Understanding Hong Kong’s Cryptocurrency Exchange Licensing System

Hong Kong's Cryptocurrency Exchange Licensing System: A GuideAuthor: GU Jiening

Thanks to its lenient regulatory environment and favorable tax policies, as well as its huge geographical advantage of being backed by the mainland, Hong Kong, the global financial center, has been favored by the cryptocurrency industry. Now, with the comprehensive plan, pragmatic spirit, flexible posture, and determination to land of the Hong Kong government, the “King Returns” to become a global cryptocurrency financial center.

To wear the crown, bear the weight. Hong Kong may be a huge opportunity for Web3.0 practitioners, but not for everyone. Only on the basis of meeting regulatory requirements can centralized virtual asset exchanges share the huge opportunities of this market.

1. Voluntary Licensing Regime

For virtual asset trading platforms, the SFC introduced a regulatory framework for virtual asset trading platforms in 2019 and made detailed provisions in its “Position Paper on Regulation of Virtual Asset Trading Platforms” (hereinafter referred to as “Position Paper”).

- A set of data tells you why you shouldn’t ignore BTC NFT

- Can the United States really avoid a recession?

- Blocking Daily | OpenAI releases iOS version of ChatGPT app; Hashkey Group plans to raise $100 million to $200 million in funding with a valuation of over $1 billion

The “Position Paper” stipulates that the SFC has no power to issue licenses or regulate platforms that only buy and sell non-securities-based virtual assets or tokens. Because such virtual assets do not fall within the definition of “securities” or “futures contracts” under the Securities and Futures Ordinance, and the business conducted by these platforms does not constitute “regulated activities” under the Ordinance. Therefore, if a virtual asset trading platform is engaged in non-securities-based token trading, it does not need to be licensed under the “Voluntary Licensing Regime”.

In fact, the “Position Paper” is consistent with the SFC’s position on regulatory sandboxes for “fintech” innovation in the 2017 “Circular on the Publication of the SFC’s Regulatory Sandbox”. It is also a specific measure in the field of encrypted finance. In 2018, the SFC further formulated the “Statement on a Framework for the Regulation of Virtual Asset Portfolio Managers, Fund Distributors and Trading Platform Operators” (hereinafter referred to as the “Regulatory Framework”).

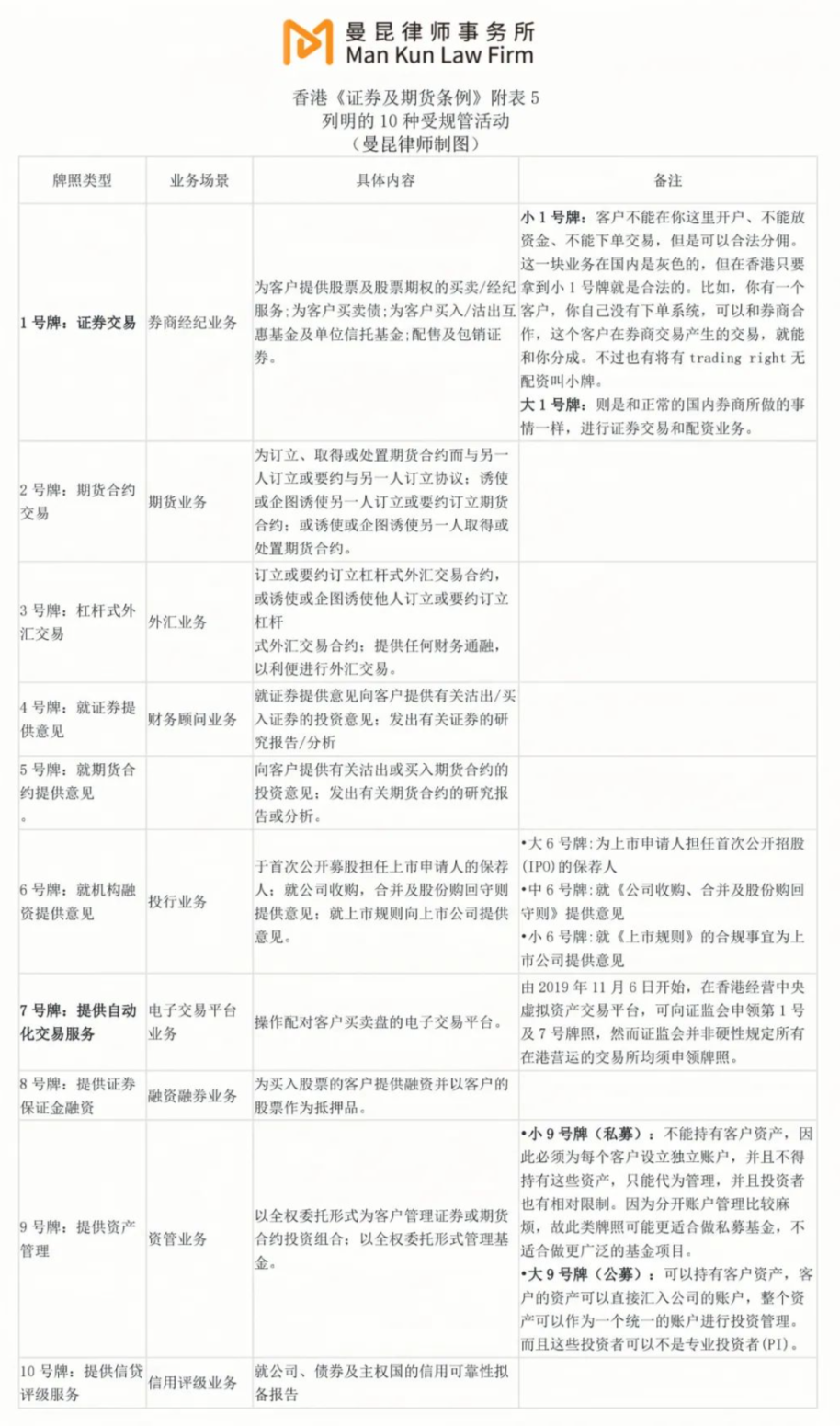

According to the “Position Paper,” a central platform that provides virtual asset trading services may apply for the first-class (securities trading) and seventh-class (provision of automated trading services) licensed activities supervised by the Securities and Futures Commission (SFC) if it intends to provide trading services for at least one type of security token. The regulatory framework includes strict standards for asset custody, network security, anti-money laundering, market supervision, accounting and auditing, product due diligence review, and risk management.

The SFC also specifically stated that it only regulates virtual asset trading, settlement, and clearing services provided by virtual asset trading platforms that have control over investor assets (i.e., centralized virtual asset trading exchanges). If a platform only provides trading services on a direct peer-to-peer market and its investors typically retain control over their own assets (whether legal tender or virtual assets), the SFC will not accept license applications from these platforms (i.e., decentralized virtual asset trading exchanges are not regulated by the SFC). Additionally, if a platform conducts virtual asset trading for clients (including sending buy and sell instructions), but the platform itself does not provide automated trading services, the SFC will not accept license applications from them.

So far, only two exchanges have obtained the above two licenses. At the end of 2020, OSL Digital Securities Limied, a subsidiary of BC Technology Group, obtained the first and seventh licenses, becoming Hong Kong’s first licensed virtual asset trading exchange. In April 2022, Hash Blockchain Limited, a subsidiary of HashKey Group, became the second virtual asset trading exchange to obtain the first and seventh licenses. Although there are more asset management companies that have obtained the ninth license, there are only six institutions such as Huobi Asset Management, Lion Global Investors, MaiCapital, and Fore Elite Capital.

However, the licensed entities under the “voluntary licensing system” can only provide services to professional investors. For most virtual asset trading exchanges targeting the “retail” market, the first and seventh licenses are not very attractive due to their lack of practicality. This highlights the “preciousness” of the VASP licensing system, which will be introduced in June of this year.

2. VASP Licensing System

On December 7, 2022, the “Anti-Money Laundering and Counter-Terrorist Financing (Amendment) Bill 2022” (hereinafter referred to as the “AML Bill”) was passed by the Legislative Council of Hong Kong to implement the virtual asset service provider licensing system (hereinafter referred to as the “VASP Licensing System”) that will begin on June 1, 2023.

Below is a simple comparison of the old and new licensing systems in Hong Kong:

Three, dual license

Depending on different regulatory authorizations, SFC will regulate the securities token trading conducted by virtual asset trading platforms according to the current system under the Securities and Futures Ordinance, and also regulate the non-securities token trading conducted by virtual asset trading platforms according to the virtual asset service provider system under the Anti-Money Laundering Ordinance.

Given that the terms and characteristics of virtual assets may evolve over time, the classification of a certain virtual asset may change from a non-securities token to a securities token (and vice versa). In accordance with the above regulatory logic, in order to avoid violating any licensing system regulations and to ensure that business can continue to operate, virtual asset trading platforms should apply for approval (i.e., apply for both the VASP license and the Type 1 and Type 7 licenses) at the same time in accordance with the current system under the Securities and Futures Ordinance and the virtual asset service provider system under the Anti-Money Laundering Ordinance.

To simplify the application process for dual licenses, if the applicant wishes to apply for licenses under both the current system under the Securities and Futures Ordinance and the virtual asset service provider system under the Anti-Money Laundering Ordinance, the applicant only needs to submit a comprehensive application form online and indicate that they are applying for both licenses.

The SFC expects that platform operators with dual licenses will only need to make one submission to comply with the licensing or notification requirements under the current system under the Securities and Futures Ordinance and the virtual asset service provider system under the Anti-Money Laundering Ordinance.

Four, compliance requirements for exchanges

Centralized virtual asset exchanges need to meet the following compliance requirements when operating, according to the “Guidelines for Virtual Asset Trading Platform Operators” and the “Terms and Conditions for Virtual Asset Trading Platform Operators” published by the SFC.

1. Safekeeping of Customer Assets

The Platform Operator shall hold customer funds and customer virtual assets in trust through a wholly-owned subsidiary (“Related Entity”). The Platform Operator shall ensure that no more than 2% of customer virtual assets are stored in an online wallet.

Because access to virtual assets requires the use of private keys, the safekeeping of virtual assets is essentially the safe management of private keys. The Platform Operator shall establish and implement written internal policies and governance procedures for private key management to ensure the secure generation, storage, and backup of all encryption seeds and keys.

Furthermore, the Platform Operator shall not deposit, transfer, lend, pledge, re-pledge or otherwise trade customer virtual assets, or create any proprietary interest in customer virtual assets. It must also have insurance coverage that covers the risks related to the safekeeping of customer virtual assets.

2. Know Your Customer (KYC)

The Platform Operator shall take all reasonable steps to establish the true and full identity, financial status, investment experience and investment objectives of each of its customers.

Furthermore, the Platform Operator shall ensure that customers have sufficient knowledge of virtual assets (including knowledge of the risks involved) before providing any services to them.

3. Anti-Money Laundering / Counter-Terrorist Financing

The Platform Operator shall establish and implement adequate and appropriate anti-money laundering / counter-terrorist financing policies, procedures and monitoring measures. The Platform Operator may use virtual asset tracking tools to trace specific virtual assets on the blockchain.

4. Conflict of Interest

The Platform Operator shall not engage in proprietary trading or market-making activities, and shall have policies for managing internal staff trading in virtual assets to eliminate, avoid, manage or disclose actual or potential conflicts of interest.

5. Inclusion of Virtual Assets for Trading

Platform operators should establish a function responsible for formulating, implementing and enforcing criteria for the inclusion of virtual assets, criteria for suspending, pausing and revoking the trading of virtual assets, along with the choices available to customers.

In addition, platform operators should conduct a reasonable due diligence review of any virtual assets before they are included for trading and ensure that these virtual assets continue to meet all criteria.

6. Prevention of market manipulation and illegal activities

Platform operators should establish and implement written policies and monitoring measures to identify, prevent and report any market manipulation or illegal trading activities that occur on their platform. The monitoring measures should include restrictions or suspensions of trading upon discovery of any manipulation or illegal activities. Platform operators should adopt an effective market surveillance system provided by a reputable independent supplier to identify, monitor, detect and prevent such manipulation or illegal trading activities and provide the SFC with access to this system.

7. Accounting and auditing

Platform operators must select auditors with appropriate skills, care and diligence, taking into account their experience, past record and ability to audit virtual asset-related businesses and platform operators.

In addition, platform operators should submit an auditor’s report for each fiscal year, which should contain a statement on whether there have been any breaches of applicable regulatory requirements.

Furthermore, we have currently imposed a licensing condition requiring platform operators to provide reports to the SFC on a monthly basis of their business activities within two weeks after the end of each month and upon request by the SFC.

8. Risk management

Platform operators should establish a robust risk management framework that enables them to identify, measure, monitor and manage all risks arising from their business and operations.

Platform operators should also require customers to deposit funds into their accounts in advance and not provide any financial accommodation to customers to purchase virtual assets.

5. Transitional arrangements

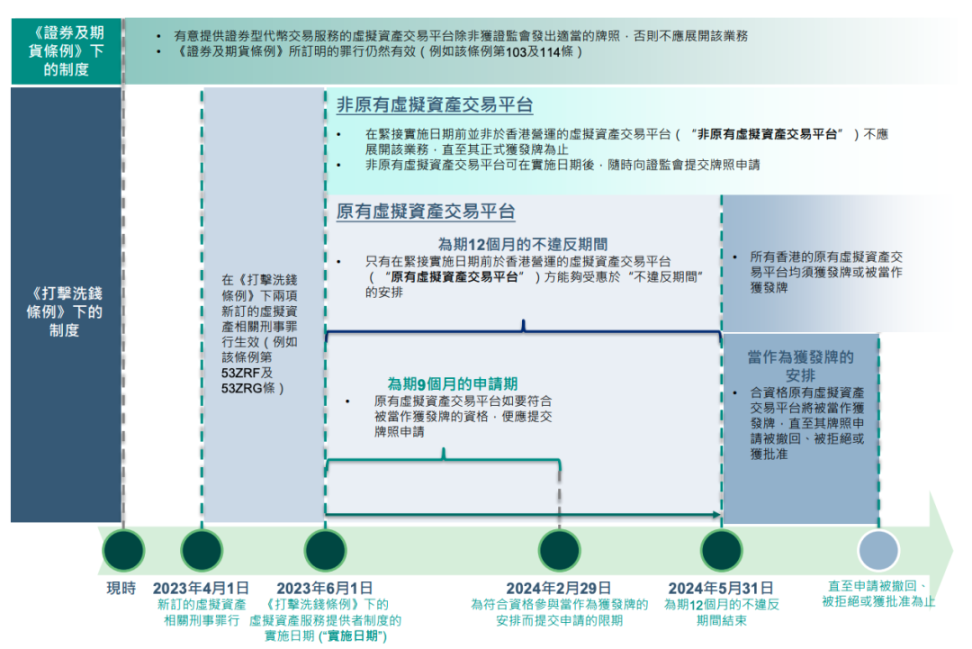

Regarding “existing virtual asset trading platforms,” the “Anti-Money Laundering Regulations” stipulate a transition period until June 1, 2024.

If the operator submits an application to the Securities and Futures Commission within nine months after June 1, 2023 and confirms that it will comply with the regulatory provisions formulated by the Securities and Futures Commission, the operator can be deemed to have been issued a license until the Securities and Futures Commission makes a decision on its license application. During this period, the operator will be able to continue to provide services until (i) the first 12 months end, (ii) the application is withdrawn, (iii) the Securities and Futures Commission rejects the application, or (iv) the Securities and Futures Commission grants the license, whichever is earlier.

If the virtual asset service provider license application is rejected by the Securities and Futures Commission, the operator must terminate its virtual asset service business within three months after receiving the rejection notice or by June 1, 2024, whichever is later. During this period, the operator can only take actions purely for the purpose of closing its services. The operator may apply to the Securities and Futures Commission for an extension of the closing period, and the extension period shall be a period deemed appropriate by the Securities and Futures Commission considering the operator’s business and activities.

For “non-existing virtual asset trading platforms” and those planning to provide virtual asset services in Hong Kong after June 1, 2023, they should apply to the Securities and Futures Commission in advance and obtain a virtual asset service provider license before conducting business.

6. “Regulatory arbitrage” is gradually fading away

According to the “Anti-Money Laundering Regulations,” relevant sanctions will be taken against illegal and non-compliant behaviors, including providing virtual asset services without a license and failing to meet AML/CTF requirements. In addition, any act of actively promoting services to the Hong Kong public will be regarded as providing virtual asset services, regardless of the location or provider of the services in Hong Kong.

Operating and providing virtual asset services without a VASP license after June 1, 2023 is a criminal offense. If convicted through a trial, a fine of HKD 5 million and imprisonment for 7 years can be imposed. If it is a continuing crime, a fine of HKD 100,000 can be imposed for each day of the crime’s duration. If convicted through a summary procedure, a fine of HKD 5 million and imprisonment for 2 years can be imposed. If it is a continuing crime, a fine of HKD 10,000 can be imposed for each day of the crime’s duration.

If licensed service providers and their responsible personnel do not comply with the statutory AML/CTF requirements, they will be committing a crime. Upon conviction, each person can be fined HKD 1 million and imprisoned for up to 2 years. In addition to criminal liability, they will also be subject to disciplinary action by the SFC, including suspension or revocation of licenses, condemnation, order to take remedial action, and fines.

In addition, various “improper conduct” during the operation of virtual asset exchanges may also face disciplinary action and fines from the SFC.

Compared with other jurisdictions, especially other regions in East Asia, Hong Kong’s regulatory environment for virtual asset trading was previously very relaxed. This is why there were countless companies of all sizes and no shortage of headquarters or operating centers in Hong Kong. However, with the introduction of the “new regulatory regime for cryptocurrency exchanges”, Hong Kong and “regulatory arbitrage” are becoming increasingly distant.

Seven, Hong Kong: The Return of the King

Thanks to its relaxed regulatory environment, favorable tax policies, and the huge geopolitical advantage of being backed by the mainland, Hong Kong, the global financial center with abundant resources, was once favored by the cryptocurrency industry, especially asset management and trading, the two most lucrative areas. In addition to major Chinese exchanges rooted in Hong Kong, Bitfinex and Crypto.com, which we are familiar with, are also headquartered in Hong Kong. Alameda Research and FTX, which were once the most prominent players in the industry, also started in Hong Kong. Not to mention that BitMEX once rented an entire floor in the Cheung Kong Center and became a neighbor of the SFC. As the center of gravity of the cryptocurrency industry shifts “east and west”, Hong Kong has been dormant for a while and overshadowed by Singapore and Silicon Valley on the other side of the Pacific.

Now, Hong Kong is making a comeback and strives to become the global cryptocurrency financial center. Regarding Hong Kong’s “new regulatory regime for cryptocurrency exchanges”, since the government began to release information in the second half of 2022, there have been various doubts and even ridicules. But this does not prevent the “tide surging in Hong Kong”. In April this year, the Hong Kong Web3 Carnival not only re-aggregated the power of the industry’s Chinese, but also attracted global attention, witnessing perhaps another historical turning point of the cryptocurrency industry in the “East rises and West falls”.

After the FTX collapse and the subsequent tightening of cryptocurrency industry regulations in the West, as well as the background of the competition for talent and funds in “New Hong Kong”, many people believe that the Hong Kong government’s “crypto new policy” may only be a flash in the pan. However, looking back at the previous review, from the Fintech Regulatory Sandbox in 2017 and the regulatory framework in 2018, to the “Position Paper” in 2019, and now the VASP licensing system, we can not only see that the Hong Kong government’s regulation of the cryptocurrency industry has a good policy continuity, but also glimpse its comprehensive plan, pragmatic spirit, flexible posture and determination to land.

Hong Kong is one of the top four financial centers in the world and the center of asset management in Asia. Its loose foreign exchange environment and sound legal system have attracted countless hot money. For centralized virtual asset exchanges, Hong Kong is a rare treasure. However, if you want to wear the crown, you must bear the weight. Only on the basis of meeting regulatory requirements can exchanges participate in the distribution of this huge cake.

If Hong Kong used to be a paradise for cryptocurrency adventurers, then the future Hong Kong belongs to industry players who follow the rules and attach great importance to compliance.

Reference:

https://www.elegislation.gov.hk/hk/cap571!zh-Hant-HK

https://www.sfc.hk/TC/Regulatory-functions/Intermediaries/Licensing/Do-you-need-a-licence-or-registration

https://apps.sfc.hk/edistributionWeb/api/consultation/openFile?lang=TC&refNo=23CP1

https://apps.sfc.hk/publicreg/Terms-and-Conditions-for-VATP_10Dec20.pdf

https://www.hkex.com.hk/-/media/HKEX-Market/News/Research-Reports/HKEx-Research-Blockingpers/2023/CCEO_CryptoETF_202304_c.pdf

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Why did hardware wallet Ledger launch the Ledger Recover service, which has sparked criticism from the Web3 community?

- 3 Counterintuitive Experiences in Cryptocurrency Investment

- EigenLayer, which raised $64.5 million in financing: A new narrative in the collateralized track

- US SEC Chairman’s pessimistic tone: Cryptocurrency businesses often non-compliant, filled with opacity and risk

- What would happen to Bitcoin if the black swan of US debt occurs?

- Inventory of the top 5 Ethereum GAS consumers

- Future Development History of NFT Derivatives: From Commodity Speculation to Financial Speculation, Gradually Abstracted Asset Symbols