Good news for Bitcoin? Understanding the upcoming Nakamoto version of Stacks with one article

Exciting news for Bitcoin An overview of the upcoming Nakamoto version of Stacks in one articleOriginal author: Alex Nguyen Original translation: Deep Tide TechFlow

As a smart contract platform, Stacks allows Bitcoin to be used for decentralized applications and decentralized finance (DeFi), unlocking trillions of potential Bitcoin capital. In this article, crypto analyst Alex Nguyen will explain Stacks and its upcoming Nakamoto version, and why this is bullish for Bitcoin.

Stacks allows developers to build dApps that use real Bitcoin for payments, collateral, tokens, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), and more. It achieves decentralized finance (DeFi), metaverse, Web 3.0, and other use cases by extending Bitcoin’s scripting capabilities while respecting the ideals of Bitcoin.

- The US instant payment system FedNow is here! But it is not a rival to cryptocurrencies.

- Blockchain Gaming June Monthly Report Market Analysis, Opportunities, and Challenges

- Binance Research An Illustrated Guide to Cryptocurrency Data Tools Track

Some key features of Stacks include:

-

A trustless cross-chain bridge with Bitcoin;

-

A new programming language called Clarity for safer smart contracts;

-

Consensus achieved through Proof of Transfer (PoX) which involves the recycling of BTC energy;

-

Tight integration with Bitcoin nodes to respond to BTC transactions.

Stacks achieves this by:

-

Recording data on Bitcoin for trustless validation of Stacks activities;

-

Inheriting the security of Bitcoin once Stacks transactions are confirmed in PoX blocks;

-

Utilizing Bitcoin’s UTXO system;

-

Respecting Bitcoin’s monetary policy.

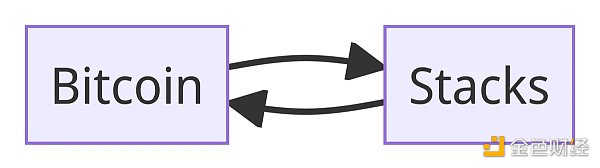

Stacks and Bitcoin establish a symbiotic relationship:

-

Bitcoin provides security, liquidity, and a monetary base asset;

-

Stacks allows Bitcoin capital to be productive in advanced applications.

The next important version is called Nakamoto, which includes:

-

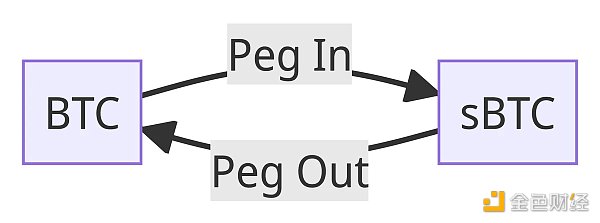

sBTC – a trustless decentralized two-way peg that brings Bitcoin liquidity to smart contracts;

-

Finality of Bitcoin – once confirmed in PoX blocks, Stacks transactions become irreversible;

-

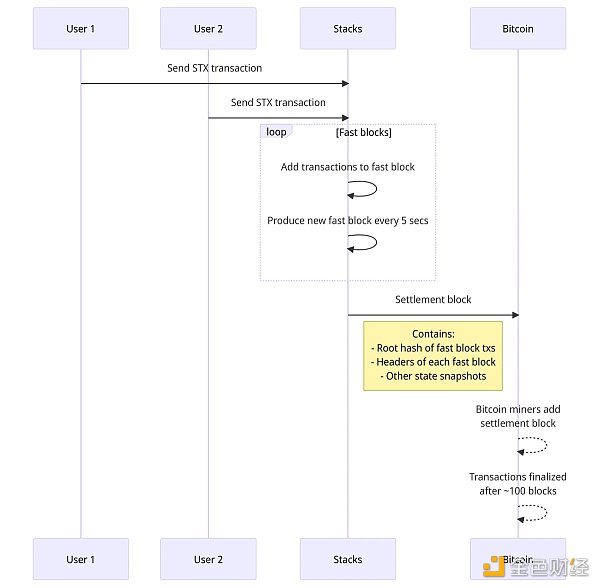

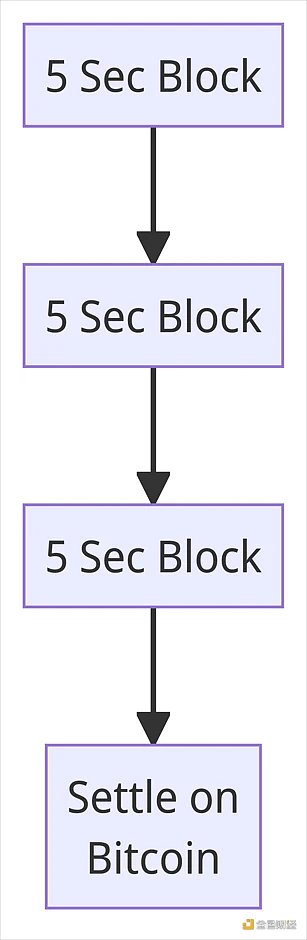

Faster blocks – producing a block every 5 seconds while maintaining security.

sBTC allows for the decentralized minting of an asset that can be exchanged 1:1 for real Bitcoin on Stacks.

sBTC can unlock trillions of capital for the following purposes:

-

Using Bitcoin as collateral in DeFi;

-

Trustless Bitcoin trading on decentralized exchanges;

-

Issuing Bitcoin-backed stablecoins and assets;

-

Bitcoin payment channels.

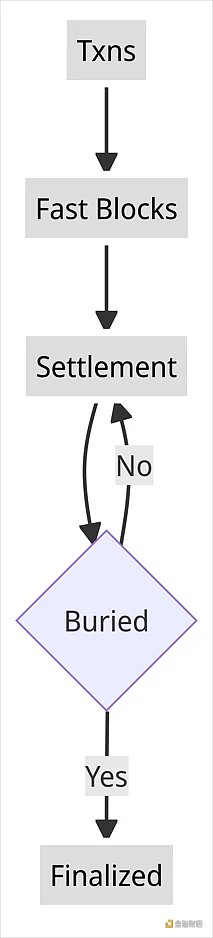

The finality of Bitcoin makes Stacks transactions irreversible within approximately 100 PoX blocks after confirmation, requiring a deep reorganization of Bitcoin to undo. This not only inherits the probabilistic immutability of Stacks transactions, but also the security of Bitcoin.

The faster block time of approximately 5 seconds greatly improves transaction throughput, enhances dApp responsiveness, while maintaining the security of Bitcoin settlement.

By enhancing the functionality of Bitcoin while deeply respecting the spirit of BTC, Stacks + Nakamoto can unlock the full potential of Bitcoin in Web 3.0. Hundreds of teams are already using Stacks to build dApps, tokens, non-fungible tokens (NFTs), DeFi, DAOs, and more.

The release of Stacks and Nakamoto versions will transform Bitcoin into the foundational settlement layer and reserve asset of an open metaverse, which is autonomous, censorship-resistant, trustless, and empowers individuals.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Paris The Fashion Capital, Embarking on a New Web3 Feast

- Review of Yuga Labs’ Ecological Development and APE Token Market Performance

- Converting mnemonic words into a set of colors? Developers launch Bitcoin mnemonic tool BIP39Colors.

- Bull market signal? How long will Bitcoin stay above $30,000?

- PwC 2023 Cryptocurrency Hedge Fund Report Traditional Funds Polarized, Cryptocurrency Funds Remain Confident

- With the entry of giants and the halving narrative, is now the best time to buy Bitcoin?

- Wu said Zhou’s selection Multichain event report in full, US June CPI up 3% YoY, XRP judgment released, and top 10 news (0708-0714)