WOO X responded that all accusations of misappropriation of assets and insolvency are false information that can be verified through public data.

WOO X denies all allegations of misusing assets and being insolvent, stating that these claims can be proven false through publicly available data.Author: Nancy, BlockingNews

In 2022, CoinDesk exposed the huge hidden dangers in the balance sheet of Alameda Research, a hedge fund under FTX, indirectly triggering the collapse of FTX, and in the subsequent investigation, the truth about the interrelated transactions and embezzlement of user assets between the two also came to light.

On May 23, Chris Brunet, an investigative journalist from Karlstack media, also warned in a post that the fund reserves of decentralized cryptocurrency trading platform WOO X had similar problems to FTX, and suspected that the platform had embezzled user assets to invest and caused insolvency. WOO X denied this and said that users can decide for themselves on the risks, and will introduce more liquidity providers in the future.

WOO Network is a liquidity network incubated by Kronos Research, one of the world’s top five cryptocurrency quantitative trading teams in 2019, which has received tens of millions of dollars in investment from institutions such as Binance Labs, Three Arrows Capital, PSP Soteria Ventures, QCP Capital, and Gate Ventures. WOO X is the flagship product of WOO Network, a trading platform for professional traders. Public information shows that Kronos Research’s initial role was to guide liquidity on WOO X Global, providing instant deep liquidity for multiple token pairs, helping the platform attract traders and gain key users, and motivating other market makers to enter and improve liquidity. In short, similar to FTX and Alameda Research, WOO X also has a hedge fund Kronos Research.

- Decoding a16z Fundraising Deck: Why is the gaming industry worth doubling down on?

- Hotbit suddenly announced its closure. Is it a reshuffle in the industry or a trend?

- How will the Ethereum Cancun upgrade change the Layer2 landscape?

From the content published by Chris Brune, he suspects that Kronos Research uses customer deposits to engage in risky activities and that WOO X is insolvent based on various data and service terms.

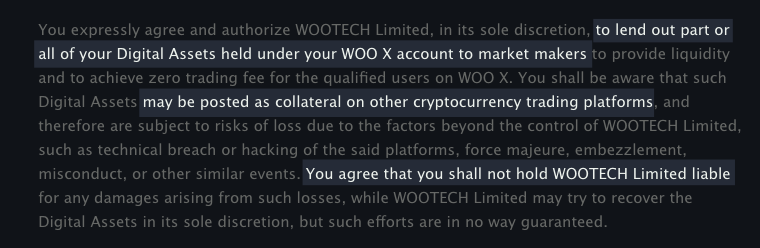

Chris Brune pointed out that the WOO X service terms show that WOOTECH Limited has the right to decide to lend part or all of the digital assets held by users in the WOO X account to market makers, which means that market makers such as Kronos Research can have unrestricted access to user deposits, but Kronos Research lacks transparency and accountability. The platform claims to adopt delta-neutral strategies, but doubts about its credibility still exist. Currently, Kronos is building a non-liquid investment portfolio similar to FTX, using user deposits.

Although WOO X clearly states in its service terms that it will not use user deposits for speculation, Chris Brunet’s analysis of WOO X’s debt-to-asset ratio has raised strong concerns.

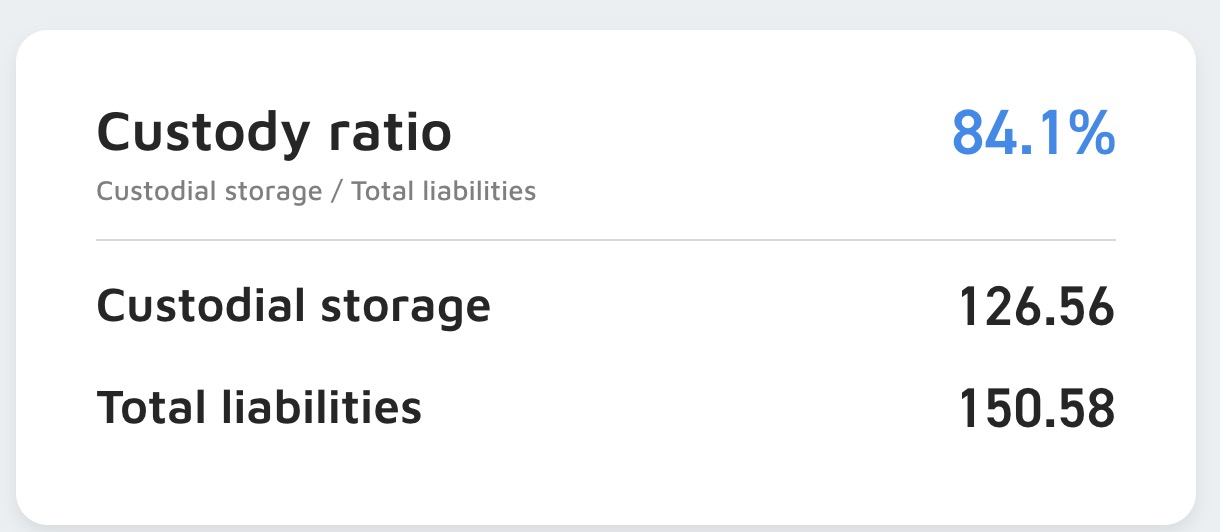

First, from the custody ratio published on the WOO X official website, it can only cover around 84.7% of the deposited funds. From the asset ratio shown in the figure below, it is like “the platform account has $126.56, but owes $150.58.” Chris Brunet believes that, although the extent of the insolvency is unknown, it is a fact. It is worth noting that a brand ambassador of WOO X also admitted in private messages, “the platform’s model is controversial, let us face it.”

Moreover, from WOO X’s asset reserve proof, nearly 42.6% of the assets are composed of the platform token WOO, and the proportion of stablecoins, Bitcoin, and Ethereum is about 36.9%. According to third-party data platform Nansen, 77.6% of the assets in WOO X’s treasury are composed of WOO, which is much higher than the data disclosed by the platform. It is worth mentioning that Alameda Research previously caused market concerns due to the disclosure of holding too many FTX platform coins FTT and related tokens Serum in its total assets. Once it loses user trust and causes a sharp drop in WOO, user stampedes and escape may cause WOO to spiral into death, and investors may face the situation of unable to withdraw assets.

In response to Chris Brunet’s doubts, WOO X stated when responding to Wushuo Blockchain that the doubts raised by Chris Brunet can be verified as untrue information through public data. Besides being saved in custody, user assets are also dispersed in 5 different third-party platforms. Users can check the specific amount on other platforms and decide the risk by themselves. Moreover, the main asset of users in WOO X is WOO, so it accounts for a relatively high proportion. In addition, WOO tokens will not be used as collateral for external loans. Users can also check the asset-liability status excluding WOO token reserves in the dynamic balance sheet, and it almost instantly reflects any changes in asset holdings. In addition, Kronos Ventures and WOO Network are independent operating enterprise entities, and Kronos Research is limited to providing liquidity on WOO X instead of speculation. The platform will also introduce more liquidity providers.

In fact, Chris Brunet also pointed out in the article that he lacked specific evidence, but he also stated that the original intention of all doubts was not to incite users to run on the exchange, and the exchange should have the ability to resist external scrutiny.

Overall, after events such as FTX, user trust has been greatly damaged. Cryptocurrency platforms can only better respond to external doubts by providing sufficient liquidity funds as evidence and publicly transparent trading records, increasing risk management awareness and establishing corresponding accountability systems.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Founder of EigenLayer Responds to Vitalik’s New Article: Consistent with the Staking Philosophy

- How has the ecosystem of Polygon zkEVM developed in the past 2 months?

- Ethereum Singapore 2023 will build a communication bridge between over 2000 Web3 developers, talents, and the local ecosystem.

- Tornado Cash is hit by a malicious governance attack, and the latest recovery proposal may be an attempt by the attacker to inflate the coin price and sell off.

- Over $76 billion in funds have been stolen, taking stock of six major tools for securing cryptocurrency assets

- “Rebellious Girl” and “Internet-addicted Youth”: 13-year-old DAO Founder Finds Self in Web3

- How to dissect ETH volatility? Breakdown of F(X) novel stable asset and leverage scheme