February global block chain private equity financing amounted to 1.295 billion yuan, China and the US market heating up

Text 丨 Interlink Pulse · Liangshan Huarong

After falling to freezing point in January, the global blockchain investment and financing market started a heating mode in February.

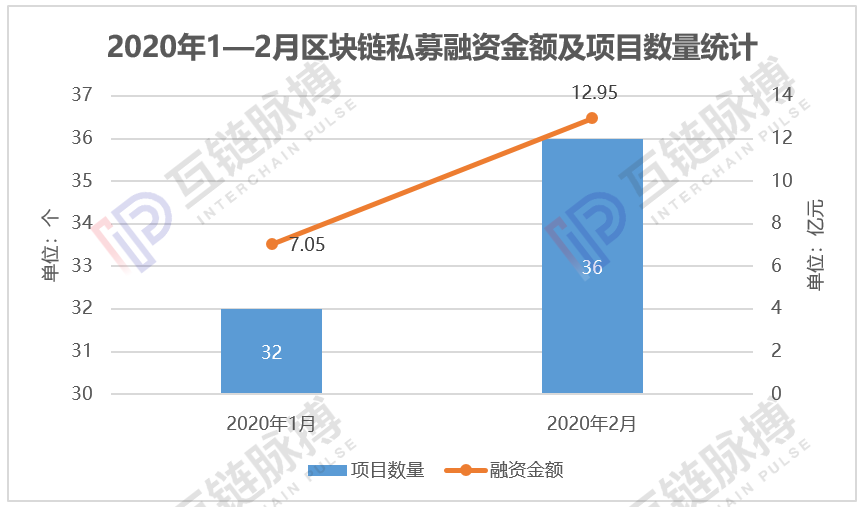

According to the statistics of the Interchain Pulse Institute (IPRI), in February 2020, a total of 36 financings were obtained in the global blockchain field, with a financing amount of 1.295 billion yuan, an increase of 83.7% from the previous quarter.

(Tabulation: Interlink Pulse Academy)

(Tabulation: Interlink Pulse Academy)

- U.S. stocks surge, bitcoin bearish: Cryptocurrency market bottleneck or difficult to break

- Post-Supreme Court case: "Historic Day" for Indian cryptocurrency

- Ukraine's anti-money laundering law is about to take effect, where does China's crypto regulatory policy go under the FATF wave?

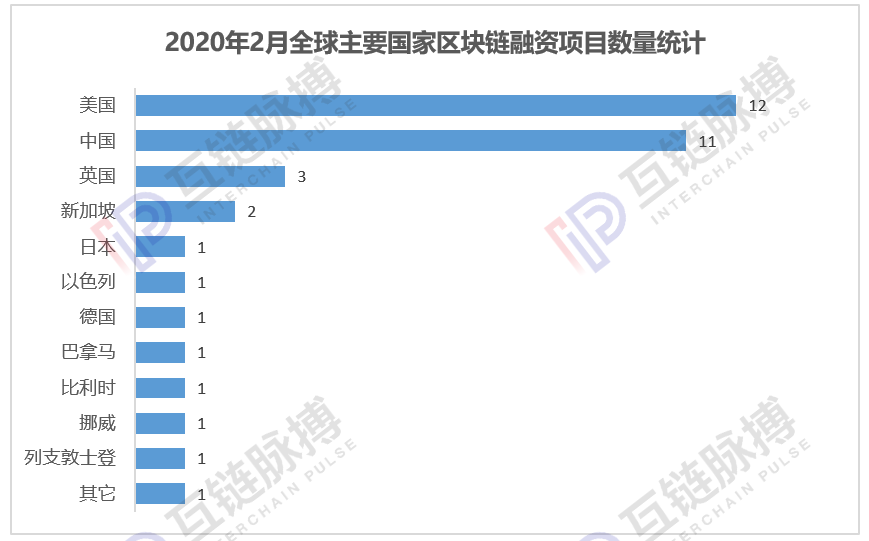

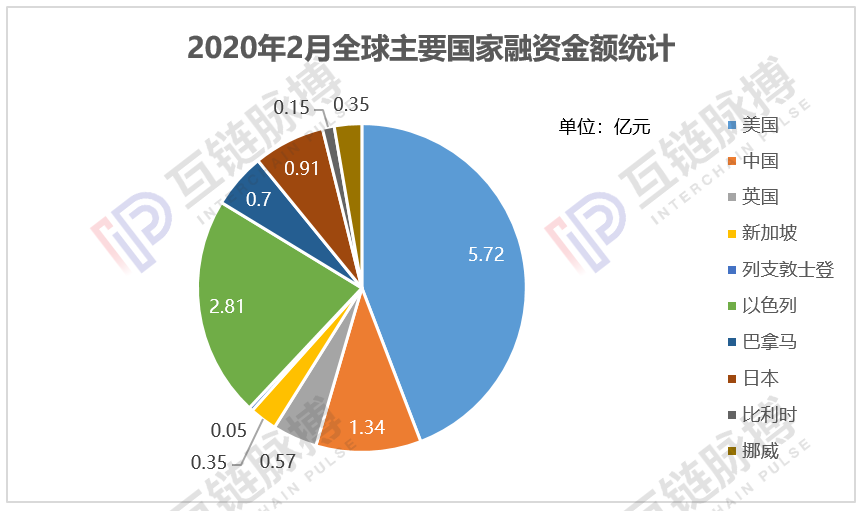

In particular, the Chinese and American markets, which are the main forces, warmed up rapidly in February. Among the 36 financing events, there were 11 financing projects in China with a financing amount of about 134 million yuan, an increase of 67.5% from the previous quarter.

And the US market is recovering faster. The Interlink Pulse Institute (IPRI) statistics show that in February 2020, a total of 12 blockchain projects in the United States were financed, with a financing amount of approximately 572 million yuan, an increase of 156.5% from the previous quarter. In terms of financing amount, it is almost 4.3 times that of the Chinese market.

(Tabulation: Interlink Pulse Academy)

(Tabulation: Interlink Pulse Academy)

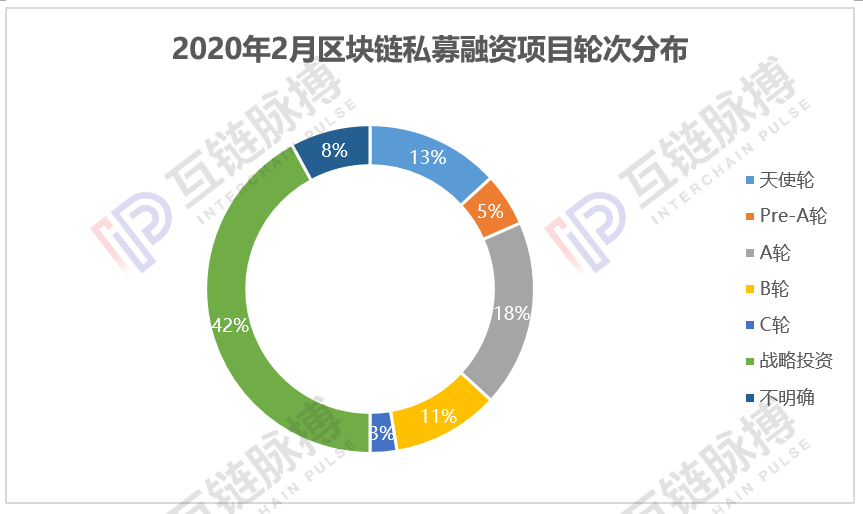

From the perspective of rounds of financing projects, the number of strategic investments was the largest, accounting for 42%; followed by round A and angel round projects, which accounted for 18% and 13%, respectively. In addition, 11% of the projects entered the B round, and some projects entered the C round of financing.  (Tabulation: Interlink Pulse Academy)

(Tabulation: Interlink Pulse Academy)

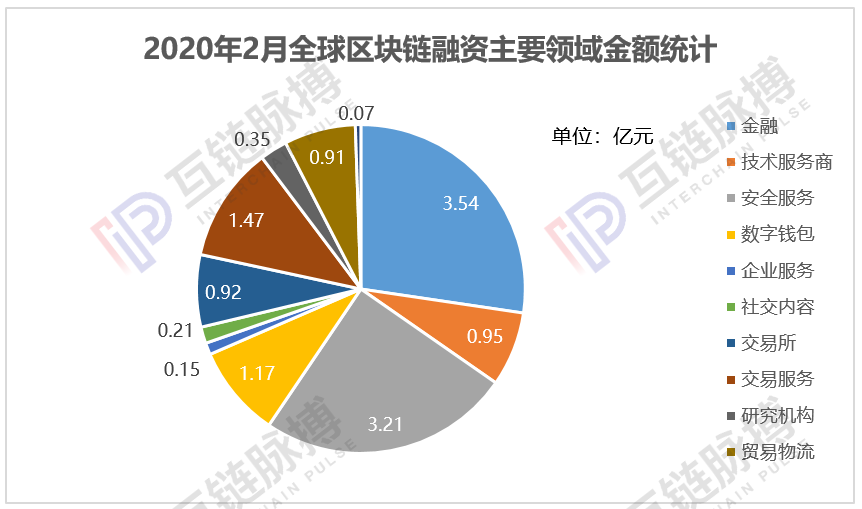

From the perspective of industry distribution, the most favored projects of capital in February were mainly concentrated in exchanges, financial services and security services.

According to the statistics of the Interchain Pulse Institute (IPRI), in February 2020, a total of 7 cryptocurrency exchanges around the world received financing, and 4 exchanges disclosed the specific financing amount, and the financing amount was mainly at the level of 10 million yuan.

(Tabulation: Interlink Pulse Academy)

(Tabulation: Interlink Pulse Academy)

Among them, the largest financing amount is Deribit, a cryptocurrency derivative exchange registered in Panama, which has recently secured tens of millions of dollars in strategic investment; followed by Singapore's BitCola Exchange with 2 million dollars (about 14.3 million yuan) Financing. The other two exchanges, XueBi.io and ZT Global, have small financing amounts, and they have received US $ 1 million and hundreds of thousands of US dollars respectively.

In the financial field, a total of 5 projects were funded in February, with a financing amount of about 354 million yuan, accounting for about 27.34%.

The largest financing amount is BlockFi Lending LLC, a digital asset mortgage loan service provider in the United States. In February, it received financing of 30 million US dollars (about 210 million yuan); another US-based commercial payment company that provides digital currency services, PayStand, also received 20 million US dollars (about 140 million yuan) financing.

(Tabulation: Interlink Pulse Academy)

(Tabulation: Interlink Pulse Academy)

In the field of technology service providers, 5 projects have also received financing, with a financing amount of about 95 million yuan, and the projects that have been invested are mainly concentrated in the US market.

For example, Lightning Labs, a San Francisco-based lightning network development team, recently received a $ 10 million (about RMB 69 million) Series A financing led by Craft Ventures; in addition, Arwen, an unmanaged settlement agreement developer in the United States, also received 330 USD 10 million (about RMB 23 million) strategic investment.

In addition to the three major areas mentioned above, several large-scale financings have also appeared in the areas of blockchain security services, digital wallets and transaction services.

In the field of security services, Israeli blockchain privacy solution provider StarkWare has secured a large financing of US $ 40 million (about RMB 280 million); the American artificial intelligence blockchain security company AnChain.ai also received 4.3 million US dollar (about 30 million yuan) financing. In addition, China's Lighttree Technology, which focuses on multi-party computing for blockchain security, also received tens of millions of yuan in financing.

In the field of digital wallets, Taiwan ’s Bitcoin hard wallet maker CoolBitX Technology has completed a round B financing of USD 16.75 million (about RMB 120 million); in terms of transaction services, Copper.co, a UK-based crypto asset custodian, also recently received 7.3 million euros (about 56 million yuan) financing.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Looking at the actual activity of Bitcoin from the on-chain data: it is inconsistent with analysts' predictions of the market below $ 8,000

- Zhu Jiaming: Finance and Technology in "Abnormal State" (with full speech)

- New users can also set it up in minutes, take a look at these five Ethereum DeFi applications that change the savings experience

- The Fed's emergency rate cuts are expected to halve in anticipation. Will the Bitcoin bull market still come?

- Blockchain: the antinomy of reality and the future

- Ethereum Foundation member Hudson Jameson: ProgPoW is not worth it, it will die

- Will big data + blockchain create a new Internet industry economy?