Fire coin "explosion door"

On May 17, the BTC price plummeted and fell to around $1,000 in half an hour, which led to a contractual long-term disaster. On the same day, a single BitMex platform exploded 20,000 bitcoins.

This round of "pins" market, so that "multi-military" is badly hurt. Afterwards, some people listed the lowest price of the BTC contract on the 17th of the three contract platforms of BitMex, OKEx and Firecoin, the three were respectively $6,380 (sustainable), $7,025 (quarterly), and $6,791 (quarterly).

Obviously, BitMex, the home of the perpetual contract, is the worst. The quarterly contract price of the fire coin is lower than OKEx.

In the “pin” market, stable contract prices can help investors reduce the risk of explosions, and the coins and BitMex contract products have been criticized by users.

- Market potential exceeds 10 billion enterprise blockchain track surge

- The Korean government announced the establishment of the second research group on blockchain supervision

- South Korea: Asia's blockchain center?

In the contract market, the fire currency is a latecomer, and it was only officially launched in December last year. Like the predecessors, the fire coin contract is also suffering from development. User feedback, the fire currency contract has been unable to close the position under extreme market conditions, the trading page is stuck, and the trading depth is insufficient.

The fire currency contract user Li Xin (pseudonym) told the Honeycomb Finance that he was forced to close the position on the fire currency contract twice on February 24 and April 4, respectively. "At the time, the market was fluctuating violently. I wanted to close the position. However, it has been prompted to fail until it bursts. "Many users have reflected a similar situation in the official group of the fire currency contract.

Li Xin wants to seek legal means to recover the losses. The user "Small Stone" told the Honeycomb that he was ready to go to the fire currency contract office to defend his rights. Some people also disappointed that "there will be no more use of the fire currency contract."

The pits that the forerunners stepped through in the contract market could not escape the fire coins. In this high-profit land, the fire currency is long and long.

BTC plunged fire coin contract "deep pin"

At about 10 am on May 17th, the BTC price fell like a waterfall, and the fire currency contract user Liu Kai (pseudonym) panicked. A few hours ago, he opened a BTC lot in the fire coin contract.

He hurriedly opened the page of the fire coin contract, but the page was stuck all the time and was displayed after repeated refreshes. At this point, Liu Kai’s position data has disappeared and he broke the position.

Looking at the "big cake" is still falling, Liu Kai can only admit that he is unlucky. "Under this market, the army will definitely be wiped out."

After an hour, the BTC price gradually rebounded. After the storm, the panic gradually dispersed, but the contract price difference of each platform at that time tied Liu Kai’s heart.

The data shows that the minimum price of the BTC contract on the 17th of the three contract platforms of BitMex, OKEx and Firecoin is US$6,380 (sustainable), US$7,025 (quarterly) and US$6,791 (quarterly).

May 17th, the quarterly contract price of the fire coin is as low as $6,791.

Liu Kai felt that "there is no harm without comparison". "This time, the coin insertion is obviously deeper than OK. If the price of the fire coin is not stabilized, it will be unsuccessful. Who is going to talk about it?"

He did not understand why the contract prices of the two platforms differed so much. What is the problem?

Some people in the industry pointed out that many contract trading platforms will use the BTC dollar price on Bitstamp to make the spot index component. This spot index and contract price will affect each other.

From the public information, the BTC price of Bitstamp is used in the BTC spot index components of BitMEX, OKEx and Firecoin.

Just a week before the plunge, OKEx adjusted its contract index and added the BTC dollar price on OKCoin. As a result, the BTC spot index in the OKEx contract market is referenced by five transactions, each with a weight of 20%. The fire currency BTC spot index refers to 4 exchanges, each with a weight of 25%.

When the BTC on Bitstamp plunged, the contract price was more intuitively influenced by reference to the slightly higher weight of the exchange. This kind of influence is more intense on the perpetual contract platform BitMex. The exchange accounted for 50% of Bitstamp's price reference component. When the price was abnormal on the day, 20,000 BTCs were exploded.

In the case of the low price of the fire currency contract on the day, the fire currency said to the Honeycomb Finance, the lowest price point of the BTC on May 17th, the comprehensive price index of all BTC platforms was 6623.78, compared with other platforms that provide quarterly contracts, the fire money was 6,791 US dollars. The contract price is smaller than the spread of the "comprehensive price index" and the contract price is more reasonable.

Investor Mark has a different attitude towards the above statement. He is an old player in the traditional futures market and went to the currency circle to play the contract last year. On May 17, he also noticed price fluctuations on the three contract platforms.

Mark analyzed that there was a huge drop in BTC on Bitstamp that day. Other exchanges linked and the contract price fell, but the BTC stopped falling at around $6,000. The bearish sentiment was not so serious because investors soon discovered that this was not The market is generally down, but it is caused by a single exchange. "After this short-term abnormal decline, there will generally be a rebound. The long-term sentiment will first be reflected in the contract market. If the contract exchange is large enough, the depth is good enough. When the needle market is down, the price of the contract should be much higher than the spot price. The price difference is reasonable, and the market has proved this. The BTC has indeed rebounded."

As a non-professional investor, Liu Kai did not study too much on these market rules, but he believes that the price of the fire currency contract was hit lower this time, because the depth is not enough.

This "not enough depth" impression comes from his actual operation. He recalled that sometimes he judged that the market would go down, and he immediately followed an empty order. "For example, I have 0.5 BTCs that have opened 20 times leverage and shorted, can't eat after the order (can't be sold), or can only eat a little bit, but On OK, 1 and 2 BTCs will open the same leverage and they will be able to make a deal."

Liu Kai, who has always been a loyal fan of fire coins, has had some trepidation after this incident. However, for this contract product that has just been on the line for half a year, Liu Kai also confessed that he could not ask too much. "It always needs a little improvement. Look at it later."

"Unable to close the position" under two extreme market conditions

After 5 pm on the 17th, after the spot price of BTC gradually stabilized, the fire currency release system upgrade announcement stated that “the system will be upgraded and maintained from 18:00 to 19:00, and it is impossible to open, close, or withdraw the order during the upgrade. "Firecoin did not inform about the system upgrade for what.

Temporary upgrades have also caught many users off guard. In the community, many users expressed dissatisfaction.

"Can't operate, the list is estimated to be over."

"I won't be in a day or two in advance, I have to inform a few minutes in advance? Is this playing Happy Bean?"

“Interim maintenance, request compensation.”

At 6:37 pm that day, the user "miner Chen Hao" said in the community, "During the maintenance period, a large number of people burst into a warehouse, and they screamed." He believes that if the platform is to be maintained, it cannot be closed and cancelled during maintenance. Should give the user sufficient reaction time, only a few minutes in advance to issue a notice slightly sloppy.

In the eyes of the old user of the fire coin contract, Li Xin, this operation has been regarded as a conscience. He broke the news to the Honeycomb Finance. He had twice suffered a "unconventional" explosion on the fire currency contract on February 24 and April 4 this year, and suffered heavy losses.

“Every time when the market fluctuated drastically, I received the SMS alert message, I immediately operated through the computer, IOS and Android phones, but I was unable to close the position and finally was forced to be flat.”

Li Xin revealed that he has been continually adding EOS to make more contracts since February 18, with a total of 90,000 positions ($10 each), worth more than 6 million yuan. After the rise, the value of all positions on February 24 is approaching. Ten thousand yuan. At around 10 o'clock that night, the market fluctuated drastically. He received the “margin margin risk warning message” from the fire coin, but it was unable to close the position after several attempts in a few minutes, which eventually led to the position being flat.

For the EOS quarterly market, the EOS index continued to rise from a minimum of 2.77 US dollars on February 18 to 4.5 USD on February 24. But that night, the EOS price plunged from a minimum of $4.5 to $3.2, a drop of 28.8%. Li Xin said that he was exploding in this wave of plunge.

It is not Li Xinyi who broke the position because the firecoin contract could not be operated for a short time. In the official group of the fire currency contract, many users reported that they could not close the position, or there were problems such as the inability to land the fire currency contract. The user "peak" emotionally expressed that "strongly defending the rights, the line has been stuck, can not operate to lighten up? Can the fire coin give a statement?"

On April 4, a similar incident happened again. Li Xin said that he had more than 20,000 contracts with XRP and EOS at the time, worth more than 1.3 million yuan. At 7 o'clock in the morning, the two currencies plunged at the same time. The XRP quarterly index of the fire currency contract fell from 0.3954 US dollars to 0.333 US dollars, a drop of 15.7%; the EOS quarterly index fell from 6.936 US dollars to 4.748 US dollars, a drop of 25.7%.

However, in this "pin" market, Li Xin said that he has been unable to place an order for a few minutes. "At the time, other platforms were all normal, and the network refreshed display was all normal. It was always prompted that the operation failed, and finally it was directly flattened."

Screenshot of the burst page and SMS provided by Li Xin

Looking at the chat history of the official community of the fire coins at the time, the users have already fried the pot. The "fire coins are stuck again" and "pull the network cable" and other doubts have come and gone.

On April 4, many users reflected the fire coin contract in the community.

Before the opening of the contract, the other contract exchange OKEx was deeply immersed in the “rights of rights protection”. Looking back, the criticism of OK, such as "plugging the cable", has now fallen on the fire coin.

After being unable to close the position, Li Xin repeatedly contacted the customer service of the fire currency contract, hoping to recover the loss. In the end, the customer service reply email of the fire currency contract stated that “the April 4th due to the inability of the APP Caton to place a single order, the company has verified it and verified the position of your position, and obtained the following compensation plans, including 371 EOS and 4534 XRP."

Firecoin contract customer service email said it will compensate Li Xin

Li Xin is dissatisfied with the compensation plan because it is far from enough to fill his losses. He believes that the fire coin only wants to borrow some small compensation to pay more attention to it. "Since there is compensation, what is the problem? In any case, the fire currency will never answer this question." He intends to seek legal and relevant government departments. Help to recover the loss.

The user who nicknamed "Little Stone" also reported to the Honeycomb Finance that he was inquiring about the office address of the Firecoin contract and was ready to defend his rights.

In this regard, the fire currency has not responded.

"Zero allocation" highlights into user slots

Since the official launch on December 10, 2018, the fire currency contract has been available for more than half a year. In the face of some rights defending voices from time to time in the user community, the fire coins are also trying to use their own strength to crush the doubt.

On May 17th, after the BTC plunging storm, the hot money global station put a striking promotion picture: the fire coin contract was distributed for 23 consecutive weeks.

Firecoin contract "zero share" boarded the global station "big screen"

“Zero allocation” often means a strong risk control capability of the contract system. In the contract transaction, the apportionment occurs in the short position, that is, in the extreme market, the user's strong flat fails to make a timely transaction, resulting in platform loss. In this case, the platform will give priority to using the risk reserve to “fill the pit”. If the risk reserve is insufficient, all profit users of this week will need to be apportioned to compensate for the platform loss.

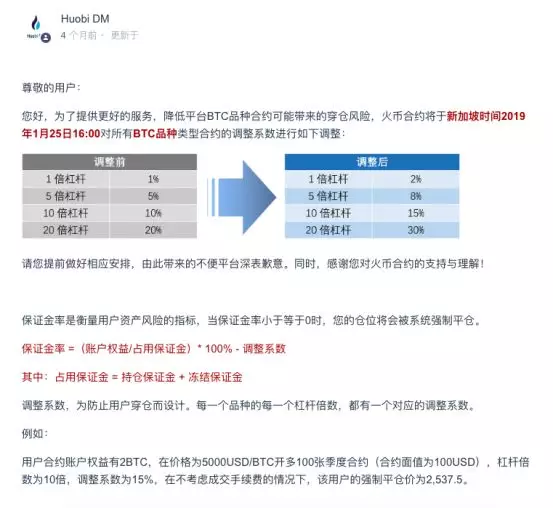

The “zero share” for 23 consecutive weeks is undoubtedly a bright spot. However, it has also been suggested that this zero share is the product of the adjustment factor. The adjustment factor is also known as the burst factor, and each leverage factor for each breed has a corresponding adjustment factor. The higher the adjustment factor, the higher the risk of a burst.

The fire currency contract raised the adjustment factor of the BTC contract

On January 25 this year, the Coin Contract increased the adjustment factor for all BTC type contracts, increasing the 10x leverage from the previous 10% to 15% and the 20x leverage from 20% to 30%.

"When the BTC contract is 10 times leveraged, the margin loss will be 85% when the margin loss reaches 85%. If the loss is 70%, the loss will reach 70%." .

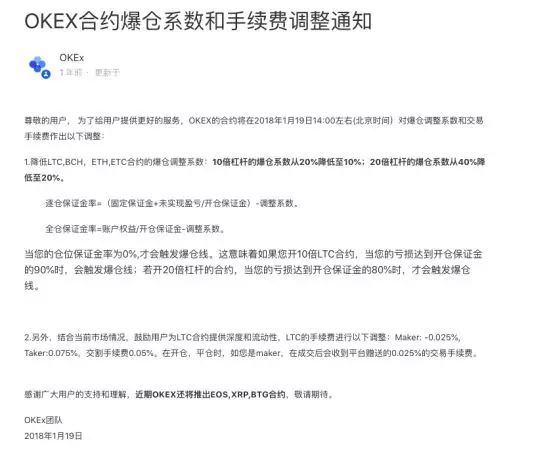

In contrast, the adjustment factor for BitMex and OKEx 10x leverage is 10%, 20% is 20%, both lower than the fire.

OKEx's current adjustment factor is lower than the fire coin contract

Li Xin calculated an account, and also opened a BTC contract with 20 times leverage in OK and Firecoin. When the OK loss is 80%, it will burst out, but when the loss of the coin is 70%, it will burst. He believes that this rule of the fire currency contract is not friendly to the user, which is equivalent to breaking the position in advance.

An exchange person told Honeycomb Finance, “Exploding in advance is actually a strategy to prevent wearing a position. When the trading depth is insufficient, some exchanges will choose to increase the adjustment factor and reduce the risk of wearing a position. Previously OK used this. The strategy, then actively reduced the adjustment factor, because this is definitely not good for the user."

In addition, the fire currency contract currently only has a full-slot mode, and does not support the warehouse-by-slot mode at present, which is also a slot in the user group.

In full position mode, all available balances in the user's account can be used as a margin to avoid being forced to close. The advantage of this model is that as long as the leverage is moderate, the possibility of a burst is very low. But in the event of extreme market conditions, users may lose all. In the warehouse mode, the margin allocated to a position is limited to a certain amount. When a position is opened, only a part of the loss is lost and the account balance is not affected.

At this stage, OKEx supports full-slot mode and warehouse-by-slot mode, while the Firecoin contract only supports full-slot mode. Li Xin believes that the mechanism of the fire currency has increased the risk of users. "I don't understand why the fire currency has not been open to the warehouse mode."

In the extreme market, the contract "newcomers" fire coins have been tested by the market one after another, and this veteran exchange is on the new battlefield.

It can be seen that Firecoin is constantly upgrading its contract products to cope with the failure of customer orders to be filled. A few days ago, the Firecoin contract was launched with the “Lightning Closeout” function, and users could achieve “optimal 10” quick closing, in order to avoid the loss of orders that could not be filled when the market surged.

In the currency market, the contract has always been a product with strong gold absorption. Many exchanges, such as Firecoin and Bibox, entered the contract market and are changing the pattern of oligarchy. At the same time of gaining profits, it is undoubtedly subject to the user's inspection.

In the past, OKEx enjoyed the bonus of the contract market. In the event of a problem, it attracted users to concentrate on it. When other exchanges set foot in this area, competition will have to make changes to the head platform, and the problem will be highlighted.

Fire coins want to get their own contract market share, the test is still ahead.

Source: Public Number: Honeycomb Finance News

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The shock plunged early in the morning, and Bitcoin was near $7,600.

- Opera will add native support for the TRON blockchain in its browser

- New Zealand blockchain organization calls on the government to develop a blockchain development strategy as soon as possible

- Ethereum’s funding plan for the next year will be disclosed for the first time, ETH or Yingda will rise sharply

- Cryptographic currency investment failure is a punishment for cognition

- Opinion: Lightning network does not need consensus, it is time to start the Bitcoin revolution.

- Bitfinex 2000 BTC transaction is suspected of money laundering and Mixing, multiple exchanges directly or indirectly