Opinion | Monetization of Bitcoin and Ethereum: Who can be the next world currency?

Over the past two years, the cryptocurrency industry has undergone major cleansing to eliminate inferior currencies. Most altcoins have collapsed, and historical highs have plummeted by more than 90%. The market value of BTC occupies more than 60% of the total market value, regaining the top spot in the industry. Some people believe that this obviously indicates that BTC is expected to become an illegal currency world currency. On the other hand, the rapidly developing Ethereum DeFi should not be underestimated.

I want to analyze two ways to achieve currency through this article:

- The method adopted by Bitcoin is to first consolidate the basic currency, and then only consider the secondary currency (montary aggregate) on the second layer / side chain, which is the general term for the statistical indicators of the number of currencies under different calibers. Here we take its derivative meaning, translated as "Secondary currency" is a problem that arises during the use of the basic currency and is a financial instrument similar to currency.

- The method adopted by Ethereum is to focus on secondary currencies: loan agreements, derivatives, etc .; the base currency is regarded as a dynamic tool, independent of the development of the total currency.

Total currency

The fundamental difference between Bitcoin and Ethereum is their different understanding of the composition of currencies. In the current monetary system dominated by fiat currency, currency is actually very vague. We usually discuss currencies at different levels and calibers. Each level has different levels of liquidity and counterparty risk.

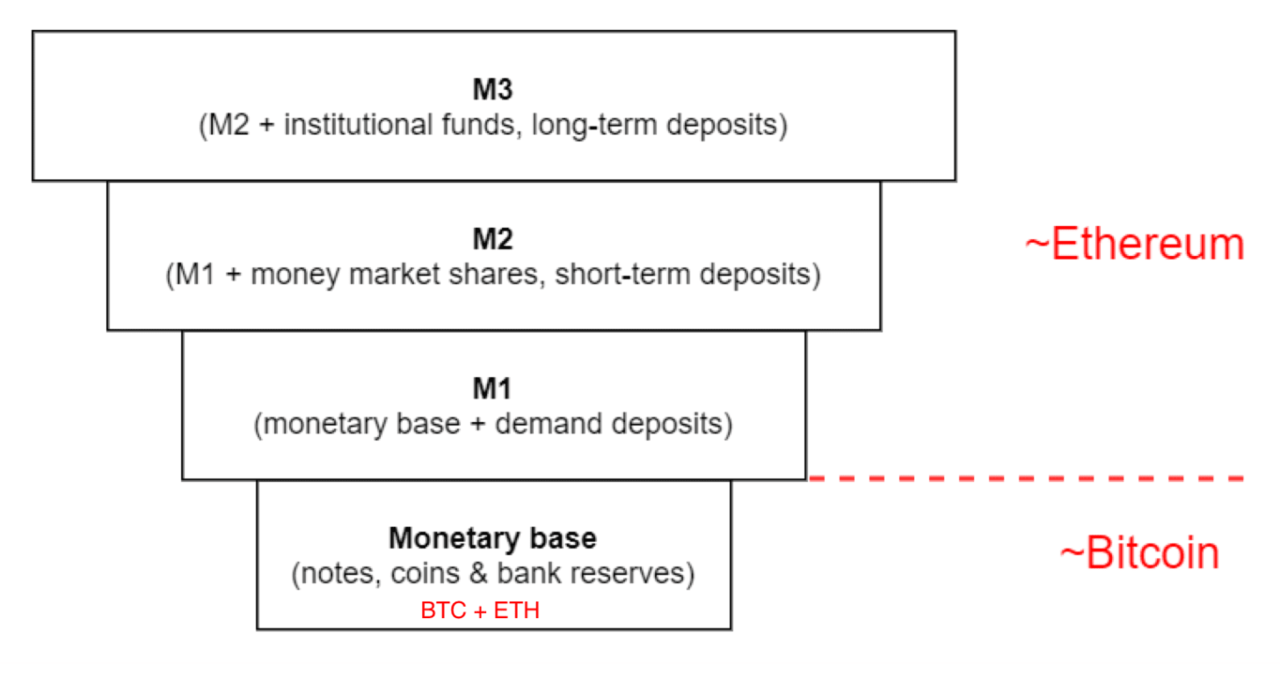

We can visualize the concept of currency through the inverted pyramid structure:

- Babbitt Column | Cai Weide: Blockchain is used for credit information to build a "Taoyuan World"

- Introduction to Blockchain | Why do miners overclock and downclock?

- Viewpoint | The Cyber Revolution in the Digital Securities Industry: How Can Sovereign Digital Identity Bring New Liquidity to Digital Securities?

-Translator's Note: The base currency includes paper money, coins and commercial bank deposits; M1 is the base currency plus demand deposits; M2 is M1 plus currency market share and short-term deposits; M3 is M2 plus institutional funds and long-term deposits Note that different calibers regarding the amount of money often only have a consensus on the calibers of M0 to M2. –

As can be seen from the above figure, the Bitcoin community mainly focuses on the characteristics of the base currency, while the Ethereum community pays more attention to the amount of money.

The base currency is at the bottom of the inverted pyramid-referring to the cash in our wallets and the reserve reserves of commercial banks held by the central bank. The base currency is a narrow currency because it is the ultimate settlement tool: whether you are a citizen holding cash or a commercial bank that deposits reserves in the central bank, there is no counterparty risk.

In addition, whether you are a citizen with deposits in a bank or a commercial bank with overnight deposits in the central bank, your counterparty risk is very small-your depository institution may be insolvent or bankrupt. This is one of the reasons why commercial banks in the United States began to deposit excess reserves in the central bank after the financial crisis, because the trust between commercial banks has disappeared (the other reason is that the Fed began to pay the reserve interest rate).

Part of the reserve system is the fundamental reason for the formation of inverted pyramid institutions-banks can issue various forms of loans with a value multiple of the reserves they hold, and the specific size of M2 is often based on the credit rating of the lender. The higher the pyramid, the higher the level of trust required and the lower the liquidity of the asset (ie, the harder it is to exchange).

(Interestingly, the total amount of money in Ethereum has a positive pyramid structure because it uses an excess guarantee system. However, this situation will change once the non-excessive guarantee money market model is formed.)

In fact, we are exposed to M1 and higher-level currencies in most transactions. Individuals and businesses around the world are increasingly adopting payment methods such as electronic transfer / credit / debit cards, and use of cash is becoming less common.

Let's summarize this section and then discuss the impact of this on Bitcoin and Ethereum. We have come to the following two conclusions:

- The definition of currency is not a single dimension: it depends on the level of trust and liquidity at different levels.

- Although the base currency has the highest degree of trustlessness and the strongest liquidity, M1-M3 are the source of currency utility.

Bitcoin's way to achieve monetary attributes

As I hinted in the previous section, Bitcoin's first effort and always the first priority is to create a reliable base currency. Let's take a brief look at the theoretical basis put forward by everyone:

- The widely circulated hard money theory and Plan B's "Stock to flow model" (in fact, it is just a popular version of the hard currency theory); half the output is a holiday in the Bitcoin world (Other festivals include: Pizza Festival, White Paper Festival, Genesis Block Festival)

- Emphasize the importance of decentralized governance and the success history of Bitcoin on this (for example, UASF (User Self-Activated Soft Fork ) and No2X Movement (against the double expansion of Bitcoin blocks))

- Bitcoin's future security budget theory that has been continuously discussed and analyzed (see Nic Carter , Dan Held , Hasu, and below)

- Scalability of payment methods : from startups that are developed on the basis of Bitcoin technology and are committed to improving the scalability and interchangeability of payments (such as Samourai , Wasabi , Strike , Lightning Labs , Square Lightning SDK )

- Social scalability : Bitcoin ’s efforts in value storage tools and payment methods may be regarded as lack of passion, but it is these efforts that naturally make Bitcoin a Schelling point of the global illegal currency (a common choice formed naturally), Because only soft forks are applied when the protocol is changed, there is no need to worry about the ongoing governance disputes (if there is really a need for collective participation in the debate, then there is also a headache, which language should be used for governance discussions)

- Decentralized expansion : Bitcoin's full nodes can be run with ordinary consumer-grade hardware, and Bitcoin's block size has also been very small, ensuring that users who use the general network can also synchronize the Bitcoin blockchain and afford the zone The storage space requirement of the blockchain; and the choice of full-node hardware is also increasing (see the full-node hardware overview on Bitcoin Magazine)

- A conservative approach to protocol upgrades : only soft forks are used to activate the upgrade, and the upgrade content is subject to rigorous peer review, even if the "not so troublesome " upgrades like the Schnorr signature scheme took several years to achieve

All in all, the Bitcoin community has accepted a very conservative and open and transparent method to lead the development of the protocol, trying to avoid breaking the consensus and Bitcoin's Sherin point status. "Reliable base currency" is the first priority, and the functions presented in the layer above the base currency are implemented by the two-layer network or even the three-layer network on the blockchain ( Lightning , Liquid , Debnk , etc.). The value storage function driven by a clear and reliable monetary policy seems to be the main reason why Bitcoin has gained global acceptance for so many years.

Of course, this conservative method has been criticized. Some people do n’t think this conservatism makes any sense, and then initiated a fork (mainly BCH and BSV) or proposed a new project (Ethereum), which also produced a lot of expression package.

– expression package of: Fiskantes –

Parker Lewis of Unchained Capital made a particularly good summary of Bitcoin's monetary development in his article " Bitcoin will replace all other currencies ":

However, no currency can simply "scarce for scarcity". Conversely, currencies with a maximum number can mediate transactions most efficiently. The most scarce monetary commodities can maximize the preservation of value in transactions across time. The relative value and relative price of all other commodities are information that is only needed after the collaborative function of money; in each transaction, each individual is motivated to maximize the value that can be saved in the future. The limited scarcity of Bitcoin will maximize the guarantee that the value of the current exchange can be saved into the future, and as more and more individuals believe that Bitcoin is the most relatively scarce monetary commodity, its price is stable Will come naturally.

Ethereum's way to achieve monetary attributes

If we regard the DeFi movement as the application scenario where Ethereum is most suitable for the market, we will find that Ethereum's road to achieving monetary attributes runs counter to Bitcoin. Let us briefly explain the reasons:

- Ethereum focuses on the utility aspect of currency -using its native token (Ethereum) as the " economic bandwidth " of a decentralized ecosystem, not as a store of value or a means of payment.

- Ethereum ’s monetary policy is flexible and is committed to achieving maximum on-chain security (rather than implementing a planned inflation policy); therefore, there will be no hard cap on the issuance of Ether or a clear inflation curve —— On the contrary, Ethereum implements a " minimum necessary circulation " monetary policy.

- Running nodes have high requirements on hardware and bandwidth -it is now difficult to start from scratch and synchronize Ethereum full nodes. About 70% of full nodes are running on managed cloud services such as AWS. In addition, it can also be run through dedicated full-node hardware like Bitcoin; it is also worth mentioning the economic incentive experiment of the node operator (for example, Pocket Network ) (Note: Eric Wall ’s Twitter given above In the link, he re-synchronized and replayed all Ethereum transactions ( I do n’t think this is necessary at all )-using the same secure fast synchronization, which took a day- for more details, click here ).

- As David Hoffman explained, there are three ways to achieve the scarcity of Ethereum: DeFi, PoS pledge, and fee destruction; from this, it can be seen that the road of Ethereum to achieve monetary attributes is an iterative process (mentioned above Two of the three mechanisms have not been implemented).

- David Hoffman also pointed out that the concept of currency has always been inseparable from debt (see Graeber's book "Debt: The First 5000 Years"), and the DeFi agreement uses this to give Ethereum currency attributes-making Ethereum a kind of Standard deferred payment method .

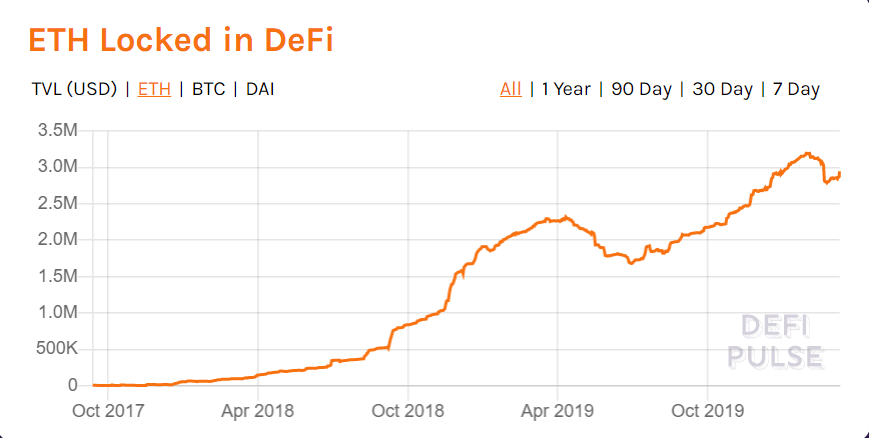

"Move quickly and introduce new ideas" is the consistent style of Ethereum. The community is always trying multiple application scenarios at the same time, and iterating again based on the last thing left. DeFi seems to be one of the scenes that has been left behind after a long trial. Various DeFi services are steadily attracting Ethereum as its "economic bandwidth":

-Source: DeFi Pulse-

The DeFi service is praised for its license-free (at least some services have this feature) and composability (referring to the possibility of interaction and collaboration).

I think the reason why DeFi can subvert the blockchain industry is because of its transparency and auditability. As Ryan Sean Adams pointed out in a recent discussion on Ivan on Tech podcasts, we cannot audit Coinbase or Kraken's collateral and internal operations-but we can do this for MakerDAO and Compound. Therefore, bZx's ability to use audits so quickly to discover vulnerabilities is a matter of celebration, and people should not simply condemn it for being insecure. In contrast, Mt. Gox has been insolvent for more than two years, but no one knows. As soon as bZx was attacked, everyone knew within a few hours.

The reason why DeFi can give Ethereum currency attributes is because it just overcomes the shortcomings of the modern financial system-closed, narrow and exclusive. Even the centralized " cryptocurrency bank " has been heavily restricted: Kraken's futures trading is banned in 36 countries , including the United States-Kraken itself is an American company! In addition, handing over assets such as Bitcoin and Ethereum to custodian institutions is very risky, and may be the Achilles heel of this currency revolution-custodian institutions can easily confiscate assets, just like in the 1930s The enacted US Presidential Executive Order obliges citizens to hand over gold to the Federal Reserve Bank.

On the other hand, DeFi still has a long way to go to truly convert ETH into currency.

First, there is always a trade-off between functionality and decentralization. Simple protocols, such as Uniswap, can be " full contracts ", but can advanced modules like currency markets also be full contracts? With governance and administrator keys, there is always a risk of compliance and governance attacks .

Second, composability (the interaction of agreements) brings both new opportunities and new problems. No one foresaw the lightning loan attack. And with the refurbishment of the DeFi field, many more complex attacks will come. Transparency and access-free properties have also produced many coveted money jars. Although insurance like Nexus and Opyn may help a little, if the attack becomes regular, the premium will be higher and higher. Therefore, the DeFi application project should ensure that the bounty can be used to attract people who expose the vulnerability, rather than letting their application become a money box.

Third, DeFi is still a niche field, and it may just be something within a complex Ethereum circle. There are many reasons for this: Maker, Compound and other services, where most of the value locked in comes from a few large households; when the price of ETH rises, the amount of ETH locked in the DeFi agreement decreases (appears in the summer of 2019 and February 2020). The indicator "ETH locked in DeFi" did not grow exponentially. Just like the entrepreneurial trend, it increased by 3000% in 2018, but it was only 52% in 2019. Now (2020), it has even fallen. As of the date of writing, DeFi has absorbed 2.6% of the total supply of ETH, which looks good, but it is still a niche field.

to sum up

Both Bitcoin and Ethereum hope to become the first world digital currency without government intervention, but both will have to overcome their respective potential weaknesses in the next 5 years:

- Bitcoin must be able to survive with its hard-coded monetary policy: the two production halvings that will occur in the next five years will tell us whether this monetary policy will work. It is essential to provide "transaction density" through economic activities on the side chain and the second-tier network. Auctioning future block space requirements through futures contracts will also help the entire market (if there is a predictable demand for futures settlement).

- Ethereum must prove that it can achieve monetization on the base currency layer that does not change. If the job of migrating to Ethereum 2.0 goes smoothly, then eliminating the need to focus on governance and the automation of monetary policy should also keep up. But there should n’t be a strong leader in a decentralized currency agreement, no matter how powerful the Chrisma personality in his position (translator's note: charismatic, Max Weber's sociological concept, refers to the absolute leader and dominance) Personality).

Both Bitcoin and Ethereum also need to create internal circular economic circles to eliminate dependence on fiat currency access channels. This is especially true for Bitcoin-in order for Bitcoin to become the base currency of the future, Bitcoin fans should consider starting to use Bitcoin / Satoshi as a unit of account.

Various interoperability solutions not discussed in this article may also bring the common success of Ethereum and Bitcoin as currencies. For example, one possibility is to use Bitcoin as a natural base currency, use Ethereum to provide other levels of currency functions, and then use trust minimization schemes such as tBTC and renBTC to utilize Bitcoin.

Judging from the situation in the past few weeks, it is very difficult to predict the future, and the future is far more likely than we thought.

Judging from the recent global market and social dynamics, mankind is entering a new era. Hopefully, in this new world, there will also be a demand for the world currency of illegal currencies.

Postscript: Most of this article was written before the price of Bitcoin and Ethereum fell in mid-March 2020. Although these events did not allow me to change the ideas expressed in this article, I admit that the current DeFi service (Mainly MakerDAO) has shown their vulnerability, because they are easy to fail in the black swan event (that is, when the network is congested and the currency price plummets, their incentive model will not work). However, in this circle, every failure is a good learning opportunity. Even if this group of DeFi services fails, there will always be a better group that will step on their shoulders and make their heads.

(Finish)

Editor's note: Regarding the currency nature of Bitcoin and Ethereum, everyone has already discussed a lot, and some things have become commonplace, but in fact, this is still the most worthy of discussion. The reason why this article is special is not only its fairness of opinion, but also that the author points out the problems that both sides ignore. Supporters of Bitcoin have long used theories related to basic currencies to explain the meaning of Bitcoin, but as the author pointed out, the meaning of currency is complex and the caliber is diverse, proving that Bitcoin has the adaptability to meet these complex needs , Is an issue that should not be ignored (in fact, this issue has also been discussed in the discussion of Bitcoin scalability). For the supporters of Ethereum, there are also some problems that have been downplayed or even ignored in the geek culture of the community, including but not limited to the tension of governance and the stability of monetary policy.

Original link: https://bankless.substack.com/p/the-moneyness-of-bitcoin-and-ethereum Author: Josef Tětek translation & proofreading: Min Min, A & A sword sword

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Blockchain Weekly | Tesla, Nestlé and other big companies apply blockchain; BCH and BSV are both halved

- Introduction | Cryptocurrency Derivatives and the World of Digital Financial Assets

- Babbitt's weekly selection 丨 BCH halving failed to promote the rise, halving effect is exclusive to Bitcoin; DeFi "Big Bang" or coming

- Observation | Hunan is building a 100 billion-level blockchain industrial park, and Shandong, Chongqing and other four provinces are gaining momentum

- Babbitt column | The payment revolution under the epidemic: What does it bring to CBDC?

- Introduction to Blockchain | In-depth understanding of Orphan Block: Orphan Block is actually a stale block

- Viewpoint | From community trust to algorithmic trust, blockchain leads the logistics revolution in credit