Comprehensive Interpretation of Ripple’s Lawsuit with SEC: Both Sides Achieved “Partial Victory”, Multiple Exchanges Re-listed XRP

Ripple's lawsuit with SEC: Both sides partially won, and XRP was relisted by multiple exchanges.さらに、米国証券取引委員会は、RippleのCEOであるBrad Garlinghouseと共同設立者のChristian Larsenに対して、「協力と扇動による請求」を提起しましたが、裁判所によって却下されました。法官は、「Brad GarlinghouseとChristian Larsenが米国の証券法に詳しいか、またはXRPトークンに適用される他の規制制度法に違反したかどうか、または無知または軽率に無視したかどうかは明確に判断できないため」と考えたためです。

Rippleと米SECはそれぞれ部分的な勝利を主張

米国ニューヨーク南部地区の裁判所の判決が出た後、Rippleと米国証券取引委員会もそれに対応しました。

実際、裁判所の判決が公表された直後、RippleのCEOであるBrad GarlinghouseはTwitterでこの結果を祝福する投稿をしました。彼は、「本日の決定を下すのを助けたすべての人々に感謝します – この決定は、すべての米国の暗号革新のために下されました、そして、将来にはもっとあります。今回の判決の最も重要な部分は、XRPがデジタルトークンであり、Howeyテストが要求する「契約、取引、または計画」を提供しないことです。これは法的問題です。」

- Forbes: How did Craig Wright become “Satoshi Nakamoto”?

- Bull market signal? How much longer will Bitcoin stay at $30,000?

- Bitcoin stays stable at $30,000, is this a signal of a bull market?

米国証券取引委員会も同様に回答し、Fox Newsによると、「裁判所は、Rippleが証券法に違反する投資契約形式でXRPトークンを提供し、販売している場合があると判断した。この部分については、SECの見解が裁判所で認められたことは満足できるものであり、Howeyテストが暗号取引が証券であるかどうかを分析するために使用でき、Ripple自身のテストが何を投資契約にするかを明確にしないとして却下しました。代わりに、Howeyおよびその後の判例が、様々な有形および無形資産が投資契約の対象となることを裁定していることを強調しました。また、裁判所は、公正な通知論点を却下し、知らない者は無罪であると主張しても、証券法違反の弁明にはならないと指摘しました。米国証券取引委員会は、今後も裁判所のこの決定を検討し続けます。」

暗号通貨市場の反応が強烈で、多くの取引所がXRPを再上場させました

米国の裁判所がXRPに有利な判決を下した後、多くの暗号通貨取引所がXRPを再上場する計画を発表しました。以下の取引所が含まれます。

- Coinbase announced that it will relist XRP as XRP-USD for full trading and put XRP-USDT and XRP-EUR in limit mode;

- Kraken Pro announced that it has opened full trading of XRP;

- Gemini announced that it is exploring the relisting of XRP;

- Crypto.com announced the launch of XRP.

Not only that, but this “good news” has also led to a sharp rise in the entire cryptocurrency market, with the current market value soaring above $1.3 trillion (a 6% increase in 24 hours), with bitcoin prices briefly rising to a high of $31,594.31 and breaking through a market value of $600 billion, reaching its highest level since June 2022; ETH also briefly broke through the $2,000 resistance level, with a 24-hour increase of 6.9%.

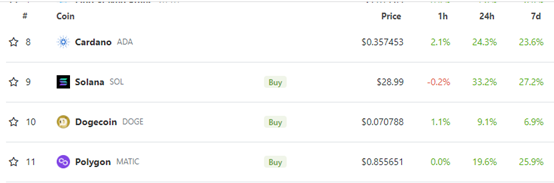

It is worth mentioning that the three tokens that were “named” by the U.S. Securities and Exchange Commission in the Coinbase and Binance lawsuits have also seen a sharp rise in prices. According to Coingecko data, as of 10:00 a.m. on July 14th: Cardano (ADA) has risen by 24.3% in the past 24 hours, Solana (SOL) has risen by 33.3% in the same period, and Polygon (MATIC) has risen by 19.6%.

XRP once rose by about 75% to nearly $0.9, and at the time of writing this article, it has fallen slightly to $0.75, with a market value of over $42.8 billion, surpassing BNB to become the fourth largest cryptocurrency in terms of market capitalization, second only to BTC, ETH, and USDT.

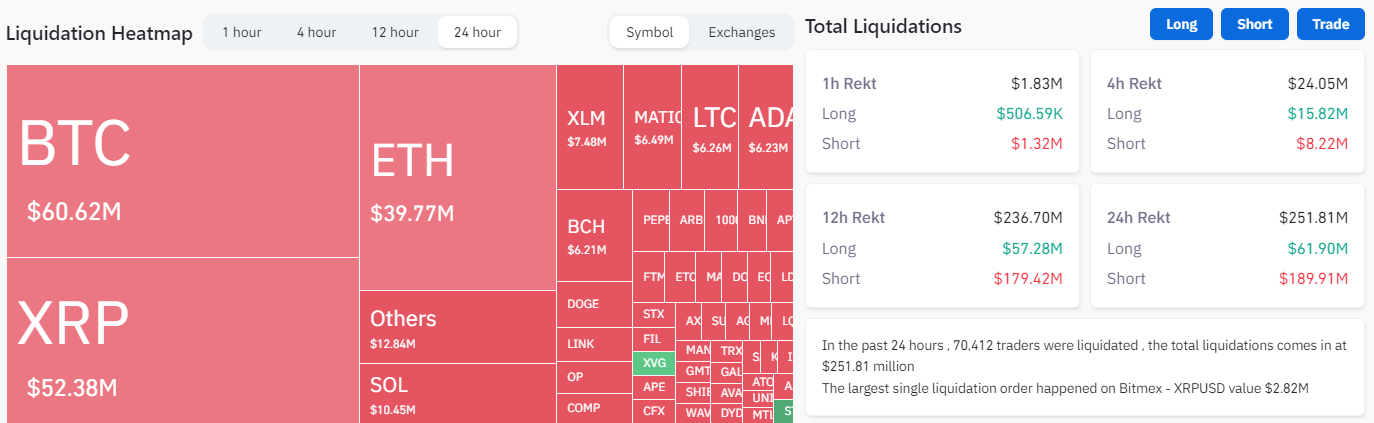

On the other hand, investors do not seem to be prepared for this sudden event. According to Coinglass data, with the rapid rebound of bitcoin and XRP prices, the total amount of liquidation on the entire network in the past 24 hours reached 251.81 million US dollars, of which the liquidation of long positions was about 61.9 million US dollars, and the liquidation of short positions reached 189.91 million US dollars. In addition, Bitcoin, XRP, and ETH are the top three currencies with the most short positions liquidated in the past 24 hours, with liquidation amounts of 60.62 million U.S. dollars, 52.38 million U.S. dollars, and 39.77 million U.S. dollars, respectively.

Summary

It should be noted that some of Ripple’s cases are still pending, and this ruling is only a decision by the trial court, some of which are likely to be overturned on appeal. Industry analysts believe that the US Securities and Exchange Commission is likely to appeal to the Second Circuit Court of Appeals because this ruling is a serious blow to the regulatory agency’s enforcement strategy, and the legislation enacted through overly broad rulemaking by the US Securities and Exchange Commission has also been seriously undermined.

Nevertheless, Ripple’s “partial victory” in the lawsuit has brought a positive signal to the cryptocurrency industry, which is trapped in a bear market. Although it is not yet certain what the broader impact of the Ripple case will be, the latest developments seem to have made cryptocurrency investors optimistic-after all, even a small positive is positive.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Galaxy Digital Founder: Bitcoin ETF Will Become SEC’s “Stamp of Approval”

- CoinMarketCap: Overview of the Overall Status of Trading Platforms in the First Half of 2023

- An Explanation of Taproot: Consisting of Three Different Bitcoin Improvement Proposals

- Boring Ape’s decline continues, where should the NFT market break the ice?

- 2017 vs 2023: Fink’s Institutional Bitcoin Perspective

- What is the difference between the supervision and sharing agreement and the information sharing agreement, as institutions compete to include them in ETF filings?

- Will purchasing Bitcoin be a good move for a publicly traded company to enter the world of cryptocurrency?