Gold hits a seven-year high, the stock market starts to fall madly, and the opportunity for bitcoin to rise is now

1,

"Spiritual antiques, gold in troubled times", this is the wisdom of investment that ancients summarized in thousands of years of historical civilization.

When the economy is booming and the social order is good, people invest in antiques, because antiques will continue to increase in value over time, and there is less possibility of being robbed or damaged in the absence of social unrest.

- New research: Lightning Network is becoming more and more centralized, the more nodes there are, the more centralized it becomes

- 71% of Bitcoin addresses remain profitable despite falling currency prices

- Bitcoin halving: price impact and historical correlation

When the social environment changes, war or turmoil occurs, the concept of "gold in troubled times" is more recognized. Compared with antiques, gold is easy to carry, has high liquidity and exchangeability, and is globally exchangeable in a certain sense. Therefore, even people who do not need to run around the world with gold will choose to hold gold during economic turmoil.

At present, because of the new crown pneumonia, people's anxiety about the world economic situation is rising sharply, and "gold in troubled times" has become valuable.

On February 24, the Director-General of the World Health Organization Tan Desai introduced at a daily briefing that outside China, there have been a total of 2074 cases of new coronary pneumonia and 23 deaths in 28 countries outside China. The sudden increase in cases is deeply worrying. "

He said the epidemic has not yet evolved into a pandemic, but the world should prepare for a "potential pandemic ."

In Asia, South Korea, where the epidemic has surged in the past few days, has raised the domestic new crown epidemic warning to the "highest level."

According to data updated by the South Korean epidemic prevention authorities in the afternoon of February 24, a total of 231 new cases were confirmed in South Korea on the 24th, and a total of 833 cases were diagnosed across the country, including 7 deaths, and more than 7,700 people in the Korean army were isolated .

In Japan, as of February 23, local time, there were a total of 838 confirmed patients, of which 691 were confirmed on the "Diamond Princess" cruise.

In this epidemic to fight the epidemic, the response level and efficiency of each country will be different, and the harm will eventually be completely different-how much stronger than China, I don't know.

2,

The sense of smell in financial markets is always the sharpest.

In the recent period of time, global stock markets, bond markets, and crude oil have fallen sharply, while gold and silver safe-haven assets have soared.

Of the three major U.S. stock indexes, the Dow fell more than 1,000 points. As of the close, the Dow fell 3.56%, the Nasdaq fell 3.71%, and the S & P 500 fell 3.35%. European stocks fell sharply across the board. Germany's DAX30 index fell 4.01%, Britain's FTSE 100 index and France's CAC40 index both fell more than 3%, and Italy's FTSE MIB index fell more than 5%.

The 10-year US Treasury yield fell to 1.367%, which is close to the historical low of 1.364% in 2016 (the price is inversely proportional to the yield).

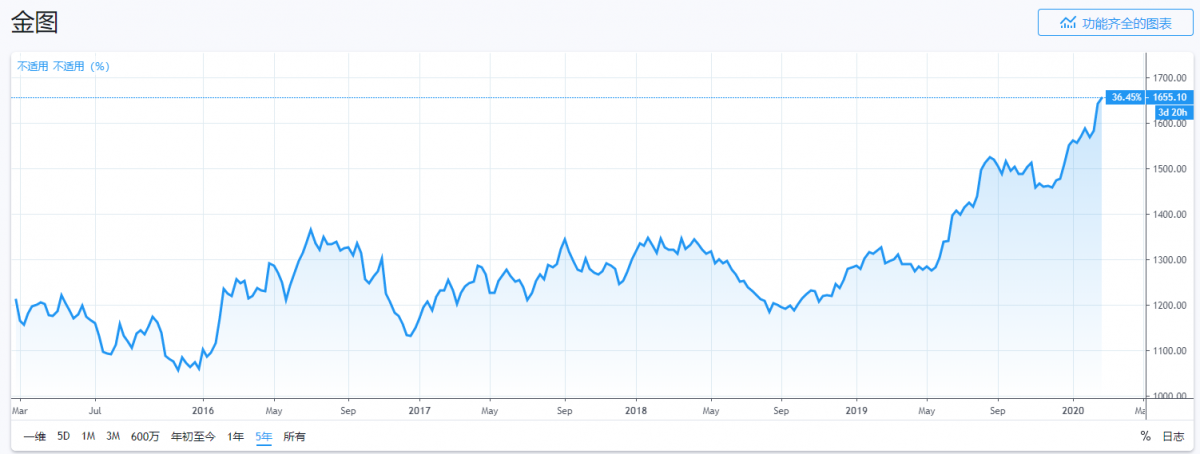

As a recognized safe-haven asset gold, the price rose for eight consecutive trading days, and rose by 1.7% yesterday to $ 1,676.60 per ounce, bringing it closer to the important psychological level of $ 1,700-this has never been exceeded since 2012 s level.

When gold rose all the way in laughter, bitcoin was still entangled in a narrow area, and the emerging safe-haven asset bitcoin, which was once hyped by the market, did not show a strong enough performance.

Although Bitcoin briefly reached the $ 10,000 round mark yesterday (February 24), it failed to complete the effective recovery of the position. Looking at big data comprehensively, it is even more bleak:

Looking at the open positions of bitcoin contracts on the CME exchange, there is no sign of funds flowing into the bitcoin market in the short term.

The transaction data of the over-the-counter trading platform LocalBitcoins shows that the total amount of bitcoin over-the-counter transactions worldwide has not risen but declined in the past week, and even the demand for bitcoin buying has fallen during the week when the epidemic broke out.

What about Bitcoin's hedging properties?

3.

The rally may be late, but it must not be absent. Regarding Bitcoin's hedging properties, we need to analyze from several dimensions:

For those who really understand the principles of Bitcoin, whether Bitcoin has a hedging property or not has a definitive answer-the only uncertainty is when the external market can be as sure as we are.

Looking at the past, no matter whether it is a regional crisis of experience, international geopolitical conflicts, and various tensions, Bitcoin can always rise sharply. Whether you understand the principle or not, you can see that Bitcoin's hedging properties are recognized by the market. For details, please refer to the 4D long text “ Depth of 4D: What is the value support of Bitcoin, USD and gold?” 》

Why is the price of bitcoin so unsatisfactory these days?

Bitcoin also has a bookmaker, and when the game is not a retail game, the market is different. This is the Bitcoin chart for the last three months:

It can be seen that the largest order volume is over 7,000 USD and 8,000 USD. From the dealer's point of view, without repeated shocks, then huge low-order buying will eventually continue to be shipped in the process of the dealer's pull to 11,000, 12000-but of course the dealer will not do charity in this way.

If you want to rise, you must wash the dish first.

Kill all the fantasies of multi-arms, and smash the price down in case the dealer receives enough low-cost chips and then pulls the disk. Only in this way, the dealer can have chips at a high position.

In fact, through the continuous release of various bad news, we have seen the means of home, not new.

But it's not over!

4.

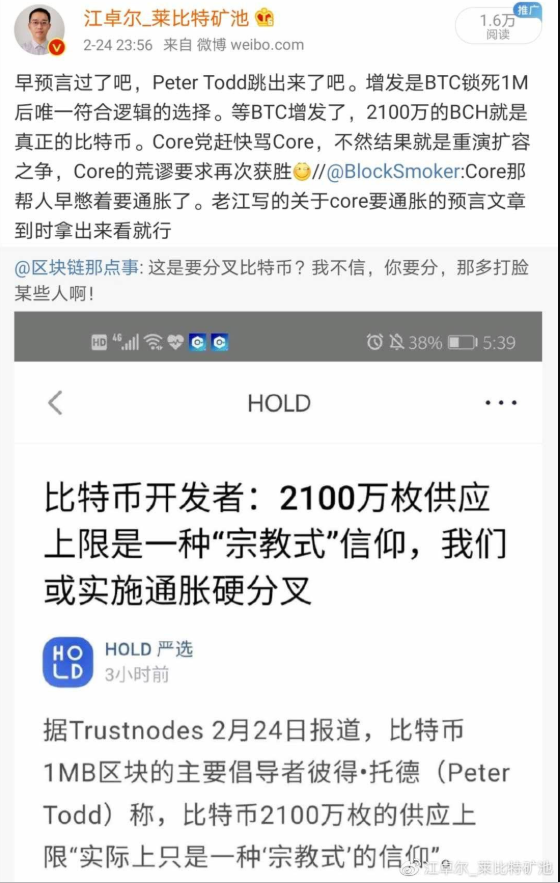

The bad news is still coming out, such as this: Bitcoin is considering additional issuance .

According to Trustnodes reported on February 24th, Peter Todd, the main advocate of Bitcoin's 1MB block, said that the 21 million supply limit for Bitcoin "is actually just a" religious "belief."

This is not the first time Todd has proposed a proposal for bitcoin inflation. Last year, he hinted that he might conduct a multi-year publicity campaign to remove the supply limit of 21 million bitcoins.

In response, Jiang Zhuoer, a BCH advocate, expressed fierce opposition:

This is very deadly news.

If the Bitcoin issuance code-named BTC, the consequences will be catastrophic, although the core development team will be able to put forward 10,000 reasons for the additional issuance due to the inability to consider the interests of people.

However, it is certain that once the BTC is issued, breaking the upper limit of 21 million will inevitably lead to new forks and market turmoil. At that time, BSV and BCH will inevitably rise and even become real Bitcoin.

But don't worry.

In my opinion, this is still just a bad news that we have to take seriously-from the bookmaker's point of view, the ideal situation is to smash Bitcoin back to about 6000, and to do this, the deadly bearishness and the market work together , It is best to add other big problems-of course, it is quite difficult to achieve at present.

The old leeks in the currency circle know that the modification of the Bitcoin ceiling is no longer a person or organization who can decide. The Bitcoin core development team can go forking, but how many supporters will there be? Forcing a fork will only be a dead end.

So far, I am still a staunch bull, but for now, the Air Force has a larger percentage of emotions. Look at the flow of funds. The 24-hour net outflow of funds in the Bitcoin market is 700 million.

However, all shorts will become the fuel for multi-arms. As long as the direction is firm, things will be easy to handle-as long as the planned price is low enough, I am not afraid that you will be short.

At present, in the digital currency market, the scale of contracts is close to the spot scale, and according to the analogy of traditional financial markets such as gold, the scale of derivatives such as contracts will further increase.

The contract market contains a lot of risk, but I don't think it is because of the gambling, but the market's opponents are different.

When buying spot, our opponents are other retail investors. Although the banker also exists, we can choose to pretend to die in the event of a fatal attack and wait for the opportunity to "resurrect". But the opponent of the contract is no longer a retail investor but an institution. Bitcoin's decline of more than 10% in a single day is enough to fill the entire market with a killing atmosphere.

For example, playing games is like playing level games in a novice village. Mobs do n’t kill people. Playing contracts is a way to face big bosses without knowing each other ’s skills. Be careful.

Some people choose to stay safe in Xinshou Village, others choose to walk out of Xinshou Village to be tested, there is no right or wrong-people who upgrade in Xinshou Village can also rise to level 20 by killing chickens, while those who leave the village may be level 3. Just hung up.

For people who haven't figured out anything about Bitcoin, it is irrational to rush into large-capital contract transactions. But even a veteran of the market, it is always irrational to open 100X and 150X contracts, not to mention the 500X contracts offered by some exchanges—this is like wearing straw shoes and holding a wooden sword. Like the critical strike spike, the monster is spiked most of the time.

However, the market's wind is changing, and the method of dead bitcoin is no longer as effective as in the past, and the eternal bull market will never appear-just as the bullish gold today has once entered the long bear after the plunge.

Where there are people, there are rivers and lakes, and all financial markets are rivers and lakes. Do you choose to retreat from the Niubishan Mountain and hope that the weather is calm? Or do you choose to face the rivers and lakes and try to be happy and revenge?

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- A shares should not be too optimistic, BTC medium-term or expected

- Jiangzhuoer mine was shut down forcibly. Is the epidemic good or bad for BTC?

- "The Secret History of Bitcoin" (1): Historical Background When Bitcoin Was Born

- Peter Schiff loses Bitcoin, says holding cryptocurrency is "bad idea"

- Bitcoin difficulty adjustment and soaring BSV prices

- Analysis: Bitcoin's Value Logic and Its Prospects

- Science | This technology escorts two-thirds of Bitcoin transactions