Grayscale GBTC fund premium suggests institutional investors hoarded bitcoin in February

Source / LongHash

In 2020, the price of bitcoin will rise from $ 6855 to $ 10,550, a 57% increase. A well-known "big player" on Bitfinex-individual investors holding large amounts of bitcoin-criticized the rise, calling it the result of other big players in the market trying to manipulate the price of coins.

It seemed to be the case at the time, but the continued increase in spot trading volume, the premium of the Gray Bitcoin Investment Trust (GBTC), and the activity of on-chain investors showed that the rise was largely reasonable.

- U.S. SEC proposes amendments to securities issue exemption rules involving token issuance

- Strong alliance, EY, Microsoft and ConsenSys build Ethereum middleware Baseline Protocol

- "If you can be the president for a day, let BTC become the national currency." Why is investment boss Tim Draper so obsessed with Bitcoin?

Grayscale Bitcoin investment trust premium rises

Digital Currency Group's Grayscale operates a publicly tradable investment vehicle for Bitcoin investors called the Bitcoin Investment Trust (GBTC). With more than $ 3 billion in assets under management, GBTC has been the preferred solution for qualified investors and institutional investors to invest in the cryptocurrency market for many years.

Each share of GBTC is worth 0.00096698 BTC. Throughout February, GBTC was trading at approximately $ 13.48. So, if the price of about 0.001 Bitcoin is $ 13.48, the price of 1 Bitcoin is more than $ 13,000. This leaves a premium of $ 3,000 for qualified and institutional investors.

Considering that the GBTC premium has remained around 7% throughout January, the 30% premium is indeed very high.

As of March, the premium has fallen back to around 13%-but considering the sharp drop in the price of Bitcoin over the past two weeks, this premium is still quite high.

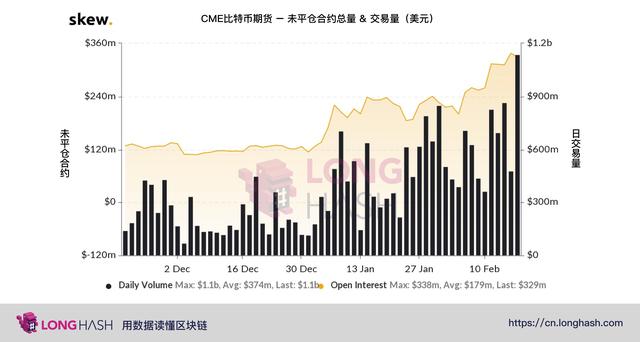

The daily volume of bitcoin futures on the Chicago Mercantile Exchange (CME) also reached a new high of 1.1 billion U.S. dollars, which is the third time in the history of the number that it has exceeded 1 billion U.S. dollars. The main targets of CME Bitcoin futures are recognized investors and institutional investors. Since CME is used by qualified investors in the United States, the product's cumulative trading volume in February was high.

Rising spot trading volume

Since December 2019, major spot exchanges such as Binance, Bitstamp and Coinbase have seen a significant increase in trading volume.

For example, in the second week of January 2020, the weekly trading volume of the most frequently traded trading pair (BTC / USD) on Binance increased from 241,000 BTC in the last week of December 2019 to 468,000 BTC. In just three weeks, the spot trading volume achieved a 94% increase.

On leveraged trading platforms, the prices of cryptocurrencies including Bitcoin, Ethereum, and XRP are easily affected because traders use relatively high leverage for transactions.

Therefore, leveraged trading platforms are easier to manipulate than spot exchanges. This also helps explain why a major Bitcoin owner would say that the initial spike in Bitcoin price from $ 6,000 to $ 9,000 was the result of market manipulation.

However, the significant increase in spot trading volumes throughout January and February indicates that retail market interest in cryptocurrencies has really grown and overall demand for the asset class has emerged.

Increased investor activity on the chain

According to Willy Woo of Adaptive Fund, as the price of Bitcoin exceeds $ 10,000, the on-chain activity of the Bitcoin network has increased.

The analyst said that basic investor activity supported this round of bitcoin price increases, noting that this wave of rebound did indeed support overall demand.

From early January to February this year, the number of unique addresses used on the Bitcoin blockchain network also increased from 350,000 to 500,000, showing an increase in user activity in two months.

To sum up, the rise in spot trading volume, the increase in on-chain investor activity, the high volume of CME futures, and the premium of GBTC all indicate that during the period when Bitcoin rose from $ 8,000 to $ 10,500 Inside, retail and institutional investors are hoarding bitcoin, which shows that this rebound is not entirely the result of market manipulation.

LongHash , read the blockchain with data.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What do those U.S. presidential candidates think about cryptocurrencies?

- How the most famous DeFi project processes data in the repository

- Demystifying the secret flow of funds: the idle fish, Alipay, 58 cities, Baidu Post Bar are "occupied"

- Introduction to blockchain 丨 10 hidden dangers every novice should know before holding crypto assets

- True or false demand? Comparison of Blockchain Invoices in Beijing, Hangzhou, Guangzhou and Shenzhen

- The market is down and production is approaching. How long will the mining winter continue?

- February global block chain private equity financing amounted to 1.295 billion yuan, China and the US market heating up