Featured | What happens if you inherit 55,000 bitcoins?

Satoshi Satoshi's Notes: Feature 5 latest high-quality cryptocurrency articles each time

Today's content includes:

1) Humor video: Congratulations on inheriting 55,000 bitcoins

2) Paradigm: a week-long quick review of mainstream stablecoin dynamics, with in-depth reviews of Satoshi Satoshi

- Analysis of investor behavior using MVRV indicators: ETH contains downside risks, and BSV is relatively speculative

- In April, China's blockchain standard construction speeds up the application of large-scale landing and adds another puzzle

- "Epic" fund CXC issued a new currency: claimed to be zero-cost mining, actually paid back in 19 years

3) Grayscale: The next Bitcoin halving

4) Our Network: DeFi star project observation

5) Coinbase: Interpretation of the recent loan and DeFi market collapse and subsequent impact

1) Humor video: Congratulations on inheriting 55,000 bitcoins

This is a three-minute humorous short film about the most coveted story of the currency circle players. If you got 55,000 bitcoins, 2.6 thousandths of the total bitcoin, what happens next?

Full text link: https://www.abmedia.io/short-film-about-55000-bitcoin-loss/

2) Paradigm: One week quick overview of mainstream stablecoin dynamics

This is a one-week review of the dynamics of mainstream stablecoins written by Paradigm Fund. Paradigm constantly updates its blogs with a frequency of 2-3 posts / day. The content is mainly a dynamic summary of various high-quality projects. In this blog, Paradigm introduced the origin and recent developments of the five mainstream stablecoins (less DAI), USDC, GUSD, USDT, PAX, and BUSD.

- USD Coin (USDC): launched by Circle and Coinbase in cooperation, issued based on the Ethereum blockchain

- Gemini Dollar (GUSD): issued by the regulated and audited New York trust company Gemini Trust, based on the Ethereum blockchain

- Tether (USDT): launched in 2014, implemented on multiple blockchains including the Omni protocol, Ethereum, EOS, TRON, Algorand, etc.

- Paxos Standard (PAX): issued by Paxos Trust Company, based on the Ethereum blockchain

- Binance USD (BUSD): Approved by the New York State Financial Services Authority (NYDFS) and issued in partnership with Paxos (1: 1 USD guarantee), based on Ethereum and Binance Chain

Satoshi Satoshi commented: The above stablecoins except Tether (USDT) are all regulated and audited. Analyzing the stablecoins from the consensus level and the technical level, you will find that the above-mentioned stablecoins at the consensus level are almost all in the value of rivet dollars. For example, the stablecoin market size of other non-rivet dollar values such as stable pounds is currently extremely small; Ethereum, which has a relatively fast duration, a relatively high degree of decentralization, and a relatively low transaction rate, is a well-deserved king. Most of the stablecoins are based on the Ethereum blockchain, although it is still unclear about stablecoin transactions. The relationship between the continued growth of transactions on the chain and the value of the underlying blockchain.

At the same time, the exchange is constantly promoting its own stablecoin, USDC is launched by Coinbase, GUSD is launched by Gemini, Tether and Bitfinex have a great relationship, BUSD and Binance wear a pair of pants.

This may also result in the stablecoin being unable to be listed on each other's exchanges due to the competitive relationship between different exchanges. When Binance launched Solana, the introduction of the BUSD trading pair instead of the USDT trading pair proved its ambition. At present, it is enough to go to the center It is possible that DAI with no standing team may be widely accepted, although the mortgage mechanism (over-collateralizing the underlying blockchain's native asset ETH, and the above five stable coins are all US dollar rivet guarantees) may lead to a slightly smaller market size.

DeFi is one of the few use cases currently. The new generation of public chain may try to add this use case to cannibalize Ethereum. The first project of LaunchBase launched by Sun Brother after the acquisition of Poloniex is the low-profile version of MakerDAO, with TRX as collateral. Generate USDJ stablecoin. There are also many DeFi applications on Polkadot that use on-chain governance, which also means that POT can participate in DeFi while gaining staking benefits.

The scale of the stablecoin market continues to grow, and the variety is endless, which also means that new opportunities will be born.

Full text link: https://medium.com/paradigm-fund/weekly-shortcuts-usd-coin-gemini-dollar-tether-paxos-standard-binance-usd-4311007dab3c

3) Grayscale: The next Bitcoin halving

In the year after the first and second halving occurred, the price of Bitcoin increased by about 81 times and 3 times, respectively.

These are several changes in the crypto asset ecosystem since the last halving in 2016:

- Infrastructure development : There is tremendous development in the entry of crypto assets, and investors have more ways than ever to obtain and express their views on Bitcoin, including regulated futures markets, and options to go long and short Markets, and products and services provided by traditional financial services. Both traditional and emerging companies are consolidating their position among investors and actively working with regulators to establish a regulated and reputable Bitcoin portal for the global community

- Engagement : With the enhancement of the Bitcoin entrance and wider knowledge of the crypto asset category, more and more people have entered the market, most of them have not invested during the halving event

- Market shocks : The prices of all markets and asset classes have been tested by unpredictable shocks, including geopolitical uncertainty and fiscal policy changes. In addition, the global uncertainty surrounding the current COVID-19 crisis continues to be reflected in huge market volatility. As investors respond to these rapid and obvious fluctuations, they will continue to seek diversification of their investment portfolios to protect themselves from market shocks. Investors will pay more and more attention to digital assets such as Bitcoin because it has historically been unrelated to other assets they may invest in

Full text link: https://medium.com/grayscale-investments/btc-halving-aa59f2572515

4) Our Network: DeFi star project observation

This is Our Network's review and analysis of DeFi star projects, including 0x, Uniswap, Kyber, dYdX.

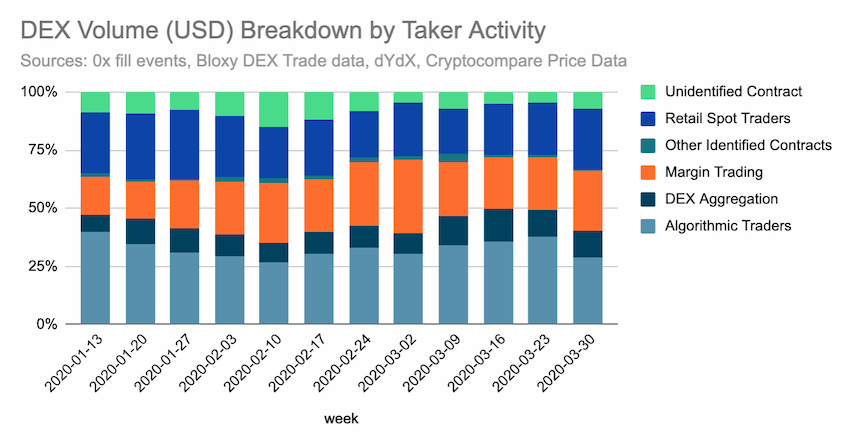

0x Data scientist Alex Kroeger identified and quantified the four main use cases of DEX liquidity through data analysis, namely:

- Spot transactions of retail investors , such as KyberSwap, Uniswap and Tokenlon, accounted for 26% in the past week;

- Margin trading , currently dominated by dYdX, and other DApps such as Nuo, accounted for 26% in the past week;

- DEX aggregation , using the liquidity of multiple DEX in a single transaction to achieve better price discovery, such as 1inch.Exchange, DEX.AG, etc., accounting for 11%;

- Algorithmic trading , arbitrage across DEX agreements, clearing lending agreements, arbitrage across DEXs and centralized exchanges, etc., accounted for 29%.

There is also Blocklytics co-founder Caleb Sheridan summarizing Uniswap's past trading volume and liquidity pool reserves, D5 co-founder Alex Svanevik analyzing the changes in the stable currency balance of centralized exchanges, and Kyber ecosystem growth director Deniz Omer analyzing Kyber.

Full text link: https://ournetwork.substack.com/p/our-network-issue-16

5) Coinbase: Interpretation of the recent collapse of the loan and DeFi market and its subsequent impact

An unprecedented plunge occurred on March 12, and many people attributed the lack of funds and high leverage on the floor, so who is borrowing? Speculators, miners? This is a blog written by Coinbase, which comprehensively reveals the reason and use of the lending market, and what will happen after the market collapses?

The crypto asset lending market has been strongly promoted. Over the past few years, loans from traditional institutions and crypto native products have totaled approximately US $ 13 billion.

The lending market enables participants to: 1) lend their encrypted assets to others and collect interest; 2) borrow cryptocurrency through collateral to pay for borrowing costs.

This market is either provided by a centralized institution or a smart contract platform (to ensure that capital losses are avoided). In this area, the company ’s main source of income is the net interest margin, that is, the interest rate paid by the borrower and the lender ’s The difference between the interest.

But lending activities are accompanied by risks. Borrowers can default on loans, especially when the underlying collateral experiences large fluctuations. In this article, we studied the performance of the lending market during the recent collapse of crypto assets on March 12.

Full text link: https://blog.coinbase.com/around-the-block-5-downstream-impacts-of-the-recent-market-crash-on-lending-stablecoins-and-48d39a3e3921

Chinese version (translated by Blue Fox Notes): https://www.chainnews.com/articles/643518999218.htm

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Technical Guide | How does Poka's NPoS mechanism work?

- Opinion | Monetization of Bitcoin and Ethereum: Who can be the next world currency?

- Babbitt Column | Cai Weide: Blockchain is used for credit information to build a "Taoyuan World"

- Introduction to Blockchain | Why do miners overclock and downclock?

- Viewpoint | The Cyber Revolution in the Digital Securities Industry: How Can Sovereign Digital Identity Bring New Liquidity to Digital Securities?

- Blockchain Weekly | Tesla, Nestlé and other big companies apply blockchain; BCH and BSV are both halved

- Introduction | Cryptocurrency Derivatives and the World of Digital Financial Assets