applications (dApps) that communicate with the blockchain, there is no shortage of work to do in the Bitcoin space, and the industry needs the top five The public races are all technical work needs.

Hire the companies with the most digital currency, blockchain and bitcoin jobs. Since blockchain technology has gone far beyond the financial realm, you will see a large number of cryptocurrency startups, as well as larger, more mature companies that have no direct relationship with cryptocurrencies.

Full text link: https://www.beseen.com/blog/talent/bitcoin-job-market-2019-beyond/

Bitcoin will not be a medium of exchange (MOE)

Bitcoin is a "good" coin. I'm sorry to tell you that "bad" coins will drive Bitcoin out of the market. The author wants to prove that bitcoin will not be able to serve as a medium of exchange (MOE) in the end, there must be a currency to act as "bad money". This may be a good story for many altcoins.

Bitcoin is digital gold. It is the largest value store of cryptocurrencies. But it doesn't help us much except for "storage of value." Some Bitcoin supporters see HODL as a use case. Some people say that Bitcoin is first a store of value and then a medium of exchange. In this narrative, it takes a lot of time for Bitcoin to be widely adopted. Once the market value reaches a certain scale, which may reach tens of trillions of dollars, people will use it as currency. But this narrative can only be used as a story to say that the price of Bitcoin is rising.

Bad coins expel good coins

Bad coins expelling good coins means that more valuable commodities (quality currencies) will gradually disappear from circulation. It will be replaced by a lower value commodity (bad money). For example, if people currently use silver coins as currency, the government decides to switch to copper coins. When the government issues a decree, the two tokens have the same value. In this case, people will hold silver coins and use copper coins. They will spend bad coins (copper coins) and keep good coins (silver coins), thus reaching bad coins to expel good coins, and bad coins become circulating currency.

Bitcoin needs to reach the critical mass of world domination. This is a future result that Bitcoin proponents often propose. In this future, the price of Bitcoin will become less volatile. It will be suitable as a medium of exchange. The argument stems from the micro perspective of Bitcoin economics. If bitcoin's market value is in the trillions of dollars, hundreds of billions of exchanges will not affect its price. The flaw of this argument is that it assumes that Bitcoin is regional, but Bitcoin is de-licensed and global. The supply of Bitcoin is fixed. But its demand is unpredictable, we may fall into war and trigger a recession, and we may achieve breakthrough productivity and rapid growth. The future is unpredictable. Another factor is the high cost. When Bitcoin no longer offers block rewards, miners will need to increase fees. When the transaction charges a high fee, Bitcoin owners will need to earn a considerable income to justify their high fees. Otherwise, he / she will do better by holding it. Bitcoin prices will continue to fluctuate. And due to price fluctuations, Bitcoin will not become a medium of exchange.

Bitcoin is a decentralized currency. It exists because many of us believe it has value. No one on earth can unite into a single conviction. There will always be other kinds of currency, and this money will not be as desirable as Bitcoin. So people will circulate them and keep their bitcoins. Bitcoin will become a store of value. We will use other "bad" currencies as the currency.

Full text link: https://medium.com/coinmonks/bitcoin-will-not-be-a-medium-of-exchange-30e01403896e

Decred market strategy summary and guidance

In fact, I'm not quite sure whether this thing is a proposal or a summary. It is a document from Decred, similar to the summary feedback document of the recent marketing strategy. It is interesting to write, there are many detailed reflections on decision-making, similar to guidance, and very "transparent". Fans of other coins can also take a look and learn marketing strategies and learn from it.

Extracted some scattered opinions:

We must know how efficient our existing marketing efforts are. To this end, we need to have a good vision of what has been done, evaluate the deliverables outlined in the proposal, and try to measure its impact. It all started with reports. Ditto reports twice a month, which is amazing and sets an example for all proposals.

Use "money" often. When explaining Decred, start with "money" or "rich money", then, carefully transition to complex terms, such as "decentralized advanced storage of degeneration values", "autonomous autonomous digital currency" Or "safe, adaptable, sustainable." It's important not to start with concepts that are so far away from everyday life. "Money" is even more powerful than "currency".

Be honest with Decred now. Always be prepared to present what we do and do n’t do fairly. Today, Decred is not a good SoV.

I think the strategy we should try is to connect directly with very relevant groups, and many communities have aligned with the values of the Decred community and reach the people who really matter.

Social media statistics are usually the first thing we do to assess the size of the community and the success of the project. Whether in the cryptocurrency space or elsewhere, there are many people with a large and / or highly relevant audience. Start communicating with crypto stars on Twitter.

Regardless of price or media coverage, we should remain calm. I'm not saying that our marketing efforts are poor. What I see is that we need something more to push.

Full text link https://xaur.github.io/writings/posts/20191127-marketing-strategies.html

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Expansion of Layer0 layer to be the CDN of the blockchain

- Proficient in Filecoin: Hello protocol of Filecoin source code

- Getting started with blockchain | What can blockchain do in agriculture?

- In Africa, I see the future of digital assets

- Ethereum token evolution: how will it develop in the future?

- Yesterday, 340,000 ETH on the Upbit exchange was stolen, but this server was attacked …

- Former Director of the Central Bank on Digital Currency, Blockchain Application and Fintech Development