Marketing expert Richard’s new venture: Why PulseChain achieved 500 million TVL in just one week

How Richard's marketing strategy helped PulseChain reach 500M TVL in a week.Learn about the story behind PulseChain’s sudden rise, which has reached a TVL of $500 million a week. Since 2021, funds on the blockchain have been declining, and new public chains have struggled to attract large amounts of funds. However, the recently launched PulseChain and the on-chain decentralized exchange PulseX are unexpected. PulseX has attracted $500 million TVL for PulseChain in just one week, making PulseChain’s TVL directly rise to eighth place. In this article, BlockingNews will take you through the background and potential risks of PulseChain’s sudden rise.

Founder Richard Heart and Controversial HEX

The success of PulseChain is closely linked to its founder Richard Heart’s background. From Twitter data, PulseChain’s official Twitter account is rarely updated, while founder Richard is working hard on marketing and achieving good results. It can be said that the success of PulseChain is mainly due to the background of its founder Richard, which brings us to the cryptocurrency HEX that he created.

HEX was issued on Ethereum through a Bitcoin UTXO snapshot in early December 2019, and Bitcoin holders could claim it for free. HEX is the world’s first high-interest blockchain certificate of deposit, also known as the encrypted version of traditional fixed deposits. Richard claimed that HEX can monetize the time value of money in a better way. In the traditional world, the money supply is constantly increasing, and the value is gradually decreasing. The inflation rate of HEX is set and will fall below 3.69% within one year.

HEX holders can pledge their tokens for a period of time (1-5555 days) and receive their principal and interest upon reaching the specified deadline. Pledgers can enjoy considerable appreciation rates, and users who hold HEX without locking it up will encounter inflation. If the pledge is terminated early, they will suffer large losses. For example, with an inflation rate of 3.69% and a pledge rate of 10%, the annualized rate of return on the pledge is 36.9%.

- Can the fluctuating UBI economy of the Worldcoin AI era become a reality?

- Vertex Labs acquires Digimental Studio, the developer of HAPE PRIME, for $12 million

- Introduction to Cascade: The First Interchain SVM Rollup Supporting IBC

HEX was criticized at the time of its issuance, including privacy issues in token claims and token structures similar to Ponzi schemes. Although Bitcoin holders were able to claim HEX tokens for free at the beginning, they also sacrificed their privacy. In addition to claiming it for free, users can also send ETH to the funding pool to receive newly issued HEX tokens.

From being worthless in 2019 to its peak in 2021, HEX has achieved tens of thousands of times in gains, making its founder Richard even more famous. The myth of getting rich quickly with HEX has changed the fate of many losers, and founder Richard has a similar background of failure.

This attracted countless followers to HEX and some people worked with Richard to build PulseChain and actively promote it. Notable figures, including XEN founder Jack Levin, are supporters of HEX and are actively collaborating on marketing efforts.

Richard himself is also a “marketing expert” (many people believe it is a scam) and is always passionate about his projects. According to public information, Richard has 324.5k followers on Twitter and 152k subscribers on YouTube, with 264 videos uploaded. Multiple HEX-related videos have more than 100k views. In addition, the HEX website shows that Richard has purchased the world’s largest cut diamond, weighing 555.55 carats with 55 facets, and Heard has renamed it “The HEX.COM Diamond.” HEX.com also sponsored JJ Yeley, one of the Triple Crown winners, in the Daytona 500 race.

PulseChain’s Airdrop Plan

After HEX reached its peak, Richard started another crypto project, PulseChain, which is a fork of Ethereum that Richard built to lower gas fees in transactions. PulseChain supports EVM and can be connected directly through Metamask, with a block time of about 10 seconds.

Similar to the airdrop given to Bitcoin holders for HEX, PulseChain’s marketing also began with an airdrop. PulseChain was once promoted as the “largest airdrop in history” worth $1 billion. Similar to fork chains like ETHW, PulseChain plans to replicate Ethereum’s state so that users who hold ETH on Ethereum can also receive an equal amount of PulseChain’s native token PLS airdrop, while other tokens can also be exchanged for PLS for profit in the early stages theoretically.

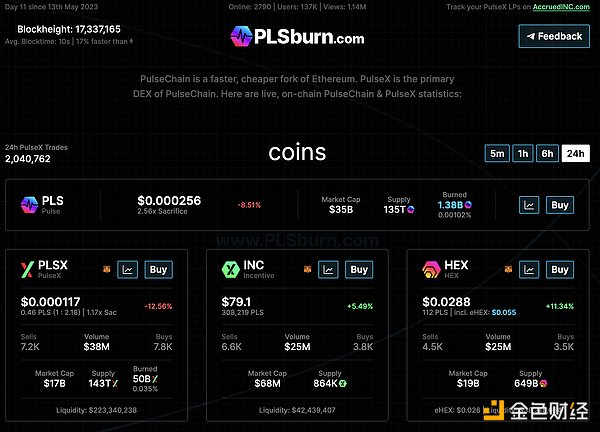

However, the situation after going online is quite different. As of May 23, PLSburn.com shows that the supply of PLS is 135T, the price is $0.000256, and the market value is $35 billion. If 1 ETH worth $1850 is held on Ethereum, it can only receive 1 PLS airdrop worth $0.000256 on PulseChain, which is almost negligible.

Unique “Sacrifice” Attracts Huge Financing

When designing PulseChain, Richard also laid out a DEX on the chain, PulseX, which is the counterpart to Uniswap on Ethereum.

Both PulseChain and PulseX have a financing method called “Sacrifice,” which means that investors “give up” their own cryptocurrencies while receiving free, worthless PulseChain and PulseX native tokens through airdrops. From their own interests, users who participate in Sacrifice are obviously hoping to profit from the airdrop, which can be seen as a financing method adopted by PulseChain to avoid legal risks.

Tokens that can participate in Sacrifice include HEX, USDC, ETH, and other mainstream currencies, and the earlier the participation, the more tokens can be obtained. According to the rules of PulseX, before January 10, 2022, every $1 token sacrificed can get 10,000 Sacrifice Points. After that, the amount of funds required to get 10,000 points increases by 5% every 24 hours, until February 25, when sacrificing $9.91 can get 10,000 points.

Richard’s reputation, combined with this FOMO financing method, has enabled both PulseChain and PulseX to raise a large amount of funds. According to Footprint statistics, the Sacrifice funds in PulseChain are $500 million. By the end of the first phase of the Sacrifice for PulseX on January 10, 2022, the amount of participation has reached $940 million.

Sacrifice seems to have become a common financing method in PulseChain, and Hexpulse.info also lists multiple projects that use this method of financing.

The liquidity mining craze on PulseChain after its launch

With the aforementioned financing method of Sacrifice, the native token PLS of PulseChain and the native token PLSX of PulseX also have a very high basic market value. The $1 billion financing scale of decentralized exchange PulseX is also one of the largest financings in the cryptocurrency industry.

As of May 23, according to DeFiLlama, there is only one project, PulseX, on PulseChain, and the Total Value Locked (TVL) of PulseX is $500 million, which makes the TVL of PulseChain directly rise to eighth place, surpassing old public chains such as Solana and Fantom, and even ten times the emerging public chains Aptos and Sui.

Driven by the high market value of PLS and PLSX, the yield of liquidity mining on PulseX is almost all above 1,000%. Due to the high demand for cross-chain from Ethereum to PulseChain, the official cross-chain bridge was once paralyzed, and most of the funds were stuck on the cross-chain bridge and could not reach normally.

According to the data on PLSburn.com, the current prices of PLS and PLSX correspond to 2.52 times and 1.13 times the sacrifice prices, respectively, which may further enhance the cohesion of the HEX community. The once-high market value HEX is perfectly transferred to new projects in this way, and profits are obtained during the downturn of the cryptocurrency market.

Risks in PulseChain

PulseChain has experienced rapid development, but also comes with great risks. The liquidity mining rewards for PulseX are given in INC tokens (Incentive Token), and as the liquidity in PulseX increases, the price of INC also continues to rise. According to GeckoTerminal data, the price of INC has increased by more than 10 times from May 19th to now. The liquidity in both INC-WPLS and INC-PLSX is over $40 million.

The most liquid trading pair in PulseX is the internal PLSX-WPLS, with a liquidity of $213 million and a corresponding APR of only 65%. The liquidity for mainstream coins such as USDC, USDT, and ETH is not high, and the highest liquidity for relevant trading pairs is only $22.44 million for WETH-WPLS. This shows that the funds in PulseX mainly come from HEX and PulseChain ecology, and there is still a lack of attraction to external funds.

Almost all mining in PulseX requires trading pairs with PLS, and the APR for the most liquid PLSX-WPLS is relatively low. Once this part of the funds starts to sell or INC starts to decline, it is easy to cause a death spiral, leading to a decline in both liquidity and token prices.

In short, PulseChain was built by Richard and his followers. Richard has strong marketing abilities, and the HEX community has a strong consensus on this. PulseChain and PulseX have attracted a large amount of funds in the short term, but most of the funds come from within HEX and PulseChain. The current market capitalization of PLS is $34 billion, and the market capitalization of PLSX is $160 million, which is relatively high, and mining requires purchasing PLS, which is risky. Richard himself is also quite controversial, and many people believe that the projects he has done are scams, so investment needs to pay attention to risks.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- OP Labs: Multiproofs Design in OP Stack and Their Impact on the Ecosystem

- Blend will support the KanBlockingi Blockingndas and Redacted Remilio Babies NFT series.

- Principles of Natural Philosophy for Petting Fur

- How to maintain liquidity in protocols? A quick look at the time-bound token protocol Hourglass

- Smart contracts, breaking away from the regulations of civil law contracts?

- Hardcore Analysis: Key Factors and Specific Investment Directions for Large-scale Adoption of DID in the Future

- Vitalik’s new article: Keep On-Chain Minimalism, Don’t Overload Ethereum Consensus