How the Macro Economy Affects Bitcoin Price

Compilation: Orange Book

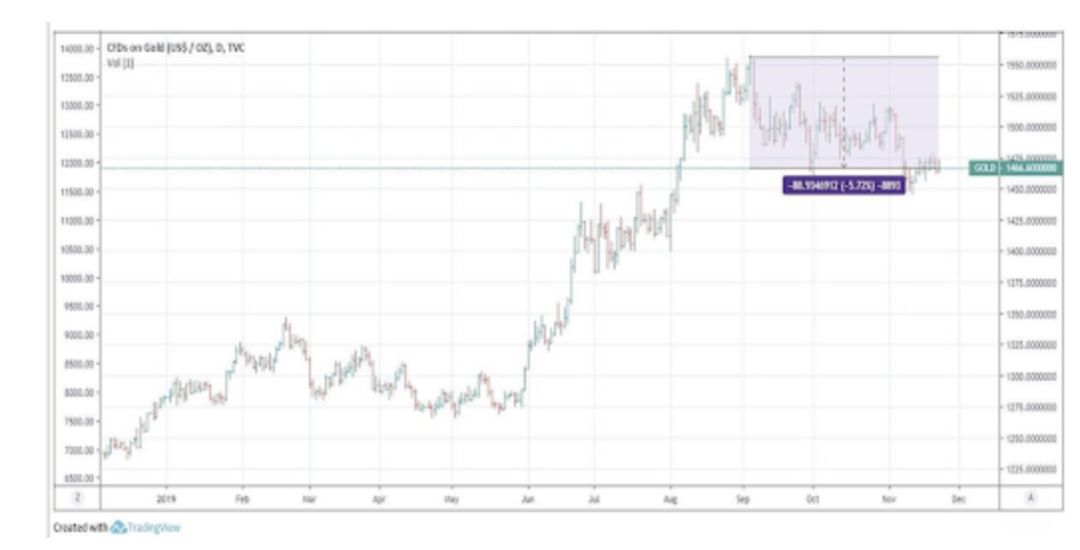

This summer, the global economy began to enter a downward cycle, and Bitcoin was at its climax. At that time, everyone liked to understand the meaning of Bitcoin when it was born from the economic crisis and broke out from the economic crisis.

As the months passed, the market ushered in another winter.

But there may still be something to do with changes in the macro economy. For example, the high point of Bitcoin in August was also the highest point of global negative interest rate debt. At the time, the 10-year TIPS (inflation-preserved bond) yield was also negative for the first time.

- Comment: The premise of regulation is to clearly define the precise meaning of digital assets

- Four keywords take you back to the major events in the mining circle in 2019

- The recent outbreak of a new ransomware has broken the heart for "promotion" of Bitcoin

And these have gradually returned to normal levels in these months.

The following is the original view, enjoy:

This summer, everyone was immersed in the sweetness of bitcoin, and everyone was looking forward to a new high in prices. At that time, we summarized four core reasons for the rise:

- Money is constantly buying

- The global economy has entered a downward cycle (negative interest rates, negative yield bonds, etc.)

- Chinese market influence

- Consensus is growing

Six months have passed, and the situation has completely reversed. Looking back at the above factors, it has actually begun to change.

The first is the inflow of funds. The inflow of talents and financial practitioners has been affected by the summer and has been increasing rapidly, but the inflow of capital has been greatly reduced.

This kind of thing often happens. Quick money comes out immediately with the price, but long-term money is not in place. Institutional capital is less affected by market cycles, and many are still in the process of intensive due diligence for 18-36 months.

Regarding consensus, it can be said with certainty that it continues to spread and strengthen.

The changes in the second and third points are worth mentioning, specifically divided into the following points:

- Negative interest rate debt balance soars

- Real return is negative

- Golden factor

- RMB depreciation

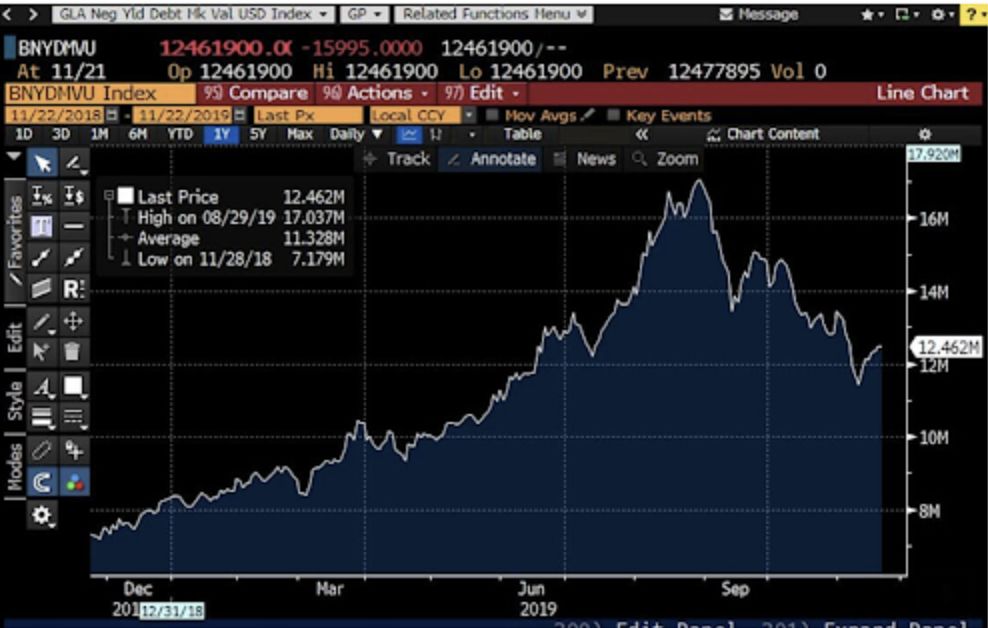

Negative interest rate debt balance explodes

This summer, the media frantically reported that global negative interest rate debt has skyrocketed. The balance of sovereign negative interest rate debt issued mainly by Japan and Western Europe has reached 179 trillion US dollars. Negative interest rate means that these countries are not able to pay back.

By winter, the negative interest rate debt balance is currently 125 trillion, a 30% drop from its high point.

Seeing the curve above, it is very similar to the trend of Bitcoin.

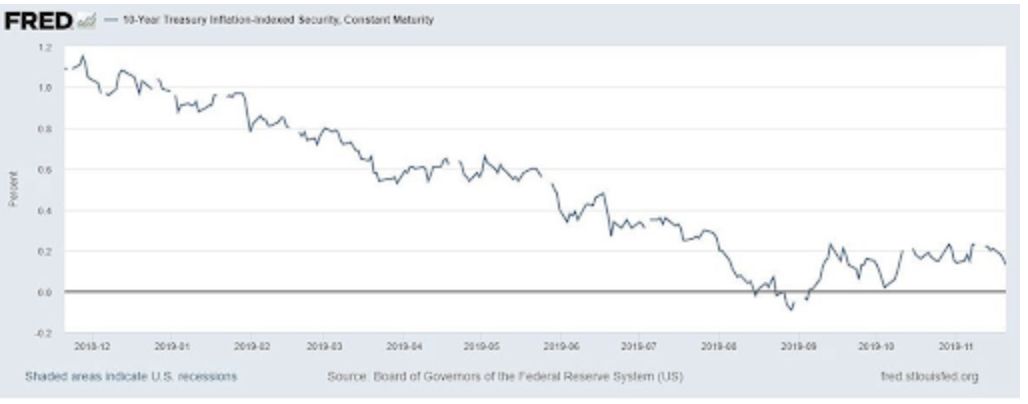

TIPS yield is negative

We believe that investors should not focus on nominal returns, but on actual returns. The actual return should be the return after excluding the effects of inflation.

Another way of saying it is that the actual return is a value that is a combination of risk and return expectations and the money that can be invested.

The 10-year TIPS (inflation-preserved bond) yield is a very good indicator of such returns.

It becomes negative briefly at the end of the summer, and the time point coincides with the peak of the negative interest rate debt balance.

When the value is negative, one of the best options for investors is to put money in assets with higher risks and better returns, in this way to maintain the purchasing power of the US dollar.

Obviously, TIPS yields are back, and the natural appeal of high-risk assets like Bitcoin has declined.

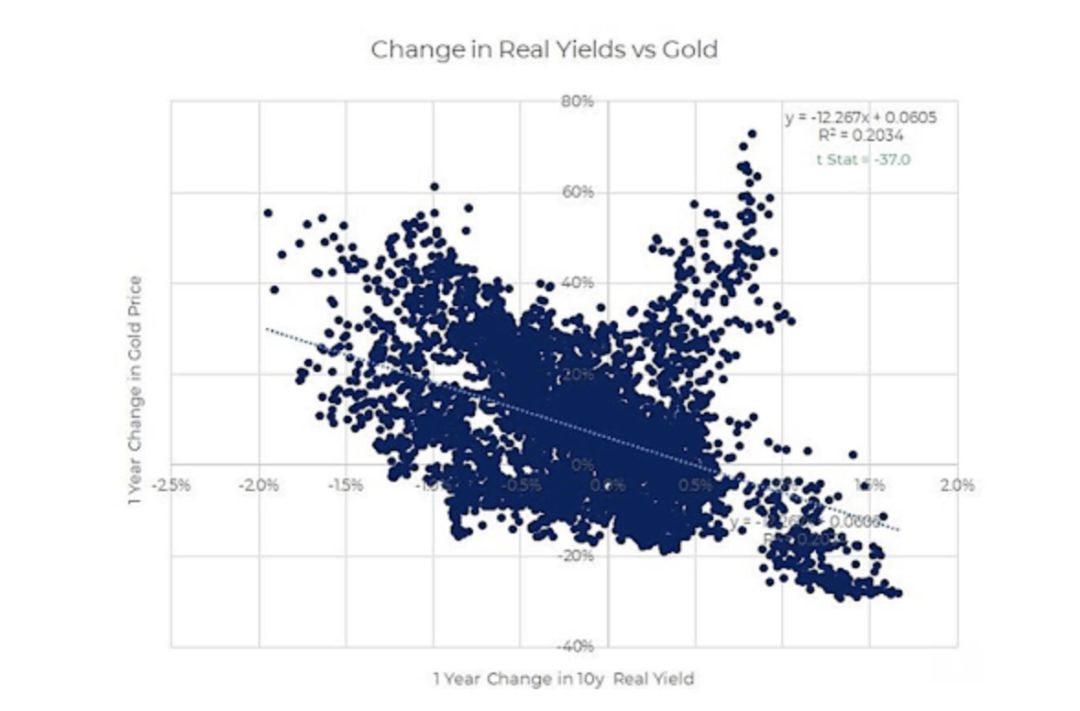

Golden factor

Earlier we discussed the correlation between the price of gold and the price of bitcoin, and the highest correlation within 90 days was 0.3, which means that bitcoin is not much related to gold.

But in the summer, there was a period when gold and bitcoin prices were highly linked.

The reason is similar to the above. When the actual return is negative, investors are more interested in converting USD assets into non-returning (non-productive) assets, such as gold, art, collectibles, and Bitcoin.

Gold has fallen by 6% since September. Although the volatility is not as great as Bitcoin, it still deserves everyone's attention, especially if it is highly consistent with the actual TIPS yield reversal.

RMB depreciation

A very important thing in the summer is that due to the impact of the trade war, in order to stimulate export trade, China's yuan depreciated, breaking the 7 for the first time in many years.

So one argument is that many Chinese users have bought Bitcoin in order to avoid continued depreciation. Of course, this is not supported by actual statistical evidence.

We just saw that the RMB exchange rate gradually began to return to normal levels before the summer.

The recent impact of Chinese policies on the price of Bitcoin also fully demonstrates the important influence of the Chinese market on the Bitcoin market.

(Finish)

Reference: https://www.ar.ca/blog/crypto-market-recap-11-26-19

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Ethereum Istanbul upgrade tentatively scheduled for December 6, here is everything you want to know

- How difficult is protecting privacy? Even anonymous coins may leak your secrets

- How will the halving of BTC rewards affect miners and currency prices?

- Gartner: Blockchain will achieve globalization and scale in 2027

- EOS founder BM latest article: Refactoring EOSIO resource allocation

- QKL123 market analysis | The trend starts to go bad, is it a good time to make a decision? !! (1127)

- Suddenly! 342,000 ETH transferred to unknown address, South Korean exchange Upbit suspected of being stolen