How has the ecosystem of Polygon zkEVM developed in the past 2 months?

What's the progress of Polygon's zkEVM in the last 2 months?Original author | 2Lambroz.eth

Compiled by | White Birch Research Institute

Do you know about the development of Polygon zkEVM? Not airdrop hunters, not alpha hunters, but want to know what’s happening on this L2?

In 3 minutes, we’ll show you everything you can do on Polygon zkEVM. Are the ecosystem projects opportunities or just airdrop hype?

- Ethereum Singapore 2023 will build a communication bridge between over 2000 Web3 developers, talents, and the local ecosystem.

- Tornado Cash is hit by a malicious governance attack, and the latest recovery proposal may be an attempt by the attacker to inflate the coin price and sell off.

- Over $76 billion in funds have been stolen, taking stock of six major tools for securing cryptocurrency assets

zkEVM is considered the holy grail of Ethereum scalability. Polygon is one of the explorers leading the way in this field, with Polygon zkEVM being the second zkEVM to go live after zkSync Era.

In this article, we will mainly discuss three things:

1️⃣ Opportunities on Polygon zkEVM

2️⃣ An overview of on-chain assets on Polygon zkEVM

3️⃣ All the Dapps currently on Polygon zkEVM

4️⃣ Reflection and summary

1. Opportunities on Polygon zkEVM

Let me show you some “temptation” — the APR on Polygon zkEVM now, to see how high the liquidity mining revenue is.

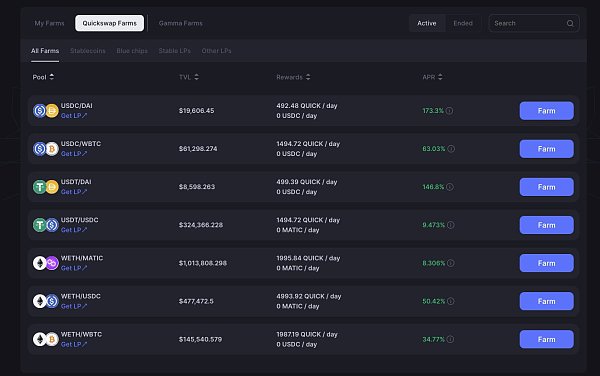

QuickSwap

TVL on zkEVM chain is about $7 million.

- USDC/DAI – 173%

- USDT/DAI – 146%

- USDC/WBTC – 63%

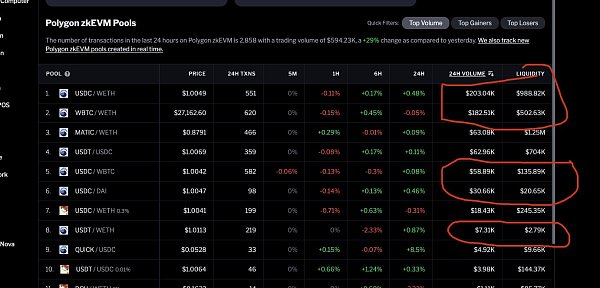

But these high returns are not just to attract liquidity, if you check on CoinGecko, you will find that the actual trading volume/liquidity ratio is also high.

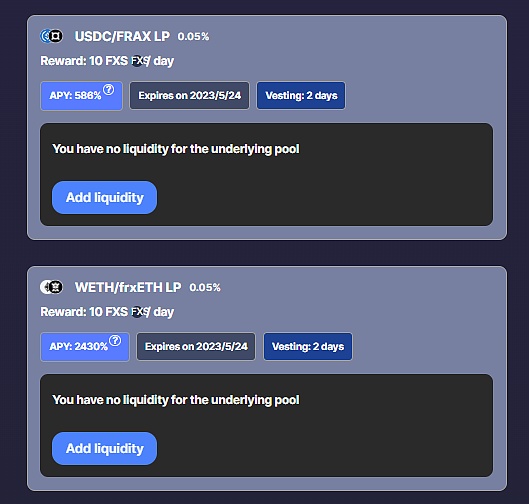

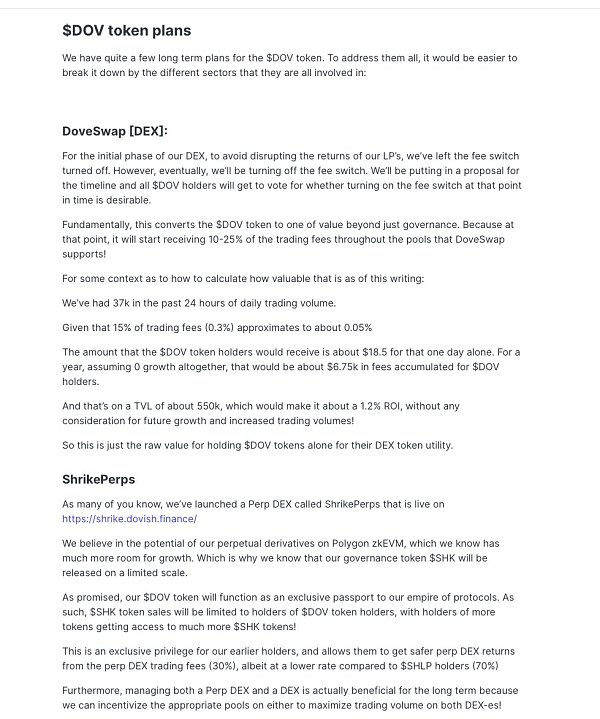

Dovish Finance

TVL is only $550,000.

The current TVL in the wETH/frxETH pool is 4.5 ETH, but the total daily earnings are only 10 FXS, which is obviously not attractive.

USDC/FRAX is the same, with a TVL of $18,000 and total daily earnings of only 10 FXS. Assuming that the FXS price stays at $7, the average daily earnings for providing $1 in liquidity is only $0.003 (70/18000).

The project also incentivizes some liquidity pools with its platform currency $DOV, but the wETH/DOV LP is very thin with only 24 wETH pairs and low liquidity. I’m not sure how $DOV will get its value, so I’ll keep an eye on it later.

Mantis Swap

I couldn’t find a stablecoin exchange AMM on Polygon zkEVM, so my friend recommended Mantis Swap to me:

🔹 Possibly the first stablecoin trading protocol

🔹 Single coin mining

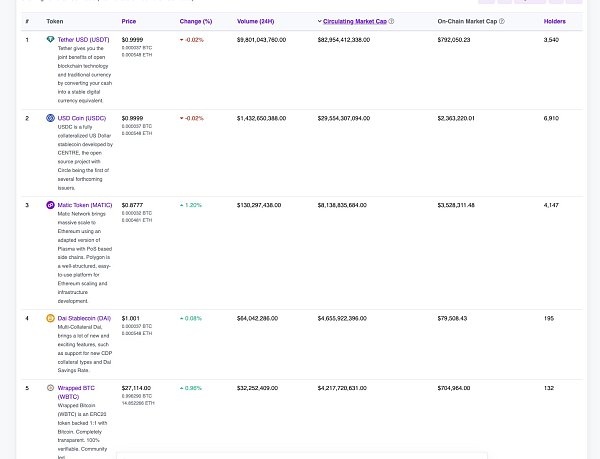

2. Overview of On-chain Assets in Polygon zkEVM

Polygon zkEVM is currently a “baby”, with TVL of only about $10 million.

- USDT – $700K

- USDC – $2.3M

- DAI – $80K

- BTC – $700K

- WETH – $2.3M

- Matic – $3.5M

Interestingly, the Frax ecosystem has been around for a long time:

- sfrxETH – $475K

- frxETH – $455K

- FPIS – $469K

- FXS – $180K

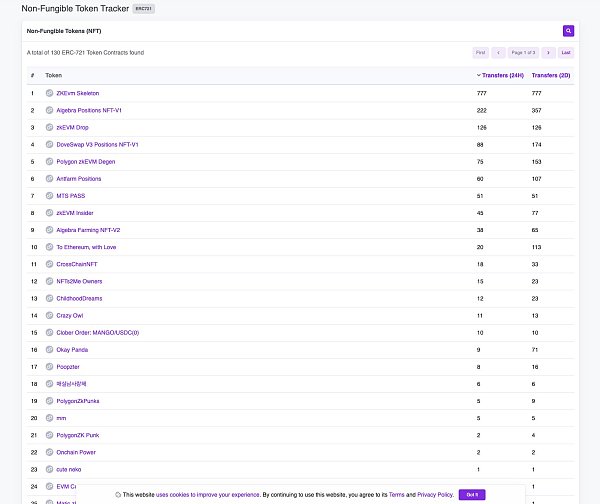

NFTs have not been crazily minted yet, but it looks like some projects are starting to lay out.

3. All Dapps Currently on Polygon zkEVM

QuickSwap

Currently the largest DEX on Polygon zkEVM.

Dovish Finance

Swap, about to launch perpetual contract functionality.

However, the current liquidity mining is not very attractive.

Uniswap

The on-chain vote to “Launch Uniswap V3 on Polygon zkEVM” has been passed and should be coming soon.

LeetSwap

A Swap built on Canto + Polygon zkEVM, but the UI currently cannot be connected to zkEVM.

Antfarm Finance

Antfarm is a Swap that prioritizes liquidity providers, aiming to provide more profit and security for liquidity providers by utilizing market price changes. The current TVL is $1.07 million, and it looks good.

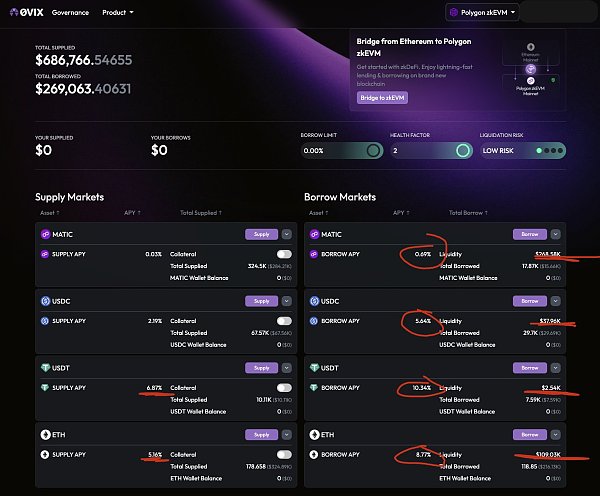

0VIX

A lending protocol, but currently there is not much liquidity available to borrow.

However, borrowing on PolygonzkEVM is currently not worth it. If you’re crossing chains to zkEVM just to borrow money, you might as well do something on platforms that offer high APYs. But if you’re airdrop hunter, give it a try.

D8X

An upcoming institutional-grade perpetual DEX.

Satori Finance

A perpetual DEX backed by PolyChain and Coinbase.

zkEVM Swap

A small swap with low Twitter popularity and no further information.

zkDeFi

A low-popularity swap with liquidity mining and LaunchBlockingd features, built on zkSync and coming to PolygonzkEVM soon.

4. Reflection and Conclusion

PolygonzkEVM is not only backed by an experienced Polygon development team, but also by a “baby” L2 with high airdrop expectations.

As Sandeep Nailwal, the founder of Polygon, has always said:

“The Polygon zkEVM ecosystem is ready to make significant improvements, such as deploying critical infrastructure (e.g., Safe), the arrival of oracles (e.g., Chainlink), improving user experience based on early developer feedback, and cost optimization through data compression. Additionally, there are no rules that existing tokens (MATIC) cannot be airdropped on a large scale.“

The advantages of PolygonzkEVM are:

🔹 Backed by Polygon, making it easy to attract more protocols for development

🔹 Strong business development skills that can invite more protocols to migrate

🔹 An active community

Nevertheless, PolygonzkEVM also faces some challenges:

🔹 Polygon is trying to do a lot, from DeFi to Web3 games to Web2 adoption

🔹 Their DeFi has slowed down a lot, and they believe QuickSwap is the “king”

🔹 Zero-knowledge proof technology is cool, but how many people really care about it?

If you want to try using PolygonzkEVM, you may find that most cross-chain bridges have low liquidity. You can basically only cross-chain ETH from the Ethereum mainnet. So the user experience of PolygonzkEVM is not very good so far (but it’s still early).

I like mining in DeFi and the high APY offered by existing DeFi Dapps is beneficial for me.

Therefore, although PolygonzkEVM is a bit early for a wider audience, it’s worth paying attention to.

Risk warning:

According to the “Notice on Further Preventing and Disposing of the Risk of Virtual Currency Trading Speculation” issued by the central bank and other departments, the content of this article is only for information sharing and does not promote or endorse any business or investment activities. Readers are strictly required to comply with local laws and regulations and not to participate in any illegal financial activities.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- “Rebellious Girl” and “Internet-addicted Youth”: 13-year-old DAO Founder Finds Self in Web3

- How to dissect ETH volatility? Breakdown of F(X) novel stable asset and leverage scheme

- Review of the Rise and Fall of Cryptocurrency Exchanges in the Last 13 Years: Dominance, Scandals, and Crashes

- How to use dynamic NFTs to provide liquidity products in the Sui public chain ecosystem?

- Decoding the new standard ERC-6551: A new way of playing NFTs in wallets

- Amid the encryption winter, what makes Worldcoin capable of securing a $100 million financing?

- 20 most active VCs and their largest investment in the 2023 bear market