Decoding a16z Fundraising Deck: Why is the gaming industry worth doubling down on?

a16z Fundraising Deck: Why Invest in Gaming?On its first anniversary, Andrew Chen, the manager of a16z Games Fund One, revealed the fund’s fundraising deck for 2022. TechFlow Research has interpreted it.

Produced by: TechFlow Research

Written by: 0xmin

- Hotbit suddenly announced its closure. Is it a reshuffle in the industry or a trend?

- How will the Ethereum Cancun upgrade change the Layer2 landscape?

- Founder of EigenLayer Responds to Vitalik’s New Article: Consistent with the Staking Philosophy

A year ago, the crypto venture capital giant Andreessen Horowitz (a16z) announced the launch of its first gaming fund, Games Fund One, with a size of $600 million. After one year, the fund has made 25 investments.

On the occasion of the first anniversary, the manager of Games Fund One, Andrew Chen, revealed the fund’s fundraising deck for 2022, which has been interpreted by TechFlow. Andrew Chen has also provided comments. For example, in Andrew Chen’s opinion, if he were to write this deck today and talk about why he is investing now, he would definitely write “AIAIAIAI” and use AI as a new investment theme.

Overview: Why gaming?

The main points are:

- A vibrant consumer ecosystem has emerged around gaming;

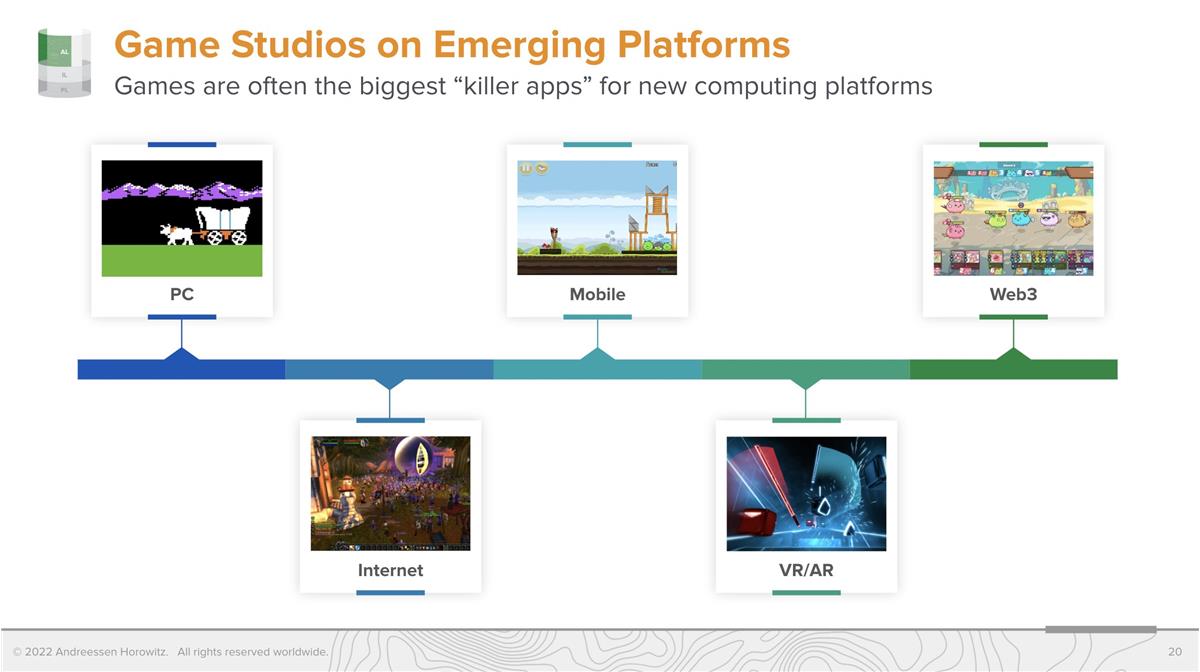

- Games are often the biggest killer apps on new platforms;

- Today’s games form a massive social network;

- Gaming has also undergone enormous changes.

Andrew: Gaming is driving the GenAI revolution, and these games are displaying their cultural power at a “miracle moment,” as some games, such as The Last Survivor and Super Mario, are expanding their entertainment IP and becoming movies, among other things.

Why now?

a16z elaborated on four aspects:

- Emerging markets: There are over 3 billion gamers in the world today

- Youth: 250 million children become lifelong gamers

- COVID-19 pandemic: Accelerate the entry of non-traditional gamers

- Web3/VR wave: Web3 games exploded in 2021, and VR/AR is at a turning point

Andrew: This is the slide that elaborates on “why now,” but today we will use AI AI AI AI AI AI 🙂 to update this slide.

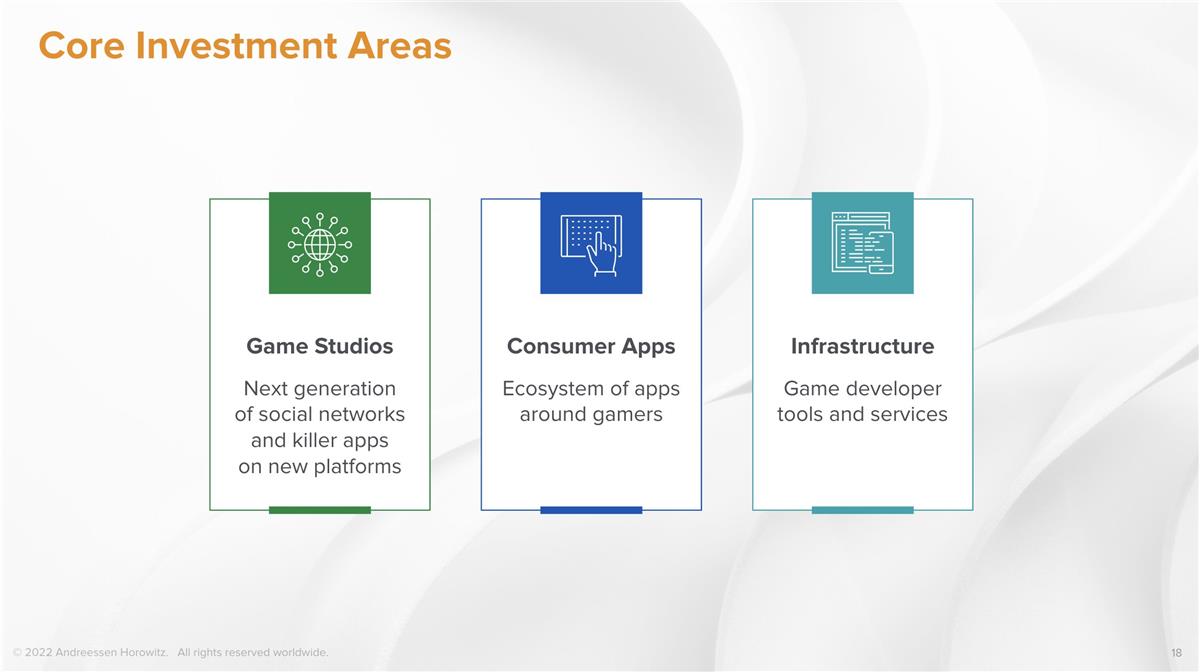

Core investment areas:

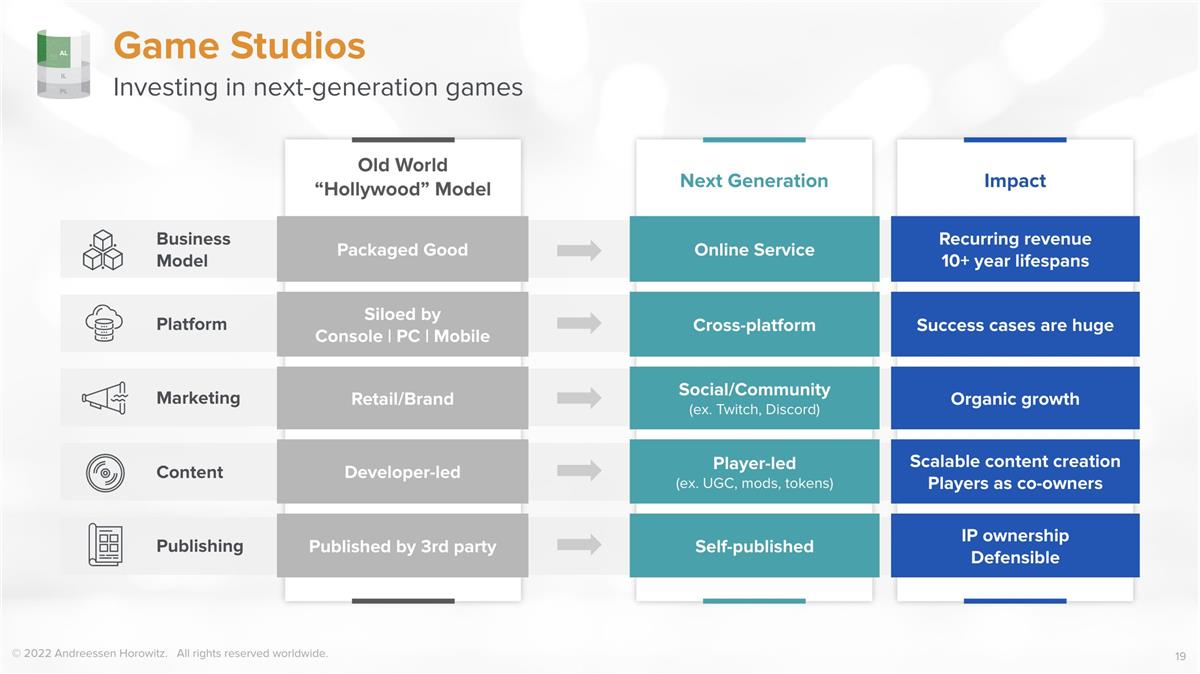

- Game studios: Invest in the next generation of games, such as cross-platform, business models from online revenue, and player-led

- Game-related consumer applications: For new platforms, games are often the biggest killer application, from PC to MOBILE to VR/AR, and then to Web3.

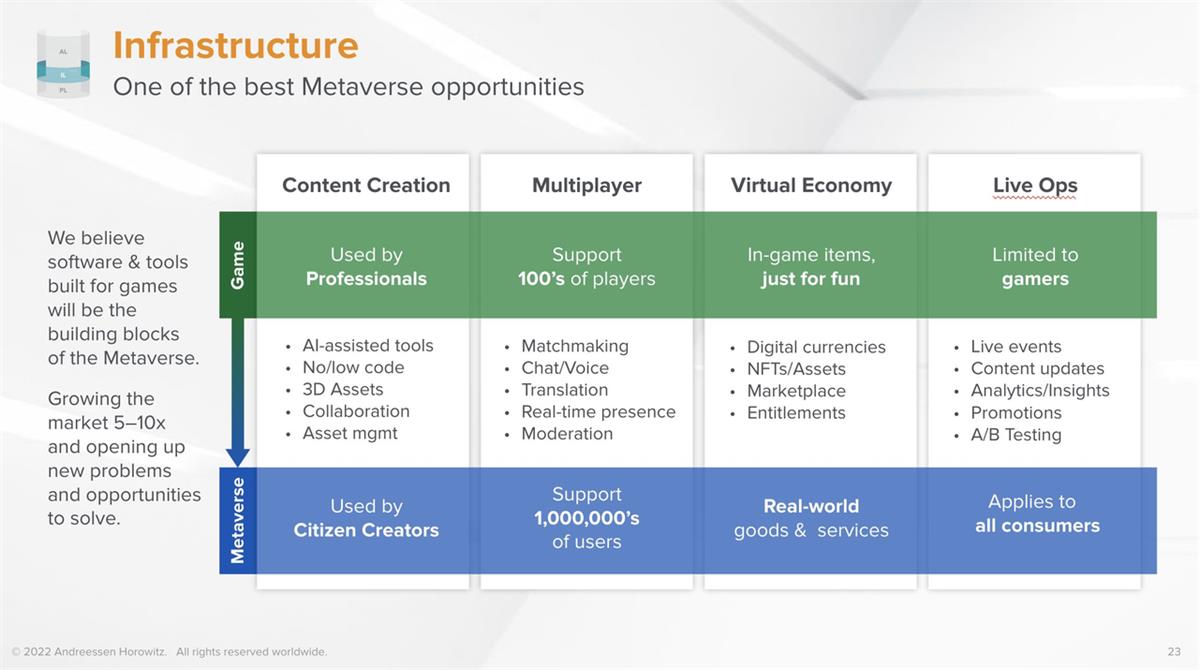

- Infrastructure: In a16z’s view, software and tools built for games will become building blocks of the Metaverse.

Andrew: Last year, we focused mainly on game studios, Web3, and infrastructure. This year we continue to maintain this focus, but we are starting to turn to the field of artificial intelligence.

In just the first quarter, we encountered over 100 AI x Games companies. By 2023, 80% of game fund investments will have a major artificial intelligence component – reshaping core gameplay or creating tools. We need to balance our investment approach to cover all key areas of gaming while also adapting to new trends.

What are a16z’s advantages in investing in the gaming industry?

a16z believes that their advantages lie in the following areas:

- A senior investment team with experience in the gaming industry, such as partners from Riot/Tencent and other major gaming companies;

- A professional operational platform for gaming companies;

- Cross-game communication and integration, such as games and crypto/financial technology/consumer;

- a16z has a decade of experience in investing in games.

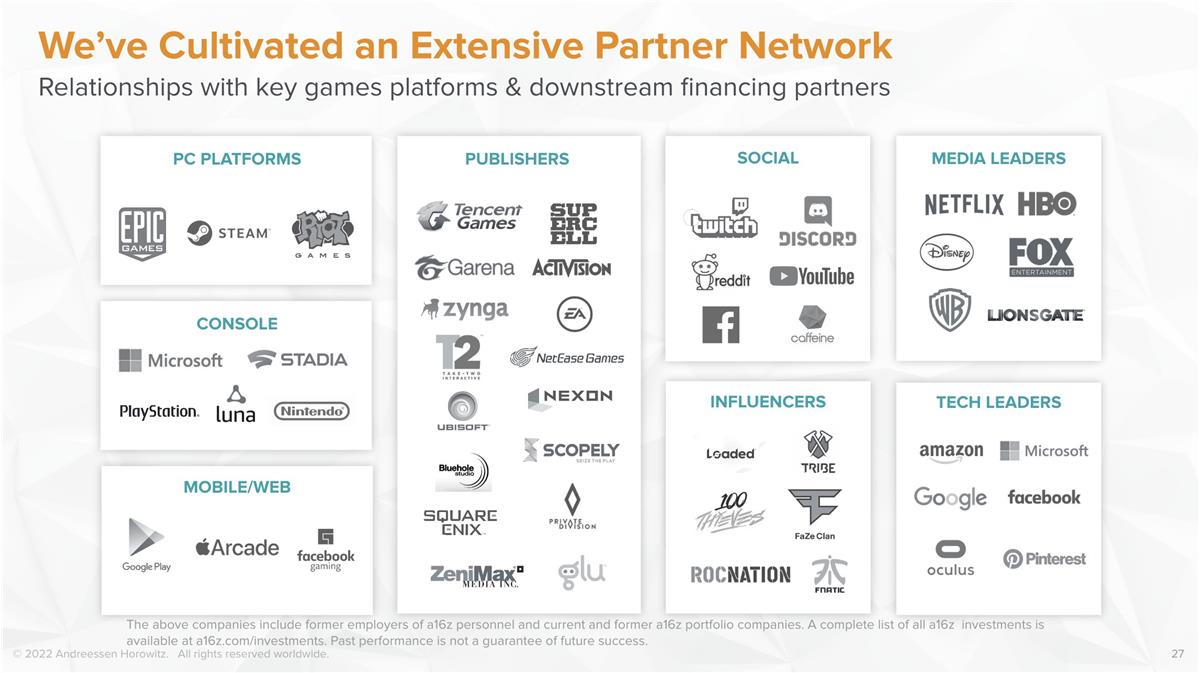

Among them, a16z highlighted the empowerment platform they have built for game founders, which provides help in early financing, publishing, marketing, growth, recruitment, and commercialization, and has established cooperative relationships with the world’s major gaming companies.

Strong post-investment has always been a feature and advantage of a16z, and most of its relevant operators occupy the vast majority, so many people believe that a16z is not so much a VC as a company or media.

Andrew: A major part of a16z’s differentiated investment is that we can help the operating team of the invested company. In fact, the vast majority of a16z’s employees focus on this, and only a small part focuses on investment. Gaming startups need this help: recruitment/creators/publishing/distribution.

Last year, we hired @DougMcCracken from Supercell to lead marketing, @Chen from YouTube to lead the “creator” field, and @justmazer from Riot to lead talent recruitment. Everyone has an entrepreneurial mindset, and we all act like hosts and work without clear instructions. (More people have joined!)

Andrew: Given the economic downturn, we have spent countless hours managing our investment portfolio to maximize its long-term potential for success. This is why the operations team is so strong. Builders need help from builders, and we formed a team in the first year, hiring talent from Blizzard, Supercell, YouTube, Riot, Twitch, and Unity!

In the past few months, we have also established SPEEDRUN, our game startup school, to make it easier for new founders to get started.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- How has the ecosystem of Polygon zkEVM developed in the past 2 months?

- Ethereum Singapore 2023 will build a communication bridge between over 2000 Web3 developers, talents, and the local ecosystem.

- Tornado Cash is hit by a malicious governance attack, and the latest recovery proposal may be an attempt by the attacker to inflate the coin price and sell off.

- Over $76 billion in funds have been stolen, taking stock of six major tools for securing cryptocurrency assets

- “Rebellious Girl” and “Internet-addicted Youth”: 13-year-old DAO Founder Finds Self in Web3

- How to dissect ETH volatility? Breakdown of F(X) novel stable asset and leverage scheme

- Review of the Rise and Fall of Cryptocurrency Exchanges in the Last 13 Years: Dominance, Scandals, and Crashes