New users can also set it up in minutes, take a look at these five Ethereum DeFi applications that change the savings experience

Author: by Will Brealey

Translation & Proofreading: Zhou Jin & A Jian

Source: Ethereum enthusiasts

Editor's Note: The original title was "Five Ethereum DeFi Applications That Change the Savings Experience"

- The Fed's emergency rate cuts are expected to halve in anticipation. Will the Bitcoin bull market still come?

- Blockchain: the antinomy of reality and the future

- Ethereum Foundation member Hudson Jameson: ProgPoW is not worth it, it will die

Today, interest rates throughout the world are sluggish, and expectations of the world's economic outlook are generally pessimistic. In the UK, outgoing Bank of England Governor Mark Carney warns that overall interest rates may be cut from 0.75% to just 0.50% as early as this month.

What many people don't know yet is that there are many applications on the Ethereum blockchain (commonly called "DeFi (Decentralized Financial) Applications"), with which you can earn ten times as much as traditional institutions provide As much yield as possible. These apps are easy to use and even new users can set them up in minutes.

My point is that saving money is just one application of this new technology. Now, let's take a look at the 5 novel gameplays you can try using the stable currency Dai, which is issued on the Ethereum blockchain and anchored to the US dollar.

Too long to look at:

1: With Argent and Compound, you can start earning 6% interest with just three clicks

2: See your 6% asset growth in real time through the Maker Oasis platform

3. Use PoolTogether to participate in a free weekly raffle

4. Donate 6% of your proceeds to rTrees to plant your commonweal saplings

5. Using DeFiZap, you can both use DAI to earn interest and get ETH risk returns

What is a DeFi application?

DeFi (pronounced "DEE-FI" ~) is a general term for a class of Ethereum-based applications. The number of such applications is numerous and growing. Its main features include:

- Open source (so anyone can check the code base and contribute to it)

- Non-exclusive (so anyone can use it, regardless of race / age / gender / international / sexual orientation)

- Uncustodial (so all your property is always under your control and no third party intervention is required)

DeFi is emerging in the field of cryptocurrency and is in a period of rapid development. Today, the total value of funds circulating in the DeFi project has reached $ 764 million, and it has increased by 30 million yesterday. On the DefiPulse website, you can see the rapid development of DeFi.

Many DeFi applications are downloaded through a browser, and you need to use the MetaMask plugin to interact with them. You can see instructions for use here.

1: With Argent and Compound, you can start earning 6% in just a few clicks

With the Agent wallet, you can easily purchase DAI and use it to earn interest, and you can control your own funds throughout the process. You will also get a free ENS domain name (a human-readable Ethereum funding address similar to activism.xyz.eth), and users can send tokens on the Ethereum network through the Argent free of charge.

Using DAI to lend in the Compound lending market is the source of your interest; currently, the deposit rate on the Compound market is slightly less than 6%, which is about 5.8%. Currently, only U.S. users can purchase cryptocurrency directly through Argent, but support for European users will go live this month.

step:

- Download Argent Wallet on Android or iOS;

- Buy DAI directly in your home currency;

- Select the Finance section and click on 'Grow Your Holdings'.

2: See your 6% asset growth in real time with Maker Oasis

Maker (an organization that issues and maintains the value of DAI stablecoins) also provides a set of tools through their Oasis app. These tools are easy to get started, but are slightly more cumbersome than using the Argent mobile app. You need to download MetaMask, a Chrome browser plug-in, and send DAI and some Ether (for transaction fees) to your address.

You can check your real-time earnings here, it's great!

step:

1. Navigate to https://oasis.app/; 2. Connect to your MetaMask wallet; 3. Click 'Save', 'deploy proxy', and confirm in the pop-up window; 4. Select the deposit amount and make the transaction signature.

Tip: If you do n’t want to do it yourself, and you want to earn the Maker system, Chai is a feasible option-the appreciation rate of this token will be consistent with Oasis' DAI deposit interest rate. Just by holding Chai, you can start earning 6%. You can buy Chai directly here, or exchange it with Ethereum or other tokens on Uniswap.

Translator's Note: The author didn't write very clearly here. In the first method above (deposit operation using Argent wallet), your interest is derived from the DAI you use to lend to the Compound lending market; and in this second method, your interest is derived from your DAI is deposited into Maker's MCP system, and the system itself will provide you with a savings rate. This function is called DSR (DAI Savings Rate). The interest sources of the two methods are different, and the interest rates of the two types of interest are adjusted in real time; Compound's deposit interest rate is automatically matched according to a formula and the supply and demand of funds in the market, and the interest rate of DSR is held by MKR The participants voted together.

3: use PoolTogether to participate in a free weekly raffle

With Compound or Oasis, you can lock your DAI and earn 6% interest.

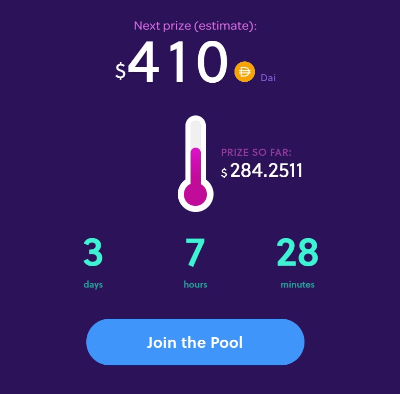

With PoolTogether, users can aggregate their respective funds together into a fund pool and win prizes once a week. The bonus is the interest generated during the week and is taken by a lucky person. For every 1DAI deposited, you will get a lottery ticket and a chance to win $ 410 a week (as of this writing). The prize pool currently accumulates $ 316,599, and weekly bonuses will continue to increase as more users join (Translator's Note: As of March 4, 2020, PoolTogether's weekly bonus has risen to more than $ 1400 Up).

step:

- Navigate to https://app.pooltogether.com/;

- Click on 'Join Pool', select the number of DAIs to deposit, and use MetaMask to sign the transaction.

4: Donate 6% of your proceeds to rTrees and plant your commonweal saplings

There is another kind of token called rDAI, whose function is that you can give up the interest of 6% and use it directly. DAI will be sent to Trees For The Future, a non-profit organization that has planted more than 43 million trees in Africa over the past three decades. The organization has improved the local ecological environment and made a direct contribution to combating climate change. You can find information about this organization here.

step:

- Navigate to https://rtrees.dappy.dev/;

- Choose how many trees you want to plant each year;

- Sign transactions with MetaMask.

5: Use DeFiZap to earn DAI interest while earning ETH risk return

You must be incredible, right, how is this possible? To earn interest from a DeFi application, you must generally have a DAI. Holding DAI is certainly good, but you could have invested this money in Ethereum. As a result, you may miss potential gains that can be much higher than 6% (that is, the gains that ETH prices will bring to you). If you think about it, Ethereum has fallen by as much as 90% from its peak.

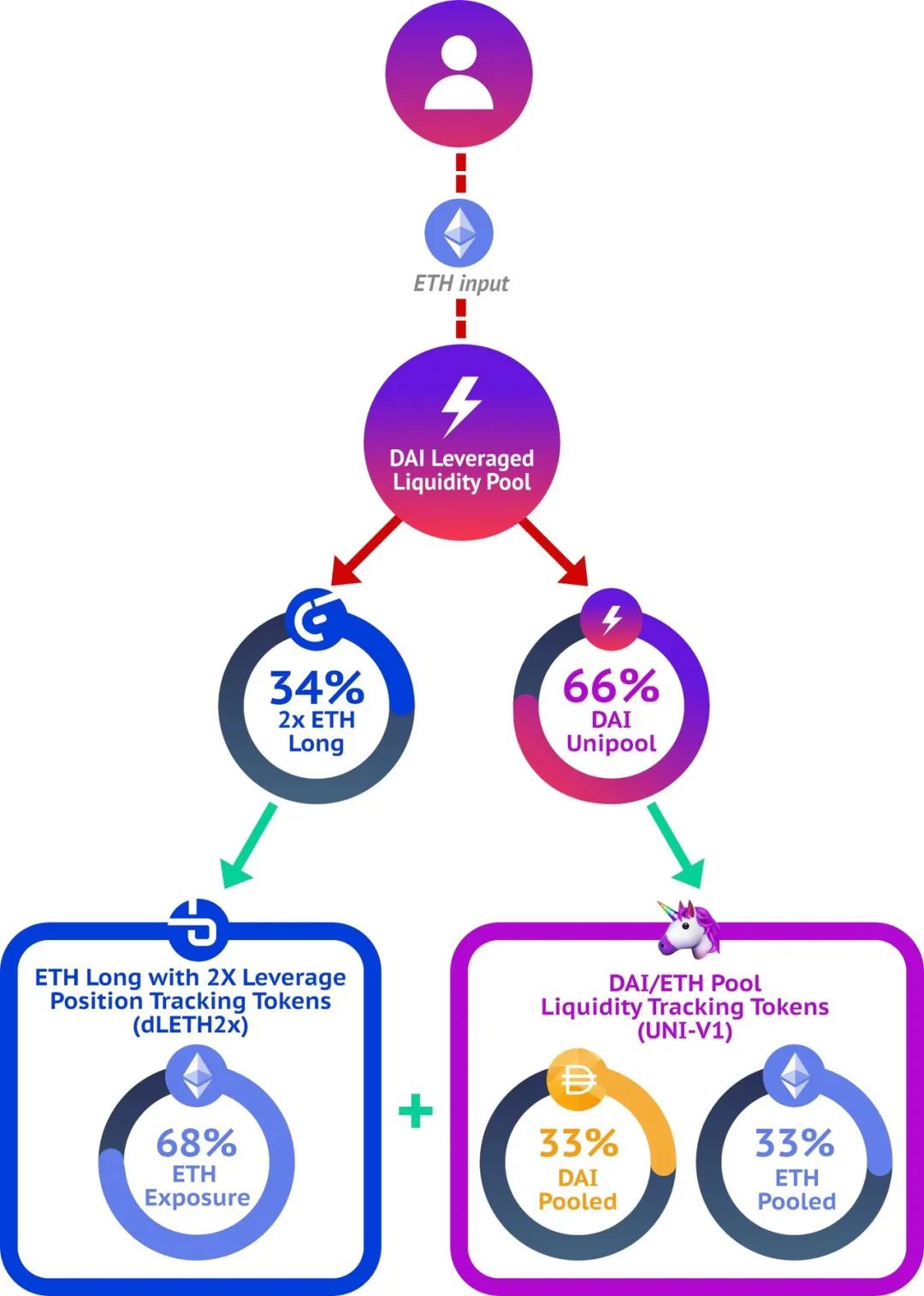

DefiZap's leveraged liquidity pool solves this problem. A portion of your account balance will be used to provide liquidity on the Uniswap decentralized exchange so you can earn some income. The remaining funds will be used to open leveraged long positions in the Fulcrum app, allowing you to get double the gains and losses caused by the change in the value of the Ethereum currency.

By combining these two operations, you can both use DAI to earn income without missing the benefits brought by the rising ETH price. Because in the end, you still maintain a 100% ETH exposure.

With DeFiZap, you can set up this complex system in just a few clicks, saving you about 8 minutes.

Caution: Leveraged investment means that once the price of Ethereum falls, you may be liquidated (liquidated) and cause some Ethereum losses. This is a risky contract and is only suitable for investors who are optimistic about the short-term trend of Ethereum. If you are unfamiliar with leveraged trading, it is best to take some time to understand the risks before you start.

DefiTutorials gives a good explanation of Zap usage.

step:

- Navigate to https://defizap.com/zaps/llpdai;

- Click on 'Use this Zap' and sign the MetaMask transaction.

Translator's Note: In the above, the Zap protocol uses the Fulcrum application to accomplish the above functions. But now it has been replaced with the leverage provided by the Synthetix protocol. Fulcrum had an attack in mid-February 2020 and should be used with caution if it has not been upgraded for the time being.

to sum up

DeFi is growing at an exponential rate and new projects are launched every week. The ease of use of these apps is unexpected: as long as you have a MetaMask wallet and some Ether, no matter who you are, you can take advantage of the revolutionary technology with a few taps of your phone.

However, although the infinite possibilities brought by Ethereum are more imminent than ever, it is still necessary for new users to thoroughly understand the risks.

- Generally, when you use DeFi and cryptocurrencies, you must take full responsibility for your funds. If you make a mistake (such as sending your funds to the wrong address), there is no way to save it. You must check again and again.

- Once you lose the private key of your wallet, your funds will be completely lost and you cannot find it. Remember to back up your private key and use multiple devices.

- This is a very new experimental technique. We cannot completely exclude unexpected bugs or vulnerabilities, and even if the contract code has been audited, we cannot guarantee foolproofness. Please confirm this risk before starting your investment.

That's all for today. If you want more detailed information or want to correct the errors in this article, please feel free to contact me on my Twitter @w_brealey. As always, you can support me by sending funds to activism.eth or my Gitcoin.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Will big data + blockchain create a new Internet industry economy?

- Ten minutes per session, understand the blockchain, "Ling Listening · Blockchain General 70 Lectures" is online

- QKL123 market analysis | Fed suddenly cuts interest rates unexpectedly, global panic has not retreated (0304)

- The wave of "absolute deflation" of platform currency is coming. How should the exchange make a choice?

- Important Ethereum Capacity Expansion Solution: Optimistic Rollup Status Report (Part 2)

- February is another milestone, ConsenSys releases latest data report on Ethereum ecology

- Breaking the Impossible Triangle of the Blockchain (6)-Blowing a Whistle on the Activity of the Blockchain