How will the Ethereum Cancun upgrade change the Layer2 landscape?

What impact will the Ethereum Cancun upgrade have on Layer2 technology?

Author | DaSheng Web3

Produced by | Plain Language Blockchain (ID: hellobtc)

- Founder of EigenLayer Responds to Vitalik’s New Article: Consistent with the Staking Philosophy

- How has the ecosystem of Polygon zkEVM developed in the past 2 months?

- Ethereum Singapore 2023 will build a communication bridge between over 2000 Web3 developers, talents, and the local ecosystem.

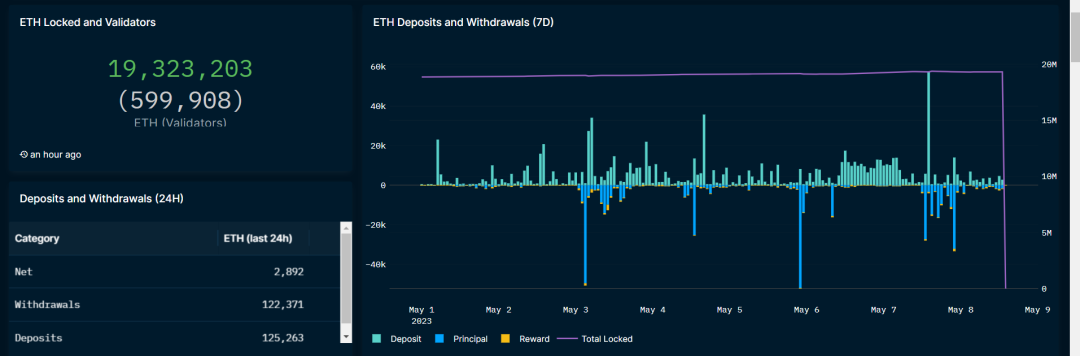

Recently, BRC20 has been on fire, and Bitcoin, which is mainly used for value storage, has an ecosystem that is even hotter than Ethereum. However, don’t forget that Ethereum is the real king in terms of ecosystem, because Ethereum is quietly brewing the next major upgrade. On April 13th, Ethereum successfully completed the Shanghai upgrade, and the ETH mainnet opened for withdrawals and flexible deposits, completing a major step for Ethereum to transition from POW to POS. However, this brought some selling pressure in the short term, so ETH has been in a weak adjustment phase recently.

Source: nansen

Each important Ethereum upgrade is often a hot topic in the industry and brings opportunities for some races to develop rapidly. For example, the Shanghai upgrade has brought fire to the LSD race, which has achieved excess returns in the first quarter. So what is the next important ETH upgrade?

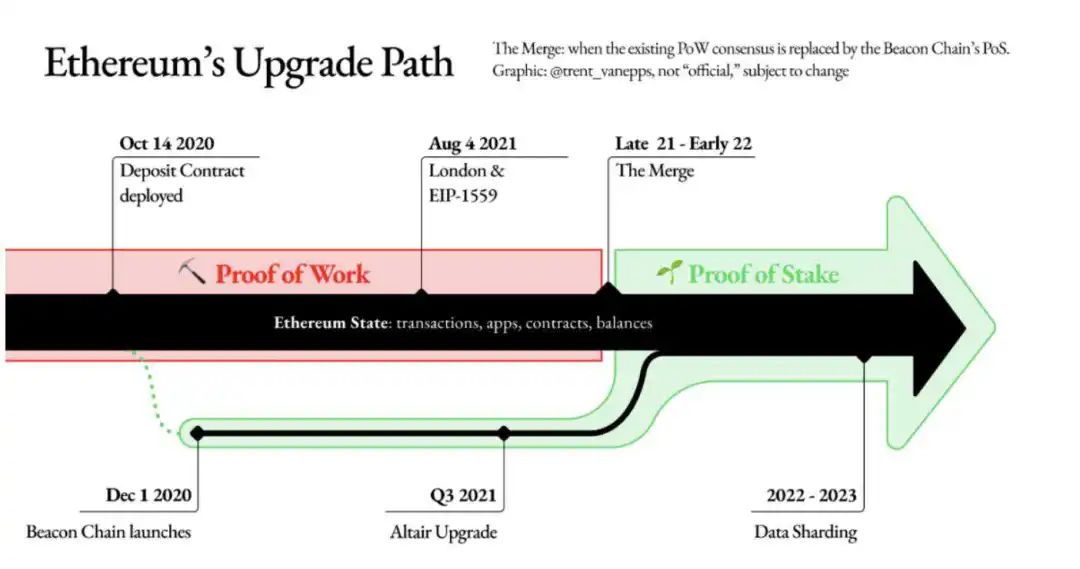

01, ETH upgrade history

An Ethereum upgrade often means new features, adjustments to some parameters, or improvements in security. However, Ethereum upgrades are also divided into active and passive upgrades . Active upgrades are easy to understand, and upgrade activities are carried out according to the intentions of developers. But passive upgrades are actions that must be taken to deal with potential security risks.

Source: @trent_vanepps

Before the Ethereum merger in September last year, ETH underwent 14 upgrades, among which the famous passive upgrade was the DAO Fork incident in 2016. Due to the theft of ETH raised by the DAO project, it triggered the ETH forking incident, and finally forked out Ethereum Classic ETC.

02, important upgrades in recent years

On August 5, 2020, the London upgrade was launched , introducing the EIP-1599 proposal, increasing ETH burns, and dynamically adjusting the Base Fee for each order.

2022.9.15, Paris Upgrade: Ethereum’s consensus mechanism will transition from POW to POS, ending the era of machine mining.

After the Shanghai upgrade, the most important upgrade this year will be the Cancun upgrade. In the latest Ethereum core developer meeting, it was announced that the Cancun upgrade is expected to take place later this year. Why is the Cancun upgrade important, what are its contents, and what development opportunities will it bring? The following will answer these questions for everyone.

03

Cancun Upgrade Content and Impact

Following the tradition of using the name of the devcon (Ethereum Developer Conference) city for upgrades, Ethereum’s next upgrade will be the Cancun upgrade in Mexico.

1. Upgrade Content

According to the summary of the 160th Ethereum Execution Layer Core Developer Meeting (ACDE), the current content included in the upgrade scope is as follows:

-

EIP-4844: The protagonist of the upgrade:

EIP-4844 aims to implement temporary storage and retrieval of off-chain data through Ethereum nodes to meet the data and storage needs of blockchain applications. If successfully activated, EIP-4844 is expected to reduce the cost of second-layer rollup solutions. It is reported that EIP-4844 has completed testing on four development networks. During the conference call, developers announced that they will launch the fifth test network.

EIP-4844 should have been completed in the Shanghai upgrade, but was ultimately postponed to the Cancun upgrade.

-

Developers also agreed to include the following EIPs in the upgrade:

·EIP-6780 (prepare for future applications of Verkle trees);

·EIP-6475 (provide better readability and compact serialization);

·EIP-1153 (introduce transient storage opcodes).

…

These proposals help ETH achieve more complete functionality.

Principle:

The essential purpose of Ethereum’s expansion is to increase data processing capacity and speed. Currently, there are two directions being pursued simultaneously: one is layer2 rollup, and the other is the mainnet sharding scheme. The complete sharding scheme is divided into three steps, with EIP-4844 being the first step.

The principle of rollup has been covered extensively before, so it will not be repeated here. The main intention of mainnet sharding is to split the data that needs to be stored on the mainnet, saving space, and adopting a flexible retrieval method to temporarily store and retrieve the required data. It’s like watching videos. Originally, all the videos were downloaded, and when you wanted to watch one, you had to find it, but many of the videos were unnecessary and took up a lot of memory, causing the system to crash. Now it’s like a video website where you can just click on the one you want to watch. It is temporarily cached, saving space.

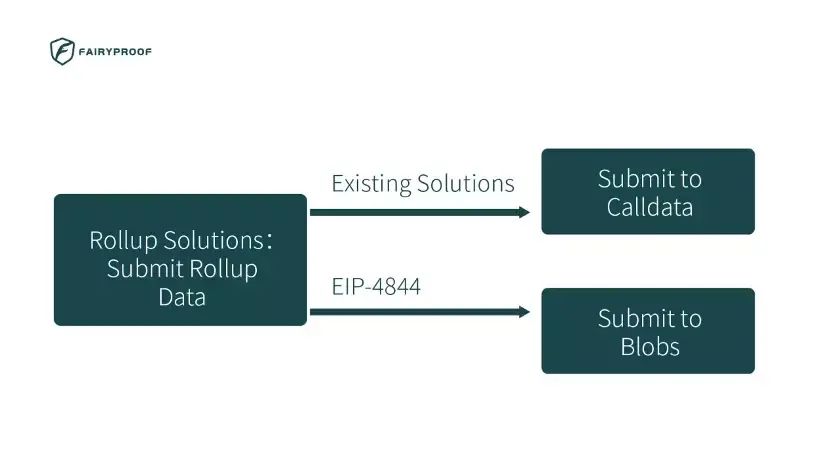

Before the Cancun upgrade, L2 information was stored in the Calldata of L1 information. But this method is costly, and the space for Calldata is limited.

After the Cancun upgrade, L1 will be stored in a new location called “Blob.” Blob storage is low cost and has more space. This can allow Ethereum to carry more data, increase Ethereum’s TPS, and reduce costs. Since Blob is a temporary data package that is cleared every fixed number of days (currently 30 days), nodes only need to download the data for a fixed month, reducing the burden on the nodes.

The Cancun upgrade will make L2 cheaper and faster. This is not only good news for the L2 protocol itself, but also for the ecosystem built on top of L2, which will experience faster development.

2. Good News for the Track

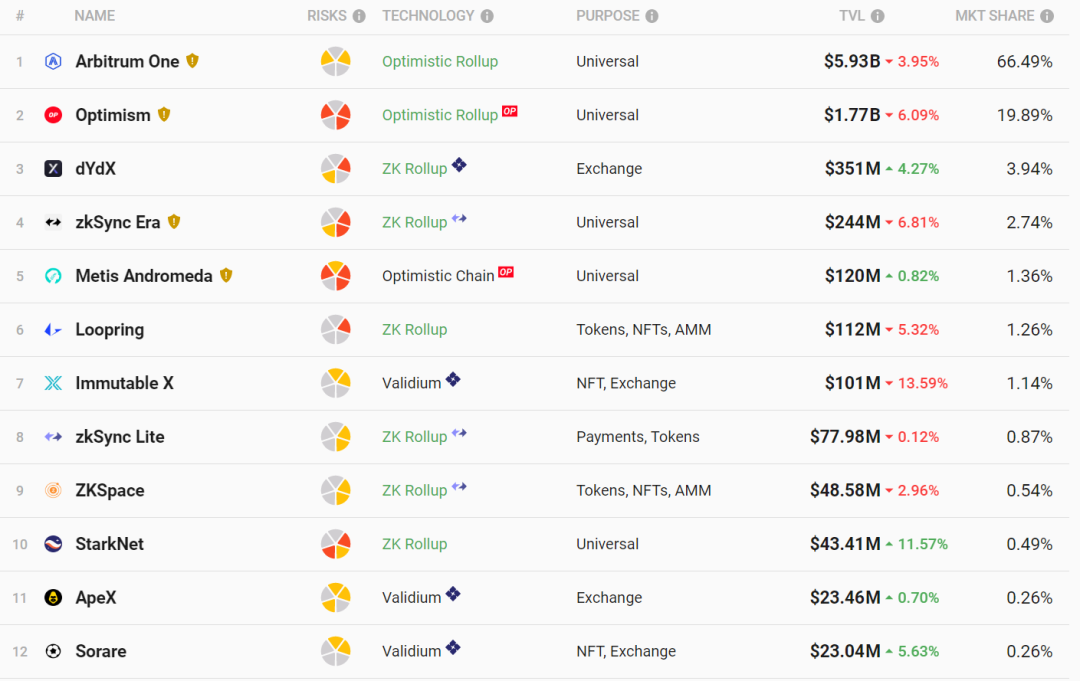

The Cancun upgrade first benefits the L2 protocol and the ecosystem within it. The OP ecosystem will become more diverse, and the ZK ecosystem will become more available due to enhanced data availability. More independent layer 2 that was difficult to operate due to high costs will grow rapidly.

Source: L2beat

-

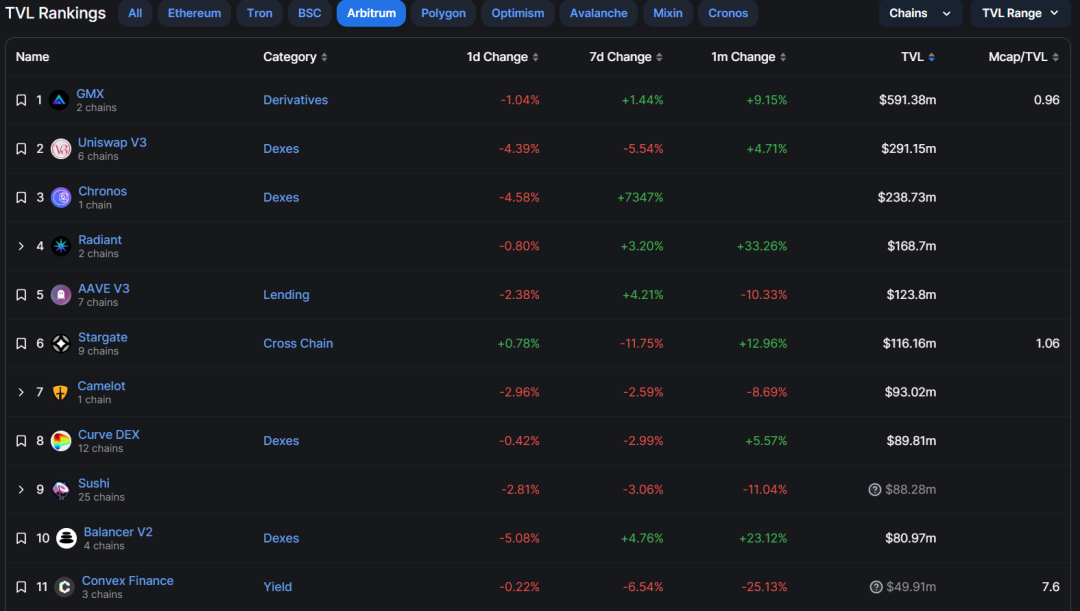

On-chain Futures DEX: GMX, GNS, etc.

Before L2 development flourished, on-chain futures DEX was always limited by Ethereum’s low TPS because leveraged trading pairs require higher speeds, so there was no good development. After L2 can gradually build ecosystems, GMX, GNS, etc., quickly emerged, and GMX quickly became the project with the highest TVL on Arbitrum. In the future, with the implementation of the Cancun upgrade, on-chain futures DEX will further develop.

According to WFE (World Federation of Exchanges) data, the order volume of derivatives in mature traditional financial markets far exceeds that of spot transactions, and on-chain futures DEX, as the current leading derivatives protocol, still has a considerable development space.

Source: defillama

-

Decentralized Options DEX: Dopex, etc.

Options are the most commonly used trading tool for institutional users. According to data from the World Federation of Exchanges (WFE), options account for 60% of the trading volume in derivative orders in traditional financial markets. Therefore, once the Cancun upgrade is successful, the development potential of on-chain options will be greater, but it has always been limited by low capital efficiency. After the infrastructure is improved, more outstanding applications will emerge.

-

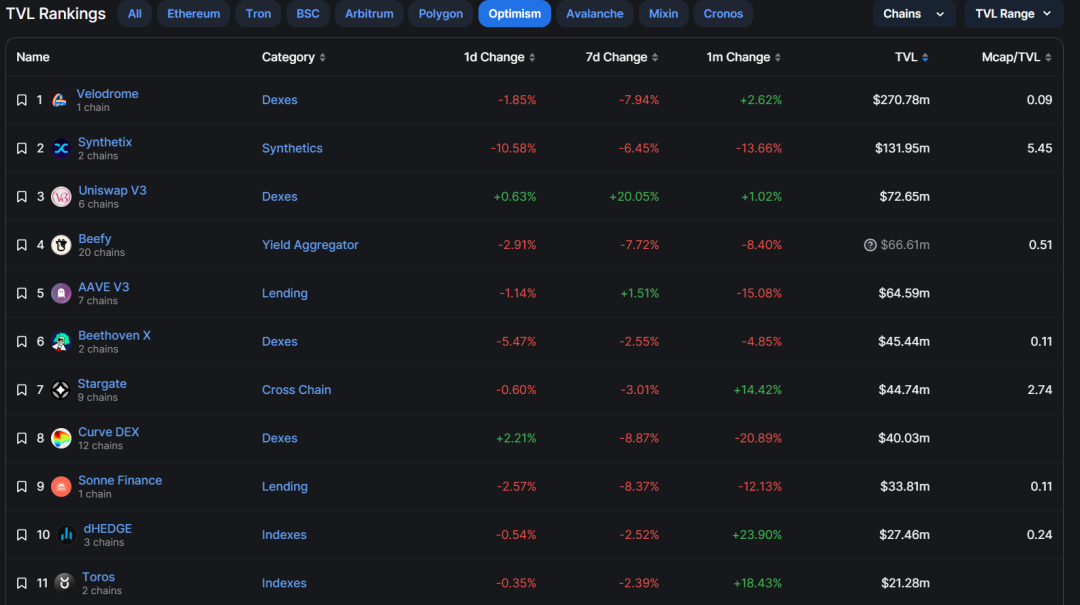

Optimism and its ecosystem

Optimism’s ecosystem development is second only to Arb, and with Coinbase’s support, its development potential is still not to be underestimated.

Source: defillama

-

Zk rollup protocols that have not yet issued tokens

Currently, the Op series is leading and occupies the vast majority of the market, but the potential of ZK is huge, and the timing of ZK’s outbreak may be when Ethereum is fully sharded.

– Zksync

Leading ZK series Layer2 protocol, which has just been launched on the main network, but has higher recognition in the industry for ZK series solutions and is more advanced.

– Starknet

Uses a proof method different from Zksync, which is beneficial for handling large orders, but has poor compatibility.

-

Zk rollup-related protocols that have issued tokens:

– Dydx

The DeFi representative application of Ethereum Layer2, leading derivative DEX.

– Loopring

Token IRC, launched at the end of 2019, is more like an application than a network, and supports DEX, NFT orders, etc.

– Immutable

Token IMX, a Layer 2 that facilitates the exchange of game NFT assets.

-

Cross-chain racecourse: layerzero, etc.

Layer 2 is essentially a multi-chain operation, so it also looks at cross-chain protocols such as layerzero, which is currently the hottest cross-chain protocol. It is detailed in an article titled “Who is the next ‘big wool’ worth paying attention to among the ‘national wool party’?” and has well-known competitors such as DOT.

-

DA racecourse

Since blob data can only be stored for a short period of time, there are problems with calling historical data, so decentralized storage protocols will have a new development channel, and Layer2 expansion solutions also need to use data availability layers.

Good news for L1 storage expansion networks, such as Eth storage, which focuses on solving Ethereum’s dynamic storage problems. Based on Ethereum’s data availability, it can provide a second-layer solution for programmable storage at a lower storage cost. EthStorage will greatly reduce the storage cost of a large amount of data on Ethereum and can save 100 to 1000 times the cost.

04. Summary

The upgrade of Cancun is an important upgrade for Ethereum, no less important than the upgrade in Shanghai, which opens a new chapter for Ethereum L1 sharding, reduces the transmission cost between L1 and L2, and achieves lower gas fees and higher TPS, which is a direct benefit to L2 and other related ecosystems. Ethereum’s competitiveness will be further enhanced.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Tornado Cash is hit by a malicious governance attack, and the latest recovery proposal may be an attempt by the attacker to inflate the coin price and sell off.

- Over $76 billion in funds have been stolen, taking stock of six major tools for securing cryptocurrency assets

- “Rebellious Girl” and “Internet-addicted Youth”: 13-year-old DAO Founder Finds Self in Web3

- How to dissect ETH volatility? Breakdown of F(X) novel stable asset and leverage scheme

- Review of the Rise and Fall of Cryptocurrency Exchanges in the Last 13 Years: Dominance, Scandals, and Crashes

- How to use dynamic NFTs to provide liquidity products in the Sui public chain ecosystem?

- Decoding the new standard ERC-6551: A new way of playing NFTs in wallets