Will Financialization Destroy NFTs? An Exploration of the Impact of NFTFi on the Market

Impact of NFTFi on the NFT MarketOriginal author: TylerD Original translation: Deep Tide TechFlow

In 2021, everything was so simple. People really bought NFTs, bought the artworks they liked, and bought NFTs with rare features.

We joined Discord groups to connect with other holders. Communities formed, communication increased, and holders grew. Then, finance began to infiltrate this mature market and things started to change.

Many people see the financialization of NFTs as a sign of a mature market. Some believe this will open the door for larger and more mainstream participants.

- How does Ethereum build ‘brick by brick’ for the metaverse?

- Interpreting the Current Situation of Digital Asset Custody Opportunities and Challenges for Institutional Investors.

- Robert F. Kennedy Jr Will Support the US Dollar with Bitcoin if Elected President

But is that really the case?

At least for an important area of the NFT market – the PFP field, financialization seems to have disrupted the NFTs we once knew. In this article, TylerD shares his views on the financialization of NFTs, including market and transaction innovations, token incentives, lending, NFT perpetual contracts/futures, and their impact on the market.

Advanced Trading Features

Overall Impact: Negative

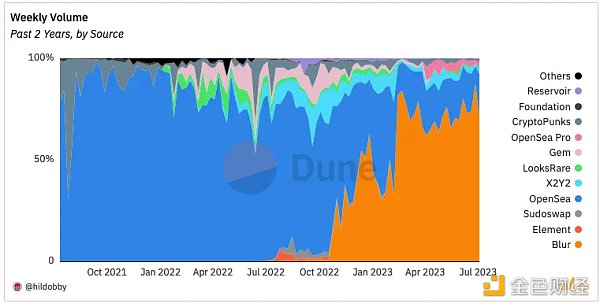

In the early cycles (i.e. late 2020 to early 2021), the NFT market was like a wild west, and OpenSea was the king.

Just as its name suggests, it was a vast ocean of open JEPGs. It can be said that it was the biggest winner in the bull market cycle of 2021, earning millions of dollars from monthly billions of dollars in revenue.

Its success brought competition, first LooksRare, then X2Y2, Gem and Sudoswap, and finally Blur.

This competition gave rise to new features in the NFT market, improving the trading experience. There are too many of these features to list, but some influential ones include:

-

Analytical charts and better data access;

-

Batch buying and listing NFTs;

-

Batch selling NFTs through accepting bids;

-

Real-time bidding and bid depth analysis.

At that time, these features were welcomed and are still popular today. But they were the first to start changing how NFT traders and collectors view their JPEG images.

Once unique digital collectibles with features and functionalities, holders formed connections and valued their possessions. Now, their non-fungibility is disappearing, and tokens are becoming homogenized.

Batch buying can be said to be the first feature that set NFTs on this path. Buying NFTs in bulk changed the shopping experience, and being able to sell in bulk through bidding changed the selling experience.

While floor sweeping often received cheers in NFT Discord groups, more savvy holders quickly realized the problem – most sweepers were more likely to become sellers and so on. They don’t care about which NFTs they own, they’re just tokens that can be bought and sold.

Therefore, although these features improve the trading experience, the experience of collecting and holding underlying assets is deteriorating. The impact of these advanced trading features is negative, even if it was not fully realized at the time.

But compared to the next stage of market competition: the impact of token incentives, the impact of advanced trading features seems pale and powerless.

Token Incentives

Overall Impact: Negative

By the end of 2022, most PFP projects have disappeared. The surviving projects seem to have hope for success.

The new generation of projects is led by Bored Ape Yacht Club (BAYC), followed by Azuki, Doodles, Moonbirds, and Clone X, each of which seems to have its own unique and powerful community.

However, everything changed in February 2023. Blur announced airdrops and mining for the second season. Early users received $BLUR tokens through airdrops, providing the market with over $275 million in liquidity.

With these stimulus measures, this liquidity re-entered the PFP market, and prices rose for several weeks in a row. In addition, the promise of another $300 million airdrop attracted new (apparently DeFi native) traders to enter this field.

Miners can earn points by listing and bidding on NFTs. And smart people naturally found ways to manipulate the system. These speculators buy NFTs without receiving rewards, and once their bids are accepted, they do not accumulate points, so the game becomes: keep the bid as high as possible but not accepted.

This reveals a fact that these farmers don’t really want these NFTs, they just want to accumulate points for $BLUR tokens.

In the BAYC market, this problem became more apparent after some well-known traders/founders/OSF and Mando conducted Bored Ape transactions. They sold 71 BAYC in a single transaction for 5,545 ETH (worth $9 million at the time) in a matter of seconds.

And the speculators who participated in the Blur bidding just absorbed 71 BAYC NFTs they didn’t want, which then triggered a chain reaction. A group of people started trading these NFTs with each other to earn points.

So, people saw these two things:

-

The same NFTs being traded repeatedly dozens of times;

-

Prices starting to fall.

Speculators have calculated the acceptable loss for each transaction as long as they offset enough Blur points with points. Starting from February 2023, this situation has gradually led to a steady decline in asset prices, which continues to this day.

One can argue why new buyers have not entered these ecosystems. Many people point out the shortcomings of the team and founders in terms of execution and vision. This does make some sense.

But another driving factor – and perhaps a more important one – is that these NFTs (especially PFPs) have lost their sense of mystery. It’s not as desirable to purchase a Bored Ape that has been traded dozens of times.

Famous NFT trader Cirrus made an analogy, saying it’s like walking into a Rolex store and seeing a group of luxury collectors throwing Rolex watches at each other all morning. Would you want to buy those Rolexes?

As this process unfolds, the characteristics that initially attracted many people to the PFP market (identifying with the features, buying an NFT worth using as a profile picture, accessing the community) gradually disappear.

These PFPs have become tokens used for trading to accumulate $BLUR tokens. Their non-fungibility is further diminished, which is why I believe token incentives have a negative impact on the market.

NFT Lending

Overall Impact: Positive

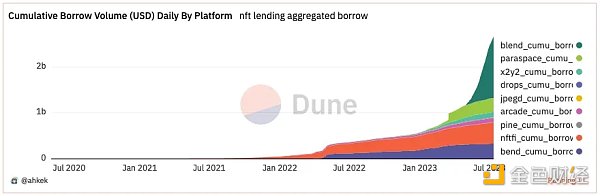

While the market war continues to brew, a new financial sector is taking off: NFT lending.

In April of this year, the cumulative trading volume of the NFT lending market surpassed $1 billion, and after Blur launched its Blend platform, the market recently surpassed the $2 billion threshold in June.

NFTfi was the first platform to enter the market, launching in the spring of 2021 and reaching a trading volume of about $400 million by the end of 2021.

The product is quite simple. NFT holders use their assets as collateral and set the desired loan conditions, while borrowers make offers for these NFTs. If the NFT holder accepts these conditions, they will accept the transaction and receive WETH, while the NFT will be placed in custody. If the loan is repaid on time, the holder will regain the NFT; otherwise, the borrower will receive the NFT.

Subsequently, other competitors entered the market, including Arcade.xyz and other peer-to-peer lending protocols, as well as BendDAO and JPEG’d, among other pool protocols. Loan terms became longer and annual interest rates decreased.

Soon, NFT holders had several options, with new participants like BendDAO promoting loans with no repayment dates, as long as the asset value remained above a certain liquidation threshold.

Then, in May 2023, Blur launched its Blend program, adding lending and an options market (Buy Now, Pay Later) to its protocol and providing token incentives for loan offers.

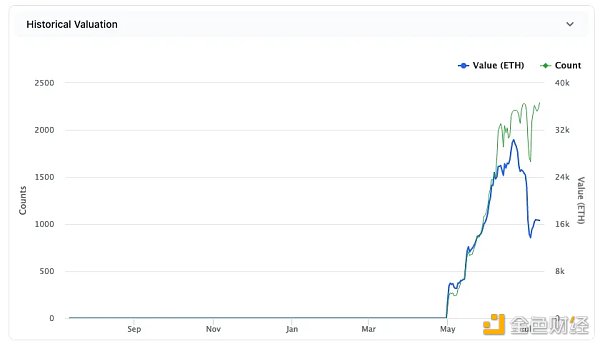

The loan-to-value ratio (LTV) increased, and the annual interest rate dropped to 0. More leverage entered the ecosystem, which became increasingly evident in recent Azuki Vegas parties, Elementals disasters, and subsequent PFP liquidation chain effects.

Although some people may think that NFT lending has potential negative impacts because leveraged trading often ends in disaster (especially for inexperienced and overexposed traders), for me, this feature is more positive.

Being able to obtain liquidity by using NFTs as collateral makes it easier to hold onto the NFT for a longer period of time.

Moreover, protocols like NFTfi, Arcade, and even Zharta allow specific quotes for specific NFTs, so characteristics and scarcity do have value in the lending process.

Non-fungibility is actually rewarding, so I think NFT lending is a positive evaluation.

NFT perpetual contracts, options, and futures

Overall impact: Negative

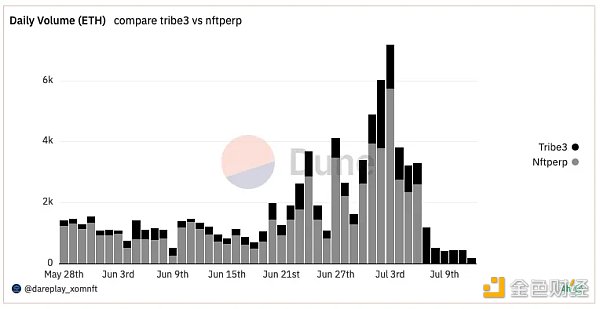

It can be said that one of the hottest financial trends during the NFT bear market is going long or short on NFTs through perpetual contract protocols like NFTperp and Tribe, as well as Wasabi (peer-to-peer).

Perpetual contracts and futures allow traders to bet on the future price of an asset, usually using leverage. For example, NFTperp allows users to use leverage of up to 10x in trading (which means a bet of 1 ETH is equivalent to a scale of 10 ETH). The difference between perpetual contracts and futures is that perpetual contracts can remain open indefinitely, while futures have set expiration dates.

A brief introduction to how these protocols work: perpetual contract protocols use virtual automated market makers (vAMMs) to allow traders to go long (betting the price will rise) or go short (betting the price will fall) on NFTs. As described by well-known crypto KOL 0x Foobar, they operate similarly to Uniswap v2 pools but without actual liquidity. They simulate liquidity through algorithms and adjust prices based on the volume of long and short trades.

This product allows holders to hedge the value of their NFTs by opening short positions, allows people who don’t have enough funds to buy NFTs (e.g., 35 ETH for BAYC) to bet on their rise with any amount of long positions, and allows those who believe that a certain NFT will fall in value to bet on this trend through short positions.

All three use cases are meaningful and have a place in traders’ comprehensive trading strategies. However, these trades and underlying models have limitations and may be tested in extreme market events, as NFTperp recently discovered in a difficult way.

Recently, NFTperp unexpectedly shut down its platform, citing accumulated bad debt of $518 million in futures trading. They have shared some details of what happened, but it is likely that the significant drop in the NFT market due to the minting and subsequent liquidation of Azuki Elementals added to the short trading volume of NFTperp, causing an impact that the system could not absorb.

This move makes Wasabi and Tribe the only remaining short-selling protocols in the market.

Overall, NFT perpetual contracts, options, and futures are the newest and least mature segments of the NFT financial market. Some believe that NFT perpetual contracts are destined to fail from a design perspective (this viewpoint is worth discussing separately).

But one thing is clear – out of all the financial aspects discussed so far, perpetual contracts and futures may have the most negative impact on maintaining non-fungibility.

At first glance, the only thing that matters is the floor price (more precisely, the vAMM oracle price). The entire community and collectibles are reduced to numbers on a screen. Rarity doesn’t matter. All bets are tied to fluctuations in the floor price.

Therefore, I have a negative overall assessment of NFT perpetual contracts, options, and futures.

Conclusion

The viewpoints expressed here are primarily focused on the NFT PFP field, as Art Blocks and the wider digital art market, as well as other NFT domains such as gaming and metaverses, are largely unaffected by token incentives and rewards.

Interestingly, the Art Blocks index has slightly increased in the past year, while the PFP index has fallen by over 50%.

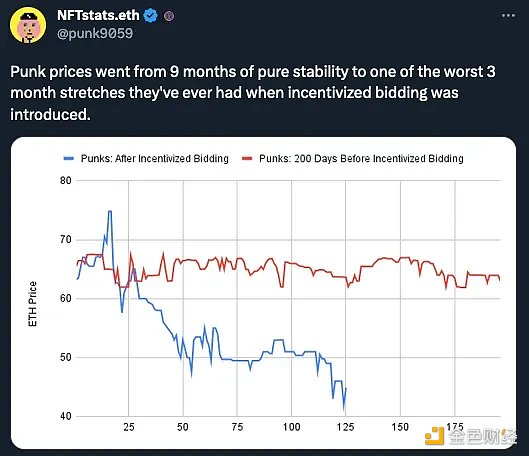

Perhaps the most disruptive evidence is the CryptoPunks market, which maintained a stable 10% range for 200 days before being added to the Blur incentivized auction, and then experienced extreme volatility for 120 days, with fluctuations ranging from +15% to -40%.

Therefore, summarizing the assessment of the financialization of NFTs on the PFP field:

-

Advanced trading features – negative;

-

Token incentives – negative;

-

Lending – positive;

-

Futures, perpetual contracts, and options – negative.

As the non-fungible token market evolves, we are starting to see various features and mechanisms that impact this new market. Many of these innovations have had significant unexpected consequences. However, most of these financial innovations erode the non-fungibility of NFTs.

This removal of non-fungibility has had a negative impact on collectors’ desire to hold these assets and has been reflected in the market. Sadly, the damage caused to this market may be irreversible, and the possible outcome is that existing PFP collections will never see another ATH.

Perhaps our early NFT market didn’t need so much financialization, and perhaps new innovations will reignite non-fungibility.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Interpreting the Current Situation of Digital Asset Custody Opportunities and Challenges for Institutional Investors

- The Battle for the Throne between Bitcoin and Ethereum What are the determining factors for victory?

- Good news for Bitcoin? Understanding the upcoming Nakamoto version of Stacks with one article

- The US instant payment system FedNow is here! But it is not a rival to cryptocurrencies.

- Blockchain Gaming June Monthly Report Market Analysis, Opportunities, and Challenges

- Binance Research An Illustrated Guide to Cryptocurrency Data Tools Track

- Paris The Fashion Capital, Embarking on a New Web3 Feast