Binance Research An Illustrated Guide to Cryptocurrency Data Tools Track

Binance Research Guide to Cryptocurrency Data ToolsOriginal text: “Crypto Data Tools: What You Need to Know” by Keng Ying Sim, Nicholas Tan Yi Da, Binance Research

Translation: “Plain-language Blockchain”

With the continuous development and application of encryption technology, there are increasingly more encryption data tools, and the application of encryption data is also becoming more extensive, providing users with more diversified and powerful choices.

Binance Research has conducted a detailed analysis of the development of encryption data tools from three aspects: the development of encryption data, specific use cases, and encryption data tools.

- Paris The Fashion Capital, Embarking on a New Web3 Feast

- Review of Yuga Labs’ Ecological Development and APE Token Market Performance

- Converting mnemonic words into a set of colors? Developers launch Bitcoin mnemonic tool BIP39Colors.

First, we will explore the development process of encryption data to understand its evolution and the security improvements it brings.

Second, we will focus on the specific categories of encryption data usage. Currently, the market is mainly divided into three major categories: tracking the flow of funds, auditing the security of smart contracts, and analyzing the basic information of projects, in order to gain a deeper understanding of the application and effects of encryption data in different fields.

Finally, we will introduce some common encryption data tools.

In conclusion, through the comprehensive analysis of these three aspects, we will thoroughly explore the current development status of encryption data, hoping to help you understand the encryption market.

Below is the original Binance research report, translated by Plain-language Blockchain:

1. Development of Encryption Data

2010: Block Explorer became the first tool to allow viewing of Bitcoin network transaction details.

2012 – 2014: Cryptocurrency data aggregators appeared, displaying currency prices and trading volumes.

2015: GraphQL was open-sourced, supporting smart contract and DeFi data.

2017 – 2018: SQL query-friendly platforms were launched, such as Dune Analytics and Flipside. Data analysts can now easily query and process on-chain data.

2020 – present: Comprehensive data monitoring platforms and artificial intelligence tools (such as DeFillama and Arkham Intelligence) emerged.

Data block explorers like Etherscan act as basic data analysis providers, allowing users to examine raw on-chain data. However, it is not easy to use such tools to understand daily active users, revenue, and other important variables of a protocol.

On-chain data analysis is crucial as it helps transform raw transaction data into valuable insights, enabling effective evaluation of crypto projects or sectors and facilitating informed decision-making and strategic planning. The demand for comprehensive blockchain data analysis has led to the rise of more sophisticated data providers.

The demand for AI-driven blockchain analysis has surged, driven by the technology’s efficient ability to identify fraudulent activities and enhance trading strategies. Blockchain analytics companies like Arkham Intelligence utilize artificial intelligence to simplify blockchain transaction monitoring and data analysis, providing users with valuable insights.

2. Specific Usage Directions

1. Tracking Fund Flows

Identify the flow of funds between different entities from major entities, and monitor “whale” addresses with significant asset balances. By utilizing artificial intelligence technologies like Arkham Intelligence, people can gain more comprehensive insights and connections.

2. Auditing Smart Contracts

Analyze smart contracts to enhance security and reduce vulnerabilities, preventing potential exploits. De.Fi is an example of introducing a risk factor scoring tool.

3. Analyzing Project Fundamentals

Understanding the fundamental indicators of cryptocurrency projects is crucial for making informed investment decisions. For example, for decentralized exchanges (dex), especially AMM dex, Total Value Locked (TVL) is a key indicator that affects effective trading spreads.

III. Cryptocurrency Data Tools

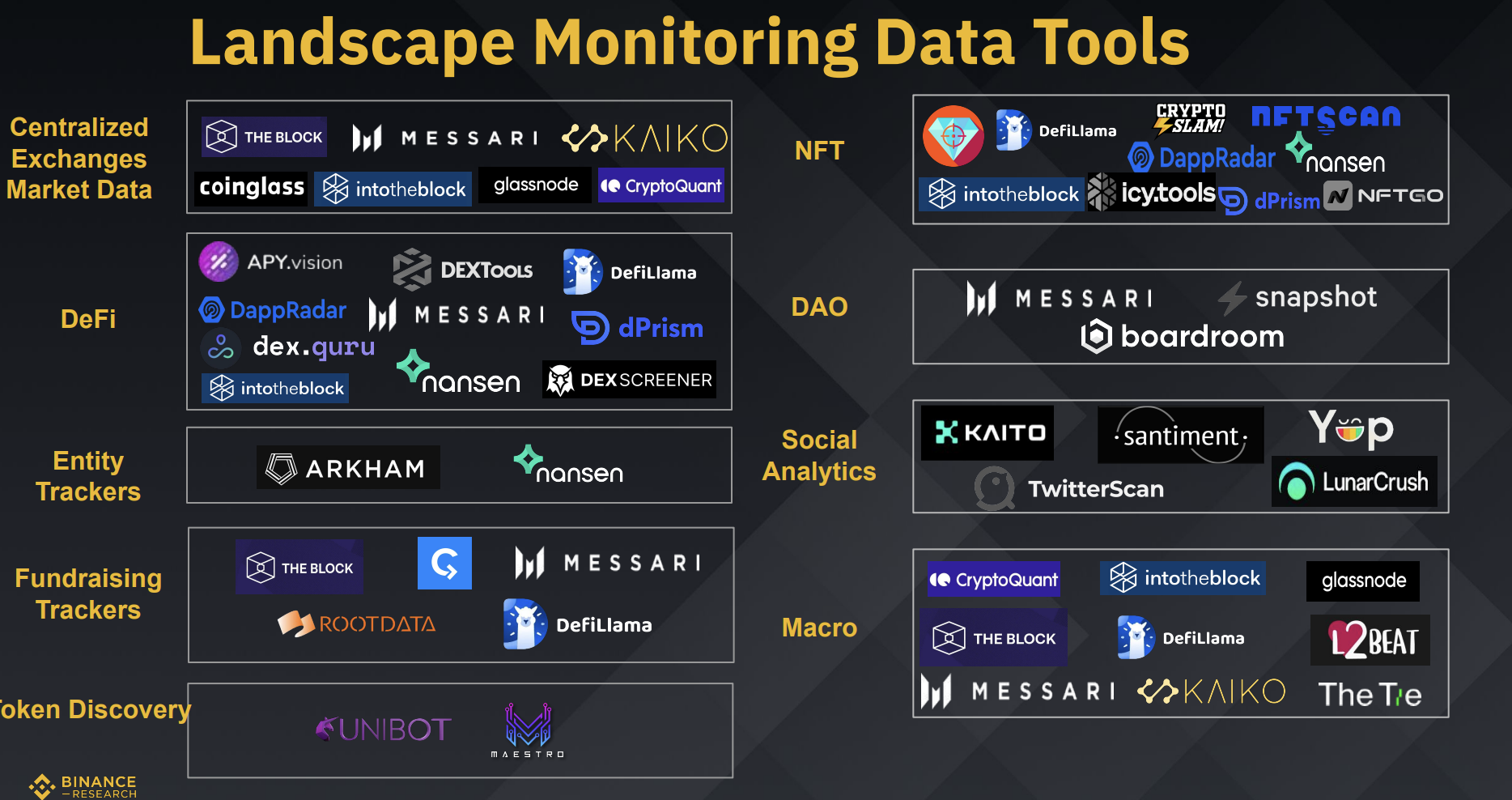

The Cryptocurrency Data Tools Chart provides an overview of available tools and infrastructure projects for analyzing data related to digital assets within the cryptocurrency ecosystem.

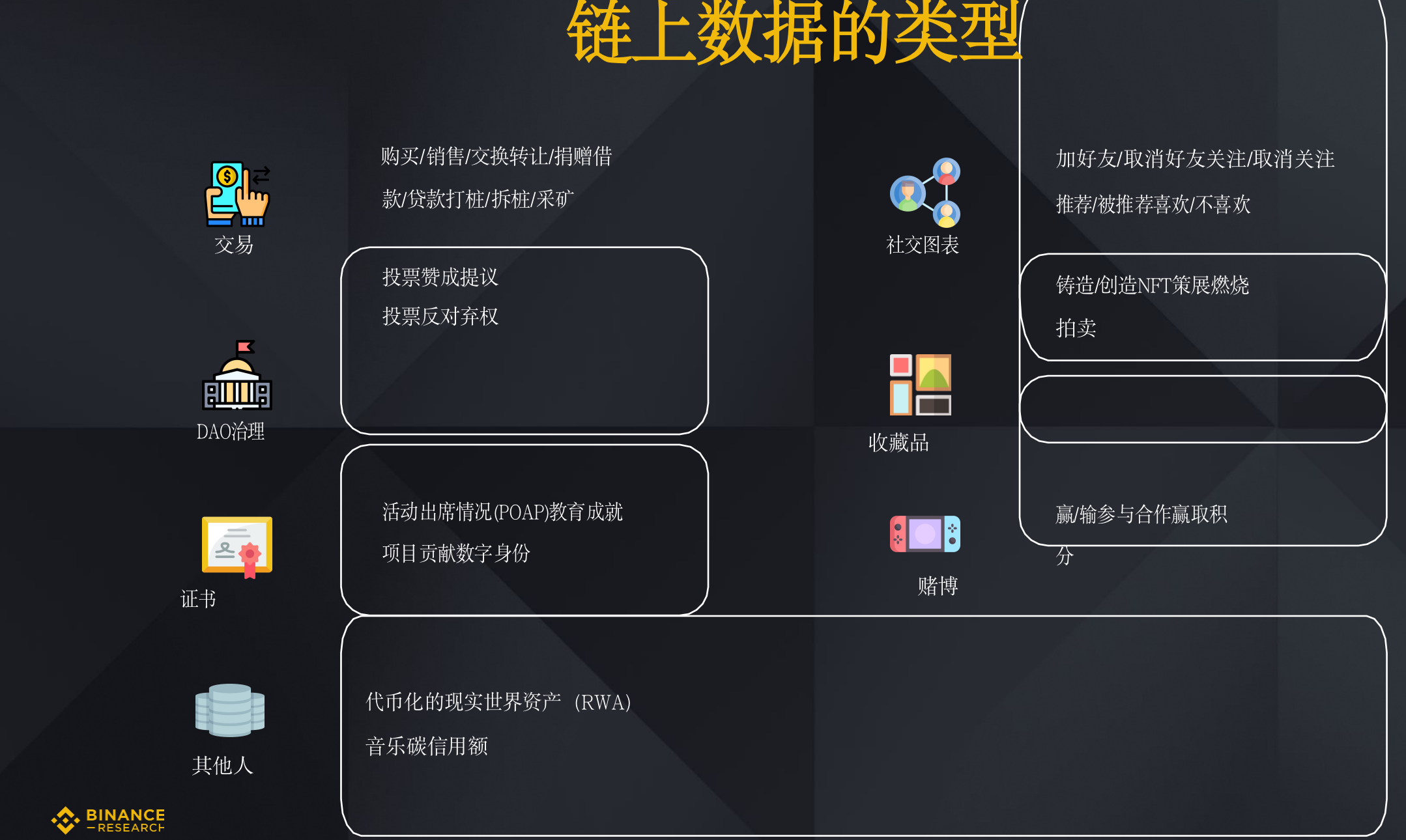

We have identified various relevant data types, including on-chain and off-chain sources, beyond the most commonly used transaction data. However, please note that some data types may not yet be provided by data tools and providers in user-friendly formats.

This map is compiled based on publicly available information. It is not an exhaustive list of projects in the cryptocurrency data field. Our aim is to present a balanced mix of existing participants and emerging projects, so certain tools or projects may be included or not. The projects showcased are plotted based on their primary use cases.

Mentioning specific projects does not constitute an endorsement or recommendation by Binance.

1. Data Tools and Infrastructure

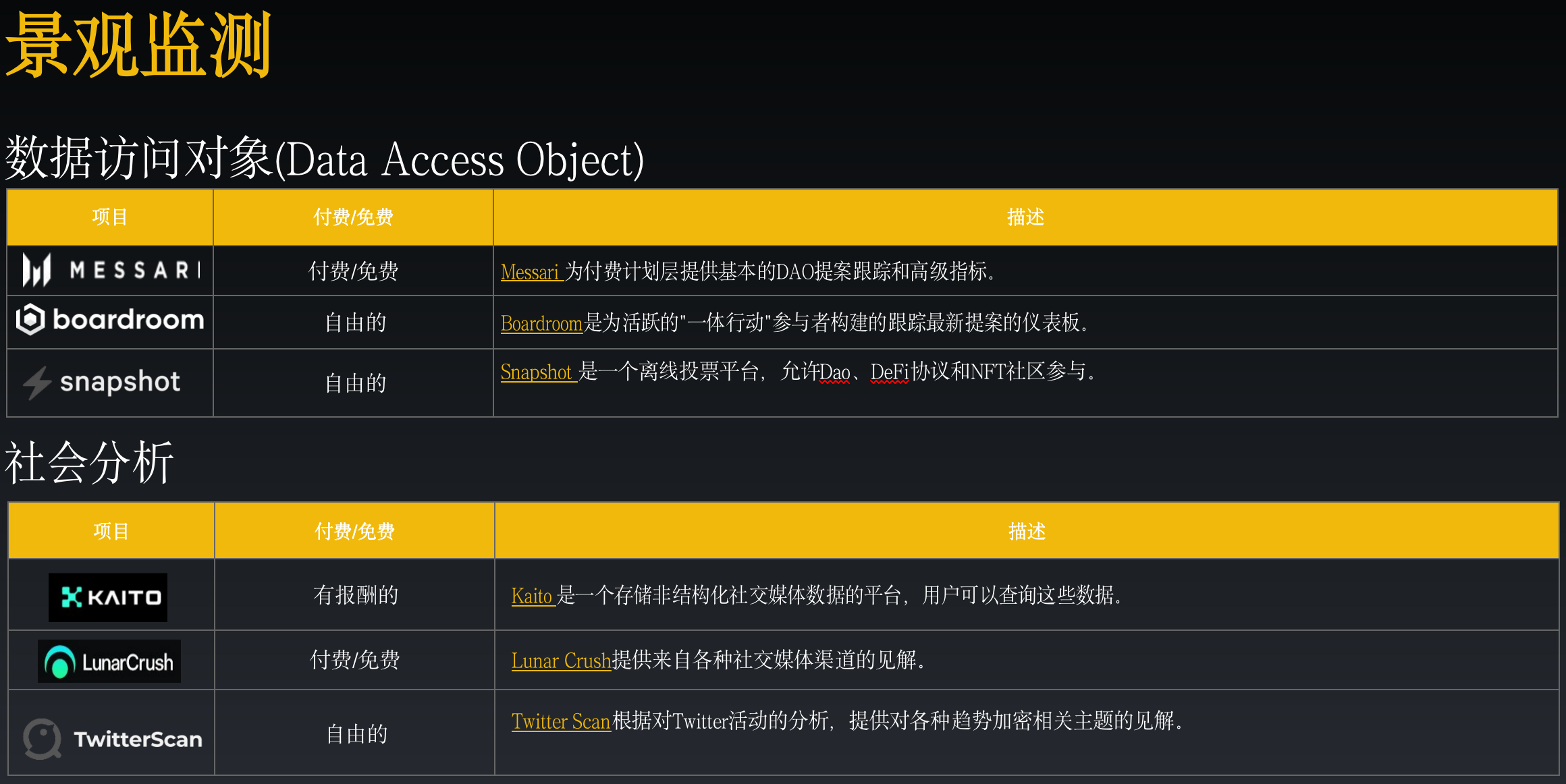

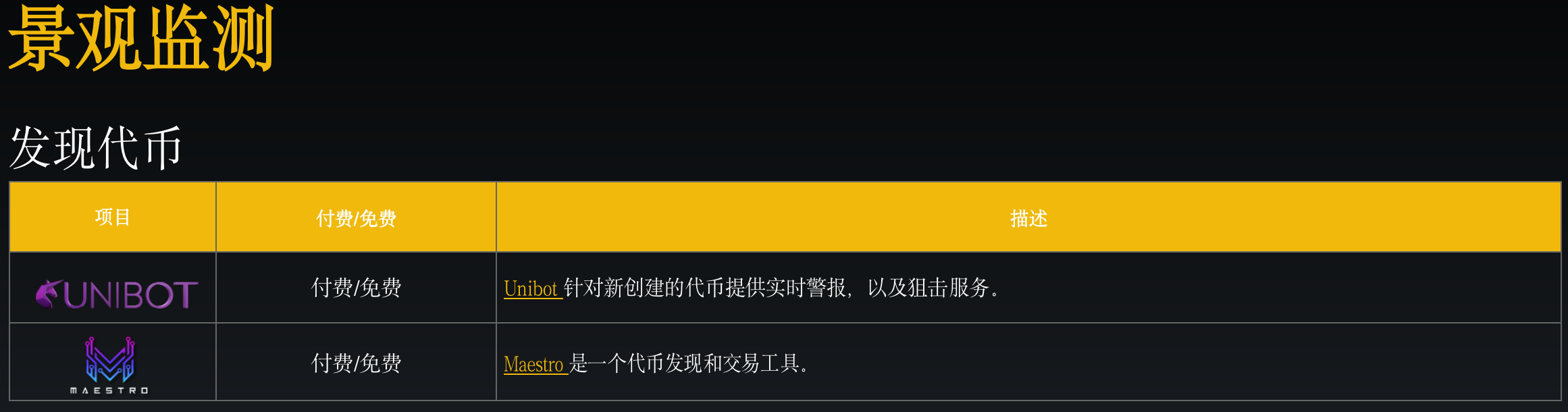

1) Panoramic Data Monitoring Tools

These tools aim to provide a comprehensive overview of market landscapes, including various variables from CeFi and DeFi, as well as insights from social listening.

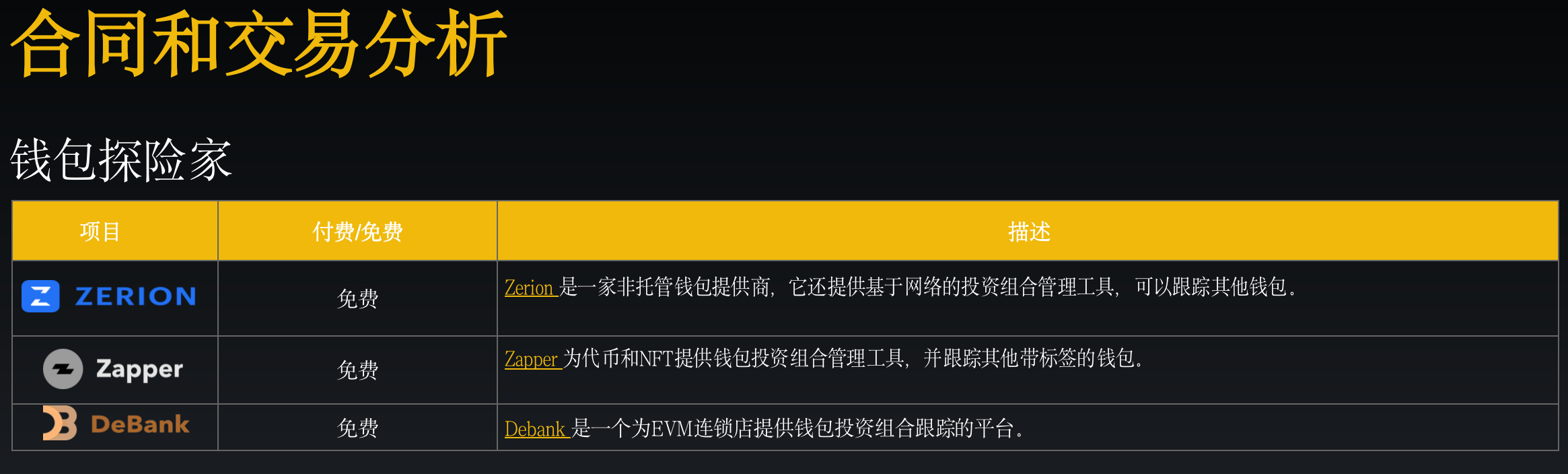

2) Contract and Transaction Analysis Tools

This series of tools primarily provide dashboard functionalities and contract risk assessment capabilities. They enable individuals to perform in-depth analysis of smart contracts and transactions, transforming raw data into valuable insights.

3) Data-Centric Infrastructure

These projects lay the foundation for a wide range of use cases in Web3 DApps. They support the democratization of data, for example, by facilitating the integration of oracles that provide accurate market data for DeFi protocols.

2. Types of On-Chain Data

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bull market signal? How long will Bitcoin stay above $30,000?

- PwC 2023 Cryptocurrency Hedge Fund Report Traditional Funds Polarized, Cryptocurrency Funds Remain Confident

- With the entry of giants and the halving narrative, is now the best time to buy Bitcoin?

- Wu said Zhou’s selection Multichain event report in full, US June CPI up 3% YoY, XRP judgment released, and top 10 news (0708-0714)

- With the entry of big players and the halving narrative, is now the best time to buy Bitcoin?

- The European Commission proposes Web4.0, is it a gimmick or a disruption?

- Comprehensive Interpretation of Ripple’s Lawsuit with SEC: Both Sides Achieved “Partial Victory”, Multiple Exchanges Re-listed XRP